Diatomite Market Segmented By Natural, Calcined Flux, Calcined Type for Filter Aids, Fillers, Absorbents, Construction Materials

Industry: Chemicals and Materials

Published Date: September-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 250

Report ID: PMRREP4425

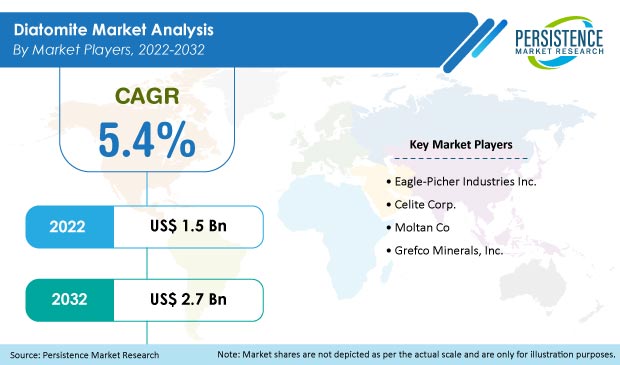

The global diatomite market was valued at US$ 1.5 Bn in 2021 and is likely to hit US$ 2.7 Bn by 2032, advancing at a CAGR of 5.4% during the forecast period (2022-2032).

North America is expected to hold the largest share of the global market, with the United States leading the way.

| Attributes | Key Insights |

|---|---|

|

Diatomite Market Size (2021) |

US$ 1.5 Bn |

|

Projected Market Value (2032) |

US$ 2.7 Bn |

|

Global Market Growth Rate (2022-2032) |

5.4% CAGR |

|

U.S. Market Share (2021) |

39.7% |

Diatomite is primarily used in the construction industry to increase the quality of concrete and cement while also making heat-insulating bricks with various binders. Diatomite is a sedimentary, porous rock formed by the aggregation of remnant diatoms.

High porosity, low density, abrasiveness, high surface area, insulating characteristics, high silica content, and inertness are some of the attributes that make diatomite a popular choice in the construction industry.

The booming construction industry worldwide is projected to spur the growth of the global diatomite market during the forecast period.

The outbreak of COVID-19 severely damaged the worldwide agricultural sector, especially in emerging economies. Due to labor and logistical challenges, the outbreak damaged the sector's production and marketing, while increasing food commodity costs altered consumption habits and economic woes reduced access to markets.

These events had a significant impact on the sales of diatomite, considering its expanding use in agricultural pesticides, rodenticides, and fungicides due to its dehydration qualities.

However, the global diatomite market is expected to bounce back during the forecast period as a result of the growing usage of safe painting solutions and pent-up demand.

North America is set to lead the global diatomite market during the forecast period. The rising population and technological advancements in developed nations such as Canada and the United States are projected to fuel the demand for diatomite in this region.

North America has the most diatomite producers. EP Minerals, Imerys S.A, Calgon Carbon Corporation, Diatomit CJSC, and Showa Chemical Industry Co., Ltd are among the largest diatomite producers in the region.

Furthermore, due to the existence of massive diatomite deposits in Nevada, California, Oregon, and Washington, The United States is the leading producer of diatomite.

Such factors are projected to boost the growth of the diatomite market in North America during the forecast period.

Asia Pacific is anticipated to follow North America in terms of revenue generation. This is due to rising demand from the healthcare and medical industries, industrial applications, and crop protection chemicals. China is projected to be one of the main producers of diatomite in Asia Pacific.

Other countries in the region, including Australia, South Korea, India, and Japan, are likely to provide significant potential prospects for the worldwide diatomite market during the forecast period.

Diatomite is also known as diatomaceous earth. Diatomite is the naturally occurring fossilized remains of diatoms. Diatomite is a sedimentary deposit that entirely consists of silica. Countries such as China, the U.S., Denmark, Japan, Mexico, and CIS were the major producers of diatomite in past few years.

The mining and extraction process of diatomite is complicated. Diatomite mining and processing requires heavy earthmoving equipment and huge processing facilities. Getting the desired grade of diatomite is a highly energy-intensive process. Diatomite can absorb liquid three times the weight of its own.

The market for diatomite was driven by the vanity of end-user industries such as water treatment, crop protection chemicals, and absorbents, among others. Huge demand for diatomite from filtration mediums has been the major factor in the growth of diatomite in the past few years.

In industrial applications, diatomite is used for the transportation of nitroglycerin. In filtration, diatomite is used in the filtering medium in swimming pools. In chemistry, diatomite is used as an aid for the filtration of fine particles in the solutions.

In the abrasives industry, diatomite is used as a mild abrasive in toothpaste, facial scrubs, and metal polishes. In crop protection chemicals, diatomite is used in fungicides, insecticides, and rodenticides, among others.

Diatomite is used as an absorbent in various applications such as excess oil spills, ethylene gas, and other toxic liquid spills. Diatomite is also used in classical thermal cookers due to its excellent thermal properties.

In medical & healthcare applications, diatomite is used in DNA purification, absorbent, and the filtration of liquids. Moreover, diatomite is also used in agricultural applications such as hydroponics, nutrient marker in livestock, and other specialty applications.

However, health regulations associated with diatomite are anticipated to slow the growth of the market in the next few years.

Some of the key manufacturers in the diatomite market are Celite Corp., Eagle-Picher Industries Inc., Grefco Minerals, Inc., and Moltan Co. among others.

| Attribute | Details |

|---|---|

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2012-2021 |

|

Market Analysis |

USD Million for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon Request |

By Type:

By Application:

By Region:

To know more about delivery timeline for this report Contact Sales

The global diatomite market is expected to expand at a CAGR of 5.4% between 2022 and 2032.

The global market for diatomite is expected to reach US$ 2.7 by 2032.

North America is set to lead the global diatomite market throughout the forecast period.

Eagle-Picher Industries Inc., Celite Corp., Moltan Co, and Grefco Minerals, Inc. are key diatomite suppliers.