Industry: Automotive & Transportation

Published Date: November-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 191

Report ID: PMRREP34897

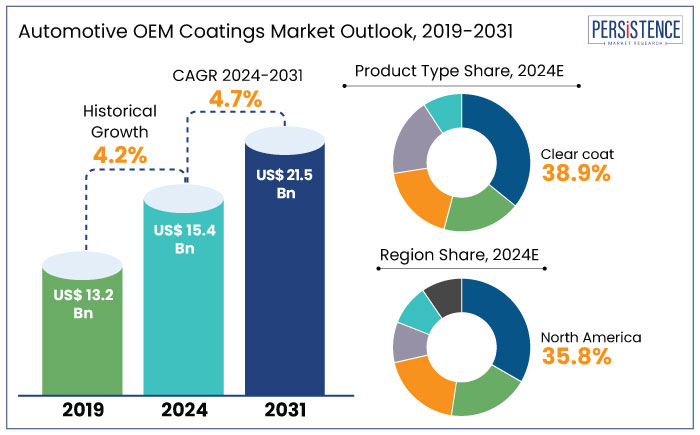

The global automotive OEM coatings market is projected to witness a CAGR of 4.7% during the forecast period from 2024 to 2031. It is anticipated to increase from US$ 15.6 Bn recorded in 2024 to US$ 21.5 Bn by 2031.

The global automotive industry displayed robust growth in 2023 as evident from significant sales increases across key markets. In the U.S., light vehicle sales surged to 1,454,597 units in December, marking a 13% rise compared to the previous year. The total annual sales reached 15.6 million units, reflecting a 12.3% year-over-year increase primarily driven by rising demand for trucks and SUVs.

In Europe, despite a December drop in new passenger car registrations by 23%, total sales for 2023 increased by 7.3%, with key players like Volkswagen and Mercedes showing notable gains. China continued to dominate Electric Vehicle (EV) sales, accounting for 60% of global transactions, with expectations of reaching 14 million total EV sales by 2023.

Rising demand for electric and fuel-efficient vehicles is anticipated to boost the need for high-performance OEM coatings. Innovations in formulations and government initiatives promoting sustainability will likely enhance growth in the automotive coatings industry.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Automotive OEM Coatings Market Size (2024E) |

US$ 15.6 Bn |

|

Projected Market Value (2031F) |

US$ 21.5 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

4.7% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

4.2% |

|

Country |

CAGR through 2031 |

|

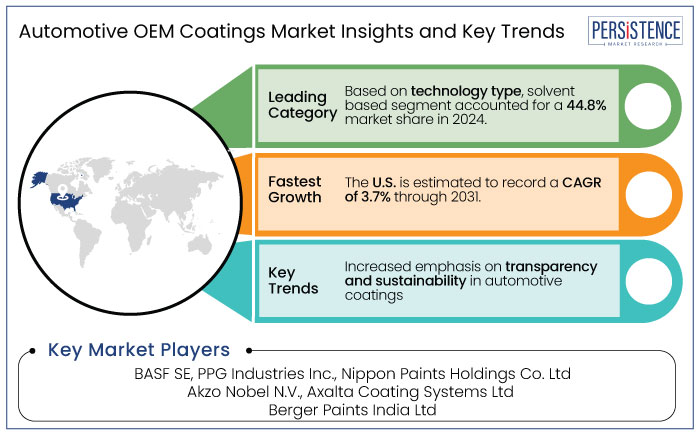

U.S. |

3.7% |

The U.S. automotive industry is experiencing a robust recovery, with light vehicle sales rising 13% year-over-year in December 2023. Full-year sales reached approximately 15.6 million units, driven by a 13.4% increase in truck and SUV sales. This growth indicates a strong demand for OEM coatings as production ramps up. Leading manufacturers like GM, Ford, and Stellantis are reporting substantial sales growth, further reinforcing the U.S. as a key hub for automotive production.

Manufacturers are also investing significantly to enhance domestic capabilities, exemplified by PPG’s US$ 300 Mn investment in Tennessee to boost coating technologies. This initiative aims to meet the rising demand for eco-friendly coatings that comply with stringent environmental standards. As sustainability becomes a priority, the emphasis on innovative and high-quality coatings will likely contribute to a positive outlook for the market.

|

Country |

CAGR through 2031 |

|

India |

5.7% |

India is estimated to boost the automotive OEM coatings market growth in Asia Pacific. Driven by rising demand for two-wheelers and commercial vehicles, India’s automotive industry has transformed the country into a regional powerhouse.

The annual vehicle production reaching 25.9 million units in FY23 and exports exceeding 4.7 million units, India supports a rapidly growing coatings sector that caters to both domestic and international manufacturing needs. As the world’s largest tractor producer and a leading manufacturer of heavy trucks and buses, demand for advanced, sustainable automotive OEM coatings is surging.

Companies are increasingly investing in India, exemplified by BASF's e-coat production facility in Mangalore and Lubrizol's plant in Aurangabad. These initiatives help meet local demand, which is crucial for sustainable automotive solutions.

Government initiatives like the Automotive Mission Plan 2026 and production-linked incentives enhance India’s potential. These are anticipated to make it an essential hub for companies seeking to broaden their presence while aligning with sustainability standards in automotive coatings.

|

Category |

CAGR through 2031 |

|

Product Type- Clear Coat |

4.4% |

In terms of product type, the clear coat category is anticipated to lead in the foreseeable future by capturing a CAGR of around 4.4%. It is primarily due to their essential role in enhancing vehicle aesthetics and providing protection.

Clear coats help create a glossy finish that not only appeals to consumers but also safeguards the underlying paint from environmental factors such as UV rays, chemicals, and scratches. This protective layer is critical for maintaining the vehicle's appearance over time, thereby driving its popularity among manufacturers.

Increasing demand for high-quality finishes and customization in vehicle design has further solidified the clear coat segment's dominance. Automakers are set to focus on improving the durability and visual appeal of their products. Investments in advanced clear coat technologies, including eco-friendly formulations, are expected to propel growth in this area. This trend highlights clear coat's significance in both production and long-term vehicle maintenance.

|

Category |

CAGR through 2031 |

|

Technology- Solvent-based |

4.6% |

Based on technology, the solvent-based segment is projected to exhibit a CAGR of 4.6% during the period from 2024 to 2031. These coatings offer superior performance characteristics, such as excellent adhesion, durability, and resistance to harsh environmental conditions.

Solven-based automotive OEM base coat paints also have fast-drying properties. These make them particularly appealing for mass production in automotive manufacturing, enabling quick turnaround times. These formulations have been historically favored for their ability to achieve high gloss finishes and excellent color retention, factors that are critical for automotive aesthetics.

The automotive OEM coatings market plays a key role in enhancing vehicle appearance, durability, and resilience. It is anticipated to directly impact manufacturers' ability to meet consumer expectations for quality.

Coatings in this segment not only protect the vehicle's exterior from environmental factors but also support automakers in adhering to stringent industry standards. As automakers emphasize both aesthetics and sustainability, these coatings have become a central focus within the manufacturing process.

A shift toward eco-friendly and high-performance coatings has defined recent trends in this industry. Companies are prioritizing low-VOC and bio-based coatings to align with evolving environmental regulations and consumer demands for sustainability.

Advances in lightweight and energy-efficient coatings are gaining traction, helping OEMs reduce emissions during production and adapt to the growing focus on electric vehicles (EVs). These require specialized formulations to withstand unique thermal and mechanical stress.

The global automotive OEM coatings industry recorded a CAGR of 4.2% from 2019 to 2023. It was driven by rising environmental standards and increasing demand for sustainable, high-performance solutions.

Companies increasingly shifted toward green manufacturing practices, motivated by regulatory pressures and consumer preference for eco-friendly products. This period saw advancements in coating technologies that improved environmental impact and product efficiency. It further resulted in innovations that reduced VOC emissions and optimized energy consumption.

Sales of automotive coatings are estimated to rise at a CAGR of 4.7% from 2024 to 2031, with a focus on expanding production capabilities and enhancing product portfolios. Future growth will likely center on localized manufacturing to minimize supply chain dependencies while addressing regional regulatory and consumer demands.

Investments in advanced, low-emission technologies are set to remain a primary focus. Manufacturers are anticipated to deliver cost-effective, sustainable solutions that align with evolving environmental standards. This trend will likely position the industry for innovation that balances performance and stewardship in the coming years.

Expansion of Manufacturing Capabilities Worldwide to Boost Growth

The automotive OEM paints industry is experiencing substantial growth as key players enhance manufacturing capacities to meet the rising global demand for high-performance solutions. Investments like PPG Industries’ US$ 10 Mn expansion in Weingarten, Germany, highlight a shift toward sustainable practices.

Several companies are focusing on producing waterborne basecoats that comply with Europe’s stringent environmental regulations. This expansion demonstrates the commitment to sustainable development and supports the growing preference for eco-friendly coatings in the automotive industry.

BASF’s expansion in Mangalore, India, emphasizes its strategic focus on high-demand regions like South Asia and ASEAN. It is aiming to supply local OEMs with essential corrosion-resistant e-coat technology.

Significant projects, including PPG's US$ 300 Mn investment in Loudon County, Tennessee, aim to strengthen local supply chains and cater to increasing coating needs in North America. The establishment of Nippon Paint's NPAC Okayama Plant in Japan also reflects the trend of prioritizing regional manufacturing hubs to efficiently meet varying demands. These examples highlight the importance of enhanced production capacity in the industry.

Launch of New Products to Meet Sustainability Goals Drives Sales

The OEM automotive coatings industry is experiencing significant momentum due to innovative product launches aimed at meeting evolving environmental standards. PPG Industries recently rebranded its advanced coating line as the PPG OPTIGUARD™ series. It streamlined operations in paint shop equipment and enhanced efficiency by reducing cleaning time and associated environmental impacts.

In Asia Pacific, BASF launched the ColorBrite® Airspace Blue ReSource basecoat, certified by REDcert2. It caters to the growing demand for eco-friendly coatings that minimize carbon footprints. This biomass-balanced basecoat reduces emissions by about 20% and reinforces BASF's commitment to sustainability.

AkzoNobel's collaboration with KIA Motors on bio-based interior coatings, specifically for KIA's EV9 SUV, further highlights the trend toward using bio-based materials in EVs. These initiatives underscore the industry’s responsiveness to sustainability demands, significantly driving growth in the OEM coatings segment.

Diverse Environmental Norms May Hinder Demand

The automotive OEM coatings market faces significant challenges due to the complexity of complying with diverse environmental regulations worldwide. For instance, the European Union's (EU) stringent VOC emission standards contrast sharply with the evolving regulations in regions like Asia Pacific.

Manufacturers must frequently adjust formulations to meet these local standards, complicating production, increasing research and development costs, and delaying product launches. The need for varied compliance strategies also creates logistical hurdles, as companies strive to meet multiple, sometimes conflicting, environmental requirements. This regulatory complexity raises operational costs and pressurizes companies to maintain high-quality performance, potentially slowing innovation and the ability to adapt to new sustainability trends.

Rising Emphasis on Transparency and Sustainability to Create Fresh Prospects

The automotive OEM coatings industry is increasingly emphasizing sustainability and environmental accountability. Companies are prioritizing eco-friendly solutions and transparency tools. PPG’s introduction of sustainable paint film solutions at the CARES Congress exemplifies the trend toward resource-efficient production processes that reduce carbon footprints while offering aesthetic options.

BASF’s launch of the Global Life Cycle Assessment of Automotive Surface Solutions (GLASS) tool enables manufacturers to assess CO2 emissions of automotive coatings, enhancing environmental transparency. BMW’s use of BASF’s biomass balance-certified CathoGuard® 800 ReSource e-coat and iGlossR Matt Resource clearcoat in its plants highlights the adoption of advanced coatings to meet stringent emissions standards.

Axalta’s partnership with Solera to integrate CO2 estimation into repair processes via the Sustainable Estimatics platform also shows how technology is being leveraged to track environmental impacts. This commitment to data-driven sustainability sets a new standard for environmental accountability in the coatings landscape.

Investments in Localized Production Capabilities to Open New Doors to Success

The global market is experiencing significant growth opportunities, driven by collaborations focused on sustainable materials and substantial investments in emerging markets. KCC Corp.’s partnership with LG Chem, signed in 2023, signifies a strategic effort to develop eco-friendly materials for coatings.

Utilizing advanced technologies like carbon dioxide conversion and microbial fermentation, the two companies aim to produce environmentally responsible coatings for automotive, auto parts, and industrial applications. This collaboration highlights a commitment among market leaders to address environmental concerns while aligning with evolving regulatory pressures that favor low-impact materials.

Lubrizol’s planned US$ 200 Mn investment in a new manufacturing facility in India exemplifies the potential for growth in regional markets where automotive production is rapidly expanding. This project emphasizes the importance of establishing a regional production footprint to meet increasing demand.

As regulatory standards in countries like India evolve to prioritize eco-friendly products, companies that localize production while adopting sustainability will likely capture high shares. The trend of significant investment in sustainable, localized production capabilities indicates a new phase of growth for the coatings industry, driven by sustainability.

The global market is marked by strong competition among established players. These include PPG Industries, BASF, Nippon Paint, AkzoNobel, Axalta Coating Systems, KCC Corp., Covestro, and Lubrizol. These companies are proactively investing in sustainable coating technologies, expanding production capacities, and forging partnerships to meet rising demand for eco-friendly solutions.

Strategic efforts include the integration of renewable energy, carbon-neutral products, and advanced lifecycle assessment tools. These enable manufacturers to align with sustainability standards and improve operational efficiencies. This focus on innovation highlights the industry’s response to consumer demand for durable, low-impact coatings suited to electric and fuel-efficient vehicles.

The future landscape of the market is expected to be highly consolidated, as key companies continue to strengthen their positions through technological innovations and acquisitions. The adoption of biomass-based and eco-friendly coatings, driven by strict environmental regulations, is set to remain a core market trend. Such sustainability initiatives are shaping the market as more companies strive to meet emissions reduction goals and environmental standards.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Resin Type

By Technology

By Vehicle Type

By Region

To know more about delivery timeline for this report Contact Sales

It is projected to rise from US$ 15.6 Bn in 2024 to US$ 21.5 Bn by 2031.

It is projected to surge at a CAGR of 4.7% from 2024 to 2031.

These are special coatings applied to substrates for protection and decoration purposes.

BASF SE, PPG Industries Inc., and Akzo Nobel N.V. are the leading manufacturers.

It is referred to as an automotive paint mixed to match any original paint color from the manufacturer.