Lighting Fixtures Market Segmented By Architecture & Commercial Lighting, Decorative & Residential Lighting, Industrial Lighting, Outdoor Lighting Type in Airport Lighting, Corporate Campus Lighting, Retail Outlets Lighting, Education Facilities Lighting, Government Office & Building with Incandescent, Fluorescent, LED and OLED Light Source

Industry: Semiconductor Electronics

Published Date: September-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 278

Report ID: PMRREP4716

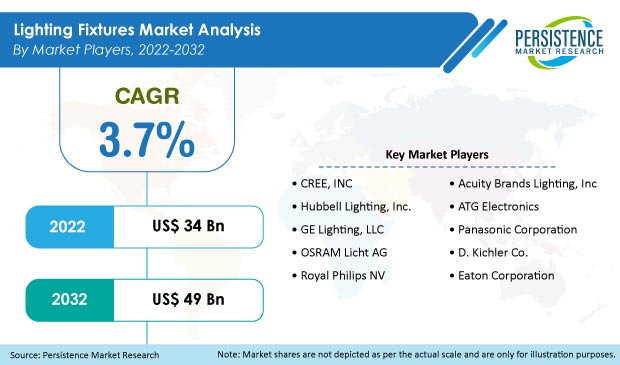

The global lighting fixtures market is expected to expand at a CAGR of 3.7%, thereby rising from its current market value of US$ 34 Bn to US$ 49 Bn by the end of 2032.

LED and OLED lights account for 54.9% share of the global lighting fixtures market. Demand for lighting fixtures in India is projected to surge at a CAGR of 8.1% during the forecast period (2022-2032).

|

Lighting Fixtures Market Size (2022) |

US$ 34 Bn |

|

Projected Market Value (2032) |

US$ 49 Bn |

|

Global Market Growth Rate (2022-2032) |

3.7% CAGR |

|

Market Share of Top 4 Countries |

33.5% |

Over the 2016-2021 historical period, the global lighting fixtures market expanded at a CAGR of 4.5%.

LED lights utilize 80% less energy than standard lights, such as incandescent and fluorescent lights. Since LED bulbs do not include harmful elements, these advantages encourage consumers to switch from standard to LED lighting. The global drive to reduce the usage of conventional lighting in numerous nations such as Europe, Brazil, and China is expected to have an influence on the adoption of LED lights.

Furthermore, smart and connected LED lights are projected to be the next big thing in smart home initiatives. This industry has transitioned from analog to digital technologies, allowing users to regulate and track light efficacy.

Wireless dimmers, lighting, and control devices with sophisticated sensors are expected to meet the demands of modern consumers. Smart lights that link to Wi-Fi use IoT technology to manage the warmth, brightness, and different color selections.

During the forecast period (2022 to 2032), the global lighting fixtures market is anticipated to evolve at a CAGR of 3.7%.

“Emergence of Smart Cities across the World”

The sharp increase in smart city initiatives is one of the major factors anticipated to boost the global lighting fixtures market during the forecast period. Over the last few years, smart lighting has evolved into one of the most sophisticated smart city applications. A growing number of businesses are implementing smart lighting solutions. Such smart lighting systems, when combined with LEDs, save around 30% of energy.

Moreover, increased government expenditures on smart cities and the advent of the smart cities concept have resulted in a rise in demand for the construction of smart buildings.

As a result, the heightened need for smart buildings is expected to raise the demand for energy-saving infrastructure such as LED lighting fixtures, resulting in the global expansion of the lighting fixtures market.

Furthermore, the considerable shift toward low-voltage infrastructure, as well as the increasing deployment of LED lighting fixtures, is projected to raise the sales of lighting fixtures during the forecast period.

“Rapid Shift from Traditional Lighting to Efficient Lighting”

The worldwide lighting industry is shifting from traditional lighting technologies, such as fluorescent and incandescent lighting, to more energy-efficient and innovative LED lighting technology.

Stringent government rules on energy use, along with rising consumer awareness of energy conservation, have resulted in a major increase in demand for innovative lighting fixtures.

Furthermore, demand for improved lighting, including color temperature, color consistency, and light dispersion, is expected to drive growth in the global lighting fixtures market, especially LED lighting fixtures, during the projected period.

“Growing Demand from Hospitality Industry”

The increased awareness of the advantages of lighting fixtures has boosted their demand, particularly in the hospitality industry. The owners of hotels and restaurants invest in lighting fixtures to generate an aesthetic and ambiance for their guests.

Moreover, the increased use of decorative lighting in hotels, restaurants, businesses, residences, and other similar settings is a significant aspect anticipated to propel the growth of the global lighting fixtures market.

In landscape lighting applications, there is a growing demand for sophisticated lighting fixtures. ENERGY STAR-certified LED lighting solutions have acquired appeal among consumers in both developing and developed economies, bolstering the growth of the global lighting fixtures market.

Furthermore, energy-efficient lighting fixtures are picking up steam in industrial, commercial, and residential applications.

“Complex Buying Decisions to Be Made”

Global market growth is likely to be hampered by complex buying decisions in the lighting fixtures market. Lighting fixture purchases are not made solely by end users but rather by a team of professionals that includes lighting designers, architects, and electrical engineers.

The involvement of several professionals has complicated the buying process, which is limiting the growth of the lighting fixtures market. As a result, these constraints are projected to limit market growth over the forecast period.

Which Country Leads the Lighting Fixtures Market in Asia Pacific?

India is expected to lead the lighting fixtures market in Asia Pacific with a CAGR of 8.1%.

The Indian lighting market is quickly developing and shifting from CFLs to LEDs. This shift is being pushed by a growing number of government energy conservation measures, increasing consumer understanding of energy-efficient products, inexpensive pricing, and product improvements that align with the overall digitalization trend.

Due to the increased demand from companies that utilize energy for manufacturing and construction, the country's urbanization level will substantially impact the trajectory of energy consumption.

With the rising rate of electricity use, there is a growing demand for an environmentally responsible and cost-effective lighting solution. Thus, the lighting fixtures market in India is likely to experience substantial growth during the forecast period.

Why is the United States Projected to Provide High-Growth Opportunities?

The United States accounts for 15.2% share of the lighting fixtures market in North America. The growing inclination of consumers for more environmentally friendly items is expected to affect industry operators' existing product portfolios.

Environmentalists have frequently stated a need for more sustainable products, such as sustainable lighting systems. As a consequence, numerous industry players have created lighting fixtures out of recyclable materials such as bamboo and Forest Stewardship Council-certified wood. Such aspects are anticipated to provide revenue-generation opportunities in the lighting fixtures market in the United States.

How are New Product Developments Boosting the Sales of LEDs and OLEDs?

The LED and OLED segment account for 54.9% of the global lighting fixtures market due to the growing adoption of energy-efficient products. Government rules mandating the phase-out of traditional bulbs and lamps are increasing the demand for LED lighting fixtures. Moreover, leading players in the lighting fixtures market are working on expanding their product portfolios.

Rising LED lighting fixture usage, new product development, and innovations such as smart lighting that can be linked with smart devices via IoT technology are some of the main aspects projected to drive the segment's growth.

Leading players in the global lighting fixtures market are substantially investing in green technology research and development. Moreover, many firms are focusing primarily on technological advancement, geographic expansion, and mergers and acquisitions to assure high product exposure and consumer retention, as well as to broaden their consumer base and raise their sales volume in the lighting fixtures market.

Furthermore, manufacturers are catering to consumer wants, creating smart product types, and attempting to reduce their carbon footprint.

For instance:

|

Attribute |

Details |

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2016-2021 |

|

Market Analysis |

USD Million for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon Request |

By Type:

By Application:

By Light Source:

By Region:

To know more about delivery timeline for this report Contact Sales

The global lighting fixtures market is currently valued at US$ 34 Bn.

The global lighting fixtures market is projected to hit US$ 49 Bn by 2032.

Sales of lighting fixtures are expected to increase at a CAGR of 3.7% through 2032.

The LED and OLED segment account for the largest market share of 54.9% in 2022.

Increasing transition from traditional lighting technology to more advanced & energy-efficient LED lighting and growing smart city initiatives are key factors driving market expansion.

The United States is forecasted to lead the global lighting fixtures market.

Hubbell Lighting, Inc., CREE, INC, OSRAM Licht AG, GE Lighting, LLC, Royal Philips NV, ATG Electronics, Acuity Brands Lighting, Inc, Panasonic Corporation, Eaton Corporation, and D. Kichler Co. are key lighting fixture manufacturers.