Coating Additives Market Segmented By Acrylics, Fluoropolymers, Urethanes, Metallic Additives Type with Metallic Additives, Biocides Impact Modification, Anti-Foaming, Wetting & Dispersion Function with Solvent-borne, Water-borne, Powder-based Formulation

Industry: Chemicals and Materials

Published Date: September-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 250

Report ID: PMRREP4419

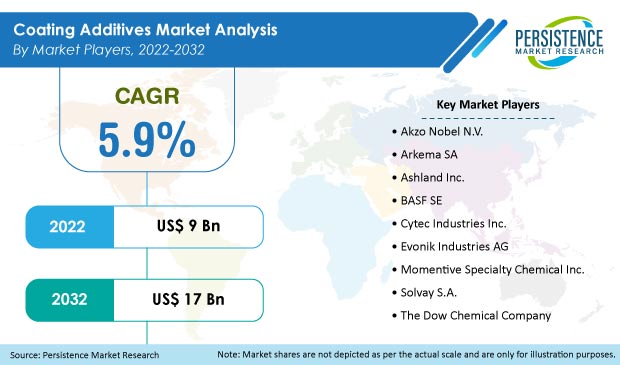

The global coating additives market is valued at over US$ 9 Bn in 2022 and is expected to reach US$ 17 Bn by the end of 2032, registering a CAGR of 5.9% from 2022 to 2032 (forecast period).

The United States currently accounts for more than one-fourth share of the global coating additives market.

|

Coating Additives Market Size (2022) |

US$ 9 Bn |

|

Projected Market Value (2032) |

US$ 17 Bn |

|

Global Market Growth Rate (2022-2032) |

5.9% CAGR |

|

U.S. Market Value (2021) |

US$ 2.5 Bn |

“Advent of Green Coatings – A Game Changer”

Coating additives are solutions that are incorporated into paints to improve their performance and quality. Due to developments in coating additives technology, they are utilized to enhance product attributes and eliminate or reduce issues that occur during the formulation and manufacture of paint systems.

The global coating additives market is anticipated to experience significant growth during the forecast period. Coating additives are rapidly needed to achieve zero-VOC emission criteria. Governments around the world are stepping up initiatives to decrease carbon emissions from construction operations.

The advent of green coatings is expected to provide revenue-generation opportunities in the coating additives market during the forecast period. Green coatings are likely to become more prominent in the motive sector in the coming years, contributing to the expansion of the global coating additives market.

“Booming Building & Construction Sector Worldwide”

The booming building and construction sector worldwide is projected to propel the global coating additives market during the forecast period. Coating additives are utilized in the construction industry to enhance the viscosity, surface effectiveness, and impact strength of substrates.

The fast expansion of commercial and residential construction activities around the world, as well as the increasing use of eco-friendly additives to boost roof and wall installations while minimizing environmental damage, is expected to spur the growth of the global coating additives market.

As a result, rapid growth in the building and construction sector worldwide is likely to drive the sales of coating additives over the forecast period.

Some of the key manufacturers of coatings additives are Akzo Nobel N.V. Arkema SA, Ashland Inc., BASF SE, Cytec Industries Inc., Evonik Industries AG, Momentive Specialty Chemical Inc., Solvay S.A., and The Dow Chemical Company.

“United States to Remain Lucrative Regional Market“

North America is set to dominate the global coating additives market during the forecast period. The United States is expected to be the largest revenue generator in the coating additives market in North America. The coating additives market is a vital and dynamic aspect of the American economy.

Coatings are essential items for the protection of a wide range of end-uses. The coatings industry in the United States is comprised of top coating additives manufacturers, raw material suppliers, coating additives suppliers, and distributors. The industry is made up of around 1,000 businesses that operate in nearly 1,200 locations.

Moreover, coating industry facilities are located in cities such as Cleveland, Chicago, Northern New Jersey, Louisville, California, Washington State, and Florida. Shipments of architectural coatings account for more than half of all paint sold in the United States. In contrast, water-based architectural coatings account for nearly 90% of all architectural coatings sold in the country.

Furthermore, the construction industry contributes substantially to the American economy. The US$ 20 trillion American economy is dependent on a huge infrastructure network, which includes everything from highways to bridges to ports to freight rail to electrical grids and internet access.

Increasing residential investment is the primary factor projected to bolster the growth of the coating additives market in the United States.

Coating additives are added to paints and coatings to augment their quality and performance. Additives improve the dispersion of solids, wetting, foam-reduction, anti-catering, gloss control, anti-chipping, UV protection, etc., of coatings. Coating additives can be of various types such as acrylics, urethanes, fluoropolymers, and metallics, among others.

Acrylic additives are the leading product type, followed by urethanes and metallic additives. Coating additives help the surfaces to deal with higher temperatures, abrasion, moisture, biocides, and chemical resistance. Based on formulations, the market for coating additives is divided into water-borne, solvent-borne, and powder-based coatings.

Solvent-borne coatings were the leading coating additives formulations in the past few years. However, due to high VOC content and environmental concerns, the popularity of water-borne coating additives formulations has increased tremendously in the recent past and they are anticipated to grow substantially in the near future owing to their lower VOC content.

The main driver for coating additives has been the huge infrastructure boom in the past decade in the building & construction industry and this demand stems from the ever-increasing need for better quality surfaces. Residential and commercial buildings are the leading end-users for coatings additives and are likely to gain further market share in the near future owing to increased construction activities in Asia Pacific and RoW.

Another major driver for the coating additives market is the automotive industry. Coating additives are used in the automotive industry to enhance surface quality and protect them from abrasion, UV rays, other weathering effects, and chemicals. Other end-users for coatings additives include wood & furniture, industrial engineering, and aviation, among others.

In the wood and furniture industry, coating additives are used to preserve the wood surfaces from microbial growth and moisture content. Increasing demand for multifunctional coating additives is anticipated to be the major opportunity for the coatings additives market. However, various environmental regulations associated with VOC content in formulation technologies can act as a major restraint for the market.

In terms of formulation used, water-borne additives exhibited the highest consumption in the past few years and are likely to grow more in the coming years. Water-borne formulations have lower VOC content than other coatings additives formulations and are preferred in developed countries where there are stringent environmental regulations regarding the paints and coatings industry.

Larger quantities of coatings additives are required in the case of water-borne formulations over other types to achieve higher performance. Powder-based formulations are also likely to gain more market share in the near future owing to their better performance than solvent-borne formulations.

|

Attribute |

Details |

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2012-2021 |

|

Market Analysis |

USD Million for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon Request |

By Type:

By Function:

By Formulation:

By Region:

To know more about delivery timeline for this report Contact Sales

The global coating additives market is projected to expand at a CAGR of 5.9% from 2022 to 2032.

The global coating additives market is set to reach US$ 17 Bn by 2032.

The introduction of green coatings and the booming building & construction sector worldwide are likely to drive high demand for coating additives.

North America, led by the United States, holds the largest share in the global coating additives market.