Industry: Industrial Automation

Published Date: November-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 189

Report ID: PMRREP34910

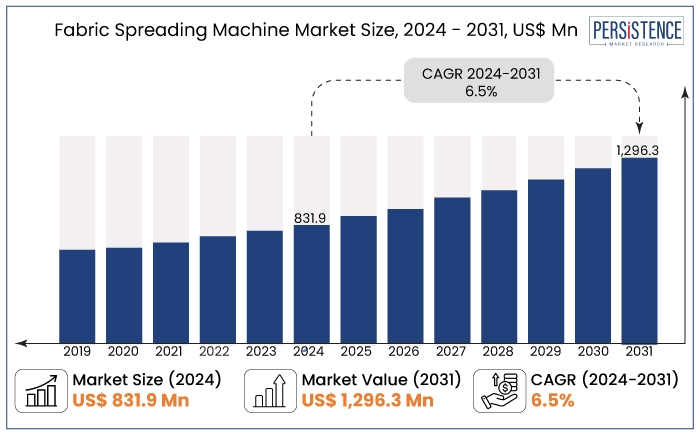

The global fabric spreading machine market is projected to expand at a CAGR of 6.5% between 2024 and 2031. This market is projected to rise from US$ 831.9 Mn in 2024 to US$ 1,296.3 Mn by 2031.

The market is experiencing steady growth, driven prominently by the expanding garment and textile industry. High demand for fast and precise fabric spreading in garment manufacturing, home textiles, and technical textiles is fueling the need for advanced machinery. As fast fashion trends accelerate, manufacturers are increasingly adopting automated spreading solutions to boost production efficiency and meet consumer demands.

Rising demand for technical textiles, particularly in automotive, healthcare, and construction, has spurred the integration of these machines across specialized applications where precision is crucial.

According to the World Trade Organization (WTO), global exports of textiles and apparel have grown consistently, reaching over $1.1 trillion in recent years, emphasizing the expanding market scope for fabric spreading machine. Countries like China, India, and Bangladesh are leading textile exporters, supporting the fabric spreading machine market growth through government initiatives and incentives aimed at industrial modernization and automation.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Fabric Spreading Machine Market Size (2024E) |

US$ 831.9 Mn |

|

Projected Market Value (2031F) |

US$ 1,296.3 Mn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

6.5% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5.3% |

|

Country |

CAGR through 2031 |

|

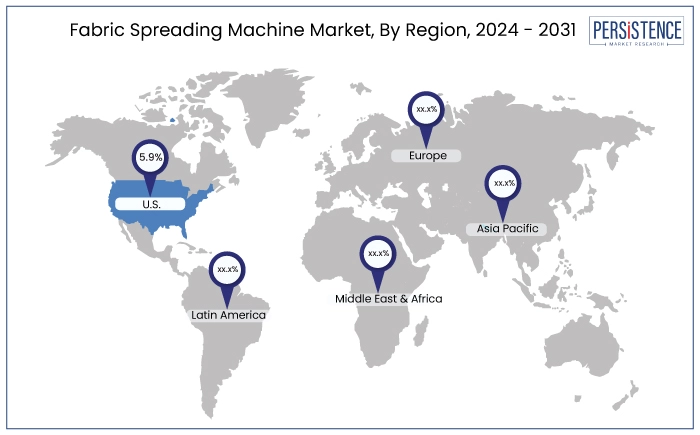

U.S. |

5.9% |

In North America, the United States is expected to experience a notable CAGR of 5.9% through 2031. The country commands a substantial share of the fabric spreading machine market within the region, driven by its advanced textile and garment manufacturing industries. High adoption of automation technologies across industries, paired with consistent demand from fashion, home textiles, and technical textiles, drives its leading position in the region.

The U.S. has solidified its leadership by prioritizing high-quality, precision spreading machines suited for large-scale production. Compared to other countries in the region, it exhibits higher demand in sectors like automotive, healthcare, and defense for technical textiles, alongside the fast-fashion industry. This diverse end-user base enables continuous investments in advanced spreading solutions.

Eastman Machine Company, has made recent advancements in the U.S. market by launching a new series of automated fabric spreading machines. These machines focus on precision and operational efficiency, aligning with the demand for cutting-edge technology across various textile applications.

|

Country |

CAGR through 2031 |

|

India |

7.0% |

The market in South Asia & Oceania is projected to see substantial growth in India, with an estimated CAGR of around 7.0% through 2031. Fabric spreading machine market in India holds a prominent market share propelled by its robust textile and apparel industry. The country’s well-established garment manufacturing infrastructure and government initiatives supporting modernization and automation have bolstered its leading position in the region.

India’s dominance is further supported by its high demand for both manual and automatic fabric spreading machines across varied end-user segments. Compared to neighboring countries, India sees significant use in sectors like fast fashion, home textiles, and technical textiles. Consequently, enabling manufacturers to scale production efficiently to meet both domestic and export demands.

IMA Spa recently expanded its presence in India by introducing energy-efficient automated spreading solutions tailored for high-capacity garment production. This development aligns with India’s growing emphasis on sustainable and efficient textile manufacturing technologies.

|

Category |

CAGR through 2031 |

|

Machine Type- Automatic |

6.3% |

The automatic category of machine type is projected to dominate in the coming years, with an estimated CAGR of approximately 6.3%. Automatic fabric spreading machines command a substantial global market share, fueled by increasing demand for enhanced efficiency, precision, and reduced reliance on labor in textile manufacturing. These machines allow manufacturers to achieve high-speed, consistent fabric spreading, essential in industries like fast fashion and large-scale home textiles.

Globally, automatic machines lead due to their widespread application in mass production environments. Industries such as garment manufacturing, technical textiles, and automotive textiles heavily rely on automated solutions to meet large production demands.

A key competitor in this category, Gerber Technology, has recently introduced a new generation of automated fabric spreading systems designed to enhance speed and material utilization. This innovation aligns with industry needs for sustainable and efficient production, solidifying Gerber’s position in the global market for advanced textile machinery.

|

Category |

CAGR through 2031 |

|

Mechanism - Conveyor Belt |

6.6% |

The conveyor belt segment, categorized by mechanism, is anticipated to achieve a CAGR of 6.6% from 2024 to 2031. Conveyor belt spreading machines capture a substantial share of the global market, driven by their high efficiency and suitability for continuous, large-scale production settings. These machines streamline fabric spreading by allowing a smooth, automated flow, which is especially beneficial for fast-paced industries like garment manufacturing and home textiles.

Their leadership globally is reinforced by their extensive use in high-output applications. Industries such as fast fashion, automotive textiles, and home furnishings heavily utilize conveyor belt systems to maintain production speed and consistency. Compared to other mechanisms, these machines excel in reducing labor costs and material waste, making them indispensable for large manufacturers.

A prominent competitor in this segment, Lectra, recently launched an upgraded conveyor belt spreading machine focused on precision and energy efficiency. This new development meets the growing demand for sustainable and high-speed spreading solutions, strengthening Lectra’s presence in the global market for textile manufacturing equipment.

The fabric spreading machine market is poised for significant growth in the coming years, driven by increasing automation and the demand for high efficiency in textile manufacturing. Future opportunities lie in the development of eco-friendly and energy-efficient spreading solutions, catering to a growing emphasis on sustainability in the textile industry. Additionally, the rise of smart textiles and advancements in technology present avenues for innovative fabric spreading solutions that enhance productivity and minimize waste.

Currently, the global market is witnessing a trend toward automation, with manufacturers increasingly investing in automatic and conveyor belt spreading machines to meet high production demands. The fast fashion industry is a significant contributor to this trend, as it requires quick turnaround times and precision in fabric handling. Furthermore, the focus on reducing labor costs and enhancing operational efficiency is steering businesses toward adopting advanced spreading technologies.

This developing trend aligns closely with the growing applications in garment manufacturing, technical textiles, and home furnishings. As manufacturers strive for higher output and better quality control, the integration of automated spreading machines will become essential in various sectors, supporting the overall efficiency and sustainability of textile production processes.

The fabric spreading machine price can vary significantly depending on factors such as the brand, model, features, capacity, and whether the machine is manual or automatic.

The global fabric spreading machine industry experienced a CAGR of 5.3% during the period from 2019 to 2023. This market has shown consistent growth over the years, driven by the expanding textile and apparel sectors around the globe. Demand surged as manufacturers in key regions embraced automated solutions to meet increasing production needs, especially in garment and technical textiles, laying a solid foundation for the market.

Enhanced productivity, cost efficiency, and the push for precision continue to shape the market as both longstanding and emerging industries adopt automated machinery.

Sales of fabric spreading machine are estimated to record a CAGR of 6.5% during the forecast period between 2024 and 2031.

Rising Demand for Automation in Textile Manufacturing

The global fabric spreading machine market is heavily driven by the textile industry’s shift toward automation to improve productivity and reduce labor dependency. Automated spreading machines allow manufacturers to achieve faster, more accurate fabric handling, which is essential in high-demand segments like garment manufacturing and home textiles. This demand for automation is especially pronounced in fast fashion, where quick turnaround times are crucial.

Industries such as automotive and technical textiles benefit from automated solutions that offer precision and consistency, helping them meet strict quality standards. Automated machines also enhance operational efficiency by reducing material waste and minimizing manual intervention.

Growth in Technical Textiles and Specialized Applications

Another key driver is the increasing demand for technical textiles across industries, including automotive, healthcare, and construction. Fabric spreading machines are essential for handling complex fabrics in these sectors, requiring specialized machinery capable of accommodating varied materials. The demand for technical textiles is encouraging investments in high-performance spreading machines tailored to meet industry-specific requirements.

This trend is particularly prominent in regions with robust industrial textile markets, such as North America and Asia, where manufacturers invest in machines that offer durability and flexibility for diverse applications beyond traditional textiles.

Intense Competition from Alternatives and High Taxation to Hamper Demand

A significant restraint in the fabric spreading machine market is the challenge of adapting machines to handle a wide range of fabric types with varied properties, such as thickness, elasticity, and texture. These technical limitations hinder flexibility and can result in inefficiencies when processing specialized textiles.

The complexity of tailoring machines for custom applications, especially in technical textiles, restricts the ability of manufacturers to address specific industry requirements efficiently. For sectors like medical and industrial textiles, this lack of adaptability remains a major barrier.

Maintaining consistent quality and precision across these diverse fabric types is challenging, limiting the adoption of fabric spreading machines in some specialized applications.

Expansion in Technical Textiles Production in India

India’s growing focus on technical textiles presents a strong opportunity for fabric spreading machine manufacturers. The Indian government’s initiatives, such as the National Technical Textiles Mission, are driving demand in industries like automotive, healthcare, and construction.

With a projected increase in technical textiles production, there is a rising need for advanced fabric spreading machines that meet the specific requirements of these sectors, enhancing both production speed and quality to support global and domestic markets. This growth provides substantial room for manufacturers to develop specialized, high-precision machines that cater to India’s emerging technical textile requirements, positioning India as a key hub in the global textile machinery market.

Increasing Demand for Automation in the U.S. Garment Sector

The U.S. garment industry’s shift toward reshoring and local production creates a favorable environment for automation, particularly for fabric spreading machines. With rising consumer demand for sustainable and locally produced apparel, U.S. manufacturers are increasingly adopting automated solutions to improve efficiency and production speed, while minimizing labor dependency. These advancements align with the industry’s focus on reducing waste and meeting fast fashion demands.

Automation opportunities continue to expand, providing manufacturers of fabric spreading machines with growth potential in supplying high-speed, precision-driven machines tailored to U.S. garment manufacturers.

The global fabric spreading machine market is highly competitive, with key players like Gerber Technology, Lectra, and IMA Spa leading advancements in automated machinery and digital integration. These companies are expanding their presence across leading textile-producing regions, including North America, Europe, and Asia-Pacific, where demand for high-efficiency spreading solutions is significatly growing. Their focus remains on delivering cutting-edge technology that enhances productivity and precision.

Market players are prioritizing strategic moves such as collaborations with regional manufacturers, research and development investments, and introducing modular machines tailored to various fabric types to secure market growth. By targeting specialized applications in technical textiles and automated garment manufacturing, companies are positioning themselves to capture emerging opportunities in sustainable and high-speed textile production.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Million for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Machine Type

By Mechanism

By Application

By Region

To know more about delivery timeline for this report Contact Sales

Yes, the market is set to reach US$ 1,296.3 Mn by 2031.

Garment manufacturing holds significant market share globally.

India is estimated to accumulate a market share of around 38.4% in 2031.

Lectra is considered the leading player in the fabric spreading machine market.

There are two basic types of spreads such as flat spreads and stepped spreads.