Industry: Chemicals and Materials

Published Date: November-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 193

Report ID: PMRREP34905

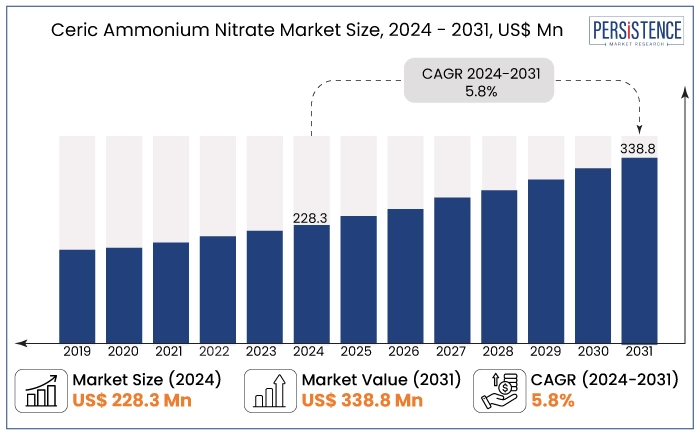

The global ceric ammonium nitrate market is set to exhibit a CAGR of 5.8% during the forecast period from 2024 to 2031. It is projected to rise from US$ 228.3 Mn in 2024 to an impressive US$ 338.8 Mn by 2031.

The market is set to witness significant growth, primarily driven by expansion of the electronics industry. Ceric ammonium nitrate is a critical reagent widely used in various production and manufacturing processes, making it essential for numerous applications.

Global IT spending is projected to reach US$ 5.06 trillion in 2024, representing an 8% increase from 2023. Expenditure on devices accounts for around 14% of total IT spending and is growing at a rate of 3.6%. As the use of devices rises, consumers are increasingly seeking efficient and multi functioning products, driving the adoption of CAN in device manufacturing.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Ceric Ammonium Nitrate Market Size (2024E) |

US$ 228.3 Mn |

|

Projected Market Value (2031F) |

US$ 338.8 Mn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

5.8% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5.1% |

|

Country |

CAGR through 2031 |

|

U.S. |

6% |

The North America ceric ammonium nitrate market is projected to lead with the U.S. at the forefront. This dominance is primarily driven by growing demand from the electronics and automotive industries for high-quality materials. As these industries continue to evolve, need for reliable and effective chemical compounds like ceric ammonium nitrate is set to rise.

Significant government investments and initiatives from leading companies focused on research and development are enhancing manufacturing capabilities. These activities are aimed at producing improved goods with unique features. These are hence broadening opportunities for ceric ammonium nitrate producers and diversifying its applications.

|

Category |

CAGR through 2031 |

|

Grade- Technical |

6.1% |

The technical grade segment of the ceric ammonium nitrate market is projected to experience a significant CAGR of 6.1% during the forecast period. This surge is primarily driven by increasing demand for high-quality materials in the production of printed circuit boards (PCBs) and semiconductors in the electronics industry.

Growth of the global market is closely linked to the expansion of the electronics industry as ceric ammonium nitrate plays a key role in the manufacturing of PCBs. As demand for electronic devices continues to rise across consumer electronics, automotive, and industrial automation domains, there is a corresponding increase in the need for technical grade ceric ammonium nitrate.

Rising adoption of unique technologies, such as 5G and the Internet of Things (IoT), is contributing to the growing demand for PCBs. These technologies require increasingly sophisticated electronic components. It is projected to further drive the need for high-quality materials like CAN. As a result, the technical grade segment is positioned for robust growth, reflecting the broad trends in the electronics industry and its evolving requirements.

|

Category |

CAGR through 2031 |

|

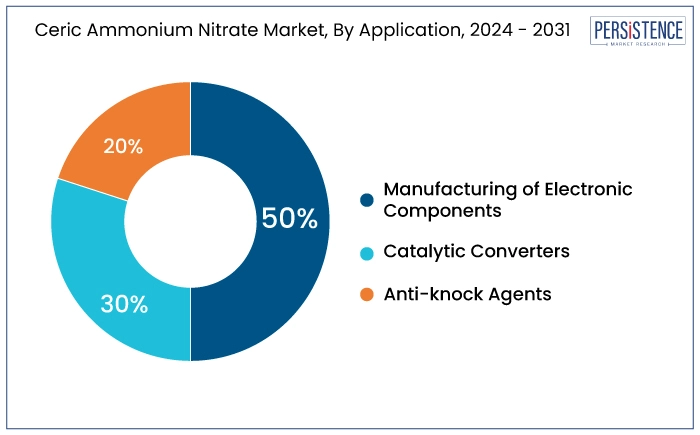

Application- Manufacturing of Electronic Components |

5.9% |

By application, the manufacturing of electronics components segment is experiencing robust growth due to the increasing deployment of IoT devices. As these devices become integral to everyday life and business operations, demand for high-performance electronic components will continue to rise. It is set to further solidify ceric ammonium nitrate's importance in this evolving landscape.

Rising number of IoT devices is set to propel enhanced connectivity and streamline workflows for users and businesses alike. This interconnectedness necessitates a vast array of electronic components, including Printed Circuit Boards (PCBs) and semiconductor devices. These are considered essential for the operation and functionality of the devices.

Ceric ammonium nitrate has gained significant traction as a key chemical compound used in various industries, particularly in electronics and pharmaceuticals. Known for its role as a powerful oxidizing agent, CAN is essential in the production of PCBs, semiconductor devices, and other electronic components. Its ability to facilitate critical chemical reactions makes it indispensable in manufacturing processes that require precision and reliability.

Ongoing expansion of the electronics industry is a primary driver of CAN. As consumer electronics, automotive applications, and industrial devices evolve, demand for high-performance materials like CAN is set to increase.

As technologies such as 5G and Artificial Intelligence (AI) continue to develop, the complexity and functionality of electronic devices will increase. This evolution will likely require high-quality materials, positioning CAN as a key component in next-generation electronics manufacturing.

The global ceric ammonium nitrate market recorded a decent CAGR of 5.1% in the historical period from 2019 to 2023. Key players in the automotive industry were actively developing technologies to enhance the efficiency of CAN in catalytic converters. Furthermore, leading electronic manufacturers made substantial investments in technological innovations to address the heating issues associated with Printed Circuit Boards (PCBs). The market is estimated to record a CAGR of 5.8% during the forecast period between 2024 and 2031.

Demand to Surge from Automotive Industry through 2031

The global market is experiencing significant growth, driven by the increasing demand for the catalytic properties of ceric ammonium nitrate in various chemical reactions. As an effective catalyst, CAN is essential in polymerization processes, which are crucial for producing plastics and synthetic materials. This functionality not only enhances production efficiency but also fosters innovation in materials science and manufacturing.

The automotive industry is a key sector where the demand for CAN is particularly pronounced. The industry underscores the need for high-quality catalysts like CAN, which are integral in various manufacturing processes, including the production of automotive components. As industries seek to enhance their production capabilities and innovate their product offerings, the growing utilization of CAN as a catalytic converter is set to further drive demand. For instance,

Booming Electronics Industry to Push Demand Worldwide

Growth of the electronics industry is significantly boosting demand for Ceric Ammonium Nitrate (CAN), which is widely utilized in production and manufacturing processes. As a key component in the production of Printed Circuit Boards (PCBs) and semiconductor devices, CAN plays an essential role in the electronics supply chain.

The evolution of digitization, along with innovations in consumer electronics and the Internet of Things (IoT), has led to an increased demand for high-quality electronic components. As these technologies continue to develop, the requirement for reliable materials like CAN becomes more pronounced, driving market growth.

Demand for ceric ammonium nitrate reagents is closely tied to the growth of the electronics industry. It is attributed to the increasing demand emerging from various applications, including consumer electronics, automotive technologies, and industrial applications. This trend is further amplified by the rising adoption of cutting-edge technologies such as 5G and IoT, which necessitate sophisticated electronic components. For example,

In a few more years, rising involvement of IoT devices will gradually connect computers to software and link users to essential resources. It is set to help in streamlining the corporate workflow and benefiting people.

Risk of Respiratory Issues due to Excessive Exposure May Hamper Demand

The hazardous nature of Ceric Ammonium Nitrate (CAN) poses significant challenges for growth, primarily due to stringent regulations aimed at ensuring safety and environmental protection. According to the University of Waterloo, exposure to CAN can lead to respiratory irritation, coughing, and shortness of breath. Additionally, contact with the skin can cause itching, while ingestion may result in vomiting and other adverse effects.

Several health risks associated with CAN compel manufacturers to implement rigorous safety measures and adhere to strict regulatory standards. Consequently, the need to comply with these regulations can increase production costs and complicate manufacturing processes.

The hazardous nature of CAN drives a few manufacturers to seek alternatives that may be less harmful or easier to handle. This shift toward safer substitutes could limit the growth potential of the market, as industries prioritize health and safety considerations in their operations.

Emergence of New Applications like Catalytic Convertors to Create Opportunities

Increasing demand for CAN in the automotive industry presents a significant opportunity for market growth. One of the key applications of CAN in this industry is in the production of catalytic converters and other emission control systems. These are essential for meeting stringent environmental regulations and reducing vehicle emissions.

As demand for vehicles reaches unprecedented levels, particularly in emerging economies, the need for effective emission control technologies becomes paramount. This surge in vehicle production not only highlights the importance of CAN in automotive applications but also indicates a robust market for this compound.

According to the International Organization of Motor Vehicle Manufacturers, the production of motor vehicles in North America is projected to reach 16,166,628 units in 2023, reflecting a steady growth of around 10% over the past two years. This upward trend in vehicle production further underscores the rising demand for materials like CAN that are vital for ensuring compliance with environmental standards.

The global ceric ammonium nitrate market is highly competitive in nature with a mix of established chemical manufacturers, specialty firms, and regional producers. Key players invest significantly in research and development to enhance their product offerings. They are focusing on high-purity formulations that meet specific industry requirements, particularly in sectors like electronics and pharmaceuticals.

Emerging countries present both opportunities and challenges, as rising demand from the automotive and electronics industries encourages companies to extend their reach. However, varying regulatory environments necessitate strategic adaptations.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Million for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Grade

By Application

By End Use Industry

By Region

To know more about delivery timeline for this report Contact Sales

The market is set to reach US$ 338.8 Mn by 2031.

The electronic industry is the target market for manufacturers.

India is estimated to witness a moderate market share in 2031.

BASF SE is considered the leading player.

It catalyzes the reaction between aromatic or aliphatic primary amines.