Comprehensive Snapshot for Champagne Market Including Regional and Country Analysis in Brief.

Industry: Food and Beverages

Published Date: April-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 170

Report ID: PMRREP35240

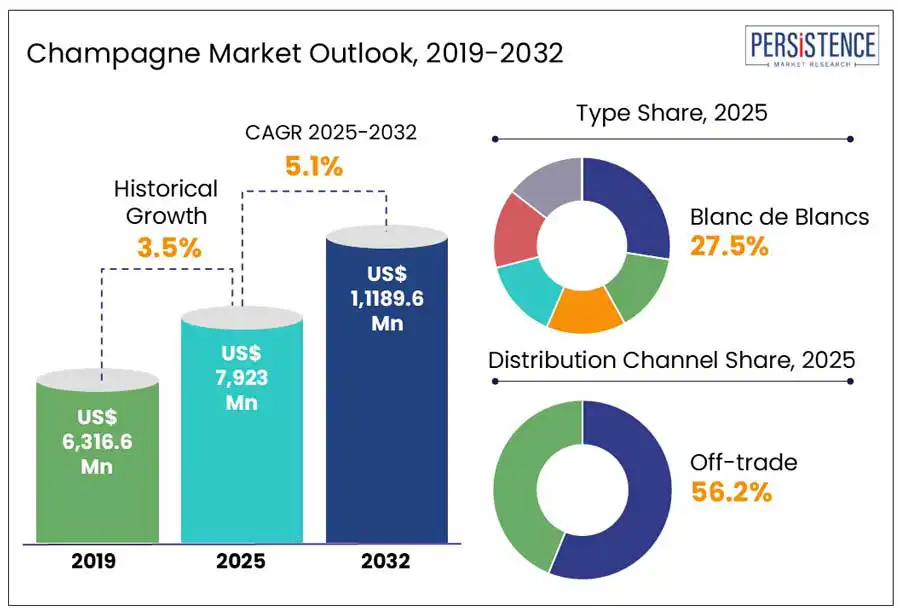

The global champagne market size is projected to rise from US$ 7,923.0 Mn in 2025 to US$ 11,189.6 Mn by 2032. It is anticipated to witness a 5.1% CAGR by 2032.

The rising number of bars, pubs, and restaurants across both developed and developing countries globally is estimated to propel demand for champagne. Traditionally, people used to consume champagne only on special occasions such as weddings or achievements. However, today, casual drinking at dinners, office parties, and birthdays has surged worldwide. In addition, increasing consumer awareness of authentic flavors and tastes is predicted to create a high demand for vintage champagne.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Champagne Market Size (2025E) |

US$ 7,923.0 Mn |

|

Market Value Forecast (2032F) |

US$ 11,189.6 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

5.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.5% |

The boom of luxury and champagne tourism worldwide is one of the key factors expected to spur the market through 2032. Affluent travelers are increasingly seeking curated and immersive experiences, including engaging in champagne tasting, visiting vineyards, and learning about the craftsmanship as well as the heritage behind these beverages. In France, the Champagne region, for instance, has turned into a global hotspot for such tourism, which is changing champagne consumption patterns.

As per a new survey, in 2024, the country witnessed a surge of nearly 25% of visitors compared to the previous year. Among these, international tourists from the U.K., U.S., Germany, and Japan formed a significant portion. These tourists are interested in sightseeing, and overnight stays at luxury estates such as Bollinger, blending workshops, cellar tastings, and vineyard tours. These types of firsthand experiences are likely to help strengthen brand loyalty and boost post-trip purchases back home or online.

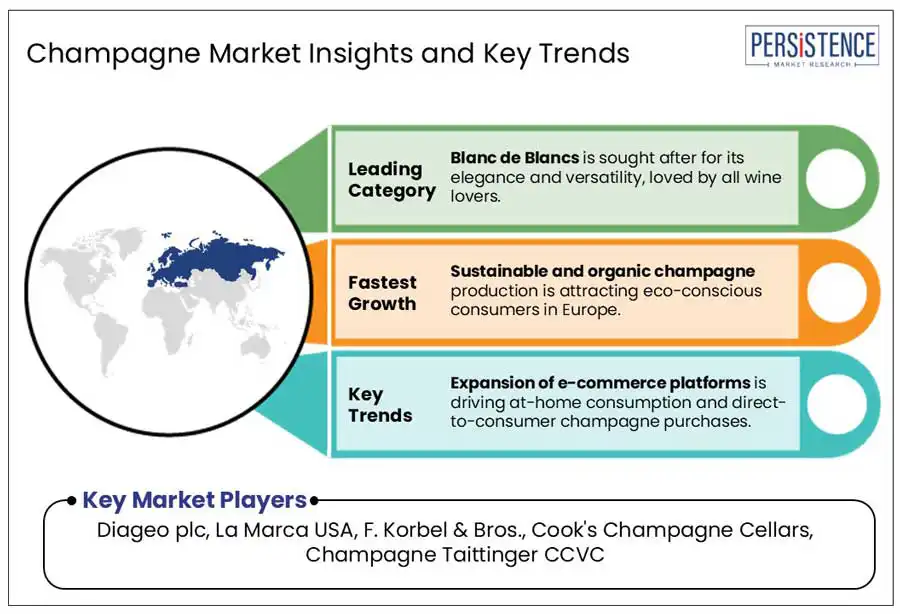

Champagne demand is speculated to decline to a certain extent due to changing alcoholic beverage consumption habits, specifically among younger demographics. In Australia and the U.S., younger millennials and Gen Z consumers focus on their health and well-being. Hence, they are showing a rising preference for zero or low-alcoholic beverages instead of champagne. As per a study, in 2023, the U.S. witnessed a decline of 2% in alcohol consumption, while the no-/low-alcohol segment increased by more than 7%.

Another significant factor hampering demand is price sensitivity. As champagne is considered as one of the most expensive drinks, several consumers choose more affordable alternatives such as Cava or Prosecco. Prosecco, reported that in 2022, sales rose by 3.5% in the U.S. The U.S. International Trade Commission also mentioned that champagne imports declined by around 1.6% in the same year. Budget-conscious consumers are more likely to opt for low-cost beverages, thereby hindering sales.

Several renowned champagne brands are now collaborating with the entertainment and fashion industries, which is predicted to create lucrative growth opportunities. Dom Pérignon, for example, recently joined hands with Lady Gaga to launch an avant-garde advertising campaign and limited-edition bottle designs featuring Gaga’s theatrical aesthetic. The campaign also featured pop-up tasting events, social media buzz, and immersive content across Tokyo, Los Angeles, and Paris. The new edition exhibited a sold-out status within weeks of the launch at premium retailers, becoming a collector’s item.

Brands such as Ruinart and Chandon have been hosting in-store champagne experiences during events such as Vogue Fashion’s Night Out in cities, including São Paulo, Tokyo, and Milan. These have been featuring champagne served during private shopping experiences or designer showcases, thereby making a direct connection with high-end lifestyle cues. To improve brand visibility and offer premium experience, several companies are investing in celebrity endorsements and collaborative product launches.

In terms of type, the market is divided into brut, rosé, Blanc de Blancs, Blanc de noirs, prestige cuvée, and demi-sec. Among these, Blanc de Blancs is poised to account for a share of around 27.5% in 2025, says Persistence Market Research. This is attributed to its high minerality and linear acidity. It is highly preferred by champagne drinkers seeking age-worthy freshness, finesse, and precision.

Sommeliers often recommend this type of champagne for seafood pairings, specifically scallops, sushi, and oysters, owing to its chalky and citrusy profile. Blanc de Blancs is estimated to carve out a niche among the early dinner and brunch crowd as preference for light, zesty wines rises. Luxury buyers are inclining toward vintage versions as these tend to age well.

Rosé champagne, on the other hand, is expected to gain immense popularity through 2032 with its fuller mouthfeel and appealing red fruit notes. It has become a significant part of various occasions, right from rooftop parties to weddings, because of its attractive hue. It is often paired with desserts, charcuterie, and even roasted poultry, making it an easy sell for restaurants.

Based on distribution channel, the market is bifurcated into on-trade and off-trade. Out of these, the off-trade segment is expected to dominate with 56.2% of the champagne market share in 2025. Off-trade channels such as online retail platforms, liquor stores, and supermarkets enable consumers to buy champagne conveniently and easily.

Off-trade channels further stock a wide range of champagne brands from different price points and types, catering to varying consumer budgets and preferences. These allow consumers to discover new types and experiment with unique champagnes, which is pushing demand.

The on-trade segment is also predicted to exhibit considerable growth in the forecast period. It is attributed to the ability of clubs, hotels, bars, and restaurants to offer a unique environment for enjoying champagne. These establishments often help in improving the consumer experience with novel presentation, fast service, and soothing ambiance. A few champagne companies are focusing on partnering with hotels and restaurants to host promotional nights and tasting events featuring special champagne and limited editions.

In North America, the U.S. champagne market is at the forefront of growth. Even though the total alcohol consumption rate has stagnated in the country in recent years, the emergence of artisanal and niche labels is anticipated to boost demand to a certain extent. High-end grocery chains and specialty wine retailers such as BevMo, Total Wine & More, and Whole Foods are striving to extend their champagne portfolios, including organic grower labels, low dosage cuvées, and vintage bottles.

Canada, on the other hand, is following the footsteps of the U.S. Société des alcools du Québec (SAQ) and the Liquor Control Board of Ontario (LCBO) are constantly broadening their champagne listings to keep up with high consumer interest. The integration of champagne into pairing menus and fine dining is another key factor poised to create opportunities in Canada.

Asia Pacific is witnessing a rapid shift of the younger demographics toward wine-pairing and dining cultures replicated from the West. Japan is speculated to outpace the other countries in the region due to the presence of various well-established Michelin-starred restaurants, France-based bistros, and sophisticated sushi bars. Comité Champagne mentioned that in 2023, the country imported more than 13 Mn bottles of champagne, which is presumed to skyrocket in future.

South Korea, on the other hand, will likely emerge as a significant market by 2032, on account of the rising influence of luxury bars, social media trends, and K-pop celebrities in Busan and Seoul. In 2023, retailers such as Lotte Department Store and Shinsegae, for example, reported about 35% surge in premium champagne sales, especially around White Day and Valentine’s Day. Private karaoke rooms and rooftop lounges in the country are further promoting mid- to high-end champagne brands to attract more consumers.

Europe will likely generate a significant share of nearly 67.1% in 2025. It is assessed to be one of the most prominent markets for premium and grower champagne in the world. France is projected to dominate through 2032, owing to rising tourism-linked sales across Auvergne-Rhône-Alpes, Provence-Alpes-Côte d’Azur, and Île-de-France. Champagne houses in France are also focusing on the oenotourism trend. They provide vineyard experiences in Reims and Épernay, further attracting international and domestic visitors.

The U.K. is expected to remain in the second position in terms of revenue generation. In 2023 alone, more than 29 Mn champagne bottles were shipped to the U.K., found the Comité Champagne. Demand will likely be high in London, specifically from cities such as Edinburgh, Birmingham, and Manchester. This is due to the rapid expansion of premium champagne offerings by renowned supermarkets such as M&S and Waitrose.

The global champagne market is highly competitive due to several large, mid, and small-scale companies. Leading companies are focusing on launching new products with innovative formulations to attract a large consumer base. A few of them are joining hands with celebrities and social media influencers to co-develop limited-edition products for target customers. As the trend of luxury gifting gains traction, some key players are introducing personalized champagne gifting services to strengthen their presence.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Type

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

The global market is projected to be valued at US$ 7,923.0 Mn in 2025.

Booming champagne tourism and increasing collaborations of brands with celebrities for product launches are the key market drivers.

The market is poised to witness a CAGR of 5.1% from 2025 to 2032.

The emergence of grower champagne and the rise in interest of consumers in tasting events offering limited editions are the key market opportunities.

Diageo plc, La Marca USA, F. Korbel & Bros., and Cook's Champagne Cellars are a few key players.