Industry: Automotive & Transportation

Published Date: October-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 179

Report ID: PMRREP3552

The forklift trucks market is estimated to increase from US$ 61.9 Bn in 2024 to US$ 103.6 Bn by 2031. The market is projected to record a CAGR of 7.6% during the period from 2024 to 2031.

The industry is growing due to factors such as the e-commerce sector, government initiatives, and sales programs. With increasing disposable income, convenience, and impulsive shopping habits, demand for compact trucks is increasing. As industrialization and manufacturing processes become complex, forklifts are essential for efficient material handling and logistics.

Companies are also introducing programs to promote industry sales. For example, the Volkswagen Environmental Mitigation Trust program offers significant funding for electric forklifts, providing up to $175,000 per forklift for units with a lift capacity of 8,000 lbs or greater. This funding is available to applicants across California, regardless of the sector they operate in.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Forklift Trucks Market Size (2024E) |

US$ 61.9 Bn |

|

Projected Market Value (2031F) |

US$ 103.6 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

7.6% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5.8% |

|

Region |

Market Share in 2024 |

|

Asia Pacific |

56.3% |

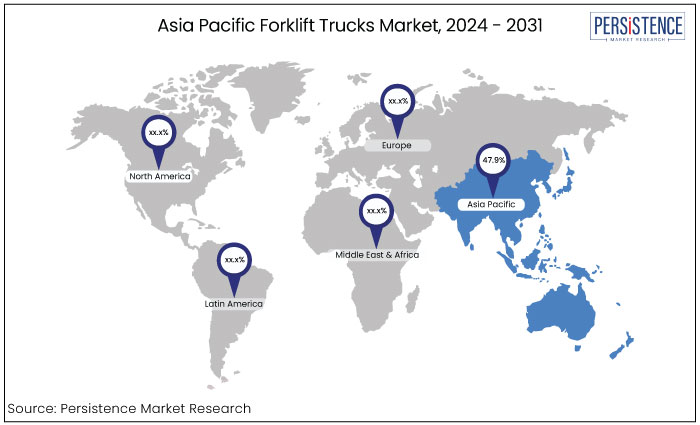

Asia Pacific is predicted to lead the market in 2024 holding a 56.3% share. This area is home to significant forklift manufacturers like Doosan Corporation and Hangcha Forklift, which drive technological advancements and enhance industry competition. As these companies develop advanced electric forklift models with improved performance, end-use industries are upgrading their fleets to stay competitive and efficient.

China stands out as a lucrative market with a diverse range of manufacturers, projected to expand at a CAGR of 8.8% during the forecast period. Additionally, partnerships among governments, manufacturers, and businesses are expected to foster further growth and adoption of forklifts in Asia.

The forklift market in Europe is anticipated to experience substantial growth during the forecast period. This surge is driven by a growing demand for sustainable supply chain solutions, heightened awareness of climate change, and an emphasis on eco-friendly practices.

The idea of a sustainable supply chain has gained significant traction across Europe, as many companies strive to reduce their carbon footprints and implement green practices throughout their operations. As businesses increasingly prioritize sustainability, the forklift industry is likely to benefit greatly from these shifts positioning itself for a promising future.

|

Category |

Market Share in 2024 |

|

Product Type - Counterbalance Forklift Trucks |

52.2% |

The counterbalance forklift trucks category currently leads the market, accounting for around 52.2% of the market share in 2024. When compared to warehouse forklifts, counterbalanced trucks are often seen as convenient and effective especially for handling heavy loads.

Trucks feature a weight at the back that helps balance the load on the forks, enhancing stability and ensuring driver safety. With these advantages, counterbalanced forklifts are expected to remain a highly profitable choice in the market catering to the growing demand for efficient material handling solutions.

|

Category |

CAGR through 2031 |

|

Technology - Electric Motor Forklift Trucks |

8.2% |

Electric motor forklift trucks are set to dominate the market during the forecast period, accumulating 62.8% of the market value in 2024. These electric forklifts are expected to expand at significant rate with a projected CAGR of 8.2%. One significant advantage of electric forklifts over their gasoline counterparts is their superior battery life offering extended usage and versatility.

Electric forklifts are environment-friendly as they produce no harmful emissions. They also operate quietly with warning horns and standby signals that are usually more audible than those of internal combustion engine forklifts, enhancing overall safety in the workplace.

Forklifts are robust electric lift vehicles that play a crucial role in various workplaces, particularly in warehouses and dockyards. They are designed to move and lift heavy items, such as containers and crates, over short distances. These vehicles are essential for tasks like loading and unloading freight from trucks and efficiently managing inventory within storage areas. As both government and private sector investments in this area increase, we can expect a promising growth trajectory for electric forklifts.

Market growth is partly driven by the expanding e-commerce sector, which has heightened the demand for efficient warehousing and distribution solutions. Government initiatives, like funding for green technology and emissions reduction also play a crucial role in this transition. For instance, the U.S. Department of Energy has supported various projects aimed at improving electric vehicle technology, which includes advancements in electric forklift systems.

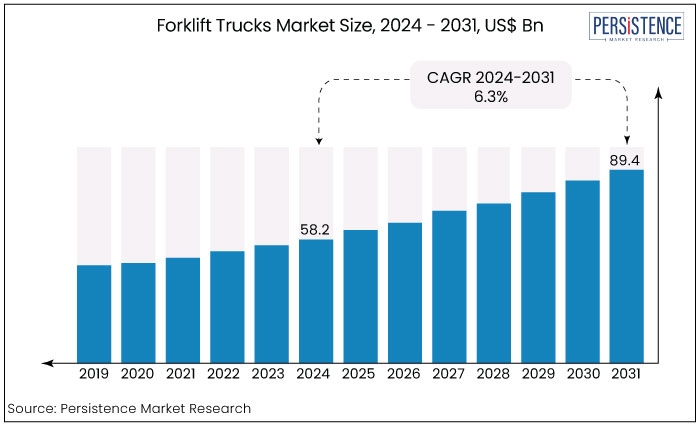

From 2019 to 2023, the forklift truck market expanded at a CAGR of 5.8%. This increase is mainly driven by the steady growth of the global e-commerce market. As customer demand rises, the need for warehouse space has also increased particularly for storing items before they are shipped in bulk to retail outlets.

Businesses are implementing various distribution methods and advanced warehouse technologies to ensure products are delivered safely and efficiently. Consequently, the growth of the market is closely tied to developments in the e-commerce sector. The sector is expected to showcase a CAGR of 6.3% from 2023 to 2031.

Surge in E-commerce Remains a Primary Driving Factor

The growing disposable income, convenient delivery options, impulsive shopping habits, and declining product costs are all driving a surge in demand for material handling solutions. With the rise of e-commerce and increased online shopping, there's been a noticeable uptick in the number of individual item orders processed in warehouses.

For example, the Census Bureau of the Department of Commerce has projected that total e-commerce sales in the U.S. for 2023 will reach around $1.12 trillion, reflecting a 7.6% year-on-year growth. As sales volumes increase, warehouse aisles are becoming narrower, leading to a heightened demand for compact forklift trucks.

Forklifts that can quickly pick up and unload items are essential for effectively managing inventory in warehouses. To keep up with customer delivery expectations, many warehouses have even implemented third shifts to ensure timely dispatch of orders.

Growing Industrial Sectors

As industrial sectors grow and manufacturing processes become complex, the demand for efficient material handling and logistics in factories and warehouses is increasing. Forklifts are essential in these settings, enabling the swift and precise movement of raw materials, components, and finished products.

Their versatility allows forklifts to adapt to various industrial environments, enhancing supply chain processes and boosting productivity. In manufacturing plants, they play a vital role by handling heavy loads and ensuring smooth operations on production lines. Forklifts facilitate the timely and accurate transportation of materials, minimizing downtime and supporting a continuous workflow.

Challenges in Forklift Operations

Forklift trucks can struggle to perform effectively in high-demand or damp environments, which poses a challenge for market growth. In multi-shift operations, maintaining and charging batteries can be difficult. Additionally, the initial investment for these trucks is considerable, and the existing electrical supply must meet the voltage requirements for battery chargers.

Safety measures like proper flooring and eyewash stations add to the costs. Internal combustion engine forklifts may not be suitable for indoor use without costly emission controls and adequate ventilation. Also, storing gasoline may require a bulk tank, subject to regional regulations. Fuel prices are expected to rise in the coming years.

Strict Regulations Remains a Key Barrier

The logistics and transport industries are significant contributors to carbon emissions, largely due to the reliance on conventional engines in industrial trucks and construction equipment. In response, various government agencies have implemented regulations aimed at lowering carbon footprints across regions.

Manufacturers are also adjusting their product shipments to adhere to updated standards and policies. For example, in March 2023, Toyota Industries Corporation announced it would suspend two diesel forklift models and one gasoline forklift model. Additionally, buyers and rental agencies are aligning with new regulations designed to reduce emissions and improve air quality standards.

Expansion of Manufacturing Industry

Forklifts are vital in manufacturing plants, where they handle heavy loads and ensure smooth operations along production lines. They facilitate the timely and precise movement of materials between different stages of the manufacturing process minimizing downtime and promoting a continuous workflow.

With an increasing emphasis on precision and efficiency across various industries, the forklift market is expected to grow significantly. They are especially crucial in sectors like automotive, aerospace, and electronics, where accuracy is paramount. By integrating forklifts into their operations, manufacturers can boost agility and scale production effectively to meet rising market demands.

Advancements in Lithium-ion Batteries

Advancements in lithium-ion batteries are creating significant market opportunities thanks to their high energy capacity, electrical efficiency, and enhanced operator safety, all of which lower the overall cost of ownership for customers. There is a growing demand for on-board charging systems in warehouses and rental fleets as these systems help improve operational efficiency.

The rising need for productivity combined with a shortage of skilled labor is driving the development of Automated Guided Vehicles (AGVs) and battery-powered forklifts. Companies are focusing on various battery charging solutions, like on-board, off-board, and hybrid options, to boost efficiency. However, many manufacturers are offering in-house charging solutions that provide cost-effective options, further propelling growth in the forklift market.

The forklift trucks market is experiencing impressive growth, highlighting its vibrant and evolving nature. To take advantage of this promising trend, companies in the industry are rolling out innovative products and utilizing cutting-edge technologies to create new opportunities.

Key players are implementing essential strategies, such as diversifying their product offerings, expanding their reach into different regions, and investing in research and development. By focusing on these initiatives, businesses aim to remain competitive, adapt to changing consumer needs, and propel further growth. This proactive approach is shaping a dynamic future for the market.

Recent Developments in the Forklift Trucks Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Product Type

By End Use

By Class

By Technology

By Region

To know more about delivery timeline for this report Contact Sales

The market is predicted to rise from US$ 61.9 Bn in 2024 to US$ 103.6 Bn by 2031.

Some of the leading manufacturers in the market are Toyota Material Handling, Kion AG, Hyster-Yale, Inc, Crown Equipment Corporation, Jungheinrich AG

Electric motor forklift trucks are expected to dominate the global market, representing an estimated 8.2% CAGR in the market.

Asia Pacific is predicted to lead the market in 2024 with a 56.3% share.

Industry 4.0 technology like IoT & AI in forklifts & the shift to electric models for sustainability are driving growth in the global forklift market.