Industry: Automotive & Transportation

Published Date: March-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 182

Report ID: PMRREP17113

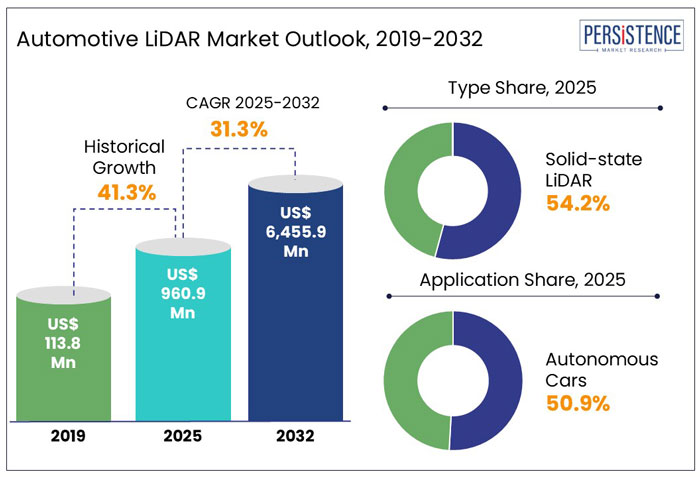

The global automotive LiDAR market size is set to grow 6.7X from the current size of US$ 960.9 Mn in 2025 to US$ 6,455.9 Mn in 2032. It will likely exhibit a staggering CAGR of 31.3% from 2025 to 2032.

Picture a world where cars move effortlessly through the bustling city streets, steering rush-hour traffic smoothly, and preventing accidents caused by human errors. This is anticipated to soon turn to reality with the adoption of automotive light detection and ranging (LiDAR).

Assisted and automated driving will likely improve with LiDAR technology. It is projected to enable vehicles to ‘look’ at their surroundings minutely. While Tesla has focused on cameras, key automakers such as BMW, Volvo, and Mercedes-Benz are incorporating LiDAR technology into their new models to enhance safety and reliability in self-driving features.

Increasing investments in Advanced Driver Assistance Systems (ADAS) and fully autonomous vehicles are projected to push demand for automotive LiDAR. Companies such as Luminar, Velodyne, and Innoviz are at the forefront, creating high-resolution LiDAR sensors capable of detecting objects up to 250 meters away, even in challenging weather conditions. As the push for autonomy speeds up, LiDAR is becoming a transformative technology, not only for high-end vehicles but also for the global automotive industry.

Key Highlights of the Automotive LiDAR Industry

|

Global Market Attributes |

Key Insights |

|

Automotive LiDAR Market Size (2025E) |

US$ 960.9 Mn |

|

Market Value Forecast (2032F) |

US$ 6,455.9 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

31.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

41.3% |

Historical Period Witnessed Impressive Growth with Popularity of Autonomous Vehicles

The automotive LiDAR market revenue surged significantly over the historical period from 2019 to 2024. It was propelled by increasing investments in vehicle safety and rising developments in autonomous driving technology.

In 2020, the market experienced a modest growth rate of 9.5%, which rose to 12.8% in 2021 as automakers and tech companies increased their efforts to integrate LiDAR technology. However, a significant breakthrough happened in 2022, with an impressive year-over-year growth of 79.1%, driven mainly by a surging demand for autonomous vehicles, supportive regulations for safety technologies, and decreasing costs of LiDAR sensors.

The momentum carried on in 2023 with a growth rate of 53.2%, and this was followed by another robust expansion of 66.2% in 2024. Throughout the historical period from 2019 to 2024, the market experienced an impressive CAGR of 41.3%, highlighting the significant influence of LiDAR technology on the automotive industry.

LiDAR-enhanced AEB to Become a Standard Feature in Vehicles to Reduce Pedestrian Fatalities through 2032

The automotive LiDAR industry is projected to maintain a steady CAGR of 31.3% from 2025 to 2032. The implementation of strict vehicle safety regulations around the globe is driving up the adoption of LiDAR technology in the automotive industry. Governments are mandating the use of LiDAR-based Advanced Driver Assistance Systems (ADAS) to minimize road accidents and improve vehicle safety, pushing automakers to quickly embrace this technology.

In the European Union, the General Safety Regulation (GSR2) (EU 2019/2144) requires new vehicles to incorporate novel safety features, including LiDAR-enabled Automatic Emergency Braking (AEB). As several vehicles in the U.K. adhere to EU specifications, this regulation is further boosting demand for LiDAR.

Similarly, in the U.S., the National Highway Traffic Safety Administration (NHTSA) has mandated FMVSS No. 127, which requires AEB systems to operate at speeds of up to 90 mph (145 km/h) for collision prevention and 45 mph (72 km/h) for pedestrian detection, significantly increasing the need for LiDAR-based solutions.

On the other hand, China’s Ministry of Industry and Information Technology (MIIT) is supporting the country’s Vision Zero initiative by promoting the widespread adoption of ADAS, which includes safety systems powered by LiDAR technology. With pedestrians making up 17% of global road fatalities according to the World Health Organization (WHO), LiDAR-enhanced AEB is anticipated to be an essential feature in new vehicle models, thereby boosting sales through 2032.

Growth Driver

Mass Production Efforts by Companies to Reduce LiDAR Costs, Making it More Accessible

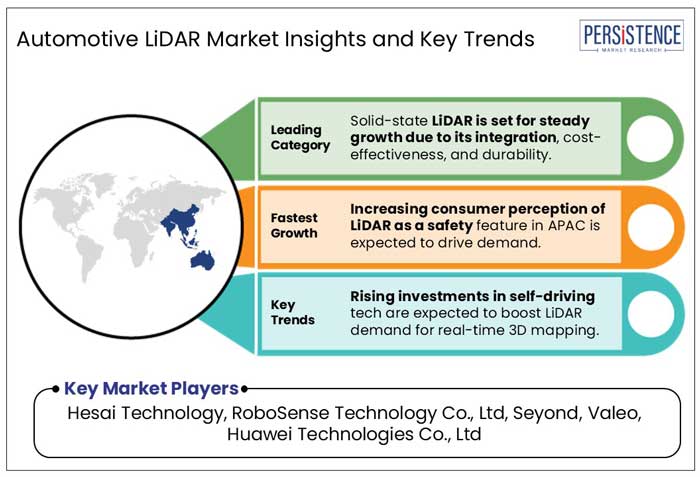

The automotive LiDAR industry is experiencing significant growth, driven by increasing adoption of autonomous and semi-autonomous vehicles. Leading companies like Tesla, Waymo, and General Motors (Cruise) are heavily investing in self-driving technology, with LiDAR playing a key role in real-time 3D mapping, enabling higher levels of automation.

China is accelerating the deployment of LiDAR-equipped robotaxis, with key cities like Beijing, Shanghai, and Shenzhen granting permits for fully autonomous ride-hailing services to companies such as Baidu and AutoX. The NHTSA has approved AV testing without human drivers, pushing automakers toward LiDAR for safety.

Tesla is reconsidering LiDAR for redundancy, while Mercedes-Benz secured Level 3 automation in Nevada and California. LiDAR is also advancing autonomous freight, with Aeva partnering with Daimler Truck and Torc Robotics to meet logistics automation demands.

Enhancements in LiDAR performance and cost reduction are making the technology more accessible for mass adoption. For instance,

The development of solid-state LiDAR, such as Ouster’s REV7 and Aeva’s Atlas Ultra, has further improved affordability, durability, and compactness, making LiDAR viable for mass-market vehicles. Government funding and investments are also driving LiDAR innovation, with the European Union allocating €1.5 Bn under the Horizon Europe program to support AI and sensor technologies, including LiDAR. The U.S. Department of Energy (DOE) is further backing research into LiDAR-enabled vehicles for energy efficiency and urban mobility.

Market Restraining Factor

Adverse Weather Conditions May Reduce LiDAR Accuracy, Leading to Challenges in Autonomous Navigation

LiDAR sensors are known to experience performance degradation under adverse weather conditions such as heavy rain, fog, and snow. Studies have demonstrated that fog, in particular, severely affects LiDAR performance due to the scattering of laser pulses by water droplets, which reduces the sensor's effective range and accuracy.

Rain can also impact LiDAR functionality by causing false reflections and diminishing the number of detectable point clouds, while snow appears to have a less pronounced effect on performance. For instance,

In contrast, radar and depth cameras maintain up to 100% of their nominal distance-ranging capabilities under similar conditions. This disparity highlights LiDAR's susceptibility to both environmental factors and surface material properties, which can adversely impact its reliability in autonomous vehicle applications. To mitigate these challenges, various companies are developing AI-based software solutions aimed at enhancing LiDAR perception in adverse weather.

Such innovations focus on improving signal processing algorithms to better distinguish between real-time obstacles and weather-induced noise. However, until such solutions are widely implemented and validated in diverse environmental conditions, limitations of LiDAR in adverse weather will likely continue to pose a restraint on its widespread adoption, especially in regions prone to harsh climates.

Key Market Opportunity

Automakers to Focus on LiDAR to Improve ADAS and Real-time Object Detection in EVs

Rapid expansion of the Electric Vehicle (EV) market presents a significant growth opportunity for automotive LiDAR manufacturers. As EV adoption accelerates, there is an increasing demand for advanced safety, navigation, and autonomous driving technologies, areas where LiDAR plays a key role.

According to the International Energy Agency (IEA), nearly 14 Mn electric cars were sold in 2023, which was a 35% year-on-year increase, thereby bringing the global EV stock to 40 Mn. This surge reflects the rising prioritization of smart mobility solutions, particularly in key markets such as China (60% of global EV sales), Europe (25%), and the U.S. (10%).

With EVs representing 18% of total car sales in 2023, up from just 2% in 2018, the need for LiDAR-powered solutions, including ADAS, autonomous navigation, and real-time object detection has never been greater. EV manufacturers are integrating cutting-edge sensor technologies to enhance vehicle safety and enable high levels of automation, making LiDAR a key component in the future of smart electric mobility.

As global EV penetration continues to rise, LiDAR manufacturers have a unique opportunity to establish strategic partnerships with automakers, Tier-1 suppliers, and technology providers. These are likely to help them strengthen their position in the autonomous and intelligent vehicle revolution.

Type Insights

Solid-state LiDAR to be Highly Preferred Backed by Cost-effectiveness and Smooth Integration Features

The solid-state LiDAR segment is projected to dominate in 2025, holding a substantial automotive LiDAR market share of 54.2%. The segment is projected to exhibit a CAGR of 34.4% throughout the forecast period.

Solid-state LiDAR is rapidly emerging as the preferred choice for automotive manufacturers due to its superior durability, cost-effectiveness, and seamless integration capabilities. Unlike mechanical LiDAR systems that rely on rotating components, solid-state LiDAR eliminates moving parts, enhancing reliability and significantly reducing maintenance requirements. This design also lowers power consumption and manufacturing costs, making it an ideal solution for mass-market vehicle deployment.

Another key advantage of solid-state LiDAR is its compact size and resilience to vibrations, which allows for flexible placement in various vehicle architectures. While mechanical LiDARs provide a 360-degree field of view (FoV), their bulky, cylindrical design limits integration options. In contrast, solid-state LiDARs can be strategically positioned around the vehicle and their data can be fused to create an FoV comparable to mechanical systems.

While the automotive industry may increasingly adopt solid-state LiDAR technologies, there will still be a demand for mechanical LiDAR in specialized applications. By 2030, the industry can expect that autonomous shuttles, delivery robots, and drones will continue to utilize mechanical LiDAR in situations where high accuracy is more important than cost considerations.

Application Insights

Regulatory Pressures for Safer Roads to Propel Expansion of LiDAR in ADAS

Based on application, the ADAS segment will likely hold a share of 49.1% in 2025, growing at 32.8% CAGR between 2025 to 2032. LiDAR plays a key role in ADAS by enhancing vehicle safety and driving efficiency through various semi-autonomous functionalities.

Novel ADAS features such as adaptive cruise control, AEB, lane-keeping assistance, and pedestrian detection rely on LiDAR’s ability to provide real-time, high-precision depth perception. This capability enables vehicles to detect obstacles, measure distances accurately, and react instantly to dynamic road conditions. As regulatory mandates for vehicle safety continue to evolve, demand for LiDAR-based ADAS solutions is estimated to surge, particularly in premium and electric vehicles.

On the other hand, autonomous cars are projected to generate a share of 50.9% in 2025. The use of LiDAR in autonomous or self-driving cars is increasing consistently as it offers high-resolution 3D mapping, which allows for accurate navigation and obstacle detection.

Asia Pacific Automotive LiDAR Market

Competitive LiDAR Pricing in China to Boost Accessibility for Automakers

Asia Pacific is anticipated to hold a share of 68.3% in 2025. Demand for LiDAR technology is rapidly growing in the region, driven by increased domestic production, particularly in China, where manufacturers like RoboSense have strengthened their presence. This has led to reduced costs, making LiDAR more accessible to automakers.

Regulatory support is also significant, with Chinese vehicles prepared for future Level 3 autonomous driving approvals and over-the-air (OTA) updates. Additionally, consumer perception of LiDAR as a significant safety feature has boosted demand.

Apart from China, other countries in Asia Pacific are also moving toward autonomous driving. Japan and South Korea, for instance, are preparing to introduce Level 3 self-driving vehicles. South Korea, starting in July, will allow automakers to sell vehicles with basic Level 3 self-driving capabilities, with companies like Hyundai, Kia, BMW, and Mercedes-Benz anticipated to launch such models. Such strategies are projected to create a high automotive LiDAR demand.

Europe Automotive LiDAR Market

Strategic Collaborations between LiDAR Manufacturers and Automakers to Fuel Innovation in Europe

Europe is anticipated to surge at a 29% CAGR from 2025 to 2032 and is projected to account for a 12.4% market share in 2025. The region plays a significant role in accelerating LiDAR technology development and its integration into vehicles.

Strategic collaborations between LiDAR manufacturers and automakers are driving innovation. For instance, Valeo has started producing LiDAR in Germany for series vehicles, BMW has extended its partnership with Innoviz Technologies, and Mercedes-Benz incorporated Valeo’s LiDAR into its S-Class models.

The landscape of autonomous vehicles in the European Union (EU) and the U.K. is evolving rapidly, with Tesla recently expressing intentions to introduce full self-driving technology to European roads by early 2025. Additionally, Luminar is emerging as a key player in the region’s automotive sector, further strengthening its influence on LiDAR adoption.

Regulatory developments are shaping the market, with the European Union enforcing Regulation (EU) 2019/2144 to support automated vehicle deployment. Currently, Level 3 automated vehicles, which require a safety driver, are allowed on public roads. However, the EU is working toward enabling Level 4 autonomy by 2025. This aligns with Tesla’s timeline for introducing its Full Self-driving (FSD) technology.

The EU has largely followed Germany’s regulatory approach, while the U.K. has introduced the Automated Vehicles Act 2024 to establish a robust safety framework, clarify legal liabilities, and protect consumers. The main challenge ahead is ensuring that existing regulations can support market-ready autonomous technologies on a scale.

North America Automotive LiDAR Market

Retailers in Canada to Embrace LiDAR-based Self-driving Trucks to Optimize Logistics

In North America, the U.S. automotive LiDAR market is projected to be a leading hub through 2032. Regulatory pressure is a significant factor propelling demand for automotive LiDAR in the U.S. The National Highway Traffic Safety Administration (NHTSA) is advocating strict requirements for ADAS, making LiDAR-based technologies important for car manufacturers.

In 2023, for instance, Mercedes-Benz’s Drive Pilot became the first Level 3 system to receive approval in the U.S., utilizing Luminar’s LiDAR technology for hands-free driving on highways. Additionally, states like California and Arizona, which are at the forefront of autonomous vehicle testing, have authorized over 1,400 self-driving cars, many of which depend on LiDAR for their navigation systems.

Canada automotive LiDAR industry is set to be supported by significant government investments and private sector involvement. In 2023, the country’s government committed US$ 500 Mn to research in AI and self-driving vehicles, focusing on LiDAR-based perception systems.

Companies such as Waabi, Gatik, and LeddarTech are leading the way in autonomous freight transport, incorporating LiDAR technology into delivery trucks for retailers like Walmart and Loblaw. Additionally, the city of Ottawa has initiated a LiDAR-based smart road project, utilizing the technology for real-time traffic management and autonomous shuttle services.

The competitive landscape is shaped by continuous technological developments, strategic collaborations, and the race to develop cost-effective and scalable solutions. Key players in the market focus on high-performance LiDAR sensors with improved range, resolution, and real-time perception capabilities.

Integration of LiDAR into mass-production vehicles accelerates, particularly in electric and autonomous vehicle segments. Partnerships between LiDAR developers and leading automotive OEMs are becoming increasingly common, enabling wider adoption and innovation. Additionally, industry consolidation through mergers and acquisitions strengthens the technological capabilities of key players, allowing for the expansion of product portfolios and improved sensor performance.

Key Industry Developments

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Type

By Application

By Range

By Vehicle Type

By Region

To know more about delivery timeline for this report Contact Sales

The market is estimated to be valued at US$ 960.9 Mn in 2025.

Stringent safety regulations are accelerating LiDAR adoption in the automotive sector.

In 2025, Asia Pacific will likely dominate the industry with 68.3% share.

Among applications, the ADAS segment is predicted to rise rapidly at 32.8% CAGR from 2025 to 2032.

Luminar Technologies, Inc., RoboSense Technology Co., Ltd, and Ouster, Inc. are few of the top companies.