Industry: Semiconductor Electronics

Published Date: December-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 172

Report ID: PMRREP33370

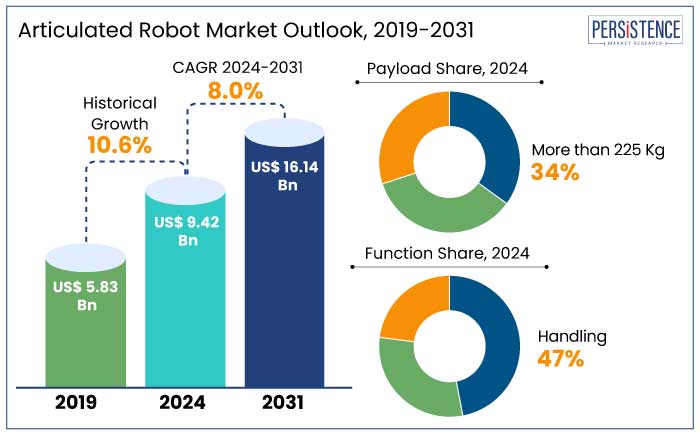

The global articulated robot market is projected to experience a CAGR of 8% between 2024 and 2031. The market is expected to grow from US$ 9.4 Bn in 2024 to an impressive US$ 16.1 Bn by 2031.

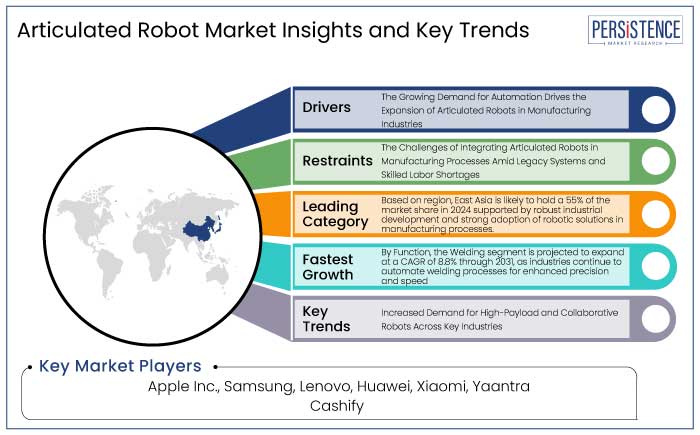

The global articulated robot market is primarily driven by the growing adoption of robotics across various industries, notably in the automotive, electrical and electronics, and chemicals, rubber, and plastics sectors. The demand for precision, high efficiency, and the ability to perform complex tasks has led to an increasing reliance on articulated robots in manufacturing and assembly lines.

Articulated robots are particularly sought after in sectors like automotive, where automation reduces operational costs and enhances production speed with their flexibility and ability to handle tasks such as welding, dispensing, and assembling.

According to a 2023 report by the International Federation of Robotics (IFR), the industrial robot market, including articulated robots, is projected to expand at a CAGR of 11.3% from 2023 to 2026. Additionally, as per Statista, the global robotics market was valued at US$ 48.2 Bn in 2023, with articulated robots holding a significant share. It is primarily driven by demand from high-growth industries such as electronics manufacturing and automotive production.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Articulated Robot Market Size (2024E) |

US$ 9.4 Bn |

|

Projected Market Value (2031F) |

US$ 16.1 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

8% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

10.6% |

Germany is expected to achieve a notable CAGR of 7.8% through 2031 in Europe solidifying its position as the leader in the articulated robot market. The country's dominance is attributed to its robust industrial foundation, particularly within automotive manufacturing, a key adopter of robotic automation. Germany's advanced technological infrastructure, skilled labor force, and commitment to Industry 4.0 are key drivers of widespread automation across various industries.

Germany has been leading the Europe region through its adoption of articulated robots in automotive production lines, precision engineering, and other industrial applications. This is largely driven by the demand for high-precision manufacturing, with robots being used for tasks such as welding, assembly, and material handling. Europe holds a market share of 30% in 2024.

Compared to other countries in Europe, Germany's focus on automating manufacturing processes and its role as a hub for leading automotive manufacturers set it apart in the region. A notable competitor in Germany market is KUKA AG, which specializes in robotics and automation solutions. In March 2024, KUKA launched a new robotic arm designed for high-precision industrial tasks, reinforcing its position in the growing articulated robot market.

The articulated robot market in East Asia is forecast to see significant growth holding a 55% market share in 2024, with South Korea leading the charge. The country is expected to exhibit a CAGR of approximately 8.2% through 2031, fueled by its substantial investments in robotics for the electronics and automotive industries.

Government-supported smart factory initiatives and automation incentives are further bolstering position of South Korea market, spurring widespread adoption of robotic systems across key manufacturing sectors. South Korea differentiates itself with a sharp focus on high-precision applications in electronics and semiconductors with the dominance of China and excellence of Japan in technological innovation.

Rapid growth of South Korea compared to China and Japan is underpinned by a small yet more innovation-driven manufacturing sector. In comparison, China's heavy reliance on articulated robots for high-volume automotive and electronics assembly and Japan's focus on robotics innovation offer distinct competition.

Yaskawa Electric Corporation, a leading Japanese competitor, unveiled a new articulated robot model in January 2024, optimized for multi-axis operations in precision industries. It highlights competitive advancements in the region.

The articulated robot market is set for significant growth, with the "More than 225 Kg" payload category projected to dominate, capturing a CAGR of 8.3%. This segment holds a substantial market share of more than 34% globally, driven by its essential role in heavy-duty applications across industries such as automotive, metal and machinery, and construction. These robots are critical for tasks such as assembling large components, transporting heavy materials, and performing high-precision operations in challenging environments.

The 60 Kg to 225 Kg category, while showing strong growth, is primarily favored for its versatility in medium-scale manufacturing tasks like welding and material dispensing. Globally, the "More than 225 Kg" segment has gained prominence in the automotive sector, where it is utilized for assembling vehicle bodies and large machinery. In the metal and machinery industries, it supports large-scale production with unmatched efficiency. Its adoption is driven by the demand for increased operational safety, consistency, and productivity compared to human labor, giving it an edge in highly automated economies. Fanuc Corporation is a prominent competitor in this category.

The handling segment of the articulated robots market is projected to exhibit a CAGR of 7.6% from 2024 to 2031, driven by its widespread use in material handling, loading, and unloading tasks across various industries. This handling articulated robot holds a significant market share of 47% in 2024 due to its ability to efficiently perform repetitive tasks with high precision and reliability, making it indispensable in sectors. These sectors include automotive and electronics manufacturing, where speed and accuracy are essential.

Handling robots are particularly valued for their seamless integration into production lines, enhancing workflows in logistics, warehousing, and heavy industrial settings. Globally, handling robots leads due to their seamless integration into production lines, supporting optimized workflows in logistics, warehousing, and heavy industrial settings.

The automotive industry relies on the robots for transporting components during assembly, while the electronics sector uses them for the precise handling of sensitive parts. KUKA AG is a notable competitor in the handling robots segment.

The global articulated robots market presents growing opportunities, driven by advancements in automation and increasing demand for efficiency across industries. Emerging markets, especially in Asia Pacific, are experiencing significant adoption of articulated robots in automotive and electronics manufacturing.

Advancements in AI and IoT integration are opening doors for intelligent automation solutions, creating a dynamic market landscape with significant potential for innovation and growth. Currently, the market is witnessing trends such as the growing adoption of robots with higher payload capacities and the prevalence of collaborative robots designed to work alongside humans.

Leading industries, including automotive, electronics, and food processing, are implementing articulated robots for high-precision tasks, reducing operational costs, and enhancing productivity. Governments are also supporting automation adoption through favorable policies, further boosting market momentum.

Evolving trends are closely linked with specific end-user applications. For instance, the automotive sector uses articulated robots extensively for welding and assembly, while electronics manufacturers rely on them for precision handling and dispensing tasks. This correlation emphasizes the growing relevance of tailored robotic solutions to meet the diverse needs of end users, ensuring continued market expansion.

The historical growth rate 10.6% for articulated robots was largely driven by the initial demand for automation in industries like automotive, electronics, and chemicals. As these sectors sought enhanced productivity and precision, robots were adopted for tasks such as assembly, material handling, and welding. This surge in demand was influenced by labor shortages and the need for quality control, making automation a vital investment.

Growth began to moderate in developed regions as the market matured. Still, emerging markets and advancements in collaborative robots continue to present strong growth opportunities. The integration of artificial intelligence and machine learning into robotic systems further expands their capabilities.

Sales of articulated robots are estimated to record a CAGR of 8% during the forecast period between 2024 and 2031.

The Growing Demand for Automation Fuels the Demand for Articulated Robots in Manufacturing Industries

The demand for automation in manufacturing industries is one of the key drivers for the articulated robot market growth. As industries such as automotive, electronics, and consumer goods seek higher efficiency, precision, and speed, robotic automation is increasingly deployed for tasks like assembly, material handling, and welding. These robots reduce human error, ensure consistent quality, and enhance productivity, making them indispensable in production lines.

The focus on improving operational efficiency and the need to maintain competitive advantage continues to push the adoption of articulated robots. Technological advancements in automation technologies, such as AI, machine learning, and IoT, further enhance the capabilities of articulated robots, leading to greater integration in production environments. The adoption of Industry 4.0 practices is accelerating, especially in manufacturing hubs globally, like China and Germany, where automation is crucial to staying competitive.

Rising Labor Costs and Shortages Drive Adoption of Articulated Robots

Labor costs and shortages have driven industries to adopt articulated robots. As wages increase and the workforce shrinks in certain regions, businesses face mounting pressure to reduce operational costs while maintaining quality. Articulated robots serve as an effective solution, allowing businesses to streamline production processes and reduce their reliance on manual labor.

Robots can operate around the clock without breaks, contributing to higher output at lower long-term costs, a critical factor in industries with high labor-intensive operations. This shift is particularly pronounced in developed economies like the US and Europe, where labor shortages in manufacturing have intensified. By automating repetitive and high-risk tasks, articulated robots not only help mitigate labor shortages but also improve safety on production lines.

Integrating Articulated Robots in Manufacturing Processes

The integration of articulated robots into existing manufacturing processes remains a significant challenge. This is particularly true for industries that have older, legacy systems which require substantial modifications to integrate new robotic technologies effectively. Such integration issues increase both implementation time and the overall cost of deployment, which hinders the robotic adoption, especially in smaller companies.

There is a pressing shortage of skilled workers who can operate and maintain advanced robotic systems. As robots become more sophisticated, the demand for trained personnel has escalated. This gap in skilled labor has resulted in slow adoption rates, particularly in regions with limited access to specialized training programs.

Growing Demand for Articulated Robots in Emerging Markets

The demand for articulated robots is increasing in emerging markets, with China leading the charge due to its booming manufacturing sector. The country’s industrial automation efforts, supported by government initiatives and a strong focus on high-tech manufacturing, present a significant opportunity for articulated robot adoption.

The integration of robots into the production lines of electronics, automotive, and consumer goods industries, further strengthened by government incentives for innovation, positions China as a dominant market. This trend is exemplified by how companies like Hikrobot, a robotics division of Hikvision, have introduced advanced robotic solutions to help manufacturers in China improve productivity in industries like electronics assembly. The market is expected to grow rapidly in response to China's push for automation, especially within its industrial sectors.

Germany Leverages AI Integration with Articulated Robots to Bring Efficiency in Automotive and Industrial Sectors

Germany, known for its advanced automotive and industrial sectors, is capitalizing on the integration of artificial intelligence (AI) with articulated robots. The country’s commitment to Industry 4.0 and smart manufacturing systems offers vast opportunities for the adoption of AI-driven robotic solutions.

As Germany leads the European Union in automation adoption, industries are increasingly relying on robots for tasks like precision welding, material handling, and assembly. An indication of this trend can be seen with KUKA Robotics, which has implemented AI-based solutions for automotive giants such as BMW. This shift toward intelligent, and self-learning robot boosts operational efficiency while allowing more flexible and adaptive production lines.

The articulated robots market is highly competitive, with key players such as KUKA Robotics, ABB Ltd., Fanuc Corporation, and Yaskawa Electric Corporation leading the global scene. These companies provide diverse robotic solutions across industries like automotive, electronics, and logistics, leveraging technological advancements in AI, machine learning, and automation.

Strategic partnerships, acquisitions, and regional expansions have been key in securing their positions in the growing market. To drive growth, these players are focusing on expanding their product portfolios and strengthening technological capabilities. KUKA Robotics, for example, is significantly investing in automation solutions for the automotive sector, while ABB emphasizes AI integration to enhance robotic performance.

Fanuc and Yaskawa Electric are expanding their presence in Asia Pacific region to capitalize on the surge in industrial automation, positioning themselves for long-term growth. These strategies allow them to maintain leadership while addressing the rising demand for automation worldwide.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Payload

By Function

By Type

By End-use Industry

By Region

To know more about delivery timeline for this report Contact Sales

Yes, the market is set to reach US$ 16.1 Bn by 2031.

China is estimated to witness a high market share of around 38.8% of the overall global market in 2031.

FUNUC articulated robot is a leading player in the market.

The market is projected to hold a CAGR of 8% through 2031.

The automotive industry holds a significant market share of around 26.9% in the market.