Compression Sportswear Market

Industry: Consumer Goods

Published Date: December-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 188

Report ID: PMRREP35007

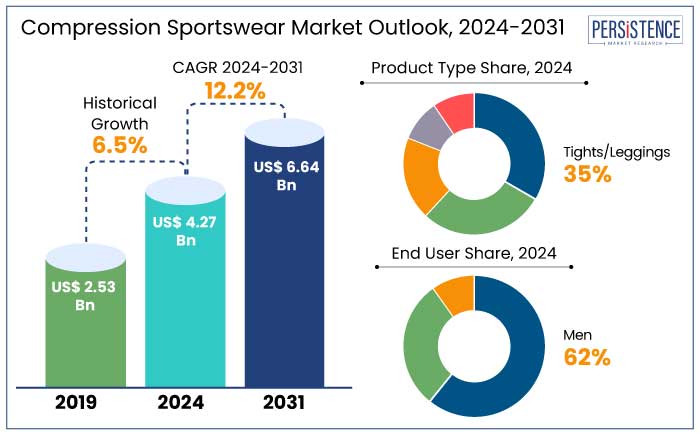

The compression sportswear market is estimated to increase from US$ 4.27 Bn in 2024 to US$ 6.64 Bn by 2031. The market is projected to record a CAGR of 12.2% during the forecast period from 2024 to 2031.

As per the studies carried out, compression wear is reported to improve athletic performance by at least 2% and reduce muscle fatigue by 10 to 15% due to which the market is seeing a steep rise. Surveys suggest that around 32% of recreational fitness enthusiasts integrate compression wear into their routines, especially for gym workouts, yoga, and running. Compression garments are widely used in endurance sports like running, cycling, and triathlons.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Compression Sportswear Market Size (2024E) |

US$ 4.27 Bn |

|

Projected Market Value (2031F) |

US$ 6.64 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

12.2% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

6.5% |

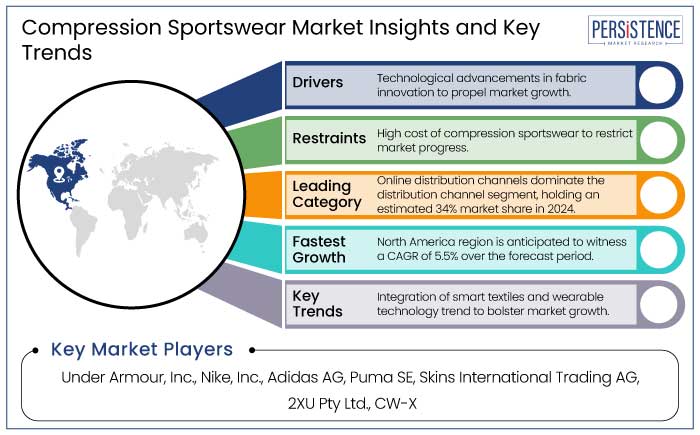

North America leads the compression sportswear market, accounting for approximately 40% of the market share in 2024. The dominance of the North American region is fueled by a well-established sports and fitness culture, high awareness of performance-enhancing athletic wear, and significant spending capacity among consumers.

The region is home to several professional sports leagues, such as the NBA, NFL, MLB, and NHL, where athletes and fitness enthusiasts are keen adopters of compression sportswear for both performance and recovery purposes. As a result, the widespread promotion of these products by professional athletes and sports teams has significantly influenced consumer behaviour.

North America’s population strongly focuses on health, fitness, and active lifestyles, contributing to the rising demand for compression wear. Increasing gym memberships, home workout trends, and participation in sports such as running, cycling, CrossFit, and yoga have further propelled the adoption of these products.

Consumers are increasingly looking for sportswear that offers comfort and style and provides functional benefits such as improved muscle recovery, blood circulation, and reduced fatigue. The demand for fitness is particularly prominent in the United States and Canada, where fitness culture is deeply embedded in society.

North America compression sportswear market is projected to expand at a CAGR of 5.5%. The market growth is driven by increasing participation in recreational and professional sports, a growing interest in fitness among millennials and Gen Z, and the rise of online and offline retail platforms. The increasing popularity of compression socks and leggings among endurance athletes for post-exercise recovery is expected to boost market growth further.

Based on product type, the market is divided into shirts, shorts, tights/leggings, innerwear and others. Among these, tights/leggings dominate the market as these are favoured by athletes and fitness enthusiasts because they provide muscle support, enhance blood circulation, and reduce muscle fatigue.

These garments are widely adopted across various sports, including yoga, Pilates, gym training, running, and athleisure wear, which expands their consumer base beyond athletes to general fitness enthusiasts. The rising popularity of athleisure fashion, clothing that blends athletic and casual wear, has significantly boosted the demand for compression leggings among women and young demographics.

Leading brands such as Nike, Adidas, and Under Armour have introduced compression leggings with advanced features, such as moisture-wicking properties, thermal regulation, and anti-odour fabrics, enhancing their functionality and appeal.

The growing participation of women in sports and fitness activities has made compression leggings a staple product. Women represent a substantial consumer base for compression tights due to their preference for form-fitting, functional, and stylish active wear.

Based on end user, the market is categorized into men, women, and children. Out of these, the men end user segment dominates the market. Men are the largest consumers of compression sportswear due to higher participation rates in sports, fitness activities, and gym workouts.

Activities like running, cycling, weightlifting, and team sports see significant male engagement, where compression wear is widely used for performance and recovery benefits.

Men often opt for compression garments like tights, shirts, and shorts to improve blood circulation, reduce muscle fatigue, and enhance athletic performance.

Compression clothing is also adopted post-workout for muscle recovery and soreness reduction. Male athletes in professional leagues like the NFL, NBA, and soccer extensively use compression gear for training and competition.

Compression sportswear is engineered to augment blood and lymphatic circulation, enhance performance, and expedite injury healing and body contouring for athletes and fitness enthusiasts. Compression sportswear garments are constructed of elastomeric fibres that exert significant pressure on body areas by supporting and compressing the underlying tissues, serving body-shaping, sports, and medicinal purposes.

Compression sportswear offers several benefits to an athlete’s performance by reducing muscle fatigue and soreness, improving perceived exertion, recovery, jumping ability, better muscle oxygenation. The said category of apparel is additionally advantageous in the healthcare sector for the treatment of senior people suffering from spondylitis and other joint and groin dysfunctions.

Prominent manufacturers and industry players are introducing significant fabric developments. These developments include smart nanotechnology-based textiles and moisture-wicking, heat-resistant compression garments for fitness and sporting pursuits. The adoption of technology-based materials is enhancing overall industry growth.

The compression sportswear market experienced steady growth during the period from 2019 to 2023 driven by increasing awareness of fitness and health trends among consumers. The rising popularity of sports participation and active lifestyles, coupled with a growing number of fitness enthusiasts, contributed significantly to market expansion.

The integration of moisture-wicking and breathable fabrics improved product performance, attracting recreational and professional athletes. Compression sportswear also gained traction in healthcare applications for rehabilitation and recovery purposes. The market benefited from the athleisure trend, particularly among women, driving demand for functional yet stylish compression leggings and gear.

The compression sportswear market is projected to accelerate over the forecast period. Adoption of smart textiles and nanotechnology for enhanced performance and recovery. Women’s sportswear segment is growing rapidly, contributing to the increasing demand for compression leggings and innerwear.

Rapid urbanization, rising disposable incomes, and growing fitness trends are fueling market growth. The healthcare sector will play a pivotal role as compression garments gain popularity for injury recovery and senior care. Sustainability initiatives and innovative product launches will continue driving growth in the global market.

Continuous Development of Innovative Fabric Technologies

One of the most significant growth drivers for the compression sportswear market is the continuous development of innovative fabric technologies. Brands focus on incorporating smart textiles, nanotechnology, and advanced elastomeric fibres into compression garments to improve athletic performance, recovery, and comfort.

Features such as moisture-wicking, temperature regulation, and anti-microbial properties are now common, enhancing the functionality of these products. Smart textiles integrated with pressure sensors help monitor muscle performance and fatigue, providing athletes with real-time data to optimize their training.

Heat-resistant and breathable materials ensure comfort during intense workouts. These technological advancements cater to athletes and expand the consumer base to fitness enthusiasts and individuals seeking recovery benefits.

As consumers become increasingly aware of performance-enhancing gear, the adoption of technologically advanced compression sportswear will continue accelerating, driving market growth.

Rising Fitness Awareness and Active Lifestyle Trends

The increasing global focus on health, wellness, and active lifestyles is a major growth driver for the compression sportswear market. Fitness trends such as gym workouts, CrossFit, yoga, running, and cycling have surged, encouraging consumers to invest in functional athletic wear that enhances performance and recovery.

The rise of digital fitness platforms, fitness influencers, and virtual training programs has further promoted active lifestyles, driving the adoption of compression gear among younger demographics. Consumers increasingly prioritize products that combine style, performance, and recovery benefits.

The growing obesity epidemic and rising awareness of the importance of physical fitness have boosted demand for athletic wear, including compression garments, to improve blood circulation and reduce muscle fatigue. These trends are particularly prominent in urban areas, where individuals adopt fitness routines to balance their sedentary lifestyles. The shift toward health-conscious living is expected to sustain long-term growth in the compression sportswear market.

High Cost of Compression Sportswear to Hinder Sales

One of the primary restraints limiting the growth of the compression sportswear market is the high cost of technologically advanced compression garments. Products incorporating smart textiles, nanotechnology, and high-performance fabrics like moisture-wicking and temperature-regulating materials are priced at a premium.

These garments are primarily targeted toward professional athletes and fitness enthusiasts willing to invest in performance-enhancing gear. The high price often deters price-sensitive consumers, especially in emerging economies where disposable incomes are relatively lower.

The cost of raw materials, research, and development associated with innovative compression technology further escalates production expenses. The price barrier restricts widespread adoption, particularly among casual users and consumers in developing markets, thus limiting overall market penetration.

Integration of Smart Textiles and Wearable Technology Trend

A prominent trend in the compression sportswear market is the integration of smart textiles and wearable technology to enhance functionality and performance monitoring. As consumers increasingly seek products that combine technology with fitness benefits, brands are introducing innovative fabrics embedded with sensors and pressure-responsive elements.

Smart textiles are capable of tracking key performance metrics, such as muscle oxygenation, blood flow, and movement efficiency, offering real-time feedback to athletes. Compression sportswear equipped with smart sensors helps monitor fatigue levels, detect muscle imbalances, and optimize training intensity.

Advancements in IoT (Internet of Things) and connected fitness devices allow compression sportswear to interact with mobile apps, creating a seamless experience for tracking workout data and recovery progress. The technological transformation caters not only to elite athletes but also to fitness enthusiasts seeking innovative solutions to improve their training outcomes.

As consumer demand for performance-enhancing gear grows, smart textiles are expected to dominate the market, driving its evolution and adoption in the coming years.

The compression sportswear market is highly competitive and characterized by the presence of global leaders and specialized niche players. Key brands such as Nike, Adidas, Under Armour, and Lululemon dominate the market through continuous innovation, strong brand recognition, and global distribution networks.

Nike leads with its advanced Dri-FIT technology and adaptive compression gear designed for elite athletes. Adidas emphasizes sustainable innovation with its Primegreen fabrics and IoT-integrated performance tracking gear.

Key players like 2XU and Skins cater to professional athletes by specializing in graduated compression technology for endurance and post-workout recovery. The rise of local brands, technological advancements, and expanding e-commerce platforms are intensifying competition.

Recent Industry Developments in the Compression Sportswear Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Product Type

By End User

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

The market is estimated to be valued at US$ 4.27 Bn in 2024.

North America is the largest sportswear market.

Running, Basketball, Cycling, and MMA use compression clothing.

Compression garments are expensive as they include more materials and a longer manufacturing time.

The United States imports the most sportswear.