ID: PMRREP15058| 336 Pages | 27 Feb 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

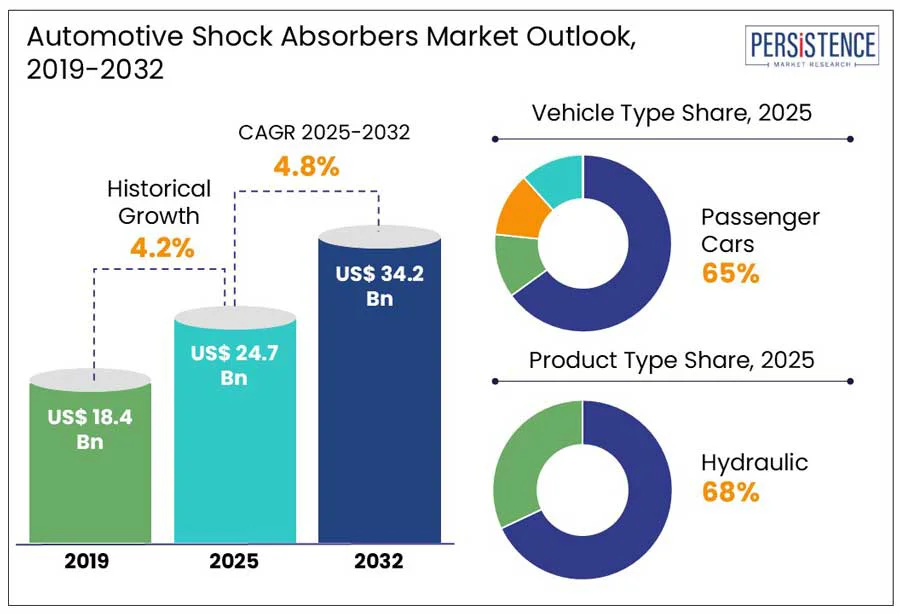

The global market revenue for automotive shock absorbers is expected to rise from US$ 24.7 Bn estimated in 2025 to US$ 34.2 Bn by the end of 2032. The market valuation is anticipated to secure a CAGR of 4.8% during the forecast period from 2025 to 2032.

|

Attributes |

Key Insights |

|

Market Size (2025E) |

US$ 24.7 Bn |

|

Projected Market Value (2032F) |

US$ 34.2 Bn |

|

Forecast Growth Rate (CAGR 2025 to 2032) |

4.8% |

|

Historical Growth Rate (CAGR 2019 to 2024) |

4.2% |

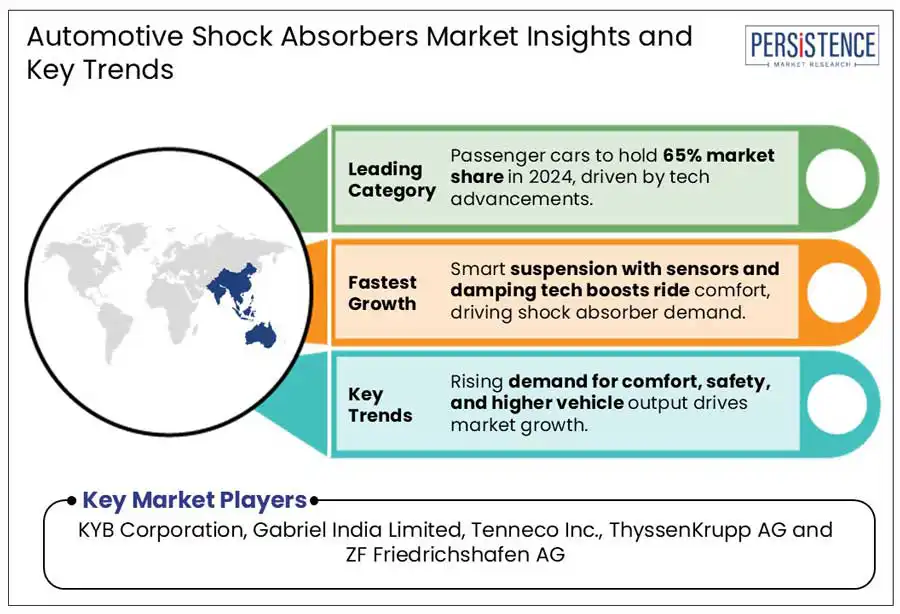

One of the key drivers for market growth is the increasing demand for passenger cars and light commercial vehicles, particularly in emerging economies such as China, India, and Brazil. Another factor contributing to the growth of the market is the increased focus on vehicle comfort and safety by consumers and manufacturers alike.

Since suspension systems play a critical role in ensuring a smooth and comfortable ride, shock absorbers have become an essential component in modern vehicles. Moreover, the growing trend of electric and hybrid vehicles is expected to provide further impetus to the growth of the market.

These vehicles require advanced suspension systems to accommodate the heavy batteries and provide a smooth and stable ride. The high cost of shock absorbers and the increasing adoption of air suspension systems in luxury vehicles may hinder the growth of the market in some regions.

Luxury vehicles use gas-filled twin-tube shock absorbers to enhance the comfort level and driving experience of these cars. There has been an increase in the demand for luxury cars manufactured by BMW, Audi, and Mercedes Benz, which is a driving factor for the automotive shock absorbers market.

Audi is working on a prototype for a shock absorber system called eROT (Electromechanical Rotary Dampers), in which hydraulic dampers are replaced with electromechanical rotary dampers for a comfortable ride.

Use of shock absorbers in automobiles is crucial for active safety or the prevention of collisions. They are in the charge of maintaining continuous pressure on the road and stabilizing the vehicle while driving.

A related issue is how a stretched car suspension reacts after a skid, which may lead to a road accident, whereas good shock absorbers keep a car rigid and enable it to be pulled out of a skid.

Historic Growth and Course Ahead

The automotive shock absorbers market has experienced steady growth driven by factors such as increasing vehicle production, technological advancements, and rising consumer demand for comfort and safety features.

The growth of the market was also affected by the COVID-19 pandemic crisis as there was a significant drop in the demand for these systems in 2020. Production activities for almost all industries, including manufacturing and transportation, were affected.

The market for the automotive shock absorbers is estimated to market for automotive shock absorbers expanded at a CAGR of 4.2% between 2019 and 2024. Growth is projected to exhibit a V-shape recovery as economic activities are back to pre-crisis levels post the containment of the pandemic. The automotive shock absorbers market is expected to continue its growth trajectory, albeit with some notable shifts and trends.

The rise of electric and autonomous vehicles will drive the demand for specialized shock absorbers designed to meet the unique requirements of these vehicle types, such as improved energy efficiency and enhanced stability during autonomous driving. Over the decade, sales of vehicle shock absorbers are expected to rise at a CAGR of 4.8%.

Key Trends Shaping the Market

High Demand for Premium & Luxury Automobiles, and Improved Ride Quality

Increasing population of high-net-worth individuals globally is driving the demand for premium and luxury automobiles. This market trend is attracting international players to invest and expand their presence.

With strategic activities like mergers and expansions, the market for automotive shock absorbers is expected to expand further, bringing new products to the market.

Customers’ attitudes about comfort and safety in the automotive industry have been evolving. Car suspension is crucial when considering the comfort of the driver and co-passengers. Shock absorbers are referred to as suspension assemblies in cars and offer greater comfort and reliability.

Increasing M&A Activity Between Key Manufacturers

Mergers and acquisition transactions may enable companies to expand their product portfolios by acquiring technologies, intellectual property, or product lines from other firms. This can allow companies to offer a broad range of shock absorber products to meet the diverse needs of customers.

These can result in economies of scale, allowing companies to reduce production costs through increased purchasing power, improved operational efficiency, and optimized supply chain management.

These cost savings can enhance competitiveness and profitability in the market. Mergers and acquisitions among key market players are allowing them to stay ahead in the market.

Focus on Advancements in Damping Valve Technology

Advanced damping valve technology allows for more precise control over damping forces, resulting in smoother and more comfortable rides for vehicle occupants. This improved ride quality is a significant selling point for consumers, driving demand for vehicles equipped with advanced shock absorbers.

A damping valve is fitted at the lower portion of a shock absorber to dampen shocks. Manufacturers of shock absorbers are concentrating on improving the damping effect for luxury vehicles through significant improvements in damping valve technology.

Modern damping valve technology often incorporates adjustable or adaptive features, allowing drivers to customize suspension settings according to their preferences or driving conditions. This customization capability appeals to enthusiasts and performance-oriented drivers, fueling demand for high-performance shock absorbers

Fluctuations in Raw Material Prices, and Need for Investment-Intensive R&D

Price competition is a significant challenge in the automotive shock absorbers market. Companies often face pressure to offer competitive pricing while maintaining profitability. Fluctuations in raw material costs, currency exchange rates, and intense competition can put downward pressure on shock absorber prices, influencing manufacturers' profit margins.

Rapid pace of technological advancements poses both opportunities and challenges for shock absorber manufacturers. Keeping up with the latest technologies, such as smart shock absorbers, connected systems, and advanced manufacturing processes, requires significant investments in research, development, and production capabilities.

Preferences and buying patterns of people are continually evolving, and companies must stay attuned to these changes. Factors such as increased demand for fuel-efficient shock absorbers, eco-friendly options, and enhanced performance create challenges for manufacturers to adapt their product offerings and meet consumers’ changing expectations.

Growing Demand for Electric and Hybrid Vehicles

The growing demand for better ride quality and comfort, improved safety features, and increased vehicle production rates are the key factors driving the growth of the market. The introduction of advanced technologies such as electronic shock absorbers and adaptive suspension systems is also expected to fuel the growth of the industry in the coming years.

In addition, the increasing demand for electric and hybrid vehicles is also expected to create opportunities. EVs, and HEVs have unique characteristics compared to traditional internal combustion engine vehicles, such as different weight distribution, lower center of gravity, and quieter operation.

Shock absorbers for EVs and HEVs thus need to be specifically designed to accommodate these differences, presenting an opportunity for manufacturers to develop specialized products tailored to the needs of these vehicles.

|

Country |

CAGR through 2032 |

|

China |

5.4% |

China to Reach Significant Market Share in Asia Pacific

Asia Pacific led the global shock absorber market in 2024. The market in Asia Pacific is projected record a significant CAGR in the forthcoming years. The market in the region is expanding with increasing automobile sales in China.

China has been aggressively promoting the adoption of electric vehicles and new energy vehicles to reduce air pollution, dependence on imported oil, and greenhouse gas emissions. As a result, there is a growing demand for shock absorbers designed for electric and hybrid vehicles, presenting opportunities for manufacturers in the Chinese market to capitalize on this trend.

The market in China is expected to reach US$5.3 Bn by 2032, expanding at a CAGR of 5.4% due to the ever-rising demand for automobiles in the country. Additionally, increasing focus on automotive safety features and implementation of emission norms in the country is further expected to boost market growth.

|

Vehicle Type |

CAGR through 2032 |

|

Light Commercial Vehicles |

4.6% |

LCVs Record the Maximum Deployment of Shock Absorbers

The light commercial vehicles segment is expected to expand at a CAGR of 4.6% from 2025 to 2032. This segment occupies a significant market share in 2023 due to its cost-effectiveness, high efficiency, and low maintenance requirements.

Passenger car shock absorbers or touring shock absorbers are the most common type for regular passenger cars. They are designed to provide a balance of comfort, handling, and durability for everyday driving.

Light truck shock absorbers or commercial vehicle shock absorbers are designed to withstand heavier loads and provide durability for vans, pick-up trucks, and light commercial vehicles. These shock absorbers have reinforced sidewalls and tread patterns suitable for commercial applications.

Commercial truck shock absorbers or heavy-duty shock absorbers are specifically designed for large trucks, buses, and other heavy commercial vehicles. They offer high load-carrying capacity, durability, and resistance to wear for long-haul transportation.

Companies invest heavily in research and development to develop advanced shock absorber technologies that offer superior performance, durability, and comfort. Key areas of innovation include adaptive damping systems, lightweight materials, electronic controls, and integration with vehicle dynamics systems.

The market is moderately fragmented, where Tier-I players hold 57% to 58% share of the global market. Gabriel India Limited, Tenneco Inc., ThyssenKrupp AG, KYB Corp., Mando Corporation, and Hitachi Astemo are considered leading players in the market operating with a vast global presence.

Market participants are strategically focusing on the introduction of durable and lightweight materials as well as public and private investments in the automotive, aerospace, and wind turbine sectors to attain higher market shares.

Many companies in the automotive shock absorbers market pursue global expansion strategies to tap into new markets and diversify their revenue streams. This includes establishing manufacturing facilities, distribution channels, and strategic partnerships in emerging markets with high growth potential, such as China, India, and Southeast Asia.

The market is anticipated to secure a CAGR of 4.8% during the forecast period from 2025 to 2032.

High demand for premium & luxury automobiles and improved ride quality is a key factor for market growth.

Some of the top players operating in the market are Fabri-Tech Inc, Airtecnics, and Meech International.

China to reach significant market share in Asia Pacific.

Growing demand for electric and hybrid vehicles is a key opportunity in the market.

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

| Report Highlights |

|

|

Customization & Pricing |

Available upon request |

By Vehicle

By Product Type

By Technology

By Design

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author