Industry: Chemicals and Materials

Published Date: December-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 192

Report ID: PMRREP3582

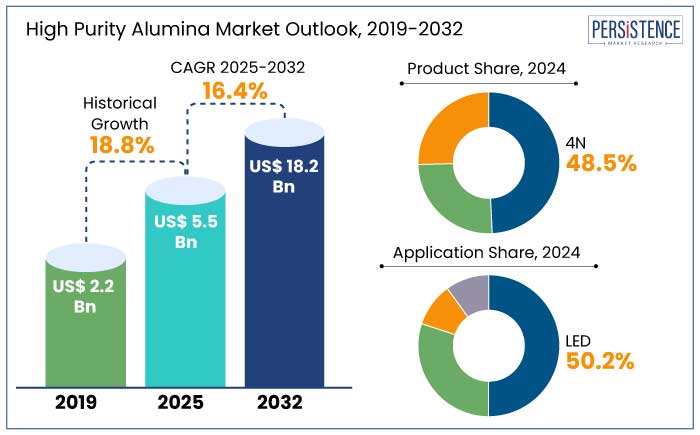

The global high purity alumina market is estimated to be valued at US$ 5.5 Bn by 2025. It is anticipated to experience a remarkable CAGR of 16.4% during the forecast period to reach a value of US$ 18.2 Bn by 2032. The global transition toward energy-efficient lighting is estimated to foster growth in the industry.

As government authorities across the globe invest in the semiconductor sector to boost innovations in 5G chips, AI processors and quantum computing, the demand for High Purity Alumina (HPA) and other high-quality materials is likely to continue rising. The CHIPS and Science Act of 2022 in the U.S. are estimated to continue boosting the semiconductor manufacturing and research in the country.

Innovations in high-purity grades is expected to continue to drive demand, especially in semiconductors and sapphire glass owing to rising investments in research and development activities. The chemicals’ role in renewable energy and energy storage systems is predicted to augment its expansion as it aligns with the global efforts to transition to low-carbon energy solutions.

Key Highlights of the Industry

|

Market Attributes |

Key Insights |

|

High Purity Alumina Market Size (2025E) |

US$ 5.5 Bn |

|

Projected Market Value (2032F) |

US$ 18.2 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

16.4% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

18.8% |

Asia Pacific high purity alumina market is estimated to hold a share of 73.5% in 2024. The region dominates the global LED market, accounting for 60% of the global LED production. The LED industry in China alone contribute substantially to HPA consumption, fueled by government policies promoting energy-efficient technologies. Asia Pacific leads the EV production, especially in China, accounting for 55% of global EV sales in 2022.

HPA is vital for lithium-ion battery separators, which is a prominent component in EV batteries. Japan and South Korea are the leading players in EV battery technology, thereby boosting the regional demand for the chemical. The region is home to the leading semiconductor manufacturers including Samsung in South Korea and TSMC in Taiwan. HPA’s use in semiconductor wafer production aligns with the region’s dominance in this sector.

Hydrolysis is emerging as the leading technology and is estimated to witness a robust CAGR of 15.2% through the forecast period. Hydrolysis process involves the reaction of aluminium alkoxides with water, thereby producing alumina with exceptional purity level of 4N to 6N. This technology ensures high yield with minimal impurities, thereby making it suitable for applications in LEDs, lithium-ion batteries, and semiconductors where ultra-pure materials are essential.

Manufacturers that have adopted hydrolysis have reported 10% to 15% reductions in production costs owing to its simplicity and operational efficiency. This process generates fewer emissions and does not produce significant quantities of toxic by-products. This aligns with the increasing regulatory pressure and corporate sustainability goals.

4N is estimated to hold a share of 48.5% in 2024 owing to its broad applicability, cost-effectiveness, and alignment with the needs of rapidly growing industries. The majority of HPA used in LED substrates and phosphor applications is 4N grade owing to its sufficient purity for improving brightness and durability at lower cost compared to high purity grades.

Compared to higher-purity grades, 4N, HPA offers a balance of performance and cost, thereby making it a preferred choice for large-scale industrial applications. Manufacturers are therefore increasing their focus on 4N production to cater to the rising demand without increasing production costs and enabling broader adoption in price sensitive markets.

LED segment is predicted to lead the market with a share of 50.2% in 2024. LEDs are replacing traditional incandescent and fluorescent lighting owing to their superior energy efficiency, longer lifespan, and lower operational costs. This transition has created a significant demand for HPA, as it is highly used in sapphire substrates for LED manufacturing.

The 4N grade HPA is particularly essential for producing high-quality sapphire substrates that improve the brightness and durability of LEDs. Government authorities across the globe are mandating energy-efficient lighting to decrease carbon footprints. The European Union’s ban on halogen bulbs in 2018 boosted the adoption of LED.

LEDs are now being used beyond traditional lighting, including automotive lightings, smart city infrastructure and display panels. This expansion in applications further increases reliance on HPA for sapphire substrates.

Potential growth in the global high purity alumina market is predicted to be driven by continuous innovations in production methods including hydrochloric acid leaching and hydrolysis of aluminum alkoxides. Consequently, decreasing production costs and environmental impact.

The chemical is estimated to undergo expansion in green technologies and energy storage solutions, further driving demand. HPA is expected to find increasing use in battery separators owing to the booming EV market.

Acceleration in EV adoption across the globe is expected to make HPA essential to improve battery safety and performance. By 2032, the LED segment is predicted to account for a significant portion of the market owing to robust support from government policies promoting energy-efficient lighting.

The high purity alumina market experienced a CAGR of 18.8% during the period from 2019 to 2023. LEDs witnessed a surge in demand for HPA going to the energy efficiency initiatives across the globe.

The chemical is a critical component in LED manufacturing owing to its optical clarity and thermal resistance. The application of the chemical in semiconductor wafers witnessed an increase with advancements in technology and the expansion of 5G infrastructure.

HPA was also progressively adopted in lithium-ion batteries, especially in electric vehicles, thereby bolstering demand. The COVID-19 pandemic brought temporary disruptions in the HPA market owing to supply chain interruptions and decreased industrial activities. The market, however, witnessed a rebound as lockdown restrictions eased an industries adapted to post-pandemic operations.

Development of Energy Storage Systems

HPA is used in advanced energy storage systems, especially in lithium-ion (Li-ion) batteries. It is used in separators to enhance battery performance by improving thermal stability and decreasing risks of thermal runaway. Energy storage technologies are crucial in supporting renewable energy integration and electric vehicles (EVs), thereby increasing the demand for HPA.

The global shift toward renewable energy sources create a need for grid-scale energy storage systems that can store excess power when supply exceeds demand. HPA is used in energy storage systems that play a critical role in stabilizing the grid by storing energy for later use.

As the EV market continuous to evolve, so will the need for large-scale battery storage systems, including those used in charging infrastructure. Advancements in solid-state batteries (SSBs) and other next-generation energy storage technologies are opening new applications for HPA.

Growing Semiconductor Industry Remains a Primary Driver

Sapphire substrates are essential in the semiconductor industry as they are primarily used for creating high-performance substrates for LEDs and other optoelectronic devices. HPA is crucial in the production of these sapphire substrates because it is processed in ultra-pure alumina, which is then used to produce superior-quality sapphire crystals.

Semiconductors are the backbone of all modern electronics, including smartphones, computers, automotive systems, and consumer electronics. Increase in demand for semiconductors is likely to further increase the need for high-purity alumina used in the production of various electronic components.

HPA is also highly used in semiconductor packaging. As packaging technology becomes advanced and vital to ensure the functionality of high-performance chips, the demand for high-purity alumina is likely to increase as a key material in thermal management.

Technological Barriers Impose a Key Barrier

Achieving HPA purity levels of 99.99% (4N) and 99.999% (5N) involves highly controlled processes including Bayer process. These methods usually require precision at every stage to avoid contamination. Producing HPA requires significant energy inputs.

The calcination step, for instance, operates at high temperatures, thereby consuming significant energy resources. Energy expenses can represent 20% to 30% of the total production cost for HPA manufacturers. Smaller producers may struggle to implement or sustain such energy-intensive without substantial capital investment, thereby limiting their ability to compete.

Upgrading production facilities to meet high purity standards or enhance yield efficiency requires significant investment in advanced machinery and automation technologies. Several manufacturers are slow to adopt new technologies like plasma processing or energy-efficient calcination methods owing to their high initial investment costs. Without innovations in technology, production costs remain high, thereby decreasing competitiveness in price-sensitive markets.

Innovation in Production and Supply Chain

Companies in the industry are investing in sustainable and efficient production processes like ChemX Materials’ HiPurA technology. This is a scalable and modular process that eliminated the requirement for conventional mining, thereby decreasing energy consumption and environmental impact that is traditionally associated with HPA production.

The HiPurA method enables the production of ultra-high purity alumina while maintaining a lower carbon footprint. Several companies are focused on building production facilities that are close to their end markets.

Companies are adopting decentralize and modular production systems to reduce their dependency on large mining operations and ensuring a resilient supply chain. Flexibility of these systems enable for production scale-up and customization based on specific requirements of end users like EV battery manufacturers, thereby strengthening market positioning.

Expansion in Advanced Ceramic Market

High purity alumina is a vital material for the production of advanced ceramics, especially for components in high-temperature and high-stress environments. HPA-based ceramics are progressively used in aerospace sector for engine parts, sensors, and other critical components that require superior thermal resistance and strength. The medical field has demand for HPA in joint applications, dental implants, and bio-ceramic materials owing to their biocompatibility and wear resistance.

Use of advanced ceramics market in electronics like substrates for integrated circuits, insulators for electronic components, and capacitors is estimated to witness growth. This growth is owing to the need for high performance and miniaturized devices. Production of sapphire substrates for LED and semiconductor applications are a few other key areas where HPA-based ceramics are witnessing expansion.

Companies in the high purity alumina market are investing in new and efficient methods for producing high purity alumina, enabling them to enhance product quality and decrease production costs. They are progressively adopting automated systems, AI, and digital technologies to monitor and control production processes, thereby improving productivity, decreasing waste, and ensuring consistent product quality.

HPA companies usually offer a wide range of alumina products with varying levels of purity to cater to different industries. They are also working toward offering specialized grades of HPA for niche markets or emerging applications to gain a competitive edge.

Several HPA producers are focusing on integrating upstream or downstream processes like securing their own alumina feedstock or collaborating with companies in the LED and battery sectors to ensure stable demand for HPA. Businesses are also partnering with universities or research organizations to accelerate the development of new technologies and processes, thereby assisting them to stay ahead in terms of innovation.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Application

By Technology

By Region

To know more about delivery timeline for this report Contact Sales

The market is anticipated to reach a value of US$ 18.2 Bn by 2032.

Increase use of LED for residential and commercial lighting along with rising applications in the electronics industry are key factors attributing growth.

Asia Pacific is estimated to emerge as the leading region with a share of 73.5% in 2024.

Sumitomo Chemical Co., Ltd., Sasol Ltd., and Baikowski are the prominent companies in the industry.

The market is predicted to witness a CAGR of 16.4% through the projection period.