Industry: IT and Telecommunication

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Report Type: Ongoing

Report ID: PMRREP16741

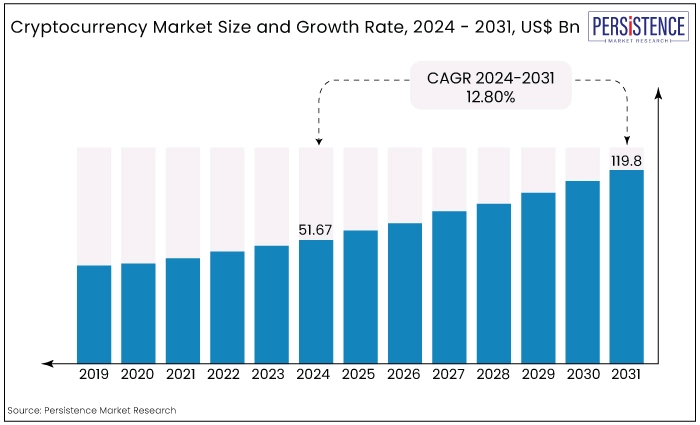

The global cryptocurrency market is projected to increase from US$51.67 Bn in 2024 to US$119.8 Bn by the end of 2031. The market is expected to secure a CAGR of 12.80% during the forecast period from 2024 to 2031.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Cryptocurrency Market Size (2024E) |

US$51.67 Bn |

|

Projected Market Value (2031F) |

US$119.8 Bn |

|

Forecast Growth Rate (CAGR 2024 to 2031) |

12.80% |

|

Historical Growth Rate (CAGR 2019 to 2023) |

10.60% |

Cryptocurrency is a future and new revenue stream in the digital finance world. It addresses is established using public and private keys. It is politically neutral as it is not bound by any rules or regulations of any specific government or exchange rates, interest rates, and country to country transaction fee, which makes international transactions faster. Moreover, it has low transaction fees and provides faster operation.

Cryptocurrency market growth is said to be more secure than conventional financial instruments, eliminating the chances of identity theft and other issues that currently plague fiat based electronic mobile payments infrastructure.

The increasing online transaction as mobile phone users prefer transactions over their phones, less transaction fees, easy and faster transaction, changing consumer and business landscape have led the demand for the market growth. Apart from these the rising online business market and use of mobile based wallet are also one of the drivers.

Currently, the customers demand is changing and they are looking more toward less time consuming financial services to make their life easier and effortless. For this, they are moving more toward online businesses like online transactions such as cryptocurrency.

Cryptocurrency is a virtual currency that people use for various purchases. It is a medium of exchange using cryptography to secure the transactions and to control the creation of additional units of the currency.

Rising Online Business Market

Many online businesses are integrating cryptocurrencies as a payment option alongside traditional methods. This adoption broadens the utility and acceptance of cryptocurrencies, driving demand among consumers who prefer using digital assets.

E-commerce platforms that facilitate transactions in cryptocurrencies provide a direct avenue for users to spend their digital assets. This expansion creates a demand cycle where users acquire cryptocurrencies.

Online businesses are increasingly engaging with DeFi protocols for fundraising, lending, and trading. These activities often utilize cryptocurrencies and blockchain technology, contributing to liquidity and innovation within the crypto market.

Ease of Transactions

Compared to traditional systems, crypto transactions can be much faster. Blockchain technology, which underpins cryptocurrencies, can process transactions in minutes or even seconds.

Transaction fees with crypto can be significantly lower than those charged by traditional payment processors, especially for international transactions. This can be a major advantage for businesses and individuals alike.

Crypto transactions can be made from anywhere with an internet connection, using mobile apps or online platforms. This makes them highly convenient for online purchases and sending or receiving money globally.

Cryptocurrency eliminates the need for intermediaries like banks, making it accessible to people who might not have access to traditional financial systems. This is particularly relevant in developing countries.

Lack of Widespread Adoption

Few merchants currently accept cryptocurrency as payment. This makes it difficult to use crypto for everyday purchases, reducing its overall usefulness as a currency.

Without widespread adoption, the user base for cryptocurrency remains limited. This affects the liquidity of the market, meaning it can be hard to buy or sell crypto quickly at a fair price.

Limited adoption creates uncertainty about the future value of cryptocurrencies. This volatility discourages some potential investors and businesses from entering the market, hindering growth.

Many blockchains, the technology behind crypto, struggle to handle a large volume of transactions. This can lead to slow transaction times and high fees if widespread adoption were to occur.

The relatively new and complex nature of cryptocurrency can be intimidating for some users. Hacks and scams can also erode trust and make people hesitant to invest.

Capacity Limits

When blockchain networks reach their capacity limits, transactions can experience delays in confirmation and processing. Users may need to wait longer for their transactions to be included in blocks, leading to frustration and a poorer user experience.

Moreover, transaction fees can spike during periods of high congestion as users compete to have their transactions processed quickly.

Congestion and capacity limits can compromise the reliability of blockchain networks. Instances of network congestion or delays can deter users and businesses from relying on cryptocurrencies for everyday transactions or critical applications.

High congestion and capacity limits can contribute to increased price volatility in cryptocurrencies. Network delays and uncertainties may trigger panic selling or buying, exacerbating price fluctuations.

For new users exploring cryptocurrencies, encountering capacity-related issues such as high fees and delays can create a negative first impression. This can deter them from further engaging with cryptocurrencies or delay their adoption until scalability issues are addressed.

Increased Adoption Among Retail Consumers

As cryptocurrencies become more mainstream, there is a significant opportunity for increased adoption among retail consumers, institutional investors, and businesses. This adoption can drive higher transaction volumes, liquidity, and overall market growth.

Cryptocurrency market players can develop and offer payment solutions that facilitate seamless and secure transactions for retail consumers. This could include crypto wallets, payment gateways, and merchant services that integrate cryptocurrencies as a payment option.

There is a need for educational resources and user-friendly platforms that help retail consumers understand and navigate the world of cryptocurrencies. Players offering educational content, beginner-friendly interfaces, and customer support can attract and retain new users.

Retail consumers are increasingly interested in investing in cryptocurrencies as part of their investment portfolio. Cryptocurrency market players can develop and offer retail-focused investment products, such as cryptocurrency funds, index funds, and savings accounts with crypto yields.

DeFi Emerges as the Leading Sector

DeFi has emerged as a leading sector within the cryptocurrency ecosystem, offering opportunities for decentralized lending, borrowing, trading, and yield farming. As DeFi protocols mature and gain acceptance, they could disrupt traditional financial services and capture a larger market share.

DeFi protocols operate on blockchain networks, providing borderless access to financial services. Market players can tap into global markets and reach users worldwide without traditional geographical limitations, expanding their customer base and market reach.

DeFi platforms enhance liquidity by allowing users to directly trade assets, provide liquidity to decentralized exchanges (DEXs), and participate in liquidity pools.

Market players can contribute to liquidity pools or develop tools that optimize liquidity management, benefiting from transaction fees and trading volumes.

DeFi has popularized decentralized exchanges (DEXs) that operate without intermediaries, offering improved security, transparency, and control over funds.

Market players can develop and operate DEXs, providing trading pairs, liquidity incentives, and innovative trading features. DeFi platforms offer various opportunities for users to earn yields through lending, staking, liquidity provision, and yield farming.

Key players can innovate by offering yield optimization strategies, automated yield farming tools, and risk management solutions for DeFi investors.

Bitcoin Represents the Largest Cryptocurrency Type

The cryptocurrency market can be segmented based on cryptocurrency type into categories such as bitcoin (BTC) and alternative coins, and stablecoins. Bitcoin, the first cryptocurrency, often serves as a store of value or digital gold.

Altcoins include a wide range of cryptocurrencies like Ethereum (ETH), Ripple (XRP), Litecoin (LTC), etc., each with unique features, and use cases. Cryptocurrencies pegged to stable assets like fiat currencies (e.g., USDT, USDC) or commodities, aiming to reduce price volatility.

North America, and Europe Lead with Higher Institutional Investments

North America, and Europe are in advanced stages of cryptocurrency adoption. Both regions have made significant strides in developing regulatory frameworks for cryptocurrencies and digital assets.

Regulatory clarity provides confidence to investors, businesses, and consumers, fostering a more mature and stable market environment.

Regulatory bodies in these regions, such as the SEC in the US, and various financial authorities in European countries, have issued guidelines and regulations that outline compliance requirements for cryptocurrency businesses. North America, and Europe have seen substantial institutional investment in cryptocurrencies.

Institutional investors, including hedge funds, asset managers, and family offices, have begun allocating capital to cryptocurrencies as part of diversified portfolios.

Major financial institutions in these regions have started offering cryptocurrency custody, trading, and investment products, providing infrastructure for institutional participation. Cryptocurrency market in North America, and Europe benefit from higher liquidity and trading volumes compared to other regions.

However, the Asia Pacific and MEA are expected to the emerging regions. In the countries like India, and Africa, the popularity and the usage of various cryptocurrencies are expected to increase in the coming years.

Asia Pacific, and MEA Emerge as Significant Players

Asia Pacific, and the Middle East and Africa regions are experiencing rapid technological adoption and digital transformation across various sectors. High smartphone penetration, young demographics, and increasing internet connectivity contribute to a fertile ground for cryptocurrency adoption and digital payments.

Both regions have large populations of tech-savvy youth who are early adopters of new technologies, including cryptocurrencies. Young demographics are more open to digital currencies and blockchain technology, driving grassroots adoption through social media, online communities, and mobile apps.

Asia Pacific, and MEA include countries with significant remittance flows, where cryptocurrencies offer a cost-effective and efficient alternative to traditional remittance methods.

Cryptocurrencies can reduce transaction fees and processing times, benefiting both senders and recipients of remittance.

Some countries in Asia Pacific, such as Japan and Singapore, have developed clear regulatory frameworks for cryptocurrencies, promoting innovation while ensuring consumer protection and market stability.

Regulatory developments in the Middle East and Africa countries vary, but some jurisdictions are exploring or implementing regulations to attract cryptocurrency businesses and investors.

The competitive scenario in the cryptocurrency market is dynamic and multifaceted, shaped by various factors including technological innovation, regulatory developments, market trends, and user adoption.

Cryptocurrencies compete based on technological advancements and innovations. The competition extends beyond individual cryptocurrencies to encompass entire ecosystems.

2023

Investor confidence rebounded, which resulted in a notable increase in venture capital funding for blockchain startups throughout 2024. Companies such as Wormhole, which focuses on enhancing interoperability between different blockchains, secured substantial investments during this period.

2023

Heightened regulatory scrutiny compelled the industry to prioritize security and investor protection. This shift led to the implementation of measures such as security audits and code reviews specifically aimed at DeFi protocols.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Cryptocurrency Type

By End User

By Region

To know more about delivery timeline for this report Contact Sales

The global cryptocurrency market is projected to increase from US$51.67 Bn in 2024 to US$119.8 Bn by the end of 2031.

Increase in online business market is driving the market growth.

A few of the top industry players in the market are Coinbase, Bitstamp Ltd., and Coinsecure.

The market is expected to secure a CAGR of 12.80% during the forecast period from 2024 to 2031.

Increased adoption among retail consumers presents a key opportunity for the market players.