Industry: Automotive & Transportation

Published Date: October-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 169

Report ID: PMRREP34883

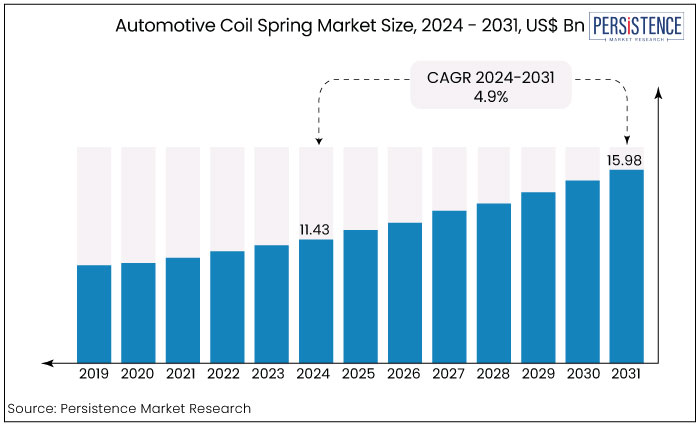

The automotive coil spring market is estimated to increase from US$11.43 Bn in 2024 to US$15.98 Bn by 2031. The market is projected to record a CAGR of 4.9% during the forecast period from 2024 to 2031.

The increasing penetration of electric vehicles (EVs), which utilize more advanced suspension systems, is positively impacting demand for coil springs. In 2023, EV coil spring demand is expanding at a CAGR of 6%, particularly in Europe and North America.

The market is shifting toward lightweight materials such as high-strength steel alloys and composite coil springs, which reduce vehicle weight and improve fuel efficiency. In 2023, steel coil springs dominate around 80% of the market, while composite springs are estimated to grow substantially with a projected CAGR of 5.5% through 2031.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Automotive Coil Spring Market Size (2024E) |

US$11.43 Bn |

|

Projected Market Value (2031F) |

US$15.98 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

4.9% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

3.8% |

|

Region |

Market Share in 2024 |

|

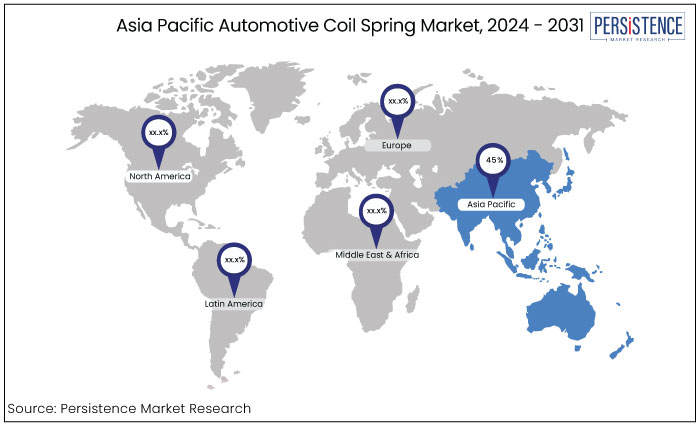

Asia Pacific |

45% |

Asia Pacific dominates the market, accounting for 45% of the total market share, which is primarily driven by the presence of major automobile manufacturing hubs such as China, Japan, India, and South Korea. These are the leading countries in the automotive production.

The high demand for passenger vehicles and commercial vehicles in these countries has led to an increased demand for automotive components, including coil springs. China, in particular, is a significant contributor to market growth with its robust automotive industry and the presence of both domestic and international car manufacturers.

Rising urbanization, increasing disposable incomes, and a growing middle class have accelerated vehicle ownership, further driving the demand for coil springs. Moreover, India's expanding automotive sector and increasing government initiatives to boost domestic manufacturing through programs like "Make in India" are expected to sustain the region's dominance. The presence of a strong supply chain, coupled with affordable labour, allows APAC to remain competitive in the global market.

|

Category |

Market Share in 2024 |

|

Type - Compression Spring |

65% |

The market is divided into compression springs, extension spring and torsion spring based on type. Among these, the compression spring type dominates the market.

Compression Springs are widely used in automotive suspension systems, particularly in passenger cars, commercial vehicles, and motorcycles. They are designed to absorb shocks and maintain the vehicle's stability, making them essential components for ensuring ride comfort and handling performance.

Compression springs provide excellent damping and shock absorption capabilities, which are critical in automotive applications like suspension struts, shock absorbers, and wheel assemblies. These are the most commonly used coil springs in both OEM and aftermarket sectors.

Given the increasing demand for passenger comfort, the popularity of sport utility vehicles (SUVs), and advancements in suspension technology, compression springs remain the leading type in the automotive sector.

|

Category |

Market Share in 2024 |

|

Vehicle Type - Passenger Vehicle |

60% |

Based on vehicle type, the market is classified into passenger vehicle and commercial vehicle, where the passenger vehicle type dominates the market.

Passenger vehicles account for the significant share in the automotive coil spring market, comprising about 60% of the market. It is primarily driven by the high production and sales volume of passenger cars globally especially in regions like Asia-Pacific, Europe, and North America.

Passenger vehicles, including sedans, SUVs, and compact cars mainly rely on compression coil springs in their suspension systems to enhance ride comfort, handling, and safety. The increasing demand for smooth driving experiences and vehicle stability contributes to the widespread use of coil springs in this segment.

Rising urbanization, growing middle-class populations, and increasing disposable incomes particularly in emerging markets are driving up demand for passenger vehicles further fueling the need for coil springs in their suspension systems.

Automotive coil springs are an essential component of a vehicle's suspension system. They are also utilized in various vehicles, including Heavy Commercial Vehicles (HCVs), two-wheelers, passenger cars, and Light Commercial Vehicles (LCVs).

Automotive coil springs are mainly utilized for suspension in wheeled vehicles. Automotive suspension springs facilitate a secure driving experience on uneven terrain and prevent collisions.

Common varieties of vehicle coil springs include close-end, square-end, open, and pigtail configurations. Fabricating these springs involves a linear wire that passes through a sequence of coiling rollers, resulting in a series of coiled points that exert force to form an automotive spring coil. These springs are employed by a wide range of vehicles, from two-wheelers to compact cars and heavy-duty vehicles such as trucks, buses, and tractors.

The adaptable characteristics of coil springs, which manufacturers can tailor to meet customer preferences and applications across diverse sectors. These sectors include automotive, real estate, and agriculture which are likely to enhance the market.

The automotive coil spring market experienced moderate but steady growth, driven by the expansion of the global automotive industry. Increasing demand for passenger vehicles, particularly in regions like Asia-Pacific and North America, was a key factor, with countries like China, India, and the United States being significant contributors.

The market saw significant adoption of coil springs in passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs), as these springs are essential components of suspension systems, offering enhanced driving stability and comfort.

However, challenges like fluctuating raw material prices (especially steel) and the impact of the COVID-19 pandemic in 2020 slowed production and disrupted supply chains, marginally affecting growth. Despite these hurdles, the focus on vehicle safety and ride quality helped maintain demand.

Post-2024, the market is projected to grow faster due to advancements in electric vehicles (EVs) and increasing demand for lightweight and high-performance suspension systems. Integrating high-strength steel alloys and composite materials in coil springs, designed for fuel efficiency and improved load management, is expected to drive growth.

Rising disposable incomes, urbanization, and government regulations promoting environmentally friendly vehicles will increase production, especially in emerging markets. The growing importance of customized spring solutions for commercial vehicles and EVs will also boost the market in this period.

Increased Adoption of Autonomous Driving Systems Enhancing Automotive Coil Spring Market

Autonomous driving systems present novel difficulties and demands for car suspension systems, particularly coil springs, to guarantee optimal performance, safety, and comfort. Automotive coil spring manufacturers prioritize the development of efficient springs to comply with safety regulations.

Autonomous driving necessitates exact vehicle control to navigate seamlessly in response to fluctuating road conditions. The increasing deployment of autonomous driving technologies drives growth in the automotive coil spring industry.

Coil springs are essential for car dynamics control systems, collaborating with Electronic Stability Control (ESC) and Traction Control Systems (TCS) to enhance vehicle handling and stability. These are widely employed in electric vehicles. Consequently, the rise in car electrification is driving market advancement.

Rising Vehicle Production and Global Automotive Demand

The growing demand for vehicles, particularly in emerging markets like Asia Pacific, Latin America, and Eastern Europe remains a significant driver for the automotive coil spring market. Countries such as China, India, and Brazil have witnessed a substantial increase in vehicle ownership due to rising disposable incomes, rapid urbanization, and improved road infrastructure.

As global economies recover from the effects of the COVID-19 pandemic, automotive production is ramping up to meet consumer demand for new vehicles. As essential components in suspension systems, coil springs are in high demand across passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs).

The increasing sales of vehicles particularly SUVs and electric vehicles (EVs), which require advanced suspension systems for enhanced ride quality are expected to sustain the demand for coil springs over the forecast period. Moreover, government initiatives promoting the automotive sector further fuel market growth.

Fluctuating Raw Material Prices

One of the primary growth restraints for the automotive coil spring market is the fluctuating prices of raw materials, particularly steel and other alloys. Steel is a key material in the production of coil springs, and its prices can be highly volatile due to global supply chain disruptions, and changes in demand from various industries.

Increases in raw material costs can significantly affect production costs for manufacturers, leading to higher prices for coil springs. This situation can deter automakers from investing in high-quality suspension systems particularly in competitive markets where cost-cutting measures are crucial.

Manufacturers may need help to maintain profit margins, which could result in reduced investment in research and development for innovative products. Consequently, fluctuating raw material prices can inhibit the overall growth potential of the market.

Growth in Electric and Hybrid Vehicle Production

The rapid expansion of the electric and hybrid vehicle market presents a significant opportunity for the automotive coil spring industry. As governments worldwide implement strict emissions regulations and consumers increasingly adopt electric mobility, the demand for lightweight, efficient suspension systems are on the rise.

Electric and hybrid vehicles often require specialized coil springs to support their unique weight distribution and performance characteristics. By developing coil springs tailored specifically for electric and hybrid applications, manufacturers can tap into this burgeoning market.

As automakers shift their production lines to accommodate electric vehicles, the need for reliable suppliers of high-quality suspension components will grow. This presents opportunities for existing coil spring manufacturers to expand their product offerings and collaborate with electric vehicle manufacturers, ultimately driving growth and innovation in the market.

A mix of established players and emerging manufacturers characterizes the competitive landscape of the automotive coil spring market. Key companies, such as Tenneco Inc., Eibach Springs, and Hyperco, dominate the market with their extensive product offerings and innovative solutions tailored for electric and hybrid vehicles. These companies invest significantly in research and development to enhance the performance and sustainability of their coil springs.

Regional players like Lesjofors and Owen Springs are gaining traction by focusing on localized production and customization to meet specific market needs. The competition is further intensified by strategic collaborations and partnerships between coil spring manufacturers and automotive OEMs to develop advanced suspension systems that cater to evolving consumer demands and regulatory requirements.

Recent Industry Developments in the Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Type

By Vehicle Type

By Region

To know more about delivery timeline for this report Contact Sales

The market is estimated to be valued at US$15.98 Bn by 2031.

Coil springs are widely used spring in automobile industry.

Coil springs are formed of wound metal and designed to support the weight of vehicle.

The market is projected to exhibit a CAGR of 4.9% over the forecast period.

Some of the leading manufactueres in the market are, NHK Spring Co.Ltd, and Sogefi Group, Mubea Fahrwerksfedern GmbH.