ID: PMRREP34682| 210 Pages | 24 Jul 2024 | Format: PDF, Excel, PPT* | Industrial Automation

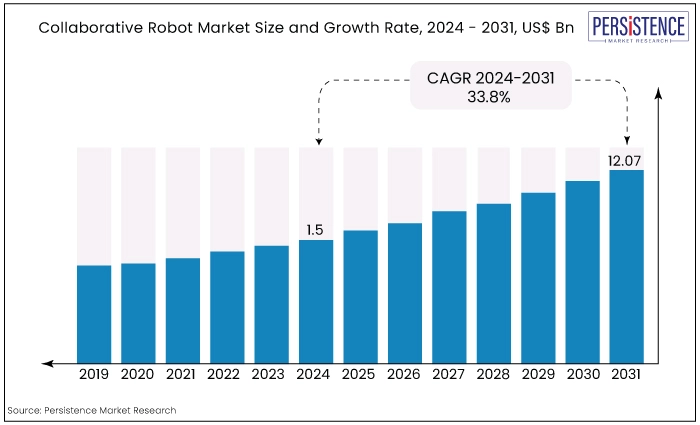

The global collaborative robot market is estimated to value at US$12.07 Bn by the end of 2031 from US$1.24 Bn recorded in 2023. The market is expected to secure a CAGR of 33.8% in the forthcoming years from 2024 to 2031.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Collaborative Robot Market Size (2024E) |

US$1.5 Bn |

|

Projected Market Value (2031F) |

US$12.07 Bn |

|

Forecast Growth Rate (CAGR 2024 to 2031) |

33.8% |

|

Historical Growth Rate (CAGR 2018 to 2023) |

21.6% |

A collaborative robot, or 'cobot,' is an advanced robot designed to work alongside humans, assisting with various complex tasks. Cobots are highly favored in industries such as automotive, electrical, and plastic because they boost productivity, add value, and facilitate the implementation of smart production systems.

Unlike traditional autonomous robots, which are programmed to perform a single task and thus limit productivity and innovation, cobots can handle multiple tasks requiring minimal problem-solving skills. This allows human workers to focus on more complex and higher-skill tasks, making cobots a highly successful innovation.

Cobots are lightweight, compact, mobile, and energy efficient. They can be redeployed to various locations without altering the production layout. They require minimal programming to begin work and do not need operators to have prior programming expertise, unlike traditional robots, which can take weeks to set up before becoming operational.

Initially, cobots were a niche segment within the broader industrial robotics market. However, their unique capabilities, such as working safely alongside humans and being easily programmable for various tasks, positioned them as valuable assets for enhancing productivity and operational efficiency.

During the historic period, there was a steady increase in the deployment of cobots in small and medium-sized enterprises (SMEs) due to their affordability and ease of use.

Unlike traditional industrial robots, which often required substantial investments and specialized programming skills, cobots offered a more accessible automation solution.

This democratization of robotic automation allowed SMEs to compete more effectively with larger companies, particularly in sectors like manufacturing, electronics, and logistics.

The versatility of cobots in performing a range of tasks, from assembly and packaging to quality inspection, further contributed to their widespread adoption.

The COVID-19 pandemic, which emerged in late 2019 and continued through 2020 and beyond, also influenced the growth trajectory of the cobot market. The pandemic highlighted the need for resilient and adaptable supply chains, and many companies turned to automation as a solution.

Cobots, with their ability to operate in proximity to human workers and their flexibility in handling various tasks, became an attractive option for businesses looking to maintain operations while adhering to social distancing guidelines.

There is a growing emphasis on safety features and standards in the collaborative robot (cobot) market. Unlike traditional industrial robots, which often operate in fenced-off areas for safety, cobots are designed to work alongside humans. This necessitates robust safety features such as force-limiting technology, speed and separation monitoring, and collision detection systems.

For example, Universal Robots' cobots are equipped with built-in safety functions that allow them to automatically stop if they encounter resistance, ensuring safe interactions with human workers.

Smart Manufacturing and Industry 4.0 Act as the Catalyst for Market Growth

Industry 4.0 represents the fourth industrial revolution, characterized by the integration of digital technologies into manufacturing processes. Smart Manufacturing leverages these technologies to create more efficient, flexible, and responsive production environments.

Cobots equipped with IoT capabilities monitor their performance, detect anomalies, and optimize processes autonomously. Data analytics and machine learning are other critical components of Industry 4.0 that drive cobot demand. These technologies enable cobots to learn from historical data, predict maintenance needs, and adapt to changing production requirements.

For example, BMW has implemented cobots in its production lines to perform tasks such as gluing, welding, and assembly. These cobots use data analytics to improve precision and reduce error rates, contributing to higher quality and consistency in the manufacturing process.

The flexibility and ease of programming associated with cobots make them ideal for small and medium-sized enterprises (SMEs) looking to adopt Industry 4.0 technologies.

Unlike traditional industrial robots, which require extensive programming and setup, cobots can be quickly reprogrammed and deployed for various tasks. This adaptability is crucial for SMEs that need to respond rapidly to market changes and customer demands.

Labor Shortage, and Need for Cost Efficiency

Industries face difficulties in hiring and retaining skilled labor, cobots offer a viable alternative by performing repetitive, dangerous, or precision tasks, thus freeing human workers to focus on more complex and value-added activities.

The labor shortage is particularly acute in manufacturing and logistics sectors, where the demand for skilled workers often exceeds supply. Europe and Asia report significant gaps in skilled labor, exacerbated by aging populations and declining birth rates.

Cobots fill these gaps by handling tasks such as assembly, packaging, and quality inspection, leading to increased operational efficiency and reduced downtime.

Traditional industrial robots expensive and require substantial investments in infrastructure and safety measures. In contrast, cobots are typically more affordable and easier to integrate into existing workflows without extensive modifications.

By automating repetitive tasks, companies achieve significant cost savings through reduced labor costs, lower error rates, and increased productivity. At BMW’s Dingolfing plant in Germany, cobots assist in the assembly of vehicle doors, reducing the physical strain on workers and increasing production speed.

Similarly, in the food industry, companies like Universal Robots have deployed cobots for packaging and palletizing, improving throughput and consistency.

Manufacturers Opt for SCARA (Selective Compliance Articulated Robot Arm) Robots over Cobots

SCARA robots, known for their speed and precision in assembly and handling tasks, offer distinct advantages in scenarios where high throughput and precise repeatability are critical.

While cobots excel in collaborative settings where they work alongside humans without elaborate safety measures, they do not match SCARA robots' speed and accuracy in high-speed assembly lines or applications demanding precise positioning.

For example, in electronics manufacturing, SCARA robots are favored for their ability to swiftly and accurately place components onto circuit boards, a task that demands both speed and precision to maintain production efficiency and product quality.

Despite advancements in cobot affordability, SCARA robots often provide a quicker ROI in applications where their superior speed and precision translate directly into increased production output and reduced defect rates. This is crucial in competitive industries where manufacturers seek to optimize production efficiency without compromising quality.

Integrating Robotic Arms with Mobile Co-Bots

The increasing focus on pairing robotic arms with mobile platforms leverages mobility to enhance flexibility, productivity, and safety across various industries.

The ability of cobots to function alongside people in dynamic, unstructured situations is made possible by developments in both mobile platform technologies and robotic arm capabilities.

Traditional cobots are often fixed to specific workstations, limiting their versatility. In contrast, mobile cobots navigate autonomously or semi-autonomously within a facility, moving between different workstations or even locations as needed.

This mobility allows businesses to optimize workflows, respond to changing production demands more effectively, and utilize space more efficiently.

For example, in manufacturing, mobile cobots transport components between assembly stations, autonomously navigate warehouse shelves for inventory management, or perform quality inspections across different parts of a production line.

Such capabilities reduce the need for fixed automation infrastructure and manual transport, thereby improving overall operational efficiency.

Advancements in AI, and ML

AI enhances cobots is in their ability to perceive and respond to the environment. Machine learning algorithms enable cobots to adapt to dynamic environments and handle unpredictable situations more effectively.

For example, cobots equipped with computer vision can identify objects, recognize gestures, and adjust their movements accordingly, making them suitable for tasks that require interaction with human operators.

Moreover, AI-driven cobots learn from human demonstrations or operate autonomously based on predefined rules and data inputs. This capability not only improves efficiency but also reduces the need for extensive programming expertise, thereby democratizing access to automation solutions across industries.

AI-powered cobots are enhancing safety standards in industries such as manufacturing, healthcare, and logistics. By continuously analyzing data from sensors and feedback mechanisms, these cobots can detect anomalies, prevent accidents, and optimize operational workflows.

In manufacturing, AI helps cobots collaborate safely with human workers by ensuring they adhere to established safety protocols and adjust their behavior in real-time to minimize risks.

|

Category |

Projected CAGR through 2031 |

|

Payload Capacity – 5-10 kg |

35.4% |

|

Application - Material Handling |

36.9% |

|

Industry - Electronics and Semiconductor |

34.2% |

Up to 5 kg Payload Capacity Segment to Account for a Significant Share

The up to 5 kg segment accounted for more than 42% of the global market revenue in 2023 and is likely to maintain its dominance during in the forthcoming years recording a CAGR of 31.7%.

Cobots in this payload range are well-suited for a wide range of tasks in manufacturing, assembly, and logistics where they handle tasks requiring moderate strength and precision.

These robots are designed to work alongside humans without the need for extensive safety measures, making them ideal for small to medium-sized enterprises (SMEs) that do not have the floor space or resources for traditional industrial robots.

Advancements in technology have enhanced the capabilities of these cobots, improving their speed, accuracy, and ability to handle more complex tasks.

For instance, Universal Robots, a leading manufacturer of cobots, has seen significant growth in sales of their UR3 and UR5 models, which fall within the up-to-5-kg payload category. These robots are increasingly being deployed in industries where precision and adaptability are crucial, such as medical device manufacturing and food processing.

Material Handling Segment Poised to Experience Rapid Growth

Collaborative robots, designed to work alongside humans in a shared workspace, are increasingly being adopted in material handling applications across industries such as manufacturing, logistics, and e-commerce fulfilment centers.

Cobots enhance efficiency and flexibility in material handling tasks by automating repetitive and physically strenuous activities. For instance, in warehouses, cobots autonomously pick, pack, and palletize goods, reducing cycle times and increasing throughput.

The scalability and ease of deployment of cobots make them particularly attractive for material handling applications. Unlike fixed automation solutions that require extensive reconfiguration for different tasks, cobots quickly reprogrammed and redeployed to perform various material handling functions.

The flexibility is crucial in dynamic environments where production lines frequently change or where seasonal demand fluctuations occur, such as in the food and beverage industry.

Automotive Industry to Hold Highest Market Share

As of 2023, the automotive industry held a commanding share of over 30% in the global collaborative robot market revenue.

Automotive manufacturers have integrated cobots extensively across various stages of production. From assembly tasks to quality control and even packaging, cobots excel in repetitive, precise tasks that are essential in automotive manufacturing.

For instance, companies like BMW, and Ford have deployed cobots to assist workers in assembling complex components like engines and transmissions, where consistency and accuracy are critical.

Modern cobots are equipped with advanced sensors, vision systems, and collaborative capabilities that enable them to work safely alongside human operators without the need for extensive safety barriers.

The automotive industry's drive towards automation and Industry 4.0 initiatives has accelerated the adoption of cobots. These robots not only complement traditional industrial robots but also empower manufacturers to implement agile manufacturing practices.

For example, General Motors has utilized cobots to improve ergonomics for workers and streamline the production of vehicles, illustrating a market trend towards leveraging automation for competitive advantage in the global automotive market.

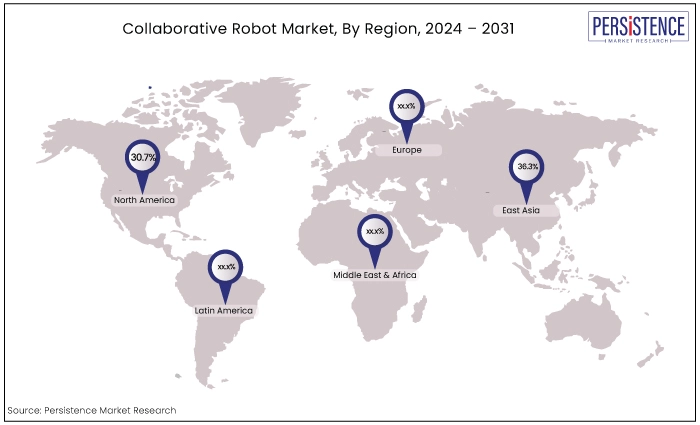

|

Region |

CAGR through 2031 |

|

North America |

30.7% |

|

East Asia |

36.3% |

North America to Account for over 30% Market Share

North America is the most significant shareholder in the global market and is expected to grow at a CAGR of 30.7% during the forecast period. The region has been a pioneer in adopting advanced robotics and automation technologies, driven by the need to enhance productivity and efficiency in various industries.

The presence of leading tech companies and research institutions also fosters innovation and development in the field of collaborative robotics.

The key reasons for North America's leading position are the substantial investments in automation and robotics by key industries such as automotive, electronics, and aerospace.

For instance, the automotive industry has been a significant driver of cobot adoption, with companies like Ford, and General Motors integrating cobots into their production lines to perform tasks such as assembly, welding, and painting.

This not only improves efficiency but also ensures safety by reducing the risk of accidents in the workplace.

According to the International Federation of Robotics (IFR), the United States alone had over 44,303 Units industrial robots installed in 2023, a significant portion of which were collaborative robots.

East Asia to Exhibit a Notable CAGR by 2031

East Asia Market is projected to secure a CAGR of 36.3% in the forecast period from 2024 to 2031. The region, comprising economic powerhouses like China, Japan, and South Korea, has been at the forefront of adopting automation technologies to enhance productivity and maintain its competitive edge in manufacturing.

East Asia has a significant concentration of manufacturing industries, which are increasingly integrating cobots to improve efficiency and reduce labor costs. For example, China, known as the "world's factory," has been rapidly deploying cobots in its factories to address labor shortages and rising wages.

According to the International Federation of Robotics (IFR), China installed approximately 290,258 robots in 2022, a significant portion of which were collaborative robots.

Japan, a leader in robotics technology, has been investing heavily in the development and deployment of advanced cobots. Companies like Fanuc and Yaskawa are pioneers in this field, continuously pushing the boundaries of what cobots can achieve.

For instance, Fanuc's collaborative robots, known for their precision and versatility, are widely used in various industries, from automotive to electronics. The IFR reported that Japan's export ratio rose to 81% of its robots in 2022, reflecting the country's strong presence in the global cobot market.

Vendors focusing on developing advanced technologies that enhance the safety, flexibility, and ease of use of cobots. Companies invest heavily in research and development to introduce features like improved sensors, AI-driven functionalities, and enhanced human-robot interaction capabilities.

Another critical strategy is strategic partnerships and collaborations, which allow vendors to leverage the expertise and resources of other industry players, including software developers, component suppliers, and system integrators.

April 2024

Collaborative Robotics has announced the successful completion of a $100 million Series B funding round. The round was led by General Catalyst and included contributions from Bison Ventures, Industry Ventures, and Lux Capital. Existing investors Sequoia Capital, Khosla Ventures, Mayo Clinic, Neo, 1984 Ventures, MVP Ventures, and Calibrate Ventures also participated, bringing the company's total funding to over $140 million in less than two years. Additionally, industry leader Teresa Carlson has joined Collaborative Robotics as an Advisor.

May 2024

FANUC America introduced the new CRX-10iA/L Paint collaborative robot. This innovative cobot is set to expand automation benefits to more companies in the painting, powder coating, and gel coating with fiberglass reinforcement industries. Designed to enhance various paint operations, including high-mix, low-volume applications, the new FANUC cobot meets the stringent explosion-proof safety standards required in the United States.

June 2023

ABB is introducing two new variants of its GoFaTM collaborative robot: the GoFa 10 and GoFa 12. These new models enable companies to leverage cobot automation for increased efficiency. Capable of handling payloads of up to 10 and 12 kilograms with market-leading repeatability, these cobots can perform a wider range of tasks in close collaboration with workers. This helps address skills and labor shortages while enhancing safety and productivity.

The demand for collaborative robots (cobots) is surging due to their ability to work safely alongside humans, enhancing productivity and efficiency in various industries. Additionally, advancements in technology have made cobots more affordable and versatile, expanding their applications across sectors such as manufacturing, healthcare, and logistics.

Some of the key players operating in the market are Doosan Robotics, AUBO Robotics, ABB, KUKA, Yaskawa Electric Corporation, HAHN Group, Universal Robots (UR), FANUC etc.

The Up to 5 Kg segment recorded a significant market share in 2023.

The advancements in AI and machine learning technologies enable cobots to perform complex tasks with greater precision and safety, creating significant market opportunities.

North America is set to account for a significant share of the market.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2018 to 2023 |

|

Market Analysis |

US$ Million for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Payload Capacity

By Application

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author