Pressure Ulcer Devices Market Segmented By Pressure Ulcer Mattresses, In-Shoe Sensors, Surface Electrodes, Smart e Pants, Alternating Pressure Wheelchair Cushions Product

Industry: Healthcare

Published Date: March-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 465

Report ID: PMRREP32831

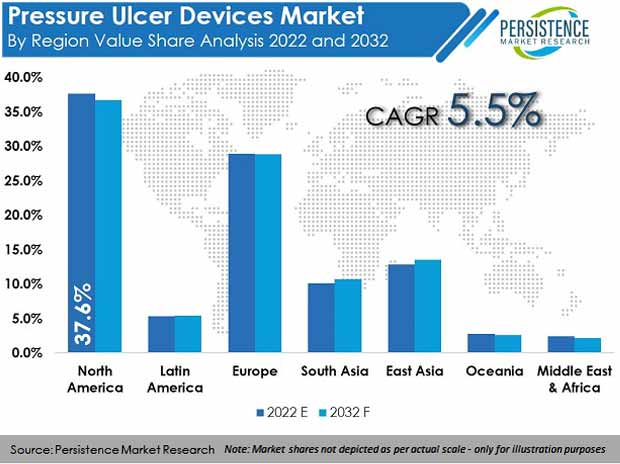

Revenue from the global pressure ulcer devices market reached US$ 4.7 Bn in 2021. With the market projected to expand at a steady 5.5% CAGR, industry valuation is set to top US$ 8.4 Bn by the end of 2032.

| Attribute | Key Insights |

|---|---|

|

Pressure Ulcer Devices Market Size (2021) |

US$ 4.7 Bn |

|

Projected Market Value (2032) |

US$ 8.4 Bn |

|

Global Market Growth Rate (2022-2032) |

5.5% CAGR |

|

Top 5 Countries by Share |

52.8% |

Sales of pressure ulcer devices accounted for nearly 57.9% of the global diabetic ulcers treatment market in 2021. As per Persistence Market Research’s projections, stage 1 wounds accounted for a substantial share of 47.5% in the global market.

The occurrence of pressure ulcers as an impeding factor in patient care is well established worldwide. Lack of mobility or presence of physical disability affects blood circulation, leading to the occurrence of bed sores and pressure ulcers. Additionally, mental illnesses such as dementia or factors such as urinary incontinence, fecal incontinence, poor nutrition, low diastolic pressure, or persistent hemodynamic instability are associated with increased risk of pressure ulcers.

Effect of the development of pressure ulcers or injury to a patient’s functional recovery is a major cause of concern as the care continuum is interrupted by raising complications such as infection and pain. This factor is associated with elongated time period of hospital stay. Management of pressure ulcers and the sales value of pressure relief devices are thus augmented by the presented concern of ensuring optimal patient outcome with each hospital visit.

Increasing incidence of pressure ulcers is set to propel demand for pressure ulcer relief devices wherein, Hospital-Acquired Pressure Ulcers (HAPUs) are increasingly gaining attention at healthcare facilities. Moreover, the presence of HAPU contributes to a surge in the cost of admission. This extra cost can be the result of an increased duration of stay or more complex care needs.

High cost of treating HAPU poses a substantial encumbrance to patients as well as the healthcare facility. Therefore, the need for rapid treatment and significant initiatives to decrease the rate of HAPUs are being gradually engaged.

The aging population is more prone to skin wounds due to higher skin fragility and thinning of the cell layers with decreased vascularization and cell proliferation, and therefore, a delayed healing process. Increasing geriatric population and obese patients is expected to drive pressure ulcer device usage over the coming years.

The global pressure ulcer relief devices market expanded at 3.9% CAGR over the past 5 years, and is expected to expand even faster over the next ten years at a CAGR of 5.5%, and offer an absolute $ opportunity of US$ 254.9 Mn.

“Rising Government & Entity Support”

Increasing awareness regarding pressure ulcers in the wound management market is a prominent market driver. Internationally recognized entities, such as the National Pressure Injury Advisory Panel (NPIAP), committed to the prevention and treatment of pressure injuries, have provided the market with opportunities for growth, while subsequently reducing the burden of bed sores and elongated hospital stays.

Additionally, government authorities in Asia Pacific and MEA have been encouraging MNCs as well as start-ups to boost the growth of healthcare and biopharmaceutical industries.

“High Focus on Working of Acute Care Settings”

Hospitals are focusing on refining their acute care settings to manage pressure ulcers. In the present scenario, changes in the skin of patients, such as swelling or soreness, are immediately taken into account by doctors and nurses. Many hospitals utilize pressure ulcer systems to look after patients’ skin and prevent and treat pressure sores.

These devices include seat cushions, protective mattresses, heel wedges, and limb protectors. Hence, growing emphasis at acute care settings to ease hospitalization costs by evading lengthy patient stay due to pressure ulcers projects lucrative opportunities.

“Growing Medical Tourism in Countries of Asia”

Additionally, medical tourism also delivers an opportunity for patients to receive proper quality of care within well-established medical facilities. The growth rate of medical tourism in Asia is rising at a fast pace, and in developing countries, medical tourism is cost-effective and allows for affordable treatment options, immediate services, high-quality medical care and treatment facilities, and well-connected flights and excellent communication services.

Growing medical tourism in developing countries thus offers great opportunities for the sale of pressure ulcer devices in respective regions.

“Rising Government & Entity Support”

“High Cost of Pressure Ulcer Relief Devices”

A restrictive factor associated with pressure ulcer devices is the cost, which is relatively high. This poses a great challenge to the growth of the pressure ulcer devices market, as the management of pressure ulcers presents a high financial cost to healthcare settings and patients worldwide.

As per the Agency for Healthcare Research and Quality, “data displays other hospital-acquired conditions such as adverse drug events and surgical site infections to have gone down, but the number of pressure ulcers continues to climb” (2019 data).

Thus, in addition to the unreasonable financial costs, the treatment of pressure ulcers takes up valuable nursing time and can have a substantial bearing on a hospital’s performance ranking. This leads to an increase in unaffordability of treatment, thus obstructing the growth of the pressure ulcer treatment devices industry.

“Lack of Reimbursement Policies for Pressure Ulcer Treatment”

Furthermore, health insurance companies do not have a defined provision of reimbursement and subsidized guidelines for certain treatments. This has affected the affordability of patients for their treatment. Multimodal therapies, which are time-consuming and costly, are not always reimbursed by insurance companies.

Absence of social health insurance combined with the disbarring delivery of private health insurance schemes is a major factor restraining the sales of pressure ulcer devices.

What Makes the U.S. the Largest Market for Pressure Ulcer Relieving Devices?

The U.S. pressure ulcer devices market dominated the North American region with a market share of 84.5% in 2021, and is expected to continue its high-growth trajectory going forward.

The U.S. projects high need for pressure ulcer treatment as a consequence of growing number of chronic diseases such as diabetes. The country is expected to hold a majority of the global market share for pressure ulcer device consumption throughout the forecast period.

Why is Germany a Lucrative Market for Pressure Ulcer Devices in Europe?

Germany dominated the Europe market for pressure ulcer devices, with a share of 18.7% in the year 2021.

Germany enjoys considerable institutional funding for R&D, due to which, the quality of research has intensified across the European region, thus adding to the global manufacturing value of pressure ulcer devices. Additionally, high establishment of nursing care facilities within the country has further promoted the market stance of Germany for pressure ulcer treatment.

Will the Emerging China Pressure Ulcer Devices Market Be Profitable for Market Participants?

China holds 42.3% share in the East Asia pressure ulcer devices market, which is projected to increase over the decade.

The China pressure relief devices market experienced rising demand with the advent of the COVID-19 pandemic. Market growth is supported by China investing 15% of revenue in research & development activities.

What is the Outlook for Japan Regarding Pressure Ulcer Device Consumption?

In 2021, Japan held 36.7% share in the East Asia pressure ulcer devices market, and the market is projected to expand at a CAGR of 6.2% from 2022 to 2032.

Japan projects significant growth in the global pressure ulcer devices market, owing to rising prevalence of infectious diseases and growing healthcare infrastructure. Moreover, presence of major players in the country, aiming for expansion and larger geographical presence, has driven market growth in the country.

Which Pressure Ulcer Equipment is Driving High Market Growth?

By product, speciality beds project lucrative growth at a CAGR of 5.7% through the forecast period.

Specialty beds promote patient comfort with the availability of variable pressure mattresses for patients under critical care as well as observation. They prevent bed sores and related wounds, thus reducing the length of patients’ stay at a healthcare facility.

Which Stage of Pressure Ulcers Account for Most Demand?

Stage I pressure ulcers accounted for a revenue share of 47.5% in 2021, with the segment projected to hold on to this high market share through 2032.

Prevalence of superficial wounds as well as sores is commonly observed in a vast majority of inpatient admissions. Thus stage I pressure ulcers hold a large share in the market.

Onset of the COVID-19 pandemic and infections had a positive impact, to some extent, on demand for pressure ulcer devices. This was due to increasing incidence of hospitalizations as a consequence of infections associated with the COVID-19 virus.

With ICU patients more likely to be at a higher risk of developing pressure ulcers, the advent of COVID-19 and infections associated with it displayed a positive impact on the pressure ulcer devices market. This also promoted a positive stance for the forecast period, as awareness and prevention of pressure ulcers is gaining traction globally.

Key medical device manufacturers are focusing on the development of innovative pressure ulcer treatment devices to enhance their product portfolios and gain profits. Innovations by pressure ulcer device manufacturers also concentrate on compliance and safety regulations.

Similarly, recent developments related to companies manufacturing pressure ulcer products have been tracked by the team at Persistence Market Research, which are available in the full report.

| Attribute | Details |

|---|---|

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2017-2021 |

|

Market Analysis |

US$ Mn for Value |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Pricing |

Available upon Request |

Pressure Ulcer Devices Market by Product:

Pressure Ulcer Devices Market by Stage:

Pressure Ulcer Devices Market by End User:

Pressure Ulcer Devices Market by Region:

To know more about delivery timeline for this report Contact Sales

The global pressure ulcer devices market is worth US$ 4.9 Bn at present, and is set to expand 1.7X over the next ten years.

Consumption of pressure ulcer relief devices is expected to reach US$ 8.4 Bn by the end of 2032, with sales revenue expected to register 5.5% CAGR.

From 2017-2021, pressure ulcer devices market growth was recorded at 3.9% CAGR.

Technological advancements & introduction of connected medical devices, acquisitions and collaborations by key players, and launch of regional websites to boost sales are some of the key trends in this marketplace.

The U.S., Canada, Germany, China, and Japan drive highest demand for pressure ulcer treatment products.

The U.S. expected to account for 83.7% of the North America market share during the forecast period.

Demand for pressure ulcer devices in Europe is expected to register a CAGR of 5.4% over the next ten years.

The U.S., Germany, and U.K. are major manufacturers of pressure ulcer devices.

The China pressure ulcer devices market held a share of 42.3% in East Asia in 2021, while Japan held 36.7% market share.