Blast Monitoring Equipment Market

Industry: Industrial Automation

Published Date: January-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 180

Report ID: PMRREP35043

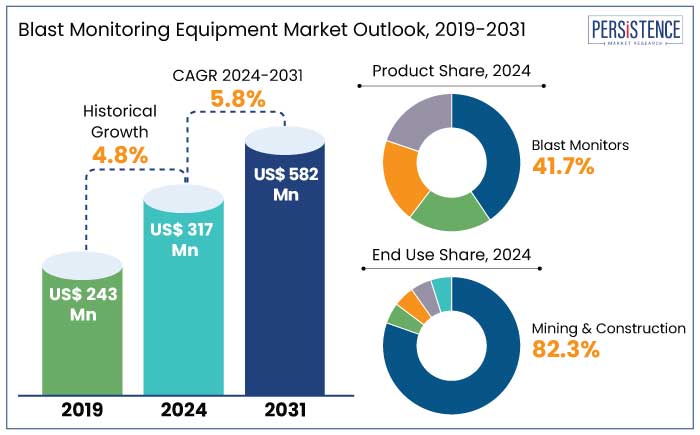

The global blast monitoring equipment market is projected to witness a CAGR of 5.8% during the forecast period from 2024 to 2031. It is anticipated to increase from US$ 317 Mn recorded in 2024 to a decent US$ 582 Mn by 2031.

Blast monitoring equipment are specialized instruments designed to measure, record, and analyze the effects of explosive activities, including mining operations, construction blasts, and military exercises. These devices, such as air overpressure sensors, noise level monitors, seismometers, and data loggers, are essential for ensuring safety, regulatory compliance, and environmental protection. By providing precise and real-time data, blast monitoring technology also enables the design of more efficient and controlled blasting processes that minimize disruption to surrounding environments.

Demand for blast monitoring equipment has continued to rise, driven by strict safety regulations and rising environmental conservation measures. Governments worldwide are implementing stringent rules in industries like mining, construction, and defense to mitigate risks associated with explosive activities. These efforts are aligned with increasing global awareness of the environmental and societal impacts of blasts, leading to broader adoption of unique monitoring technologies.

Rising urbanization and large-scale infrastructure development projects remain a significant factor driving the market. According to the World Bank, Private Participation in Infrastructure (PPI) investments in 2023 amounted to US$ 86.0 Bn, representing 0.2% of the GDP of all low- and middle-income countries.

While this figure reflects a slight decrease from US$ 91.3 Bn in 2022, it marginally surpassed the five-year average (2018 to 2022) of US$ 85.5 Bn. This trend highlights the persistent demand for controlled blasting in infrastructure development despite economic fluctuations.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Blast Monitoring Equipment Market Size (2024E) |

US$ 317 Mn |

|

Projected Market Value (2031F) |

US$ 582 Mn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

5.8% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

4.8% |

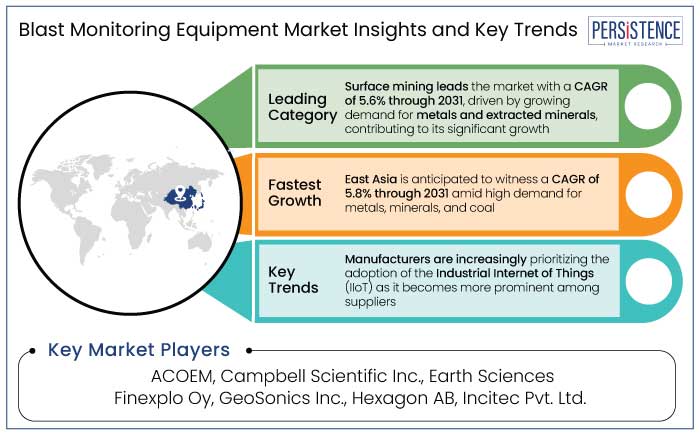

East Asia will likely witness a CAGR of 5.8% through 2031 and hold a share of 39.3% in 2024. China is a dominant player in the region due to its substantial contribution to industrialization, construction, and mining activities.

The country’s rapid economic growth has driven significant demand for metals, minerals, and coal. China is the world’s most prominent producer and consumer of coal and a leading producer of over 20 key minerals. These include aluminum, cement, gold, graphite, iron and steel, lead, magnesium, rare earths, and zinc. For example,

While significant amounts of minerals are imported, domestic production forms a substantial part of the supply for almost all commodities. The mining sector in China is vast, with over 1,500 key mining operations, about 75% of which are underground.

China has identified 71 demonstration projects on intelligent mines nationwide, with the coal mine stock processing market alone potentially reaching trillions of RMB, and the intelligent equipment market estimated at RMB 800 Bn. As the non-coal sector continues to surge, China’s green mining industry is set to surge by 30% to 50% in the next 20 years, underscoring its key role in East Asia.

In the Middle East and Africa, the blast monitoring equipment market is estimated to exhibit a CAGR of around 6.5% through 2031. This growth is driven by substantial investments in mining projects and infrastructure development. For example,

The United Arab Emirates is also playing a significant role, with the International Holding Company (IHC) anticipated to sign US$ 1 Bn in mining deals this year alone. It includes acquisitions of Zambia’s copper mines and joint ventures for iron ore in Angola, along with discussions for nickel mines in Burundi, Kenya, and Tanzania.

Such developments position the United Arab Emirates as a competitor to China in Africa. The U.S. remains heavily reliant on China for 24 out of 50 critical minerals identified by the U.S. Geological Survey. However, forging new partnerships, especially with GCC nations, Saudi Arabia, United Arab Emirates, Qatar, and Oman, provides an opportunity to access resource-rich markets and reduce this dependence. As a result, the Middle East and Africa is the fastest-growing region for the blast monitoring equipment industry.

In terms of end use, the mining and construction category is anticipated to lead in the foreseeable future by witnessing a CAGR of around 5.5%. The segment is likely to hold a share of 82.3% in 2024. This is due to the significant scale and growth of mining activities worldwide, driven by increasing demand for raw materials and minerals across industries.

Surging underground and surface mining operations is a key factor driving demand for blast monitoring equipment. For instance,

Countries with significant mining operations, such as China, Australia, India, and Brazil, are investing heavily in modernizing their mining infrastructure, including adoption of unique monitoring equipment. Demand for precision in managing ground vibrations, air overpressure, and seismic activity is further set to create new opportunities. In addition, strict safety regulations globally are anticipated to reinforce the segment’s dominance.

Based on application, the surface mining segment is projected to exhibit a CAGR of 5.6% during the period from 2024 to 2031. It is anticipated that the segment will hold a share of 60% in 2024.

It is driven by increasing demand for metals and extracted minerals. According to recent statistics, surface mining accounted for over 60% of the total market share. For example,

The aforementioned figures underscore the robust demand for extracted minerals, further fueling growth of the surface mining segment. Moreover, innovations in surface mining techniques, such as the use of highly efficient equipment and technologies like draglines, hydraulic shovels, and conveyor systems, have significantly improved productivity, reduced operational costs, and enhanced safety. These innovations make surface mining the preferred method for extracting minerals, driving its dominance in the market.

The global market for explosion monitoring equipment is seeing notable trends among manufacturers and suppliers. Companies like Orica Limited, Instantel Inc., and Campbell Scientific Inc. are driving the market forward.

They are introducing novel technology for applications in surface mining, underground mining, detonation, and demolition activities. A key trend among these manufacturers is the integration of Internet of Things (IoT) into their blast monitoring equipment, enabling real-time data collection and remote monitoring. This development enhances safety and operational efficiency, allowing manufacturers to provide smarter, more reliable solutions to their clients.

Adoption of the Industrial Internet of Things (IIoT) is becoming increasingly prominent among suppliers. By incorporating IIoT into existing manufacturing processes, suppliers can connect multiple sensors, such as those for explosion, vibration, and temperature monitoring, to the Internet.

It would help in enabling real-time asset monitoring and predictive maintenance. This integration not only improves the efficiency and reliability of operations but also allows manufacturers to offer innovative business process automation solutions.

Growing use of IIoT in industries like manufacturing and oil and gas is driving a significant shift in the blast monitoring equipment market. Suppliers are likely to capitalize on these trends to enhance their product offerings and meet evolving customer demands.

The global blast monitoring equipment industry recorded a decent CAGR of 4.8% in the historical period from 2019 to 2023. The industry has seen steady growth in recent years. It is mainly driven by increasing safety regulations and the need for more precise monitoring of blasting activities in industries like mining, construction, and quarrying.

Historically, the market grew at a moderate pace, with developments in sensor technologies and real-time data analytics playing a key role in improving blast control and reducing environmental impact. As regulatory pressures intensify, especially regarding environmental concerns and worker safety, demand for unique monitoring solutions continues to rise.

Sales of blast monitoring equipment are estimated to record a CAGR of 5.8% during the forecast period between 2024 and 2031. The industry is poised for significant growth, driven by innovations in IoT-enabled sensors, automation, and AI-based analytics. These offer more accurate, efficient, and cost-effective monitoring solutions.

High Demand from Construction and Mining Sectors to Boost Sales

Increasing demand from the construction and mining sectors across the globe is a key driver for the blast monitoring equipment market growth. Rise in construction blasting activities has significantly increased demand for industrial explosives, which are closely linked to the mining sector.

The imbalance between supply and demand for raw materials such as coal for electricity production, iron ore for steel production, limestone for cement production, and aggregates from quarries, especially for mining and infrastructure projects, is substantial. As population density rises, construction activities such as drilling and blasting intensify, driving the need for blast monitoring systems.

Growth in the mining and construction sectors, which is directly proportional to the demand for blast monitoring equipment, fuels the market. Moreover, rising number of infrastructure developments, including roads, tunnels, and bridges, which often involve blasting, further contribute to market growth. For instance,

Rising Emphasis on Safety and Regulatory Compliance to Propel Demand

One of the main factors driving demand for blast monitoring systems is the increased focus on safety and regulatory compliance. Commonly used in sectors like mining, building, and quarrying, blasting activities carry several serious concerns. These include flying debris, structural damage, ground vibrations, and noise pollution. These risks have the ability to negatively impact the environment in addition to endangering the security of the workforce and surrounding communities.

Strict regulations are being introduced by governments and regulatory agencies around the world to guarantee that blasting operations are carried out safely and with the least amount of impact possible. For instance,

Lack of Skilled Operators to Hamper Demand in Developing Countries

Lack of skilled operators in developing nations poses a significant restraint to the market for explosion monitoring equipment. The impact of regulatory codes of practice, combined with a shortage of skilled technical resources in data processing, further limits adoption of these systems.

There is also a knowledge gap regarding the long-term maintenance of explosion monitoring equipment. It can lead to maintenance failures, difficulties in explosion measurements, and the risk of false explosion signals.

Experienced users often question the diagnostic capabilities and predictive accuracy of these systems, creating challenges in ensuring process efficiency. Additionally, workers may resist new methods of planning and maintaining process efficiency. It is anticipated to impede the effective implementation of explosion protection equipment.

Demand for explosion monitoring equipment may decline due to these challenges, especially in production settings where the installation of these systems is complex. Liability issues related to the predictive capabilities of control systems are a significant barrier to industry growth, further constraining the market.

Emergence of IoT and IIoT Technologies to Forge Growth Opportunities

One of the main opportunities for manufacturers and suppliers in the global blast monitoring equipment market lies in the rising adoption of unique technologies such as the Internet of Things (IoT) and the Industrial Internet of Things (IIoT). These technologies enable real-time data collection, remote monitoring, and predictive maintenance, which enhance operational efficiency and safety across various mining and construction activities.

Manufacturers can capitalize on this opportunity by integrating IoT and IIoT solutions into their equipment, offering enhanced features such as data analytics, automated alerts, and predictive maintenance capabilities. This trend not only meets the evolving demands of the mining industry but also positions manufacturers to differentiate themselves in a competitive market. It helps in providing innovative solutions that improve productivity and safety in mining operations globally.

The competition in the blast monitoring equipment market is highly dynamic, driven by continuous developments and innovations from leading players. Key manufacturers and suppliers such as Orica Limited, Instantel Inc., Campbell Scientific Inc., Yokogawa Electric Corporation, Hexagon AB, and Trolex Ltd are at the forefront of this competitive landscape.

Leading companies are introducing cutting-edge solutions, such as Yokogawa’s explosion-protected wireless steam trap monitoring device and Hexagon’s AI-powered 3D Blast Movement Intelligence (BMI). These technologies enhance blast movement monitoring and safety in mining operations, setting new standards in the market.

Other recent innovations include Orica’s Fortis Protect Series of explosives and Trolex Ltd’s Air XS Silica Monitor, both enhancing operational efficiency and safety. Additionally, Blast Movement Technologies’ FED 2.0 vibration monitor exemplifies the trend toward safer, more integrated solutions for blast monitoring activities.

Such a dynamic environment fosters continuous growth and evolution in the market. Leading companies are competing through technological innovation, safety improvements, and meeting stringent regulatory requirements.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Product

By End Use

By Application

By Region

To know more about delivery timeline for this report Contact Sales

Yes, the market is set to reach US$ 582 Mn by 2031.

Mining and construction industries are the main industries that companies need to target.

East Asia is set to witness a CAGR of 5.8% through 2031.

The surface mining application is projected to rise at a CAGR of 5.6% through 2031.

Opportunities include the rising adoption of IoT and IIoT technologies for real-time data collection and predictive maintenance.