ID: PMRREP3052| 190 Pages | 17 Sep 2025 | Format: PDF, Excel, PPT* | Packaging

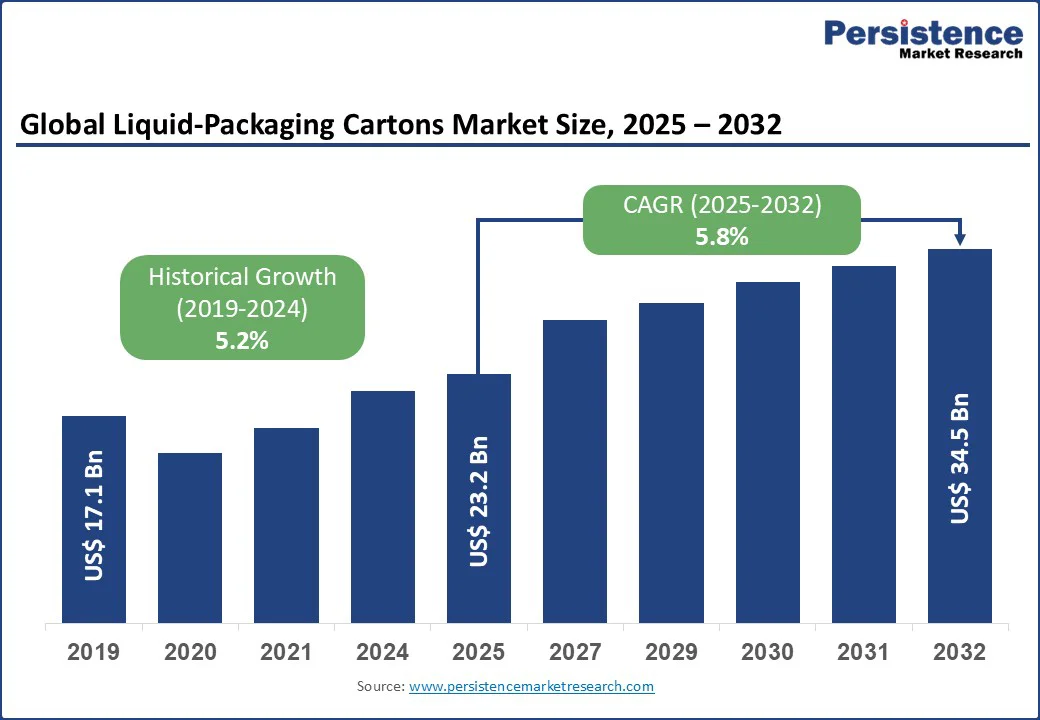

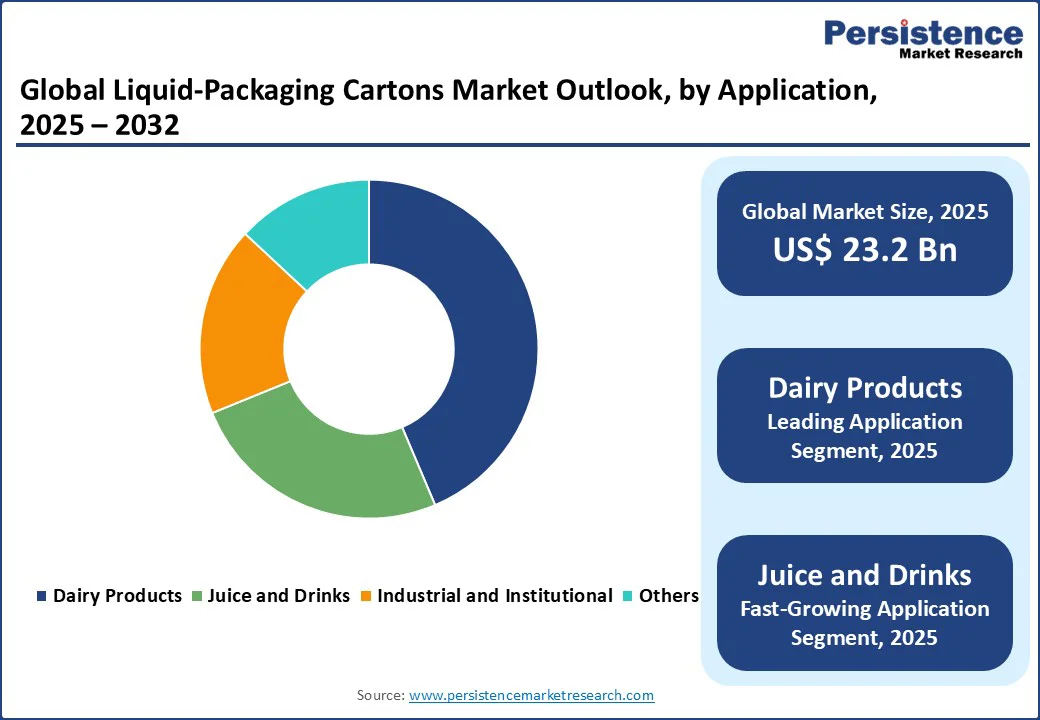

The global liquid packaging cartons market size is likely to be valued at US$23.2 Bn in 2025 and projected to reach US$34.5 Bn by 2032 at a CAGR of 5.8% in the forecast period from 2025 to 2032 due to increasing demand for sustainable packaging solutions, increasing consumption of dairy and non-alcoholic beverages, and growing adoption of aseptic cartons offering extended shelf-life without refrigeration.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Liquid Packaging Cartons Market Size (2025E) |

US$23.2 Bn |

|

Market Value Forecast (2032F) |

US$34.5 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.2% |

Food and beverage manufacturers are increasingly adopting aseptic liquid packaging cartons, including brick cartons and paper-based barrier cartons, to ensure extended shelf life, maintain product quality, and simplify distribution without relying on cold-chain logistics. In Germany, Hochwald introduced UHT milk in SIG Terra Alu-free aseptic cartons, which cut the carbon footprint by about 34% while retaining barrier properties for long shelf life. This innovation demonstrates how sustainable packaging solutions meet consumer demand for convenience and environmentally friendly products.

Similarly, Tetra Pak and Lactogal introduced a paper-based barrier aseptic carton in Portugal, composed of approximately 90% renewable paperboard. The carton supports ambient distribution, reduces carbon emissions by around 33%, and preserves nutrients and flavor in milk and juice products. By enabling longer shelf life without preservatives and ensuring convenience for busy consumers, this launch highlights how innovations in liquid packaging cartons are driving market adoption and shaping the future of sustainable, ready-to-use beverages.

The growth of the liquid packaging cartons market faces increasing competition from PET bottles and flexible pouches, which are widely adopted by beverage and dairy manufacturers. These packaging formats offer advantages such as lightweight construction, convenience, and ease of handling, making them especially attractive for on-the-go consumers and ready-to-drink beverages. In India, rigid PET bottles dominate packaging for beverages, supported by well-developed collection systems and initiatives promoting reusable and refillable models, further strengthening their market position.

Flexible pouches and PET bottles benefit from regulatory and sustainability support. Governments in Europe and India are promoting recycling mandates, circular economy initiatives, and resource efficiency policies, encouraging manufacturers to adopt packaging with recycled content and reduce waste. Well-established recycling systems and consumer familiarity with PET and flexible formats limit the expansion of aseptic and paperboard cartons, particularly in regions prioritizing cost-effective, convenient, and sustainable solutions. This trend continues to constrain liquid carton adoption despite its environmental and shelf-life advantages.

The growing development of bio-based coatings presents a strong opportunity for the liquid packaging cartons industry, as manufacturers aim to reduce dependence on aluminum and fossil-based plastics while meeting rising sustainability expectations. In May 2025, UPM Specialty Papers and Eastman launched a recyclable paper-based solution with bio-based barrier coatings, designed to deliver moisture and oxygen resistance while being fully compatible with recycling streams. This shows how carton makers can combine performance with eco-friendly design, responding directly to consumer and regulatory pressures for low-carbon packaging.

Earthodic launched Biobarc, a 100% bio-based water-resistant coating that improves durability while keeping cartons recyclable. Unlike synthetic coatings, Biobarc is derived from renewable resources and allows carton manufacturers to enhance both performance and sustainability credentials. Such product innovations highlight how bio-based coatings are not only technically feasible but also commercially attractive, opening new growth avenues for liquid packaging cartons worldwide.

Brick cartons remain the most widely used carton type globally, accounting for an estimated 56.4% share in 2024. Their rectangular shape maximizes pallet utilization, enabling efficient stacking, storage, and transportation across supply chains, which significantly reduces logistics costs for manufacturers and retailers. This space efficiency, combined with cost-effectiveness in large-scale production, makes brick cartons the go-to choice for a wide range of liquid products.

In April 2025, Malo Dairy in France adopted Elopak’s Pure-Pak brick cartons on a new aseptic line, highlighting how brick formats continue to evolve with sustainable innovations. Such advancements demonstrate the carton’s ability to balance functionality with eco-friendly design, reinforcing its dominance as the most practical and commercially viable carton type for beverages, dairy, and other liquid applications.

Milk cartons remain one of the most preferred packaging formats for dairy, particularly in Europe and Asia, where consumers and retailers prioritize freshness, sustainability, and convenience. In early 2025, Nissha Metallizing Solutions (NMS) and TetraPak introduced a paper-based barrier aseptic carton for milk made with FSC-certified paper, offering food protection comparable to traditional aseptic cartons.

This illustrates how milk packaged in cartons is benefiting from innovations in barrier technology that maintain flavor and safety without aluminum, aligning with environmental expectations in regions sensitive to packaging waste.

Europe is witnessing a surge in biodegradable milk packaging using paperboard-biopolymer coatings and eco-friendly cartons. European dairy brands are increasingly launching milk in cartons that reduce plastic content and emphasize renewable materials. These developments reflect consumers’ growing willingness to pay for cartons that safeguard milk quality while contributing to sustainability goals, underlining why milk packaging remains a leading application for liquid packaging cartons globally.

In the U.S., consumer demand for plant-based milk is encouraging packaging innovation, particularly in gable-top cartons. For example, Hochwald Foods switched its fresh dairy and mixed milk beverages to Pure-Pak gable-top cartons in August 2024, reducing plastic content by around 50% compared to their previous packaging. This reflects a broader effort to combine sustainability with convenience: gable-top cartons are perceived as more premium, easier to stack, and more friendly for chilled and plant-based drinks, which makes them a strong packaging format for manufacturers targeting eco-conscious consumers.

Packaging machinery companies such as Galdi and FILL good are now supporting more plant-based beverage producers to adopt gable-top lines. Their systems facilitate efficient changeover between volumes and maintain food safety for products such as almond, soy, and oat beverages packaged in gable-top cartons. As sustainability becomes a high priority for brands and consumers alike, these developments illustrate how the gable-top format is accelerating the adoption of plant-based milk alternatives in North America.

Europe is experiencing rapid adoption of liquid packaging cartons, fueled by consumer demand for sustainable solutions and a surge in plant-based alternatives. In May 2025, Dutch company Boermarke expanded its “Vairy” range of plant-based drinks, puddings, and yoghurts in Pure-Pak Sense cartons made with Natural Brown Board. The products are filled on an ultra-hygienic line in Enschede, highlighting how manufacturers are turning to cartons to reduce plastic use while delivering shelf-stable and eco-friendly products.

Sustainability-driven innovations are also reshaping traditional dairy packaging. This underlines Europe’s leadership in developing low-impact carton solutions, ensuring compliance with environmental regulations and aligning with consumer preferences for recyclable and renewable packaging.

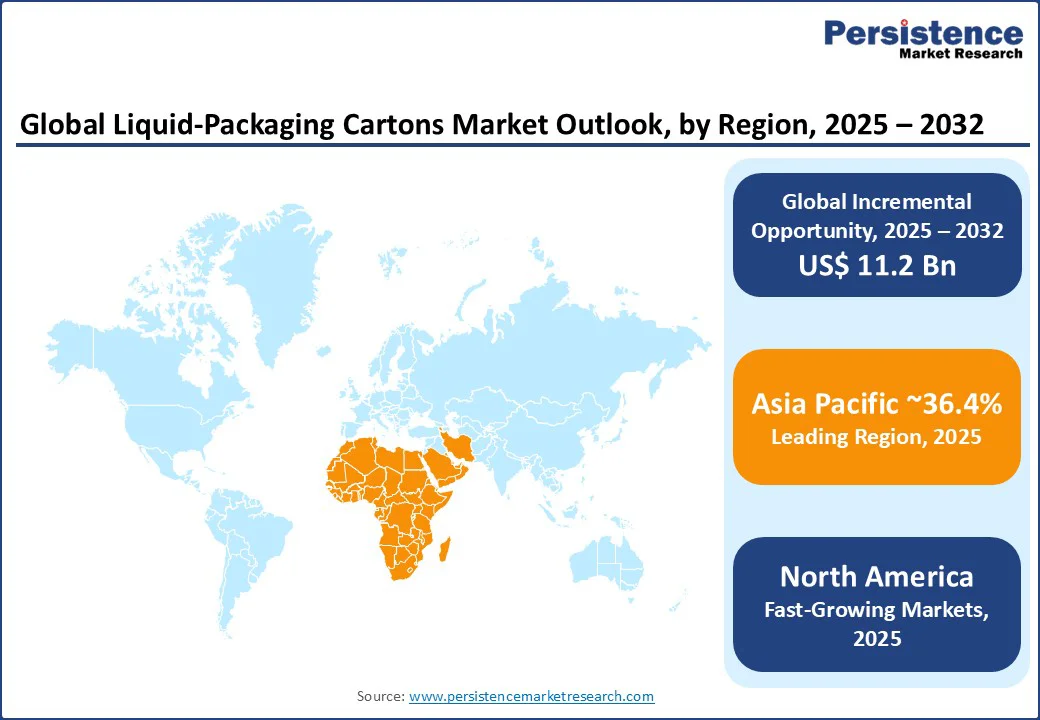

In the Asia Pacific, liquid packaging cartons are gaining strong momentum as governments and consumers increasingly promote sustainable beverage packaging. In China, Tetra Pak partnered with Mengniu to launch paper-based caps and renewable materials in beverage cartons, supporting the country’s shift away from single-use plastics.

India’s dairy sector is driving demand as factory-use milk is forecast to increase from about 122.7 to 125.5 million metric tons in 2025, underscoring the growing importance of packaged milk products where cartons are a leading format.

Southeast Asian markets are also witnessing rising adoption of portion-pack cartons for juice and flavored milk, particularly in school nutrition programs where hygiene, affordability, and convenience are critical. Japan, known for early adoption of eco-friendly packaging, continues to expand the use of FSC-certified paperboard across both dairy and plant-based drinks. Together, these developments highlight Asia Pacific as a hub of packaging innovation, blending sustainability, rising dairy consumption, and functionality to meet evolving regional needs.

The global liquid packaging cartons market is moderately consolidated, with competition shaped by a mix of multinational players and regional producers. Leading companies focus on innovation in carton types such as brick, gable-top, and shaped designs, alongside coatings like LDPE and aluminium to meet functionality, cost-efficiency, and regulatory demands. Sustainability has become a central differentiator, with increasing investment in bio-based materials and paperboard-certified solutions.

Smaller and regional manufacturers are competing by tailoring products to local market needs, such as single-serve packs for school programs or cartons designed for dairy-rich economies. Partnerships with dairy processors, beverage brands, and institutional buyers continue to define the landscape, while evolving shelf-life requirements and recycling infrastructure are shaping long-term competitiveness across regions.

The global liquid-packaging cartons market is projected to be valued at 23.2 bn in 2025.

Increasing preference for aseptic cartons, driven by extended shelf-life and reduced cold-chain dependency, is fuelling global demand.

The liquid-packaging cartons market is poised to witness a CAGR of 5.8% between 2025 and 2032.

Growing development of bio-based coatings offers manufacturers a pathway to meet regulatory and consumer sustainability expectations.

Major players in the liquid-packaging cartons market include Elopak Inc., Evergreen Packaging Inc., Refresco Gerber N.V., SIG Combibloc GmbH, Tetra Pak, and others.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Units |

Value: US$ Bn, Volume: Tons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Carton Type

By Coating Type

By Shelf-Life Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author