Industry: Chemicals and Materials

Published Date: January-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 187

Report ID: PMRREP32544

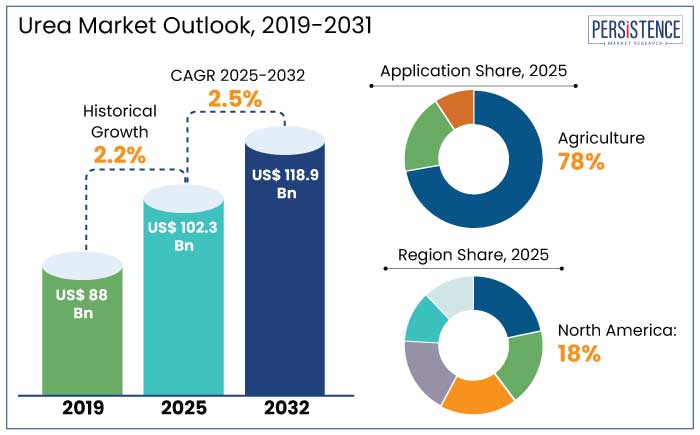

The global urea market is estimated to reach a size of US$ 102.3 Bn in 2025. It is predicted to rise at a CAGR of 2.5% through the assessment period to attain a value of US$ 118.9 Bn by 2032.

Urea, a crucial nitrogen source, is set to witness significant growth in the global urea market due to its significant role in enhancing crop yield and soil fertility. A vital component of agriculture, urine is rising due to its growing use in Asia Pacific, where nations like China, India, and Indonesia account for most of the consumption.

Significant economies including the U.S., China, and India have resumed industrial activities in 2024, marking the industry's recovery from the global epidemic. The agriculture and animal feed industries have shown resilience in the face of trade difficulties, assuring a consistent need for fertilizers based on nitrogen.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Urea Market Size (2025E) |

US$ 102.3 Bn |

|

Projected Market Value (2032F) |

US$ 118.9 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

2.5% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

2.2% |

The urea industry in North America, which is set to hold 18% of the global market share in 2025, is rising steadily due to high demand from the industrial and agricultural sectors. Nitrogenous fertilizers, crucial for crop yield enhancement and global food export, are gaining popularity due to their industrial applications in resins and adhesives, bolstering urea demand. For instance,

Adoption of eco-friendly farming practices and government subsidies are set to sustain growth. The urea industry in North America is predicted to record a CAGR of 3.8% from 2025 to 2032, driven by technological developments and sustainable agriculture initiatives.

Asia Pacific is anticipated to dominate the global urea market with a 65% share in 2025, driven by the agricultural sector's demand for urea-based fertilizers to boost crop yields. Countries like China, India, Indonesia, Japan, and South Korea dominate the worldwide urea industry. The rising population of Asia Pacific is driving the need for food, which, in turn, is spurring demand for fertilizers and feed-grade materials.

The regional automobile industry is utilizing urea-based Selective Catalytic Reduction (SCR) systems to decrease vehicle emissions and aid in carbamide production. The market is predicted to generate a CAGR of 4.5% from 2025 to 2032, fueled by ongoing investments in sustainable agriculture, unique farming technologies, and emission control solutions. Asia Pacific is changing due to China's carbon neutrality target and India's agrochemical modernization initiatives.

In 2025, the fertilizer-grade urea segment is estimated to dominate the global market, accounting for 72% of share, driven by growing demand in developing countries from Africa and Asia. As the global population is set to reach 9.7 billion by 2050, countries in these regions are prioritizing the use of high-yield fertilizers to boost agricultural productivity.

Fertilizer-grade urea is particularly valued for its high nitrogen content, making it essential for key crops such as wheat, maize, and rice. For example,

In 2025, agricultural applications are predicted to hold 78% of the global urea market share, demonstrating its crucial role in meeting the increasing demand for food and animal feed. Urea, a nitrogen-rich fertilizer, is utilized to boost crop yields and supplement cow feed in developing countries, especially in India and China, leading to global agricultural output. The agriculture sector’s reliance on urea is driven by its affordability and efficiency in providing essential nutrients to crops like rice, wheat, and maize. For example,

Growing population and rising food demands in emerging countries are driving the agricultural sector's development, which is further pushing demand for urea. For example,

Industrial applications in plastics, resins, and adhesive manufacturing continue to fuel demand. Adoption of urea-based solutions is being promoted through sustainable agriculture practices, precision farming techniques, government subsidies, and unique agricultural technologies.

Environmental regulations are influencing investments in urea production capacities in leading urea-producing regions like the Middle East and China to achieve sustainable goals. The loss of arable land due to urbanization makes it necessary to use fertilizers efficiently to increase agricultural yields, which is why slow-release and bio-based urea formulations are becoming more popular. In 2024, demand for bio-urea formulations surged due to rising need for eco-friendly alternatives to conventional urea products.

The global urea powder market recorded a CAGR of 2.2% in the historical period from 2019 to 2024. Global economic recovery has been hindered by the Russia-Ukraine war because of supply chain interruptions, increased commodity prices, and economic sanctions. Nonetheless, certain regions are experiencing development because of government programs like fertilizer purchase incentives by the Government of India.

Global consumption of urea-based products is predicted to increase, with almost one-fourth of the surge occurring in South Asia. The industry has been affected by supply chain interruptions, economic sanctions, and rising commodity prices. But in the years that followed, the war had an effect on markets all around the world. Demand for urea powder is estimated to record a considerable CAGR of 2.5% during the forecast period between 2025 and 2032.

Increasing Food Demand Drives Fertilizer Consumption in Developing Economies

According to projections, there will be 9.7 billion people on the planet by 2050, which would lead to a rise in fertilizer use in emerging agricultural nations. In urbanized areas, fertilizers, especially nitrogen-based ones like urea, are essential for soil fertility and agricultural production.

As seen by the African Development Bank's investment in fertilizer manufacturing facilities and India's increased urea subsidy scheme, governments are providing more assistance for agricultural inputs. By encouraging sustainable agricultural methods, these initiatives seek to close the gap between the supply and demand for food.

Implementation of Urea-based Adblue/DEF Solutions to Reduce Vehicle Emissions

The global adoption of AdBlue/diesel exhaust fluid (DEF) solutions, based on urea, is increasing due to strict emission regulations in the commercial transportation sector. AdBlue, a urea-water solution, is critical in selective catalytic reduction (SCR) systems for reducing nitrogen oxide (NOx) emissions, helping diesel vehicles meet emission standards.

Key markets like North America and Europe are leading adoption, supported by increasing DEF infrastructure. For example,

Acceptance of Organic Farming May Hamper Production

Globally, the price of urea, petroleum, and natural gas is rising, which affects import-dependent nations like Brazil, Australia, Japan, and India. The primary fertilizer used in agriculture, carbamide, raises input prices and increases emissions of carbon dioxide and ammonia. Both human health and ecology are adversely affected by these pollutants.

Alternative farming methods, such as organic and natural farming, are being promoted by governments all over the world without any funding. The Paramparagat Krishi Vikas Yojana program of the Government of India encourages chemical-free farming methods, yet because of the power of prominent customers, these initiatives may impede growth of the market.

Cosmetic Industry to Boost Usage of Urea-infused Products

Rising discretionary budgets and awareness of skincare issues are driving the cosmetic industry's demand for urea, a crucial component of personal care products. The clean beauty movement and the outstanding skincare qualities of urease have made it a popular natural and sustainable component in North America and Asia Pacific. For example,

Development in Urea Production Presents Growth Potential

Integration of novel technology in urea production is estimated to present key opportunities to market players. Utilizing carbon dioxide, nitrogen, and water as basic ingredients, Blue Urea is a significant industrial process that electrolyzes hydrogen.

Renewable energy sources, such as wind turbines, which are situated close to agricultural land, provide the energy. This approach removes contaminants from traditional production and lowers emissions and transportation costs.

Standardized ISO containers may be used to store the equipment, which encourages delocalization and lowers emissions. The product is ideal for usage because its composition is devoid of pollutants. This cutting-edge production method presents substantial prospects for market expansion.

The urea market is shaped by leading corporations that prioritize significant developments in their product lines. These key players are actively engaging in strategic joint ventures and extending their reach into emerging markets, all while making substantial investments in research and development.

The primary objective is to diversify not only their product offerings but also to surge their customer base by introducing innovative, dependable, and sustainable solutions. This dynamic and multifaceted industry empowers companies to solidify their competitive edge and enhance their positions in the urea market, fostering a continual cycle of growth and improvement.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Grade

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The market size is set to reach US$ 118.9 Bn by 2032.

Urea phosphate outperformed DAP in grain yield and P-fertilizer efficiency, with higher yield at 60ppm P2O5 compared to 80ppm P2O5 at 8.98g pot-1.

In 2025, North America is projected to hold a market share of 18%.

In 2025, the market is estimated to be valued at US$ 102.3 Bn.

Euro Chem, BASF SE, China National Petroleum Corporation, CF Industries Holdings, Inc., and Nutrien Ltd., are a few key players.