Chipless RFID Market

Industry: Semiconductor Electronics

Published Date: September-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 185

Report ID: PMRREP10768

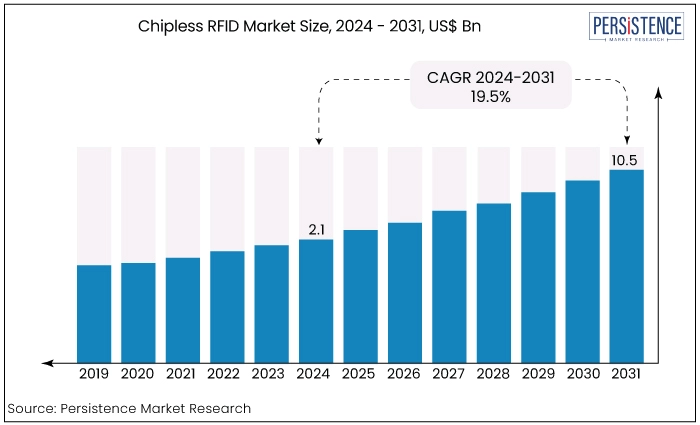

The chipless RFID market is estimated to increase from US$2.1 Bn in 2024 to US$10.5 Bn by 2031. The market is projected to record a CAGR of 19.5% during the forecast period from 2024 to 2031. Chipless RFID sales are growing rapidly as its adoption is rising in diverse industries, including retail, healthcare, logistics, and aerospace. The retail and consumer goods sector is expected to be the significant revenue generating segment, projected to expand at a CAGR of over 19.1% from 2024 to 2031.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Market Size (2024E) |

US$2.1 Bn |

|

Projected Market Value (2031F) |

US$10.5 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2032) |

19.5% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

13.1% |

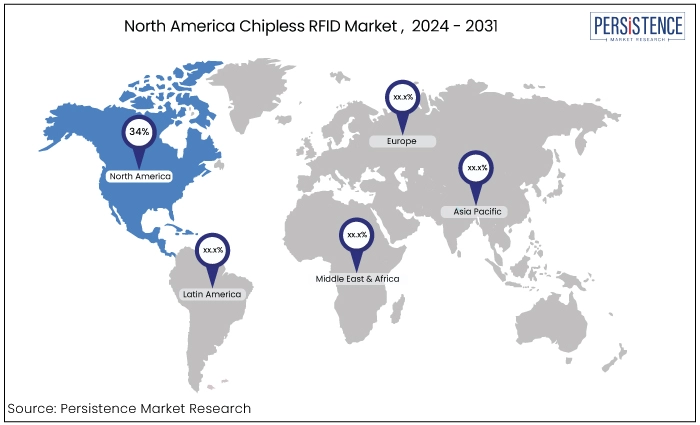

Growth in the region is driven by the increasing adoption of RFID technology across China and India. In India, the market is gaining momentum due to rising per capita income and a surge in demand for appliances like smartwatches. Additionally, the growing use of thin-film batteries in portable electronics, which often rely on printed and chipless RFID technology, is further driving market expansion.

Asia Pacific chipless market is poised to lead due to several key factors. Rapid economic growth and increasing consumer spending in countries like China and India are driving demand for advanced RFID solutions. Additionally, the region's expanding retail and logistics sectors are fueling the need for efficient tracking and inventory management.

|

Region |

Market Share in 2024 |

|

North America |

34% |

Chipless RFID technology has gained significant traction in North America market. The region houses numerous prominent technology providers and has experienced early implementation of sophisticated RFID systems.

The rise of the global market in the region may be attributed to the existence of a well-established retail industry, stringent anti-counterfeiting rules, and a strong emphasis on optimizing the supply chain. Also, the rise in demand for cost-effective and scalable RFID solutions, and the growing adoption of RFID in industries such as retail, logistics, and healthcare are driving market growth in the region.

|

Category |

Market Share in 2024 |

|

Component - RFID Tags |

43% |

The chipless RFID market is segmented into RFID Tags, RFID Readers, and RFID Middleware. Among these, the RFID tags segment dominates the market accounting for 43% of the market share. The RFID tags segment is projected to witness the most significant growth. It has numerous applications in the retail and consumer goods sector.

The expansion of the global chipless RFID Tags segment is being driven by the retail sector's increased use of chipless RFID tags in its retail chain and outlets.

Chipless RFID tags are used in smart shelves and item-level tracking in the retail industry. They are created with an integrated RFID reader system that sounds an alert whenever the amount of stock on the shelf drops, preventing stock-outs.

|

Category |

Market Share in 2024 |

|

Industry - Retail & Consumer Goods |

31% |

The chipless RFID market is segmented into healthcare, aerospace & defence, logistics & manufacturing, and retail & consumer goods. Among these, the retail & consumer goods segment dominates the market. The most widely used application of the chipless RFID is in the retail and consumer goods industry.

Expansion of the aerospace and defence industry can be connected to the increasing need for customized equipment. RFID tag creators have been helped to produce tiny and flexible RFID tags by developing innovative printed electronics technologies.

Thin-film photovoltaic solar cells, printed sensors, and other technologies are coupled with these tags. It is anticipated that the rising use of ink technologies and electronic printing will enable RFID developers to manufacture their chipless RFID tags on-site in response to demand.

The development of chipless RFID tags is anticipated to present profitable prospects due to technical improvements, the rise in demand for Industry 4.0 standards, and the emergence of Industry 5.0.

The market has experienced growing acceptance in diverse sectors such as retail, logistics, healthcare, automotive, and aerospace. Chipless RFID technology has benefits such as the ability to identify objects without a direct line of sight, track them in real-time, and do so at a lower cost compared to typical RFID systems that use chips.

The retail sector has played a significant role in the growth of the chipless RFID market worldwide. This is mostly due to the demand for better inventory control, higher customer satisfaction, and more efficient business processes.

Chipless RFID technology assists merchants in optimizing inventory levels, minimizing stockouts, improving product visibility, and facilitating smooth checkout operations. The healthcare and pharmaceutical industries have been implementing chipless RFID technology for purposes such as tracking assets, monitoring patients, and managing medicines. Also, chipless RFID tags offer immediate visibility, aiding healthcare firms in enhancing patient safety, optimizing equipment usage, and streamlining supply chain operations.

The chipless RFID market experienced moderate growth during the historical period from 2019 to 2023 driven by advancements in wireless communication, increased adoption in industries like retail and logistics, and the need for efficient inventory management.

Innovations in material science and printing technologies particularly in regions like North America and Europe helped in expanding the market.

Post-2024, the market is expected to witness accelerated growth. This is driven by the increasing demand for cost-effective, scalable, and eco-friendly solutions in asset tracking, supply chain management, and anti-counterfeiting. Furthermore, technological advancements such as improvements in read range and data capacity are anticipated to make chipless RFID more competitive.

The growing focus on sustainable solutions and the integration of the Internet of Things (IoT) are likely to propel market expansion. Also, emerging economies in Asia-Pacific and Latin America are expected to play a significant role in driving demand owing to the rapid industrialization and increasing investments in smart infrastructure.

Cost-Effectiveness and Scalability

One of the primary growth drivers for the chipless RFID market is its cost-effectiveness compared to traditional RFID systems. Chipless RFID tags use printing technologies that significantly reduce production costs, as they do not require expensive silicon chips. This makes them highly attractive for industries where tagging a large volume of items, such as retail or logistics, is essential.

The scalability of chipless RFID also allows businesses to adopt this technology for large-scale operations without incurring prohibitive costs. As more industries seek to improve efficiency and reduce costs especially in supply chain management, the adoption of chipless RFID is expected to rise further driving market growth.

Technological Advancements

Technological advancements in material science, printing techniques, and data processing are another significant driver for the chipless RFID market. Recent innovations have led to improvements in read range, data storage capacity, and environmental durability of chipless RFID tags. These advancements are making chipless RFID more competitive with traditional RFID systems, which previously had superior performance metrics.

Ongoing research and development in this field are expected to continue improving the technology, thereby increasing its adoption across various industries, including healthcare, automotive, and manufacturing. As chipless RFID technology matures, its applications are expected to diversify, fuelling market expansion.

Limited Data Storage and Functionality

A significant restraint for the chipless RFID market is the limited data storage capacity and functionality compared to traditional RFID systems. Chipless RFID tags typically store less data and have fewer capabilities such as not being able to support complex encryption or advanced tracking features. This limitation makes them less suitable for applications requiring detailed information storage or high levels of security such as in financial services or high-value asset tracking.

Industries that require robust data handling and security may be reluctant to adopt chipless RFID, preferring traditional RFID or other technologies. This limitation could hinder the market's growth particularly in sectors where data accuracy and security are paramount.

Technical and Environmental Challenges

Another restraint is the technical and environmental challenges associated with chipless RFID technology. While advancements have been made, chipless RFID still faces issues with reliability in harsh environmental conditions, such as extreme temperatures, humidity, or exposure to chemicals. Such factors can affect the performance of chipless RFID tags, leading to inconsistent read rates or data loss.

The challenges could slow the adoption of chipless RFID particularly in industries like logistics, where robust performance under varied conditions is critical. Overcoming these technical and environmental barriers is essential for chipless RFID's broader acceptance and growth in the market.

Integration with the Internet of Things (IoT)

One of the most promising opportunities for the chipless RFID market lies in its integration with the Internet of Things (IoT). As IoT continues to expand across various sectors, the need for efficient, low-cost, and scalable tracking solutions becomes increasingly critical.

Chipless RFID technology, with its cost advantages and potential for mass deployment is well-positioned to serve as a backbone for IoT ecosystems particularly in applications that involve large volumes of items or assets. In the IoT landscape, devices and objects are interconnected, enabling real-time data collection, analysis, and decision-making.

Chipless RFID tags can be embedded in a wide range of objects from consumer goods to industrial equipment allowing these items to be tracked and managed throughout their lifecycle.

The data generated by these tags can be integrated into IoT networks, providing valuable insights into supply chain efficiency, inventory management, and asset utilization.

The low cost of chipless RFID tags makes them particularly suitable for applications where the sheer number of connected items would make traditional RFID or other tracking technologies prohibitively expensive. As IoT adoption continues to accelerate, the integration of chipless RFID technology presents a significant opportunity for market growth.

Companies that can effectively combine these technologies stand to gain a competitive edge driving innovation and expanding the use cases for chipless RFID in the evolving digital economy.

The competitive landscape of the market is characterized by the presence of several key players and emerging start-ups focused on innovation and cost reduction. Established companies like Zebra Technologies, Thin Film Electronics, and RF Code are significant players leveraging their experience in RFID technology to explore chipless alternatives.

The companies often compete on technological advancements, particularly in improving read range and data capacity. Start-ups and small firms contribute by introducing innovative printing techniques and materials that reduce production costs.

The market is also marked by strategic partnerships and collaborations aimed at enhancing product offerings and expanding market reach. Competition is intensifying as companies seek to capitalize on the growing demand for affordable, scalable, and sustainable RFID solutions.

Recent Industry Developments in the Chipless RFID Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Region Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Components

By Industry

By Region

To know more about delivery timeline for this report Contact Sales

The market is estimated to be valued at US$2.1 Bn in 2024.

The market is projected to exhibit a CAGR of 19.5% over the forecast period.

A prominent opportunity lies in its integration with Internet of Things (IoT).

Some of the key industry players in the market are Zebra Technologies Corporation, Spectra Systems, and Molex Inc.

Asia Pacific dominates the market for chipless RFID technology.