Industry: Industrial Automation

Published Date: March-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 182

Report ID: PMRREP33211

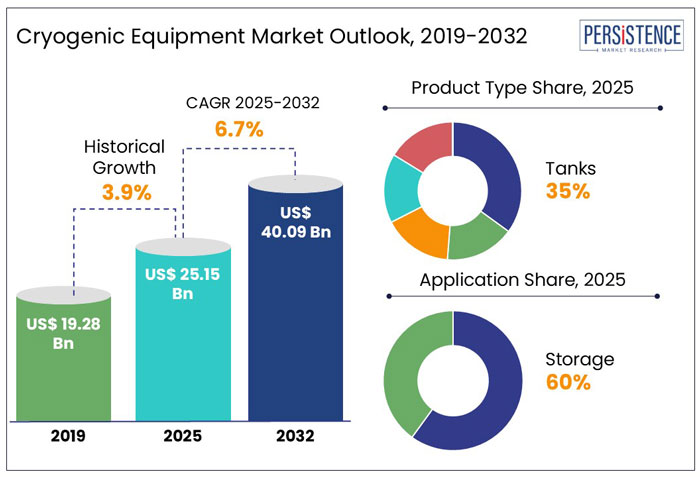

The global cryogenic equipment market size is anticipated to rise from US$ 25.15 Bn in 2025 to US$ 40.09 Bn by 2032. It is projected to witness a CAGR of 6.7% from 2025 to 2032.

In the industrial gas sector, the demand for cryogenic equipment is rapidly increasing, driven by the need for specialized storage and distribution systems for gases like nitrogen, oxygen, and argon. Global infrastructure investment is projected to exceed US$ 250 Bn by 2030, with the liquefied natural gas (LNG) sector being a major catalyst for this growth.

Post-pandemic, the worldwide demand for medical oxygen has surged by 30%, leading the healthcare industry to adopt cryogenic technology. Additionally, the food sector utilizes cryogenic freezers to rapidly freeze products, which helps to extend their shelf life and maintain quality. High-performance cryogenic systems are also essential for satellite propulsion and fuel storage in space exploration, and innovative cryogenic energy storage solutions are currently under research.

Key Highlights of the Cryogenic Equipment Market

|

Global Market Attributes |

Key Insights |

|

Cryogenic Equipment Market Size (2025E) |

US$ 25.15 Bn |

|

Market Value Forecast (2032F) |

US$ 40.09 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.9% |

Spur in Demand for Medical Cryogenic Storage Influenced by Pandemic

As per Persistence Market Research, the global cryogenic apparatus industry witnessed a CAGR of 3.9% in the historical period between 2019 and 2024. The global demand for cryogenic equipment faced turbulence in 2020 and 2021 due to capacity expansion outpacing demand, leading to supply issues. The COVID-19 pandemic further exacerbated this imbalance, creating a surplus supply. However, cryo-freezer sales are projected to surge, driven by increasing demand in healthcare.

The global sales of medical cryogenic storage are expected to grow at a CAGR of 7.8% through 2032, fueled by vaccine storage and biopharmaceutical preservation. Additionally, rising LNG-based power generation, expected to reach 640 GW globally by 2030, is boosting demand for cryogenic gas storage. Investing in technologies catering to the research and development in cryogenics is envisioned to boost sales further in the forthcoming period.

Trend of Sustainable Technological Improvements Boost Green Innovation

In the estimated timeframe from 2025 to 2032, the global market for Cryogenic Equipment is likely to showcase a CAGR of 6.7%. Since conventional HFCs have a large potential for global warming, the market for cryogenic equipment is moving toward low-GWP and natural refrigerants like carbon dioxide and liquid nitrogen in an effort to minimize carbon emissions. For instance,

Similarly, Air Liquide has been developing cryogenic energy storage (CES) systems to enhance renewable energy efficiency. SpaceX and NASA are also adopting green cryogenic fuels, such as liquid methane, for sustainable space missions.

The healthcare industry is improving the efficiency of cryogenic freezers that use liquid hydrogen and nitrogen in order to minimize energy usage and preserve biological samples, therefore addressing environmental concerns.

Growth Driver

Rise in LNG Infrastructure Worldwide Presents Prospects for Cryogenics

The global growth of LNG (liquefied natural gas) infrastructure is increasing demand for specialized cryogenic storage tanks, transport systems, and vaporizers. Transporting and storing LNG at -162°C (-260°F) necessitates the use of sophisticated cryogenic equipment.

In 2023, China and the U.S. led global LNG infrastructure expansion, with China adding 22 million tons per year (MTPA) of regasification capacity and the U.S. boosting LNG export terminals. Companies like Linde, Chart Industries, and Air Products are innovating vacuum-insulated storage tanks and cryogenic vaporizers to improve energy efficiency. For instnace,

Europe has expedited LNG terminal building due to energy security concerns, with Germany set to open its first LNG import facility in 2023. In a rapidly evolving energy sector, such expansion ensures effective LNG storage and transmission by driving demand for cutting-edge cryogenic tanks and heat exchangers.

Market Restraining Factor

Investment Barriers in Cryogenic Storage for Small Businesses

Investing in cryogenic storage facilities poses several challenges for small and medium-sized businesses (SMBs). These challenges include high upfront costs, ongoing maintenance expenses, and strict regulatory requirements. The setup cost for a cryogenic storage system can range from US$ 500,000 to US$ 5 Mn, depending on the technology used and its capacity.

In 2023, stricter safety and environmental regulations enforced by U.S. agencies such as OSHA and the EPA have led to increased compliance costs. Additionally, long-term affordability is a concern due to operating expenses, which include energy-intensive refrigeration systems and the need for liquid nitrogen refills.

Without financial assistance or government incentives, many SMBs struggle to justify their investments, despite the growing demand in sectors like food processing, healthcare, and industrial gas.

Key Market Opportunity

Advancements in Technology Paves the Way for Industrial Applications and Research

Improvements in vacuum technology and insulation materials are increasing the storage capacity and efficiency of cryogenic equipment. Materials like aerogel and high-performance multilayer insulation (MLI) help store gases such as liquid nitrogen, liquid oxygen, and LNG for longer periods by reducing heat transfer. Companies like CryoWorks and Chart Industries are investing in better insulation methods to cut thermal losses in cryogenic storage tanks and transfer systems.

At the same time, the need for specialized cryogenic cooling systems is rising due to research in quantum computing and superconductivity. Quantum computers, such as those built by Google and IBM, require temperatures close to absolute zero (-273.15°C) for their qubits to work reliably. Companies like Oxford Instruments and Bluefors are developing cryogenic solutions for these applications, leading to a growing demand for cryocoolers and dilution refrigerators.

As cryogenic technology grows, these innovations are improving energy efficiency, lowering costs, and enhancing reliability in storage and computing.

Product Type Insights

Tanks Captures a Significant Share with Wide Applications in Different Industries

The cryogenic equipment market is poised for strong growth, with cryogenic tanks leading at 35% market share in 2025. These tanks are vital for storing and transporting liquefied gases like LNG, oxygen, nitrogen, and argon.

Chart Industries, in March 2024, announced the expansion of its cryogenic storage solutions, focusing on large-scale LNG and hydrogen storage tanks. Similarly, companies such as Linde plc have ramped up investments in medical-grade cryogenic tanks to support the growing demand for liquid oxygen storage in healthcare.

On the other hand, valves are set to capture 22% of the market due to their crucial role in gas-producing facilities and LNG regasification terminals. Such as Emerson Electric Co., in January 2024, launched an advanced cryogenic control valve series designed to enhance safety and efficiency in LNG cargo systems. As global LNG infrastructure expands, demand for cryogenic valves is projected to rise in the forthcoming period.

Cryogen Type

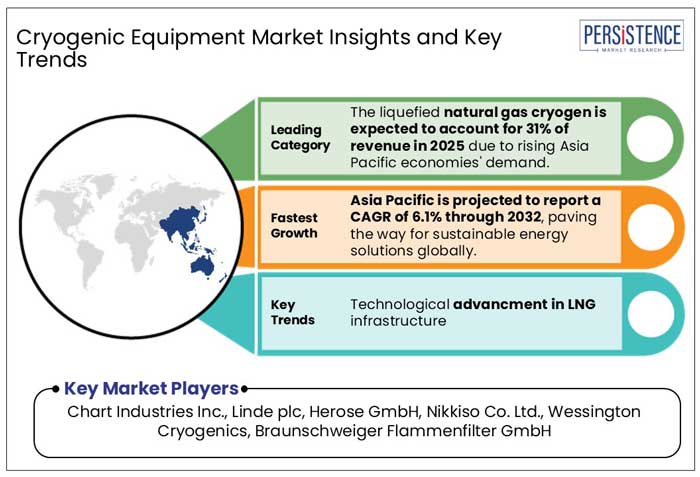

Awareness Regarding Clean Energy Boost the Demand for Liquid Natural Gases

According to projections by Persistence Market Research, the liquefied natural gas cryogen category is expected to account for 31% of revenue in 2025, dominating the global cryogenic equipment market. Growing demand for LNG in rising economies, especially in Asia-Pacific, where nations like China, India, and South Korea are growing their capacity to import and degasify LNG, is driving this increase. Businesses like Linde plc and Air Products are making investments in next-generation cryogenic storage tanks to meet the growing demand of clean energy in the region.

In the meantime, the nitrogen category is expected to have a 26% market share by 2025, owing to its significance in medicines, medical packaging, and blood freezing. Companies like Chart Industries and Cryoport Inc. are at the forefront of developing nitrogen-based cryogenic transportation technologies, which are utilized extensively in cold chain logistics for vaccine storage. Furthermore, the need for liquid oxygen cryogen in blast furnaces is rising in the metal processing industry, which helps lower exhaust gas emissions and boost energy efficiency in the production of steel.

Europe Cryogenic Equipment Market

Cryogenic Equipment Market in Europe Thrives Amid Energy Expansion

In 2025, Europe’s cryogenic industry is expected to hold a 39% market share, driven by the region’s growing demand for industrial gases, LNG storage, and sustainable energy solutions. According to the European Commission (EC), the continent’s power demand is increasing due to the expanded use of cryogenic equipment in industries such as healthcare, manufacturing, and energy storage.

The International Energy Agency (IEA) forecasts a 1.5% annual rise in natural gas demand from 2019 to 2025, further propelling the need for cryogenic tanks, vaporizers, and storage systems. With 27% of the world's gas imports in 2019, Europe is the biggest LNG importer.

Countries like Germany, France, and the UK are adopting low-emission cryogenic technology. However, smaller firms are unable to invest in cutting-edge cryogenic infrastructure due to high capital costs and reliance on the spot market. Leading companies in the sector, such as Linde plc and Air Liquide, are growing their cryogenic storage networks across Europe.

Asia Pacific Cryogenic Equipment Market

Rise in Investment in Cryogenic Technologies in Asia Pacific Shows Investment Opportunities

In 2025, Asia Pacific is anticipated to hold a market share of 25%, driven by rapid industrialization development and rising energy demand. With a forecast CAGR of 6.1% from 2025 to 2032, the region will continue leading advancements in cryogenic technologies, positioning itself as the global hub for sustainable energy solutions.

The region’s investment in gas-based power plants is fueled by the need for cleaner energy solutions and sustainability initiatives. Such as the Asian Development Bank (ADB) has committed US$ 1 Bn in energy projects from 2019 to 2021, focusing on expanding renewable energy capacity and enhancing electricity access.

Countries like China, India, and Japan are investing heavily in cryogenic storage and transportation solutions to support LNG imports, which surged by 6.3% in 2023 in China alone. Furthermore, the demand for industrial gases in sectors like healthcare, manufacturing, and metallurgy is accelerating the adoption of cryogenic storage tanks, vaporizers, and transfer systems.

North America Cryogenic Equipment Market

Rise in LNG Infrastructure in North America Shows Avenues

North America is expected to maintain a 18% market share in the worldwide cryogenic equipment market by 2025, owing to increased LNG infrastructure and industrial expansion. As coal-fired power facilities are being phased out and the demand for cleaner energy alternatives rises, the U.S. and Canada are establishing themselves as major LNG exporters.

The need for cryogenic storage tanks, vaporizers, and transfer systems is increased by the U.S. government's proposal to build 18 GW of new gas-based power plants. Furthermore, the manufacturing and processing sectors, which account for 11% of U.S. GDP, demand cryogenic gases for use in metal processing, healthcare, and food preservation.

For producers of cryogenic equipment, the expanding investments in natural gas liquefaction plants significantly expand market prospects.

In order to enhance their market presence and adapt to the evolving technological demands of various end-use sectors, cryogenic equipment manufacturers implement a range of strategic approaches. These include pursuing acquisitions to expand their capabilities, forging partnerships that leverage shared expertise, and collaborating on joint projects that drive innovation.

Additionally, market players focus on developing cutting-edge products that meet emerging needs and exploring regional expansions to tap into new markets and opportunities.

Key Industry Developments

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Cryogen

By Application

By End User

By Region

To know more about delivery timeline for this report Contact Sales

The market is set to reach US$ 25.15 Bn in 2025.

Cryogenic equipment is vital in the oil & gas industry for LNG transportation and storage, boosting economic growth and raising awareness of clean energy resources.

Chart Industries Inc., Linde plc, Herose GmbH, and Nikkiso Co. Ltd. are a few leading players.

The industry is estimated to rise at a CAGR of 6.7% through 2032.

Europe is projected to hold the largest share of the industry in 2025.