ID: PMRREP2892| 198 Pages | 27 Nov 2025 | Format: PDF, Excel, PPT* | Consumer Goods

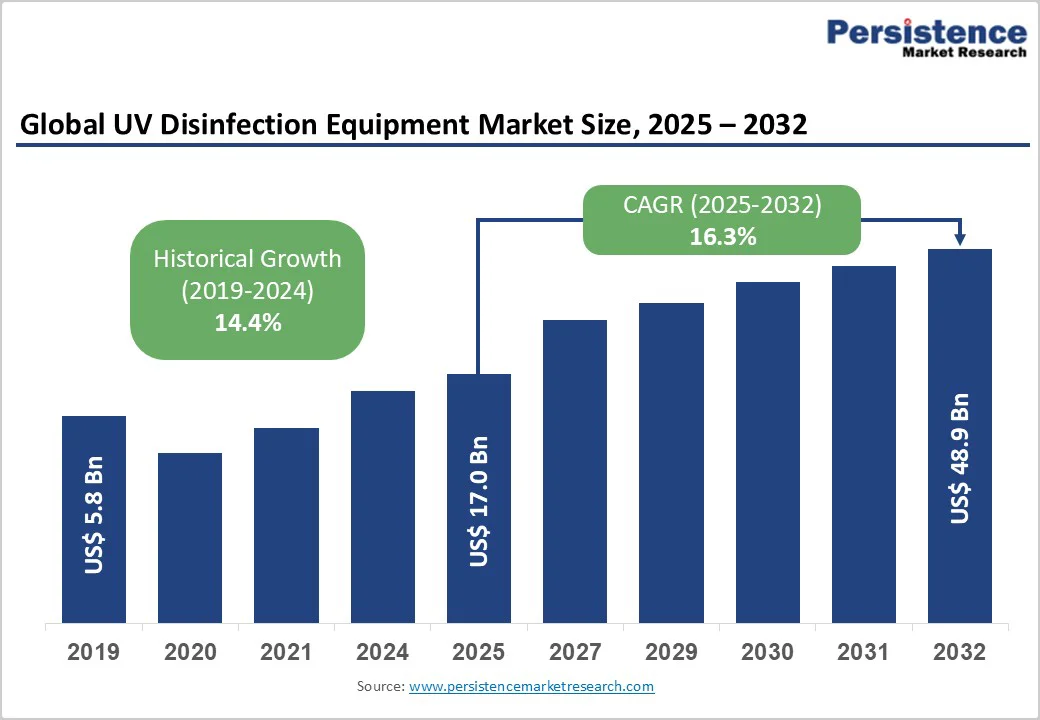

The global UV disinfection equipment market size is likely to be valued at US$ 17.0 billion in 2025, and is projected to reach US$ 48.9 billion by 2032, growing at a CAGR of 16.3% during the forecast period 2025-2032. This growth is fueled by technological advancements in UV-C LED technology, offering mercury-free, energy-efficient alternatives that reduce operational costs significantly. Government investments in water treatment infrastructure, especially in emerging markets, are further accelerating adoption.

The demand is driven by increasing regulatory focus on water quality, rising public health awareness, and the growing need for chemical-free disinfection solutions across water, healthcare, and industrial sectors. The adoption of smart water infrastructure alongside enhanced environmental safety considerations is reinforcing this expansion.

| Key Insights | Details |

|---|---|

|

UV Disinfection Equipment Market Size (2025E) |

US$ 17.0 Bn |

|

Projected Market Value (2032F) |

US$ 48.9 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

16.3% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

14.4% |

Government agencies worldwide have established robust regulations mandating UV disinfection for drinking water, wastewater, and medical environments, driving compliance-based demand across these sectors. For example, the U.S. Environmental Protection Agency (EPA)’s Ultraviolet Disinfection Guidance Manual (UVDGM) sets standardized UV dose requirements and performance criteria for municipal water treatment. Similarly, Germany’s DVGW standards designate UV as the sole approved physical disinfection method for public water supplies, requiring minimum disinfection efficacy. The U.K.’s Drinking Water Inspectorate enforces strict turbidity limits and mandates calibration and monitoring to ensure reliable pathogen inactivation. In healthcare, regulatory bodies require UV surface disinfection to reduce healthcare-associated infections, contributing to heightened adoption in clinical settings.

Parallel to regulatory momentum, recent advancements in UV-C LED technology are significantly transforming the market. These mercury-free LEDs deliver peak germicidal wavelengths aligned with microbial DNA absorption, achieving higher disinfection efficiency than traditional mercury lamps. Innovations such as Toyoda Gosei’s 200-milliwatt single-chip LEDs with instant on/off functionality eliminate warm-up delays and substantially reduce energy consumption. The extended operational lifespan of UV-C LEDs, over 30,000 hours versus 5,000–9,000 hours for mercury lamps, reduces replacement needs and lifecycle costs. UV-C LEDs also meet the increasingly stringent environmental regulations, including the European Union (EU)’s mercury ban starting in 2027, making them essential for sustainable and cost-effective disinfection solutions worldwide.

UV disinfection systems require significant capital investment, especially for municipal and large industrial applications, which can limit adoption in budget-constrained areas. Complete installations, including reactors, quartz sleeves, ballasts, cooling systems, and sensors, cost millions and require specialized engineering for industrial wastewater treatment, adding substantial costs. Retrofits add further expenses due to infrastructure modifications and compatibility testing. Installation, commissioning, and staff training demand additional resources, and energy upgrades might be needed for high-capacity systems.

Effectiveness of UV disinfection heavily depends on water quality, particularly turbidity and UV transmittance, necessitating extensive pretreatment with filtration and sedimentation. UV treatment inactivates microorganisms but cannot remove particulates or dissolved contaminants, so a dual-barrier approach is essential. High turbidity blocks UV light, requiring continuous monitoring and maintenance to prevent efficiency loss due to scaling and biofilms, which increase operational complexity and costs.

Rapid industrialization in Asia Pacific, Africa, and Latin America is intensifying water scarcity while highlighting gaps in established treatment infrastructure, creating significant growth opportunities for UV disinfection technologies. Government-led projects in India such as the Clean Ganga Mission and Pradhan Mantri Jal Jeevan Mission are driving massive investments to provide safe drinking water for over a billion people. Similarly, China’s Healthy China 2030 program has prioritized advanced disinfection technologies, leading to increased UVC adoption in hospitals and municipal water systems. Moreover, countries in Southeast Asia are applying UV disinfection to public transport and water reuse initiatives, improving pathogen control in critical urban and agricultural settings.

The healthcare sector is providing additional momentum to the market, with rising awareness of healthcare-associated infections prompting widespread use of UV surface disinfection equipment. Hospitals are deploying mobile UV robots achieving high pathogen reduction rates, especially in patient rooms and operating theaters, complementing traditional cleaning methods. Portable UV sterilization chambers provide chemical-free disinfection of medical devices and protective equipment without harmful residues, facilitating safer clinical environments. This sector’s growth is fueled by modernization efforts, increasing infection control standards worldwide, and heightened post-pandemic hygiene protocols.

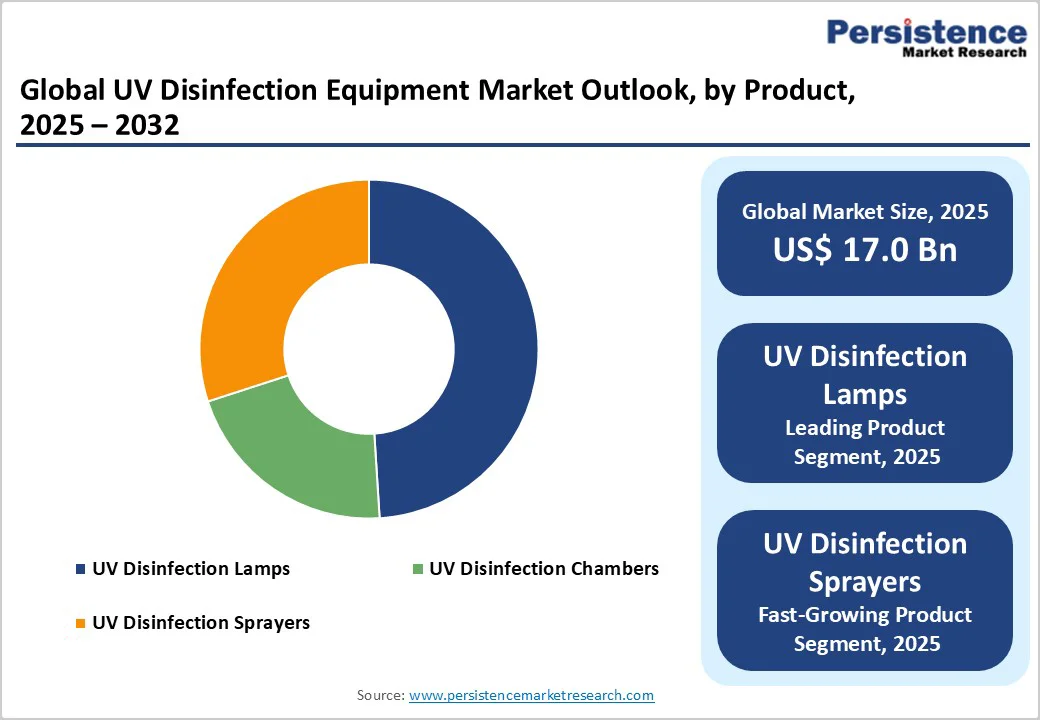

UV disinfection lamps currently hold a dominant share, accounting for approximately 38.5% of the revenue share in 2025 due to their proven efficacy at the 254 nm wavelength and cost-effectiveness in municipal and industrial water treatment applications. Long-life amalgam lamps are widely used in large-scale systems, benefiting from extensive installed bases that drive steady replacement demand. Although medium-pressure lamps offer broader UV coverage, the emerging UV-C LED technology is gaining favor for compact and energy-efficient systems, signaling a gradual shift away from traditional mercury-based lamps.

Portable UV disinfection sprayers represent the fastest-growing category within the market, fueled by their increasing adoption in healthcare, hospitality, and commercial sectors seeking mobile and chemical-free surface sterilization solutions. Compact UV-C LED handheld devices and consumer sterilizers are rapidly expanding, especially in emerging economies where affordable, decentralized disinfection is crucial. This segment is projected to reach billions in value by 2033, driven by the demand for flexible, battery-operated disinfection tools that complement fixed UV systems.

Water and wastewater disinfection lead with about 48.5% of the UV disinfection equipment market revenue share in 2025, driven by strict regulatory standards ensuring municipal water safety and industrial effluent compliance. UV systems are widely used to inactivate chlorine-resistant pathogens, with applications spanning municipal utilities, wastewater treatment plants, and industries such as food, pharmaceuticals, and semiconductors. Water scarcity in regions such as the Middle East, North Africa, and Australia fuels investment in UV-enabled reuse infrastructure, pushing the market toward substantial growth by 2032.

Surface disinfection is set to emerge as the fastest-growing application through 2032, supported by healthcare infection control efforts, widespread adoption of autonomous UV robots, and increasing use of UV-C LED technology in hospitals, airports, and commercial spaces. This segment complements water disinfection markets by providing effective and chemical-free solutions for reducing pathogens on high-touch surfaces, contributing significantly to overall market expansion in the coming years.

Online retailers dominate the UV disinfection equipment market with a 44.2% share, capitalizing on consumer preferences for convenience, product transparency, and rapid delivery across both residential and commercial segments. E-commerce platforms facilitate easy product comparisons, access to customer reviews, and subscription-based purchases of replacement components such as lamps, sleeves, and filters, generating consistent recurring revenue streams. Social media-driven direct-to-consumer marketing campaigns further amplify brand awareness and engagement, particularly within the residential market. Additionally, hybrid sales models are increasingly adopted for complex municipal and industrial UV systems, which require specialized technical consultation and project support.

Wholesalers and distributors represent the fastest-growing channel, fueled by the increasing demand for professional installation and compliance-driven procurement. Regional distributors enhance the customer experience by offering faster service responsiveness and value-added offerings like system design, operator training, and ongoing maintenance support. These services are especially critical for municipal and industrial clients in emerging markets, where regulatory compliance and infrastructure modernization are paramount, driving sustained growth and deeper market penetration.

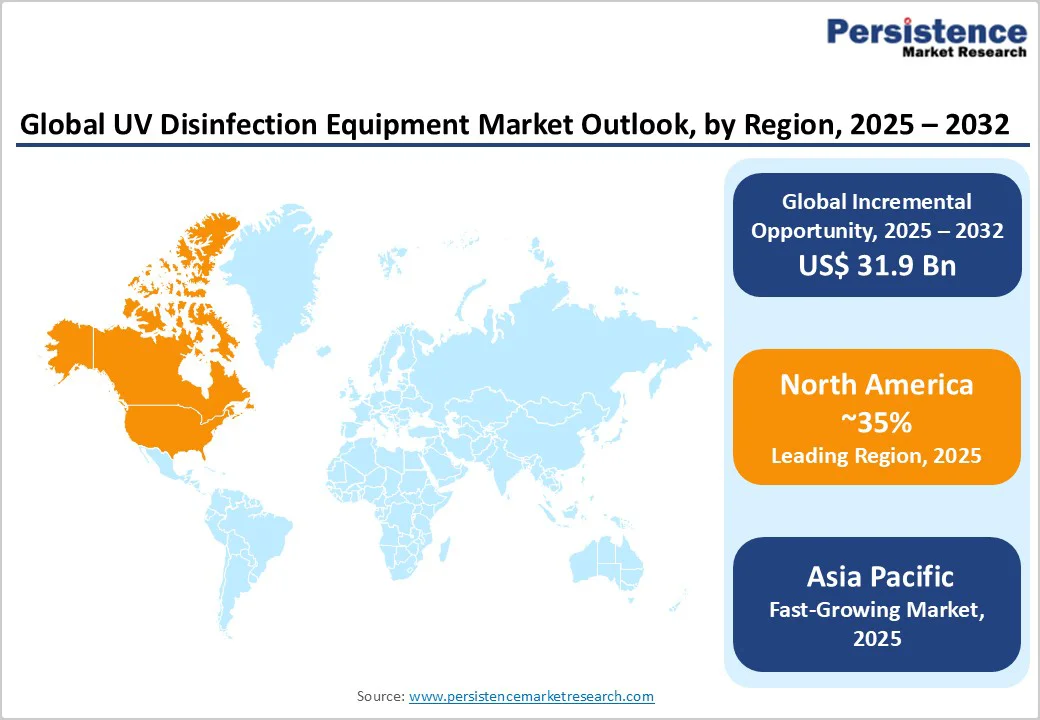

The North America UV disinfection equipment market is valued at approximately US$ 5.95 billion in 2025, boosted by stringent EPA regulations, healthcare infection control mandates, and ongoing infrastructure modernization. The U.S. dominates this market, supported by strong EPA guidelines that regulate UV dose and performance across thousands of municipal water treatment systems. Major cities such as Los Angeles, Chicago, and New York are advancing large-scale UV projects aimed at reducing chemical disinfectants and targeting chlorine-resistant pathogens. The healthcare sector accounts for a substantial portion of the demand, while residential UV sterilizers are gaining popularity through online retail channels.

Canada contributes steady growth through investments in water treatment infrastructure, supported by key industry players such as Xylem, Trojan Technologies, and Atlantic Ultraviolet, who focus on smart, energy-efficient UV systems. Together, these drivers create a robust regional market poised for continued expansion, fueled by regulatory support, public health concerns, and technological advancements in UV disinfection solutions.

The market for UV disinfection equipment in Europe is projected to grow steadily during the 2025-2032 forecast period, driven by stringent environmental regulations and strong demand for sustainable, chemical-free disinfection technologies. Germany leads the regional market with a 28% share, supported by rigorous DVGW standards mandating UV use in drinking water and robust product validation. The U.K. follows with 22% of the market, fueled by NHS healthcare standards, Drinking Water Inspectorate protocols, and infrastructure modernization. Other large European economies such as France and Spain are accelerating adoption by aligning with EU Water Framework Directive requirements, particularly in food and beverage applications.

Key industry players such as Halma plc, Industrie De Nora, and Heraeus Noblelight are capitalizing on this growth by innovating with UV-C LED technology, IoT-enabled solutions, and environmentally friendly designs. The growing focus on Europe’s green transition is also driving interest in portable and far-UV disinfection systems, reflecting broader trends toward smart, integrated applications across healthcare, water treatment, and commercial sectors. These factors contribute to a robust market poised for continued expansion through 2032 and beyond.

Asia Pacific is the fastest-growing regional market for UV disinfection equipment market, expected to register a robust CAGR between 2025 and 2032. This rapid growth is driven by factors including urbanization, acute water scarcity, and significant government infrastructure investments. China holds the largest regional share, supported by initiatives such as Healthy China 2030 and increased UV-C adoption in hospitals. India exhibits the highest growth rate, propelled by government programs such as the Jal Jeevan and Clean Ganga missions. Japan experiences steady growth through grid modernization and UV-C LED innovations, while ASEAN countries expand UV system adoption across municipal, industrial, and healthcare sectors.

The expansion of the regional market is finding further acceleration from its strong manufacturing capabilities, lower production costs, and the integration of IoT-enabled smart water solutions. These dynamics position Asia Pacific as a key player in the UV disinfection market, with substantial opportunities for new and existing stakeholders as demand for effective, energy-efficient, and sustainable disinfection technologies continues to rise.

The global UV disinfection equipment market landscape is being shaped by rapid technological innovation, increasing regulatory requirements, and growing demand across healthcare, water treatment, and commercial sectors. Leading players are focusing on developing intelligent disinfection solutions that leverage AI-powered monitoring and automation to enhance efficiency and ensure consistent pathogen inactivation. The market is also seeing a shift toward sustainable, green technologies, such as mercury-free UV-C LEDs, which offer improved energy efficiency and longer lifespans, positioning companies to meet stricter environmental standards.

Key industry leaders including Trojan Technologies, Xylem, Halma plc, and Heraeus Noblelight dominate the market by combining strong global distribution networks with advanced product portfolios. These companies invest heavily in R&D to integrate IoT capabilities and smart system controls, enabling remote management and predictive maintenance. Smaller innovative firms are also gaining traction by focusing on niche applications and portable disinfection devices, further intensifying competition and fostering continuous product improvement across the market.

The global UV disinfection equipment market is projected to reach US$ 17.0 billion in 2025.

The growing need for safe, chemical-free, and efficient disinfection solutions across water, air, and surface treatment applications is primarily driving the market.

The market is poised to witness a CAGR of 16.3% from 2025 to 2032.

Technological advancements in UV-C LED technology, government investments in water treatment infrastructure, especially in emerging markets, growing need for chemical-free disinfection solutions across water, healthcare, and industrial sectors, and the adoption of smart water infrastructure are key market opportunities.

Signify Holding, Hanovia Ltd, Calgon Carbon Corporation, and Xylem Inc. are some of the key players in the market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product

By Application

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author