Industry: Food and Beverages

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Report Type: Ongoing

Report ID: PMRREP34665

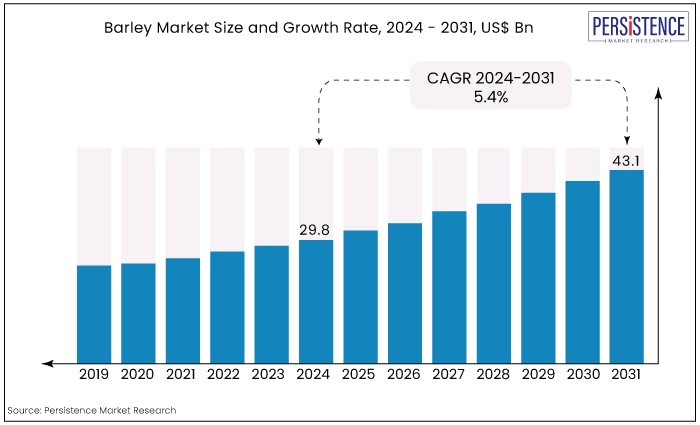

The global market for barley is expected to increase from US$29.8 Bn in 2024 to US$43.1 Bn by the end of 2031, securing a CAGR of 5.4% during the forecast period from 2024 to 2031.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Market Size (2024E) |

US$29.8 Bn |

|

Projected Market Value (2031F) |

US$43.1 Bn |

|

Forecast Growth Rate (CAGR 2024 to 2031) |

5.4% |

|

Historical Growth Rate (CAGR 2019 to 2023) |

4.9% |

One key driver is the global demand for beer production. Barley is a fundamental ingredient in brewing, and as beer's popularity fluctuates worldwide, so does the demand for barley.

Global demand is influenced by factors such as changing consumer preferences, economic conditions affecting disposable income, cultural trends toward craft beers, or traditional brewing methods.

Another significant driver for the market growth is the agricultural aspect of barley production itself. Barley is cultivated in various regions globally, each affected by local climatic conditions, soil quality, and agricultural practices.

Weather patterns and climate change can significantly impact barley yields, leading to fluctuations in supply.

In addition to climate factors, agricultural policies, technological advancements in farming practices, and shifts in land use also influence barley production volumes and market dynamics.

The market for barley is driven by a complex interplay of factors, including global beer demand, agricultural production conditions, climate variability, and broader agricultural and economic trends. Understanding these drivers is crucial for stakeholders ranging from farmers and brewers to investors and policymakers involved in the barley market.

The market witnessed a period of consolidation and recovery in 2022, with demand stabilizing and agricultural yields returning to pre-pandemic levels in many regions. Technological advancements in farming practices continued to improve efficiency and yield quality, supporting sustainable growth in barley production.

The global market had evolved with increased emphasis on sustainability and traceability in supply chains by the end of 2023. Consumer preferences for organic and locally sourced ingredients influenced barley production practices, while regulatory developments and trade policies shaped international market dynamics.

Beyond brewing, barley is increasingly used in food products, particularly in the health food sector, due to its nutritional benefits. The demand for barley in animal feed is also expected to grow as livestock production expands globally.

Consumer preferences towards healthier and natural ingredients are likely to boost the demand for barley-based products, such as malted barley drinks and barley-based snacks. Barley's nutritional profile, including its high fiber content and low glycemic index, positions it favorably in the health food market.

Growing Demand from F&B

Barley is a fundamental ingredient in beer production, constituting a substantial portion of the global beverage market. As consumer preferences evolve towards craft beers, specialty brews, and premium beverages, the demand for barley as a primary brewing grain continues to rise.

This barley market trend is particularly evident in regions experiencing a surge in microbreweries and artisanal beer production.

Beyond brewing, barley is increasingly recognized for its nutritional benefits. It is rich in dietary fiber, vitamins, minerals, and antioxidants, making it a desirable ingredient in various food products.

The food industry is incorporating barley into a wide range of products including breakfast cereals, bread, snacks, and health foods marketed for their high fiber content and health benefits.

Growing consumer awareness of the health benefits associated with barley consumption is driving its demand in the food and beverage sector. Barley's low glycemic index and its ability to support digestive health appeal to health-conscious consumers seeking natural and functional ingredients in their diets.

As emerging markets in Asia Pacific, Latin America, and Africa experience economic growth and urbanization, the demand for processed foods and beverages, including those containing barley, is expected to increase. This demographic shift toward urban lifestyles and Western dietary patterns further supports the growth of the market in these regions

Increasing Consumption by Brewing and Distilling Industry

Barley serves as a primary raw material in the production of beer and whiskey. Its starch content undergoes malting and fermentation processes to convert into sugars, which are essential for alcohol production.

As the global consumption of beer and whiskey continues to grow, particularly in emerging markets and among craft producers, the demand for barley as a brewing and distilling grain is increasing.

There has been a notable shift towards premium and craft beers globally. Craft breweries, which prioritize quality ingredients and traditional brewing methods, often favor barley for its flavor profile and ability to impart specific characteristics to beer.

The trend has spurred a high demand for specialty barley varieties that offer unique flavors and aromas, thereby driving innovation and differentiation in the brewing industry.

Barley is a globally traded commodity, and developments in international trade agreements and market access policies significantly influence its availability and pricing.

Changes in tariffs, trade regulations, and geopolitical factors can impact the flow of barley between major producing regions and consuming markets, affecting market dynamics and prices.

Evolving Consumer Preferences

Consumer preferences continuously evolve, influenced by health trends, dietary choices, and cultural shifts. In the barley market, this translates into increased demand for products that offer health benefits, such as barley-based foods and beverages known for their nutritional value and functional properties.

Barley is recognized for its high fiber content, vitamins, and minerals, making it a popular ingredient in health-conscious diets. Products like barley flour, barley flakes, and barley water are gaining popularity among consumers looking for whole-grain alternatives to refined grains.

The growing interest in plant-based diets and sustainable protein sources has also boosted the demand for barley as an animal feed ingredient, particularly in organic and specialty markets.

Furthermore, the craft beer industry continues to drive innovation in barley breeding and processing techniques. Brewers are experimenting with different barley varieties to create unique flavors and improve brewing efficiency. This innovation not only caters to consumer demand for diverse beer styles but also enhances the economic viability of barley cultivation for farmers and suppliers.

Sustainability Initiatives

One of the most significant drivers impacting the market for barley today is the push toward sustainability across the agricultural sector. Consumers, governments, and corporations are increasingly demanding products that are produced with minimal environmental impact.

Barley is a crucial crop used in brewing, animal feed, and food production. However, it is under scrutiny for its water usage, fertilizer requirements, and overall carbon footprint.

Farmers are adopting practices such as precision agriculture, which utilizes technology to optimize inputs like water and fertilizer, thereby reducing waste and environmental impact.

A growing trend is toward organic and regenerative farming methods within the barley industry. These methods aim to reduce environmental harm and promote soil health and biodiversity, making them attractive to consumers and investors alike.

Sustainability certifications and labeling schemes are gaining traction in the barley market. These certifications assure consumers that the barley used in their products was grown using sustainable practices, further driving demand for responsibly sourced ingredients.

Companies in the barley supply chain are responding by investing in sustainability initiatives, from farms to processing facilities, to meet these growing consumer expectations and regulatory requirements.

Expansion in Craft Brewing and Distilling

The craft beer and spirits industries continue to expand globally, presenting significant opportunities for barley growers and maltsters. Craft brewers are increasingly interested in specialty barley varieties that offer unique flavors and characteristics, enhancing the diversity of their products.

The demand for high-quality malting barley is growing as distillers seek to produce premium whiskies and other spirits.

Barley market players can leverage market trends by developing partnerships with craft breweries and distilleries, ensuring a consistent supply of specialty barley tailored to their specific needs.

Growing Demand for Health and Wellness Products

Rising consumer awareness about health and wellness is driving demand for nutritious food ingredients like barley. Barley is rich in fiber, vitamins, and minerals, making it a desirable component in health-focused products such as cereals, bread, snacks, and beverages.

Barley's potential as a functional food ingredient is increasingly recognized for its cholesterol-lowering properties and contribution to digestive health. Market players can capitalize on this trend by innovating and introducing new barley-based products that cater to health-conscious consumers.

The fiber content in barley contributes to a feeling of fullness and satiety, which can aid in weight management and support healthy eating habits. Barley's ability to promote satiety makes it a desirable ingredient in weight loss programs and meal replacement products. This aspect appeals to consumers looking for nutritious, filling foods that support their dietary goals.

Food Segment to Exhibit 3.7% CAGR in the Market

There is growing awareness among consumers about the health benefits of incorporating whole grains like barley into their diets. Barley is recognized for its high fiber content, vitamins, minerals, and beneficial plant compounds, contributing to its reputation as a nutritious food ingredient.

Consumers are increasingly seeking out foods that offer functional benefits such as improved digestion, heart health support, and weight management, which barley can provide. Barley's versatility as an ingredient allows it to be incorporated into a wide range of functional food and beverage products.

Manufacturers are developing innovative products such as barley-based breakfast cereals, breads, snacks, and beverages fortified with barley extracts or fibers. These products cater to consumer demand for convenient, nutritious options that support a healthy lifestyle.

Barley's mild flavor, smooth texture, and nutritional benefits make it suitable for use in baby foods and infant nutrition products. As parents become conscious of the nutritional quality and ingredients in baby food products, barley is gaining traction as a wholesome option that provides essential nutrients for infants' growth and development.

Europe to Maintain the Leading Position

|

Country |

CAGR through 2031 |

|

Germany |

3.1% |

Europe remains a leading regional market and accounts for a notable share of both consumption and production. The increasing prevalence of strong brewing traditions and the increasing number of health-conscious consumers are the key factors driving the European barley market. Germany will exhibit a notable CAGR of 3.1% during the forecast period from 2024 to 2031.

Europe has a long-standing tradition of barley cultivation and consumption, particularly in countries with strong brewing traditions such as Germany, the UK, and Belgium.

Barley is a fundamental ingredient in beer production, which remains a significant industry in Europe. The demand for malt barley, used in brewing, drives substantial acreage dedicated to barley cultivation across the continent.

The brewing and distilling sectors are major drivers of barley demand. Large multinational breweries and distilleries, as well as craft breweries, contribute to substantial barley consumption.

These companies often have long-term contracts with barley suppliers to ensure a consistent supply of high-quality barley for beer and spirits production.

Some companies in the barley market are vertically integrated, meaning they are involved in multiple stages of the supply chain, from farming and processing to distribution and marketing. This integration can provide efficiencies and control over quality and costs, giving these companies a competitive edge.

Key Industry Developments

In January 2023, the European Commission unveiled its ambitious new Common Agricultural Policy (CAP), designed to bolster Europe's farming sector toward greater sustainability and resilience. This strategic initiative aims to enhance agricultural practices and safeguard the cultural and economic diversity of rural communities across the continent.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Application

By Type

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

Increasing application of barley in the pharmaceutical sector is a key driver for market growth.

Some of the leading industry players operating in the market are Malteurop Groupe, Cargill, and Bries Malt & Ingredients Co.

Expansion in craft brewing and distilling presents a key opportunity for the market players

Europe is the dominant regional market for barley.

The food sector is expected to record a significant CAGR in the market.