Industry: Healthcare

Published Date: January-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 192

Report ID: PMRREP2983

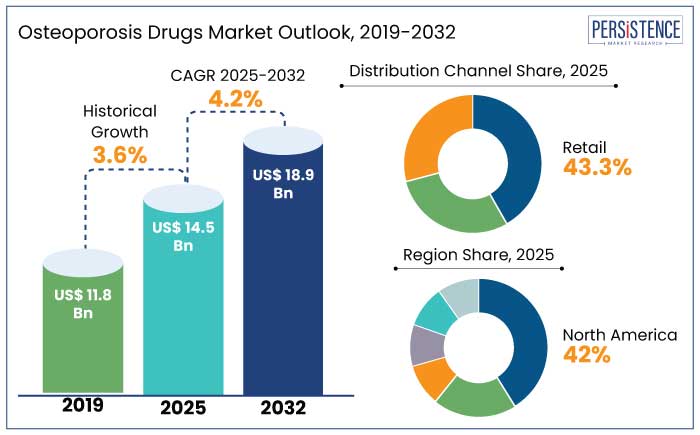

The global osteoporosis drugs market is predicted to reach a value of US$ 14.5 Bn by 2025. The market anticipated to experience a CAGR of 4.2% during the assessment period to reach a value of US$ 18.9 Bn by 2032. Growth in the industry was fueled by enhanced awareness campaigns, advancements in bone density diagnostic technologies, and routine osteoporosis screenings are increasing diagnosis rates.

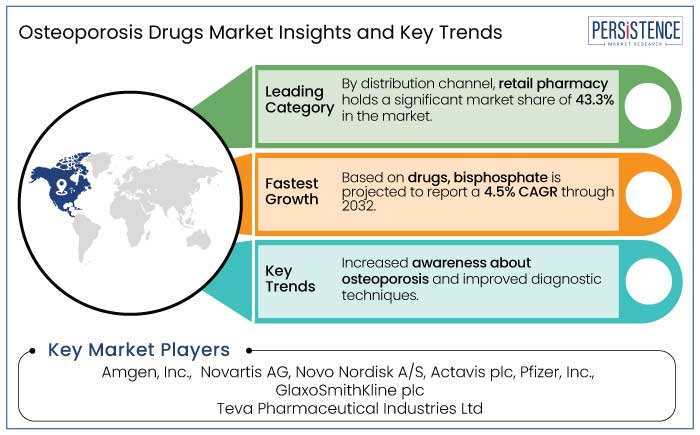

Retail pharmacies are expected to maintain a dominant market share of 43.3% in 2025, owing to their convenience and strong trust among patients. RANK inhibitors, such as denosumab, are gaining traction due to their strong efficacy in reducing fracture risks. The recent FDA approval of biosimilars like Jubbonti and Wyost signals an increase in accessibility and competition, which could drive down costs.

Key Highlights of the Industry

|

Market Attributes |

Key Insights |

|

Osteoporosis Drugs Market Size (2025E) |

US$ 14.5 Bn |

|

Projected Market Value (2032F) |

US$ 18.9 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

4.2% |

|

Historical Market Growth Rate (CAGR 2025 to 2032) |

3.6% |

North America is expected to hold the largest share of the osteoporosis drugs market, accounting for approximately 42%. This is driven by the aging population, high healthcare spending, and advanced healthcare infrastructure in the U.S. and Canada, along with widespread awareness and high adoption rates of osteoporosis treatments.

Europe follows with a 25-30% market share, while emerging regions like Asia Pacific and Latin America are growing steadily, contributing 15-20% and 5-10% of the market, respectively, due to improving healthcare access and rising awareness. The Middle East and Africa have a smaller share, around 5-7%, as their healthcare systems continue to develop.

Retail pharmacies currently hold the highest market share around 43.3% in the osteoporosis drugs market. This is primarily due to their widespread accessibility and convenience for patients, as most individuals with osteoporosis seek treatment through local pharmacies for quick access to medications.

Retail pharmacies often offer a broad range of osteoporosis drugs, including over-the-counter supplements and prescription medications, making them a preferred distribution channel. Hospital pharmacies are also significant but are typically limited to inpatient or specialized care, while online sales are growing but still face challenges in terms of patient education, prescription verification, and regulatory hurdles.

The osteoporosis drugs market has witnessed significant growth due to rising awareness about bone health, an aging global population, and advancements in treatment options. The market is currently dominated by bisphosphonates, monoclonal antibodies, and anabolic agents, with biologic therapies like denosumab and romosozumab.

Key trends include a shift toward more targeted therapies, the development of combination treatments, and the rise of biosimilars, which are driving down costs and increasing accessibility. Additionally, emerging markets in regions like Asia Pacific and Latin America are becoming key growth areas as healthcare infrastructure improves and disposable incomes rise.

The osteoporosis drugs market has experienced steady growth over the past few decades, driven by advancements in treatments such as bisphosphonates, selective estrogen receptor modulators (SERMs), and biologic therapies like denosumab and romosozumab. These innovations have significantly improved the management of osteoporosis and fracture prevention.

The market is expected to continue growing, fueled by increasing global awareness, an aging population, and expanding healthcare access in emerging economies. Future growth will likely be shaped by the development of new biologics, combination therapies, and more affordable treatments, as well as a focus on reducing side effects and improving patient adherence.

Demographic Shifts and Disease Burden Fuel Demand

The global aging population is a key driver of the osteoporosis drugs market, as the prevalence of osteoporosis increases significantly with age.

According to the United Nations' World Population Prospects 2019, the proportion of individuals over 65 years old is expected to reach 16% by 2050, with the number of osteoporosis patients projected to rise to 221 million. This demographic shift has amplified the demand for effective treatments, particularly for older adults at high risk of fractures and reduced quality of life.

The rising prevalence of osteoporosis and low bone mass among both women and men further underscores the need for pharmacological interventions.

Studies show that 10%-17% of postmenopausal women and 3%-5% of men in the United States have osteoporosis, with an even greater percentage experiencing low bone mass. This growing disease burden highlights the importance of early diagnosis and treatment to manage osteoporosis and prevent its progression, thereby driving the market for osteoporosis drugs.

Cost-Effectiveness of Osteoporosis Drugs in Reducing Fracture Expenses

The high cost of treating fractures, particularly hip fractures, is a significant driver for the osteoporosis drugs market. Hip fractures alone can cost between $35,000 and $50,000 in the first year, covering expenses such as hospitalization, surgery, and follow-up care, with additional long-term costs for rehabilitation and loss of independence.

In comparison, osteoporosis medications provide a cost-effective solution by significantly reducing the risk of fractures, with some treatments lowering the risk of hip fractures by up to 38%.

While lifestyle changes, such as a diet rich in calcium and vitamin D, regular weight-bearing exercise, and avoiding smoking and excessive alcohol, can improve bone health, they may not be sufficient for high-risk individuals, further emphasizing the need for pharmacological interventions.

Managing the Safety Challenges of Long-Term Osteoporosis Drug Use

The long-term use of osteoporosis drugs, particularly bisphosphonates, poses significant challenges due to potential adverse effects, which act as a restraint for the osteoporosis drugs market. Gastrointestinal issues, such as oesophageal irritation, heartburn, and acid reflux, are common side effects of oral bisphosphonates.

Serious complications include jaw osteonecrosis, a rare but severe condition where the jawbone fails to heal after minor trauma, typically associated with high doses of bisphosphonates used in cancer treatments. Additionally, prolonged use of these drugs has been linked to atypical femoral fractures unusual fractures of the thigh bone that can occur with little to no trauma.

Patients may experience persistent thigh or groin pain as an early warning sign of such fractures. These risks underline the importance of regular monitoring and careful patient management, but they also limit the long-term acceptability and adherence to osteoporosis drug therapies, restraining market growth.

Cutting-Edge Therapies Open New Avenues

Increased research and development for novel therapies presents a significant opportunity in the osteoporosis drugs market. Pharmaceutical companies are focusing on the development of advanced biologics, combination therapies, and drugs with fewer side effects to address the limitations of existing treatments. For example,

Rising Incomes and Healthcare Access Increase Sales in Emerging Markets

The expanding market in emerging economies presents a significant opportunity for the osteoporosis drugs market. Regions such as Asia Pacific and Latin America are experiencing rapid growth due to improving healthcare infrastructure, rising awareness of bone health, and increasing disposable incomes.

As more individuals in these regions gain access to quality healthcare and osteoporosis treatments, the demand for effective therapies is rising. Additionally, growing awareness campaigns about osteoporosis prevention and the importance of early diagnosis are further driving market growth. With a large, aging population and the increasing prevalence of osteoporosis, these regions offer immense potential for pharmaceutical companies to tap into a largely underserved market.

The osteoporosis drugs market is highly competitive, with leading players like Novartis, Amgen, Sanofi, and Merck & Co. leading the way with treatments such as bisphosphonates, biologics, and anabolic agents. Emerging biotech firms are focusing on innovative therapies, including biologics targeting sclerostin and new anabolic agents. The rise of biosimilars and generics is intensifying price competition, particularly in developed markets.

Emerging economies in Asia Pacific and Latin America are becoming key growth areas, driven by improving healthcare infrastructure and rising incomes. Despite challenges such as long-term side effects and patient adherence issues, the market presents significant opportunities for companies with innovative therapies and affordable solutions. Strategic partnerships and market expansion into underserved regions are crucial for staying competitive.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Drug

By Distributional Channel

Region

To know more about delivery timeline for this report Contact Sales

The market is anticipated to be valued at US$14.5 Bn in 2025.

The top manufacturers are located in the United States, Germany, Switzerland, India, and Japan.

Bisphosphonates currently hold the largest market share due to their affordability and efficacy, but biologics are rapidly gaining traction.

Key players include Amgen Inc., Novartis AG, Eli Lilly and Company, Pfizer Inc., and F. Hoffmann-La Roche Ltd.

The market is anticipated to witness a CAGR of 4.2% through the forecast period.