Industry: IT and Telecommunication

Published Date: March-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 195

Report ID: PMRREP32970

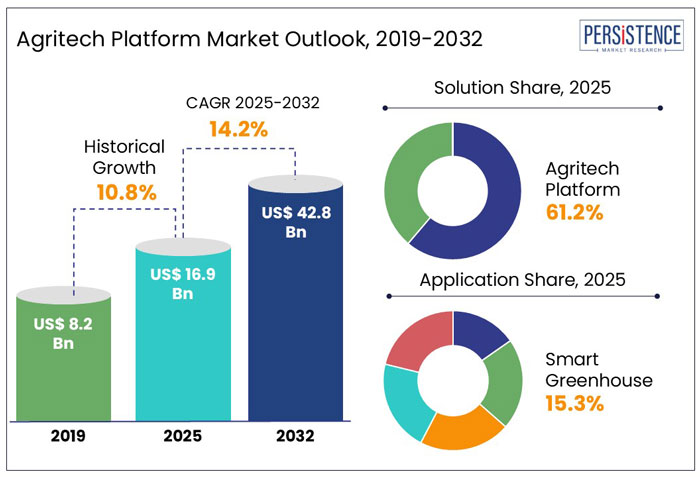

The global agritech platform market size is anticipated to reach a value of US$ 16.9 Bn in 2025 and is set to witness a CAGR of 14.2% from 2025 to 2032. The market will likely attain a value of US$ 42.8 Bn in 2032.

Think of a world where farmers use Artificial Intelligence (AI) to forecast weather patterns, IoT sensors to track soil health, and digital trading in crops to avoid middlemen. This is not a futuristic dream- it is happening now. Traditional agriculture is being redefined by platforms like America's Farmers Business Network (FBN), which uses big data to optimize yields, and India's DeHaat, which links over 1.5 million farmers with market access, input supply, and advisory services.

Agritech platforms are no longer considered an innovation, but a necessity to battle rising demand for food and surging climate challenges. They have the power to completely transform food security, sustainability, and financial prospects for farmers around the world by bridging the gap between technology and agriculture.

Key Highlights of the Agritech Platform Industry

|

Global Market Attributes |

Key Insights |

|

Agritech Platform Market Size (2025E) |

US$ 16.9 Bn |

|

Market Value Forecast (2032F) |

US$ 42.8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

14.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

10.8% |

From Drones to Livestock Monitoring Systems, Agritech Witnessed Innovations in Historical Period

As per Persistence Market Research, in the historical period from 2019 to 2024, the global agritech platform industry witnessed a considerable CAGR of around 10.8%. With blockchain, AI, and smart farming technologies changing how farmers make decisions and maximize yields, the 2020s have been a turning point in agritech. In addition to increasing efficiency, these developments strengthened agriculture's sustainability and resilience to the challenges of global food security and climate change.

To increase productivity and decrease manual labor, smart farming combined automation, robotics, and Internet of Things (IoT) sensors. For example, to maximize resource efficiency and reduce waste, John Deere's AI-powered tractors employed computer vision to precisely plant seeds, plow land, and explore fields on their own.

XAG, based in China, also created agricultural drones that accurately apply fertilizer and pesticides, significantly lowering the environmental impact and abuse of chemicals. To help farmers reduce calf mortality rates, Ireland-based Moocall further developed IoT-enabled sensors for livestock farms that track the health of cows and notify farmers when they are ready to give birth. Such innovations helped the global market to rise at a steady pace in the historical period.

Forecast Period to Showcase Developments in Machine Learning to Enhance Crop Health

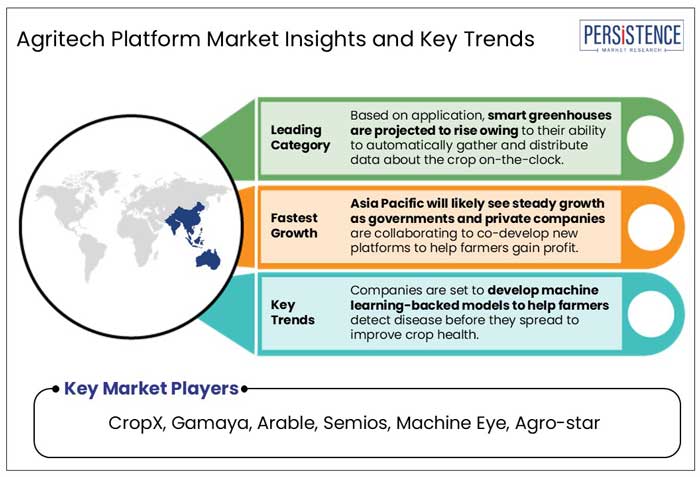

From 2025 to 2032, the agritech platform industry is likely to exhibit a CAGR of 14.2%. Machine Learning (ML) is anticipated to be a key element of agritech platforms in the foreseeable future. It will likely transform agriculture by offering precise recommendations and assessing vast amounts of farm data for farmers.

ML models may help detect diseases before they spread, recommend fertilizers, or predict suitable planning times, unlike conventional methods that involved trials and errors. Israel-based Taranis, for instance, utilizes ML-backed aerial imagery to detect individual pests on crops. It enables farmers to take focused action rather than indiscriminately applying pesticides.

This degree of accuracy can minimize environmental damage and cut costs by up to 30% when it comes to pesticide application. On the other hand, using predictive insights and intelligent crop monitoring, the agritech start-up CropIn in India has employed ML to assist farmers boost yields by 25%. The market is anticipated to witness several innovations in this field, thereby creating new opportunities for companies.

Growth Driver

Limitations in Traditional Farming to Meet High Food Demand Boosts Adoption of Agritech Platforms

Demand for food is skyrocketing worldwide, propelled by rapid population growth and changing dietary habits. By 2050, the United Nations predicts that there will be 9.7 Bn people on the planet, necessitating a 70% increase in food production to meet demand.

There are, however, several obstacles to traditional farming practices, such as a lack of arable land and water, deteriorating soil fertility, and changing weather patterns. Farmers find it challenging to increase production without adopting new technologies because of these obstacles.

To increase production, maximize resource use, and lower post-harvest wastage, agritech platforms are set to be essential. Farmers are producing more with fewer resources due to technologies like blockchain-driven supply chains, automated machinery, precision irrigation systems, and predictive analytics.

Connectivity Gaps and Fragmented Digital Infrastructure May Hinder Adoption

Strong internet connectivity, cloud computing, and efficient data sharing are essential for agritech platforms to function properly. However, several rural farmlands do not have these resources. For example,

According to an International Telecommunication Union (ITU) case study, the adoption of automated farm management platforms has declined in Southeast Asia due to a lack of 4G and 5G coverage. This compels farmers to make decisions manually rather than using data-driven insights. Without enhanced rural internet infrastructure, agritech platforms cannot attain their full potential.

AI and Big Data to Transform Credit Scoring for Farmers Without Traditional Financial Records

Farmers have historically come across significant obstacles in obtaining financing, especially smallholder farmers in underdeveloped countries who face exorbitant borrowing rates, a lack of collateral, and little financial knowledge. Because of supply chain fragmentation, weather dependence, and fluctuating commodity prices, traditional banks and financial institutions frequently view agricultural lending as high-risk. Agritech platforms may have a high chance to fill this funding gap and transform farmers' access to credit and financial services.

Due to the lack of official financial records, determining a farmer's creditworthiness is one of the most difficult tasks in agricultural financing. To develop alternative credit scoring models based on farm productivity, soil quality, historical yield records, and even mobile transaction histories, agritech platforms are utilizing AI and big data analytics.

Solution Insights

Increasing Demand for Direct Farm-to-market Connections Spurs Need for Agritech Platforms

By solution, the agritech platform segment is anticipated to hold a share of 61.2% in 2025. These platforms are projected to help address the issues of price manipulation by intermediaries and long supply chains that conventional agricultural markets often suffer from. The platforms can help ensure lower transaction costs and fair pricing by offering direct farm-to-market connections.

Agritech services, on the other hand, are set to exhibit a steady CAGR through 2032. These services cover various aspects- right from supply chain optimization and financial inclusion to digital advice platforms and precision farming. The gap between smallholder farmers and modern, efficient agriculture is reducing with the emergence of agritech services that combine digital technologies with conventional farming methods.

The development in Uttar Pradesh, India, where agriculture still constitutes the foundation of the state's economy, is one such example. About 92% of smallholder farmers in the state depend on horticulture crops as their main source of income, making them essential to the agricultural sector.

Smallholders confront obstacles such as restricted access to resources, market connections, and a low degree of technological knowledge, despite their substantial contribution to the state's development. The state government hence collaborated with the World Economic Forum and set up the Digital Agriculture Export Promotion Council (DAEP) in August 2023. The council promotes agritech services to smallholders and delivers guidance on agri-related issues.

Application Insights

Smart Greenhouses Gain Popularity as Demand for Exotic Produce Rises All through the Year

In terms of application, the smart greenhouse segment will likely hold an agritech platform market share of 15.3% in 2025. Consumers now expect exotic fruits and vegetables to be available all year round. This phenomenon became common only in the mid-20th century.

Smart greenhouses have a significant role to play in this development. Not long ago, produce during the winter season across supermarkets was limited. The availability of a wide range of fruits and vegetables today is possible because of smart greenhouses that help extend growing seasons and offer once seasonal produce to shelves throughout the year.

Due to novel sensor and communications technology, smart greenhouses automatically gather and disseminate data about the crop and the environment around-the-clock. An IoT platform uses analytical algorithms to turn gathered data into insights that may be used to identify abnormalities and bottlenecks.

It allows for the control of lighting, spraying, and irrigation activities as required. Continuous data monitoring also facilitates the development of predictive models to assess crop disease and infection risks.

Precision aquaculture, on the other hand, is anticipated to showcase considerable growth trajectory through 2032. Overfeeding, water pollution, and disease outbreaks are a few issues that the aquaculture sector faces.

The sector provides more than half of the seafood consumed worldwide. Real-time water quality monitoring, underwater drones, and automated feeding systems are few of the agritech solutions that can help address these problems.

Asia Pacific Agritech Platform Market

Research Collaborations across India and China to Strengthen their Agritech Ecosystem

Asia Pacific is projected to hold a share of 25.8% in 2025. Innovations in this field are set to rise in India, as nearly two-thirds of the country’s population depends on agriculture for their livelihood. The country is anticipated to see partnerships between government and educational institutions for the development of new platforms. For example,

China is projected to witness government-backed digital initiatives, emergence of precision farming technologies, and innovations in biotechnology in the foreseeable future. Leading agritech companies are forming strategic alliances to increase crop resilience and productivity as the country places a high priority on agricultural efficiency. For example,

Middle East and Africa Agritech Platform Market

Government Initiatives and Digital Solutions to Transform Agriculture in the Middle East and Africa

The Middle East and Africa is projected to experience strategic collaborations, investments, and innovations in the field of agritech platforms. In Egypt, agriculture is considered an important sector, contributing around 11.6% to the national GDP. However, climate change, conventional farming methods, and water scarcity are few of the main issues in the sector.

The Sustainable Agricultural Development Strategy 2030 is one of the measures the Egyptian government has taken to address these issues. In addition to providing prospects for the nascent agritech industry to transform the country’s agriculture, this initiative aims to foster growth and guarantee food security during the ensuing ten years.

In the United Arab Emirates (UAE), on the other hand, Emirates Integrated Telecommunications Company (du) collaborated with Gracia Group in May 2024 to introduce an agritech platform. The platform is a complete digital ecosystem designed to revolutionize the UAE's agriculture industry in accordance with the country’s growth strategy. By integrating digital excellence and novel technologies into farming practices, such strategies are likely to support the government’s aims to achieve sustainability and food security.

North America Agritech Platform Market

International Partnerships to Boost Precision Farming and Agritech Development in North America

In North America, the U.S. agritech platform market is projected to emerge as a key hub, leveraging new technologies to improve market connectivity and agricultural efficiency. Various agritech companies in the country are focusing on e-commerce integration, supply chain optimization, and precision farming.

The U.S. is at the forefront of agricultural digitization in North America due to its extensive agricultural landscape and investments in smart farming technologies. International partnerships have surged in this context.

Hot Farm, developed and funded by Hyperchain Capital, for instance, joined hands with a leading U.S.-based agritech company in November 2024 to come up with an integrated online-offline sales system. In this partnership, the agritech company will help Hot Farm in improving the planting process across its physical bases with its strong agricultural supply chain and management technologies.

The global market for agritech platforms is highly competitive, especially in Asia Pacific, where agriculture is considered a significant aspect of the economy. Several start-ups are coming up in the region with the launch of new solutions. They are also focusing on obtaining funds from renowned organizations to develop new products. A few other companies are striving to collaborate with government agencies to gain their support for the development of new technologies and solutions.

Key Industry Developments

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Solution

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The market is set to reach US$ 16.9 Bn in 2025.

The industry will likely be valued at US$ 42.8 Bn in 2032.

The industry is set to surge at a CAGR of 14.2% through 2032.

CropX, Gamaya, Arable, and Semios are a few leading providers.

India is projected to witness a CAGR of 19.2% from 2025 to 2032.