Comprehensive Snapshot of Baby Care Product Market Research Report, Including Regional and Country Analysis in Brief.

Industry: Consumer Goods

Published Date: April-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 170

Report ID: PMRREP35236

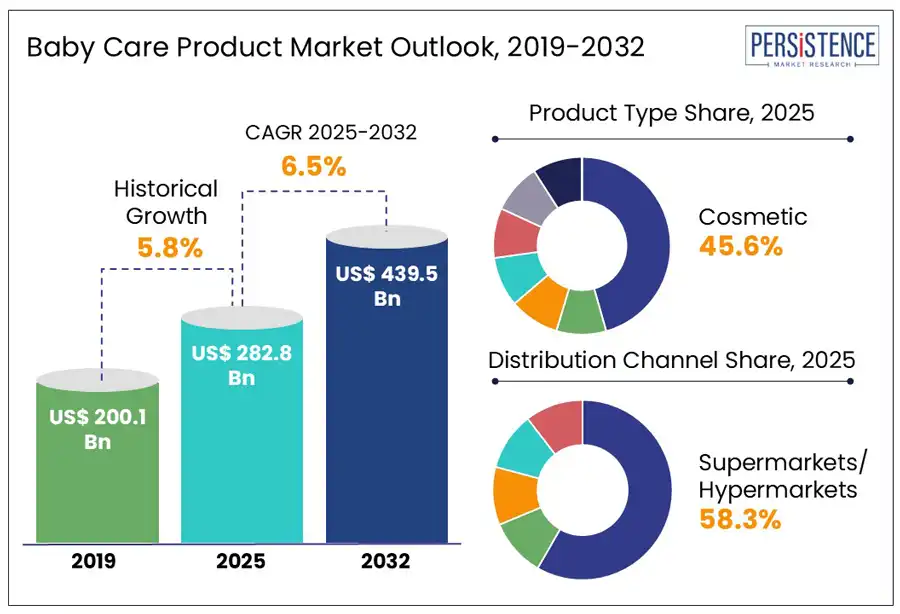

The global baby care product market size is projected at US$ 282.8 billion in 2025 and is expected to reach US$ 439.5 billion by 2032, at a CAGR of 6.5% by 2032. According to the Persistence Market Research report, the growing awareness of baby health and hygiene fuels the need for baby care products. In addition, the availability of various baby products also lures first-time parents to choose from a large pool of varieties.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Baby Care Product Market Size (2025E) |

US$ 282.8 Bn |

|

Market Value Forecast (2032F) |

US$ 439.5 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.8% |

The rise of digital parenting and social media has transformed parents’ choices for baby products. Parents now rely on online platforms such as blogs, social media groups, and review sites for recommendations before buying. Influencers play a key role in shaping brand preferences by sharing personal experiences and product reviews. Platforms such as Instagram, YouTube, and TikTok are powerful marketing channels where brands collaborate with influencers to build trust. Real-time feedback and user-generated content significantly enhance engagement, making digital word-of-mouth a major influence on consumer behavior.

Currently, increased regulatory scrutiny and challenges related to ingredient safety and product claims pose greater challenges. Governments and health organizations have implemented strict regulations on baby skincare, diapers, and food to ensure that these products are free from harmful chemicals, allergens, and toxins. Compliance with standards such as EU REACH, FDA regulations, and ISO certifications raises costs and slows down product launches.

Furthermore, brands risk legal action for making misleading claims, such as “100% natural” or “hypoallergenic,” unless these statements are scientifically validated. Growing consumer awareness and lawsuits against false advertising are placing additional pressure on companies to improve transparency, conduct thorough testing, and reformulate products to meet evolving safety standards.

The rising demand for safe, natural baby care products has resulted in edible, multifunctional formulations. Parents are concerned about chemical exposure, leading brands to create food-grade edible lotions for added safety. Additionally, 2-in-1 shampoos and body washes simplify bath time, while diaper rash creams that also serve as moisturizers enhance convenience. These innovations reflect minimalist parenting trends, emphasizing non-toxic, hypoallergenic, and eco-friendly solutions that prioritize safety and efficiency.

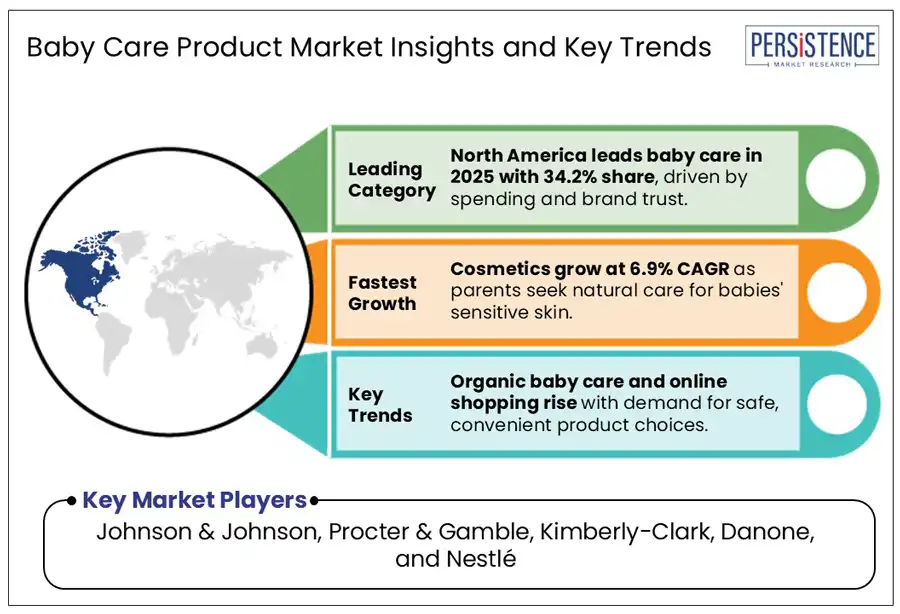

The cosmetic segment is expected to grow at a leading CAGR of 6.9% by 2032. It is driven by parents' preference for natural and organic skincare. The growing awareness of harmful chemicals such as parabens and sulfates is increasing the demand for safe, plant-based options.

Additionally, rising disposable income and heightened concerns about baby hygiene and skin sensitivity are fueling the growth of dermatologist-approved and hypoallergenic products, contributing to market expansion. In 2024, Aveeno Baby launched a new organic skincare line that emphasizes natural ingredients and is free from parabens, sulfates, and dyes. This move addresses the growing demand for safe, plant-based options as parents seek dermatologist-approved, hypoallergenic products for their babies' sensitive skin.

Retail formats such as hypermarkets and supermarkets provide a wide range of baby products to meet the diverse needs of parents. Walmart is the largest supermarket chain in the U.S. It offers a wide variety of baby products, including Johnson & Johnson baby shampoos, Gerber baby food, Pampers diapers, and Graco strollers, all available in one place. They offer a convenient one-stop shopping experience, enabling parents to find everything they need in one location. Additionally, these stores often feature competitive pricing, making baby products at affordable prices. Their economies of scale allow them to negotiate lower prices with suppliers, which they ultimately pass on as savings to customers.

The Asia Pacific baby care product market is projected to reach a CAGR of 7.7% by 2032, driven by a cultural emphasis on premiumization and a rising demand for natural and organic products. Parents are prioritizing high-quality, chemical-free, and eco-friendly products for their infants. This rising awareness of health risks linked to synthetic ingredients has increased demand for organic skincare, diapers, and feeding essentials.

The leading players prefer investing in manufacturing natural and organic products, such as Johnson & Johnson's launch of its "Cottontouch" range with naturally derived ingredients and The Himalaya Drug Company's successful Herbal Baby Care line. Brands such as Pigeon and Mustela are also reinforcing premiumization by offering high-end, dermatologically tested products. Overall, consumer preference for natural, chemical-free baby care is shaping the market in the region.

North America baby care product market is poised to dominate with a revenue share of approximately 34.2% in 2025. Parents' preference for premium, organic, and eco-friendly options fuels the demand. Moreover, parents are particularly focused on chemical-free, plant-based products, for organic skincare, biodegradable diapers, and non-toxic wipes.

Brands are responding with hypoallergenic, fragrance-free formulations certified by USDA Organic and EWG Verified. Growing environmental concerns and rising disposable incomes also encourage investment in eco-conscious solutions. The Honest Company provides eco-friendly, non-toxic baby care products, including biodegradable diapers and wipes. Its focus on transparency and sustainability appeals to parents looking for safe alternatives, highlighting growing demand for premium, organic, and sustainable baby products in North America.

The surge in e-commerce and subscription models has significantly boosted the market in Europe. Europe is projected to capture nearly 28% of the global market revenue share in 2025. Online retail and direct-to-consumer brands provide parents with convenient access to premium baby care items, while subscription services offer tailored monthly deliveries of essentials like diapers and organic skincare, ensuring consistent supply and cost savings.

The global baby care product market is highly competitive, with key players prioritizing innovation, safety, and organic formulations. Leading companies offer diverse products in skincare, haircare, diapers, wipes, and food. Rising parental awareness of organic options has prompted brands to enhance their market presence, while e-commerce platforms like Amazon and Walmart facilitate penetration. Market leaders follow mergers, acquisitions, and product diversification to stay competitive.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn, Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

The market is estimated to be valued at US$ 282.8 Bn in 2025.

The growing influence of digital parenting and social media is a key demand driver for the market.

In 2025, North America dominates with 34.2% market share.

Among product, cosmetic segment is expected to grow rapidly at 6.9% CAGR from 2025 to 2032.

Johnson & Johnson, Procter & Gamble, Kimberly-Clark, and Nestlé are the leading players in the baby care product market.