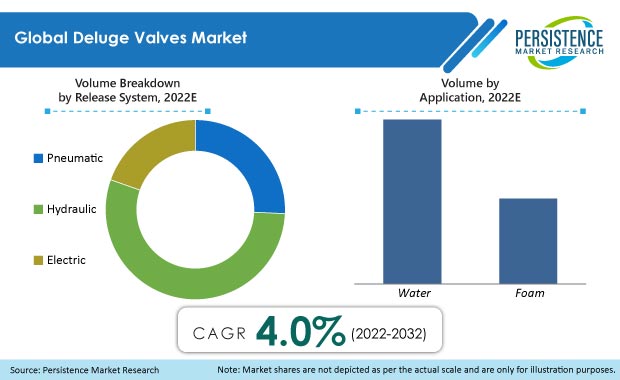

Deluge Valves Market Segmented By Pneumatic Deluge Valves, Hydraulic Deluge Valves, Electric Deluge Valves Release System in Water and Foam Application

Industry: Industrial Automation

Published Date: May-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 320

Report ID: PMRREP33099

The global deluge valves market size reached US$ 1.56 Bn at the end of 2021. Over the 2022 to 2032 assessment years, sales of deluge valves are predicted to increase at 4% CAGR and reach a market valuation of US$ 2.4 Bn.

Together, hydraulic and pneumatic release deluge valves account for more than 80% share of the global market for deluge valves.

| Attribute | Key Insights |

|---|---|

|

Deluge Valves Market Size (2021A) |

US$ 1.56 Bn |

|

Estimated Market Size (2022E) |

US$ 1.62 Bn |

|

Projected Market Value (2032F) |

US$ 2.4 Bn |

|

Value CAGR (2022-2032) |

4% |

|

Collective Share: Top 3 Countries(2021) |

39.1% |

Demand for deluge valves is being driven by rising awareness of fire safety procedures. Furthermore, increased concerns about the security of property and life are expected to drive market growth.

The deluge valves market is projected to grow in several countries around the world as a result of rapid urbanization and industrialization. In terms of volume, the oil & gas and chemical sectors are anticipated to lead demand growth over the forecast period.

Over the past half-decade, sales of deluge valves have been steady on the back of growing awareness about fire safety precautions, rising public awareness of fire safety procedures, and population expansion that is driving commercial and residential infrastructure growth. The U.S., China, and Germany are experiencing the highest growth in this market.

By volume, demand for deluge valves is projected to increase at 3.5% CAGR in the first half of the forecast period and 2.8% in the second half, owing to rising construction activities in several industries such as oil & gas, chemicals, pharmaceuticals, and mining.

Firefighting valves are utilized in high-risk environments such as airplane hangars, power plants, chemical storage facilities, and fire processing factories. Deluge valves are utilized in fire suppression systems where the pipe is left empty until the deluge valve distributes pressurized water through nozzles or sprinklers.

Consumption of pneumatic release system deluge valves is projected to increase at 3.8% CAGR by volume. These valves are actuated by air or gas, eliminating the risk of leakage and corrosion that hydraulic release deluge valves might create.

Due to the low cost and easy accessibility of water, the water segment held a higher market share of around 67.1% in 2021; however, the foam is projected to expand at a volume CAGR of 3.9%.

“High Demand for Corrosive-resistant Deluge Valves in Marine Projects”

An increasing number of development projects in offshore areas is boosting the demand for corrosive-resistant deluge valves in marine projects. End users choose seawater in firefighting systems due to its ease of use and low cost. Due to its high salt content, seawater poses a threat to fire systems and associated components such as deluge valves and pipes and deluge valve control systems.

In seawater applications, appropriate material is required to protect the deluge valves from failure in the event of a fire emergency and reduce maintenance costs. As a result, high-corrosion-resistant deluge valves are preferred in firefighting systems that use seawater.

“Increasing Construction Activities across End-use Industry Verticals”

The deluge valves market is a fragmented space in terms of end-use applications. One of the major factors influencing the market is increasing industrial construction activities across end-use industries such as oil & gas, power & energy, chemicals, and pharmaceuticals.

Currently, North America holds the highest share of the global deluge valves market, but the East Asia regional market is projected to expand faster at a volume CAGR of 4.4%. Along with the East Asian market, the South Asia Pacific market is also projected to rise steadily at a CAGR of 4.6% through 2032.

“Strict Firefighting System Standards across Regions”

Rising standards and regulations for fire protection systems are further expected to drive the sales of deluge valves in the global market. For instance, The National Fire Protection Association requires deluge valves to meet UL-260 standards that specify fluid leakage limit.

Demand for deluge valve variants such as quick release diaphragm valves and firefighting valves, besides others, is set to only ride going forward.

Why are Deluge Valve Producers Eyeing the Asia Pacific Market?

“High Rate of Infrastructure Activities in Asia Pacific Region”

Rapid industrialization and fast-growing economies due to extensive investments in infrastructure activities in oil & gas, energy & power, chemical, and pharmaceutical industries are factors expected to impact the growth of the deluge valves market.

The Asia Pacific region is expected to witness significant growth in industrial infrastructure fuelled by a combination of supportive government policies and infrastructural investments. Additionally, Asia’s demand expansion is driven by the power sector, which further adds to the high growth opportunity for deluge valve suppliers in the region.

The East Asia deluge valves market is projected to expand at a volume CAGR of 4.4%, while the South Asia Pacific deluge valves market is projected to grow at a value CAGR of 4.6% over the forecast period.

Due to rapidly increasing industrialization and infrastructure development, the Asia Pacific region is likely to retain a substantial share of the worldwide deluge water valves market over the forecast period.

Which Countries Account for High Demand for Deluge Valves in Europe?

“European Market Growth Led by Germany, the U.K., and France”

Europe, being the second-largest chemicals producing region in the world, carries steady growth opportunities for firefighting systems. Germany is the largest contributor to the European market and is projected to expand at a CAGR of 3.9% during the forecast period.

Germany is Europe's largest contributor, followed by the United Kingdom and France; these countries are likely to drive high demand for valves for deluge systems in the European market.

During the projection period, the United Kingdom deluge valves market is anticipated to account for more than 18% of the European market share. One of the primary reasons driving positive growth is increasing government investments in construction projects, including both residential and non-residential infrastructure.

Which Deluge Valve Release System is Most Popular?

“High Demand Predicted for Hydraulic Release Deluge Valve Systems”

Hydraulic release deluge valves are most commonly used for fire protection systems and are predicted to account for 53% volume share of the global market. Hydraulic deluge valves activated by water are extremely popular due to their low cost and easy accessibility.

However, demand for pneumatic release systems is projected to rise at a CAGR of 3.8% to reach a market valuation of US$ 633.3 Mn by 2032. Pneumatic release systems provide an added advantage as they offer cleaner operations through the use of non-corrosive media with air or gas for the activation of deluge water valves.

What Size of Deluge Valves are Most Widely Used across Geographies?

“High Demand Predicted for Hydraulic Release Deluge Valve Systems”

Consumption of 80 mm to 120 mm size deluge valves is estimated to increase at a rate of 3.7% to reach a market valuation of around US$ 813.5 Mn by 2032.

The deluge valve size is defined by the firefighting system that would be installed in the construction project. 80 to 120 mm deluge valves are anticipated to increase their market share, largely dependent on the number of sprinklers or nozzles and end-use applications.

Deluge valves are used in a variety of industries, including oil & gas, mining, power and energy, pharmaceuticals, and residential construction. Demand for fire suppression systems in the 80 mm to 120 mm size range is being driven by an increase in the number of commercial infrastructure projects, investments in non-residential buildings, and changes in key regulations for fire suppression systems.

Over the past few years, new product development and expansion activities have increased in the deluge valves market. Several key manufacturers of deluge valves are focusing on developing lightweight and compact deluge valves. The emergence of new manufacturers has also been witnessed in this space.

| Attribute | Details |

|---|---|

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2017-2021 |

|

Market Analysis |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon Request |

Deluge Valves Market by Release System:

Deluge Valves Market by Size:

Deluge Valves Market by Working Pressure:

Deluge Valves Market by Application:

Deluge Valves Market by End Use:

Deluge Valves Market by Region:

To know more about delivery timeline for this report Contact Sales

The global deluge valves market is currently valued at US$ 1.56 Bn.

Sales of deluge valves are projected to increase at 3.6% CAGR and be valued at over US$ 2.4 Bn by 2032.

Increasing demand for lightweight deluge valves and rising preference for corrosion-resistant deluge valves are key trends in this space.

The U.S., Germany, China, ASEAN, India, and GCC countries are lucrative markets for deluge valve suppliers, with Asia Pacific projected to hold the highest market share of around 35%.

Hydraulic release systems have more widespread applications and are projected to expand at a volume CAGR of 3.2% over the forecast period.

Minimax GmbH, Mueller SV, Viking Group Inc., Talis Group, and Draegerwerk are the most well-known manufacturers of deluge valves.