Industry: Automotive & Transportation

Published Date: February-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 190

Report ID: PMRREP35136

The global automotive ultrasonic technologies market size is anticipated to rise from US$ 6.97 Bn in 2025 to US$ 11.88 Bn by 2032. It is projected to witness a CAGR of 7.9% from 2025 to 2032.

Automobile ultrasonic technologies are propelling vehicle safety by helping drivers detect objects in their path. These systems are vital in Advanced Driver Assistance Systems (ADAS), powering features like parking sensors, blind spot detection, and collision avoidance.

With road accidents causing over 1.35 million deaths annually, based on the findings of WHO in 2023, automakers are prioritizing safety. Companies like Bosch, Continental, and Denso are investing in ultrasonic sensors for next-gen vehicles.

According to Persistence Market Research, the global demand for ADAS is projected to reach US$74.5 Bn by 2027, driven by rising demand for smart, autonomous safety features. As more vehicles integrate intelligent sensing systems, driving is becoming safer and more efficient.

Key Highlights of the Automotive Ultrasonic Technologies Market

|

Global Market Attributes |

Key Insights |

|

Automotive Ultrasonic Technologies Market Size (2025E) |

US$ 6.97 Bn |

|

Market Value Forecast (2032F) |

US$ 11.88 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.7% |

Collaborative Efforts in the Automotive Industry Promotes Innovative Imaging Technology

The global automotive ultrasonic technologies industry witnessed a CAGR of 6.7% in the historical period between 2019 and 2024. Ultrasonic technology, developed nearly a century ago, has evolved significantly, initially used in intruder alarms and later in automotive park assist to detect obstacles beyond the driver's line of sight. In the observed period, the companies dealing with ultrasonic technologies are estimated to boost their market presence on a global scale with the help of collaborations. For instance,

To create next-generation powertrain advancements for Formula E racing, ON Semiconductor Corp. teamed up with Mercedes-AMG Petronas Motorsport and the Mercedes EQ Formula E team in 2019.

Ultrasonic sensors are more versatile and can be used in advanced applications outside the vehicle and in-cabin, such as occupant detection and gesture recognition. The popularity of ultrasonic sensors is rapidly increasing, with the integration of AI and next-gen imaging technology envisioned to help the sales of ultrasonic technology in the automotive industry.

Adoption of Ultrasonic Technology for Electric and Hybrid Vehicles to Boost Sales

In the estimated timeframe from 2025 to 2032, the global market for automotive ultrasonic technologies is likely to showcase a CAGR of 7.9%. The automotive industry is extensively utilizing ultrasonic technology, particularly in the development of ultrasonic sensors that monitor battery performance, detect leaks, and enhance energy efficiency in electric and hybrid vehicles. These ultrasonic technologies have the potential to improve safety features, such as collision prevention and parking assistance.

The introduction of the Afeela EV by Sony and Honda, which is equipped with 45 sensors, including cameras, radar, and ultrasonic sensors, indicates a significant predicted growth in the electric vehicle market in the forthcoming period.

Moreover, various sectors, including battery manufacturing, power electronics, bus bars, cable-to-terminal connections, and electric vehicles, employ ultrasonic welding processes. The torsional PowerWheel and SONIQTWIST® technologies are particularly suited for high-voltage cable termination and electric vehicle battery production, as they have expanded the range of ultrasonic applications and enabled new design and manufacturing techniques.

Growth Drivers

Adoption of Advanced Driver Assistance Systems Presents Prospects for Parking Assistance

Since advanced driver assistance systems (ADAS) like adaptive cruise control, lane-keeping assistance, and traffic jam assist improve vehicle safety and allow for more automation, the market for automotive ultrasonic technology is anticipated to expand. Automakers are investing in automotive ultrasonic technologies to develop advanced products for safety and reliability.

Based on the studies, the sales of two-wheeler vehicles in India have reached over 20.5 million units in 2024, an all-time record.

Israeli company Ride Vision has partnered with Indian automotive leader Spark Minda to introduce its Collision Avoidance Technology to the India, designed to handle region's unique road conditions, diverse vehicle types, and complex traffic behavior. The shift towards technology-driven accident prevention is potentially reshaping road safety for millions of riders in the forthcoming period.

High Replacement and Maintenance Cost of the Upgradation of Technology Challenges the Industry

The possible replacement of conventional ultrasonic sensors by alternative technologies like as radar and Light Detection and Ranging (LiDAR) is posing concerns for the operation. Compared to conventional ultrasonic sensors, LiDAR provides high-resolution 3D mapping and object detection. This raises questions regarding ultrasonic sensors' long-term performance in particular applications.

High implementation costs, complicated configurations, and the requirement for regular upgrades to keep interoperability with the outside world are the market's key obstacles.

In smart vehicles, the cost of parts and assembly is higher, and it costs more to integrate sensors into a single dielectric plate. The aftermarket use of ultrasonic technology in cars is hampered by the increased expense of installing wireless equipment in vehicles.

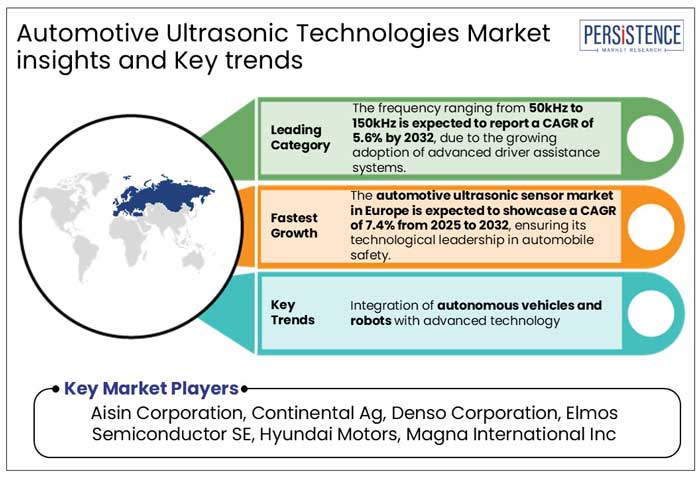

Development of Autonomous Robots and Cars Present Lucrative Avenues for the Future

In the smart city infrastructure, self-driving cars and robots are envisioned to present lucrative growth opportunities. Integrating ultrasonic sensors with other components such as cameras, is anticipated to create comprehensive environmental detection systems for automated vehicles.

The emphasis on pedestrian safety across the world increases the adoption of ultrasonic systems for obstacle detection in low-speed urban environments. To cater the these urban demographic several tech start-ups are estimated to develop self-driving delivery robots and vehicles with automated technology. For instance,

Along with that, Cartken, an early player in robotic delivery market, has raised US$ 22.5 Mn and operates in over 100 locations in six countries. Starship Technologies, with over 2,000 robots deployed globally, plans to increase production this year. Such technological advancements are estimated to present growth avenues for investment in the future.

Frequency Range Insights

Widespread Use in Object Detection and Parking Assistance Presents Prospects for Frequency Ranging from 20kHz to 50kHz

The automotive ultrasonic technologies market is categorized into four different segments based on the frequency range, each serving different applications. In 2025, the low-frequency segment (20kHz to 50kHz) is expected to dominate, holding a market share of 45% due to its widespread use in parking assistance systems and object detection.

Meanwhile, the medium-frequency segment (50kHz to 150kHz) is projected to report a CAGR of 5.6% by 2032, driven by its increasing adoption of advanced driver assistance systems, including blind-spot monitoring and collision avoidance. Companies like Bosch, Continental, and Valeo are enhancing sensor performance in this range.

The high-frequency segment, spanning 150kHz to 250kHz, is expected to grow for safety applications like pedestrian detection and autonomous driving, while the frequency range above 250kHz is expected to propell for non-destructive testing and medical imaging.

Vehicle Type Insights

Government Regulations Boost Integration of Ultrasonic Technologies for ICE Vehicles

The Internal Combustion Engine (ICE) vehicles are expected to dominate the automotive ultrasonic technologies market in 2025, capturing 68% of the market share. This is due to the widespread adoption of ADAS in passenger and commercial vehicles. For instance,

Government safety regulations, such as EU mandates for rear-view cameras and parking sensors in new cars, are contributing to the market's growth.

At the same time, the electric vehicle segment is projected to gain traction as the adoption of EVs rises globally. In 2025, EVs are expected to achieve a market share of 32%, reflecting the ongoing shift towards electrification and automation in the automotive industry. Companies like Tesla, Rivian, and BYD are investing in sensor-integrated EVs to enhance their autonomous driving and object detection capabilities.

Automakers in Europe Boost Production of Hybrid Vehicles with Robust Regulations

Europe is expected to dominate the global automotive ultrasonic technology market in 2025, accounting for 35.2% due to strict safety regulations and high consumer demand for advanced driver assistance systems.

The European Union's General Safety Regulation mandates blind-spot detection, automatic emergency braking, and parking assist in new vehicles, further boosting ultrasonic sensor adoption.

Leading manufacturers like Bosch, Continental AG, and Valeo are expanding production to integrate high-frequency ultrasonic sensors into electric and hybrid vehicles, which are gaining traction in the region.

Meanwhile, Tesla’s Giga Berlin facility is ramping up production of sensor-integrated EVs, reflecting the industry's shift toward automation.

In order to maintain its technical leadership in automobile safety, Europe's automotive ultrasonic sensor market is anticipated to record a CAGR of 7.4% between 2025 and 2032.

Research and Development Programs Catering Innovation in Auto Industry of Asia Pacific

The need for safety systems and the use of ADAS in luxury cars are driving the rapid expansion of the automotive ultrasonic sensor market in Asia Pacific, which is predicted to account for 28.7% of the market in 2025.

While India's Bharat New Car Assessment Program imposes safety criteria for ultrasonic sensor integration, China and India, two of the fastest-growing automotive markets in the Asia Pacific, are encouraging the use of ADAS in cars to improve road safety.

Manufacturers such as Hyundai, Toyota, and Tata Motors are partnering with research institutions to develop next-generation automotive safety technologies. For instance,

The demand for automotive ultrasonic sensors in Asia Pacific is anticipated to grow owing to rising investment in research and development and strong regulatory support.

Rise in Safety Features for Automobiles in North America Paves the Way to Success

As more automobiles with ADAS are sold, the demand for automotive ultrasonic sensors in North America is growing. In 2025, the U.S. is expected to nurture almost 80% of its vehicles equipped with ADAS.

The need for ultrasonic sensors is being driven by the National Highway Traffic Safety Administration's (NHTSA) mandates for enhanced safety features including blind-spot detection and automated emergency braking.

In order to improve parking assistance and driver safety, major manufacturers such as Tesla, General Motors, and Ford are incorporating these sensors into their vehicle models.

The need for high-precision ultrasonic sensors has also increased due to the expanding use of electric and driverless cars. North America is still a major market for vehicles with ADAS because of the region's robust governmental support and high customer demand for safety features.

In the global automotive ultrasonic technologies market, various companies are expected to enhance their market presence by introducing innovative products and technologies in new vehicles.

Several industry players are likely to increase their manufacturing capabilities through strategies such as mergers and acquisitions, research and development, geographical expansion, and product diversification.

The integration of new technology such as AI and ML into traditional machinery in the automotive industry is anticipated to drive sales of upgraded ultrasonic technologies in the forthcoming years.

Key Industry Developments

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Frequency Range

By Vehicle Type

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The market is set to reach US$ 6.97 Bn in 2025.

The systems typically consist of four to 16 strategically placed sensors around the car to ensure the desired detection coverage.

Aisin Corporation, Continental Ag, Denso Corporation, and Elmos Semiconductor SE are a few leading players.

The industry is estimated to rise at a CAGR of 7.9% through 2032.

Europe is projected to hold the largest share of the industry in 2025.