ID: PMRREP34659| Upcoming | Format: PDF, Excel, PPT* | IT and Telecommunication

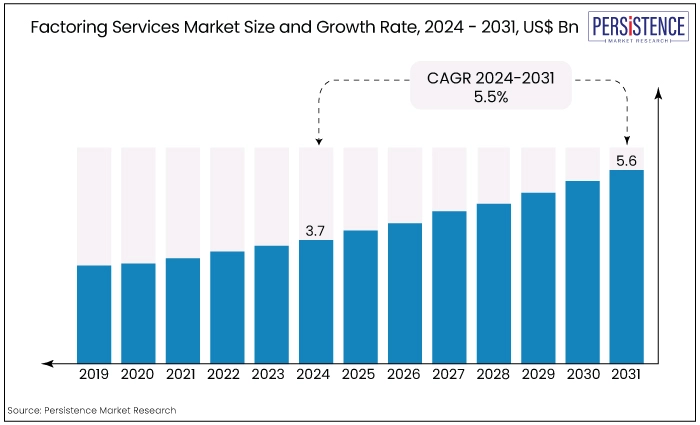

The Global market for factoring services is estimated to reach a valuation of US$5,680 Bn by the year 2031, at a CAGR of 5.5%, during the forecast period 2024 to 2031.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Market Size (2024) |

US$3,725 Bn |

|

Market Size (2031) |

US$5,680 Bn |

|

Forecast Growth Rate (CAGR 2024 to 2033) |

5.5% |

|

Historical Growth Rate (CAGR 2019 to 2023) |

4.8% |

Factoring is a financial service provided by banks or third-party financial service providers. It involves a seller trading their accounts receivables to a factor at a discounted rate to acquire funds.

In recent years, the factoring services market share has been consistently growing due to the rising need for alternative financing choices among small and medium firms. Factoring services provide firms with the opportunity to obtain working capital loans and mitigate credit risks.

Furthermore, the increasing utilization of cutting-edge technologies, such as Artificial Intelligence (AI) and machine learning, is expected to improve the detection of fraud risks, streamline the evaluation of insurance applications, generate cost savings in operations, and simplify payment procedures.

The market growth has been primarily driven by businesses' recognition of the advantages of factoring, the increasing globalization of commerce, and the growing number of small and medium-sized enterprises (SMEs) that are seeking flexible financing options.

Furthermore, advancements in technology have streamlined the process of factoring, enhancing its accessibility and efficiency for firms of various scales.

Fluctuations in the economy, modifications in regulations, and shifts in industrial patterns persistently impact the global factoring market size.

The period from 2019 to 2023 marked a transformative phase for the global factoring services market exhibiting a healthy growth rate of 4.8%, characterized by robust growth, technological advancements, and evolving regulatory landscapes.

As market participants navigate challenges and capitalize on growth opportunities, strategic alignment with digital trends and customer-centric solutions will be critical for achieving sustainable growth and competitive advantage in the market.

Further, the global factoring services market has experienced significant growth and transformation from 2019 to 2023, driven by evolving business needs, regulatory changes, and technological advancements in financial services.

Increased Adoption of Fintech Solutions

The adoption of fintech is being driven by the increasing awareness of the advancement of financial technology, including money transmission and payments, budgeting and financial planning, borrowing, saving and investment, and insurance.

Small business proprietors are encouraged to enter the market by the majority of payment service providers, who instil confidence in them.

For example, International Fintech, a licensed e-money institution and payment service provider, provides Fintech solutions for small business owners. These solutions include automated solutions for volume payments and related services in the financial sector.

An automated solution provided by Fintech solution providers is implemented due to the reluctance of the majority of institutions to issue numerous pay checks.

Fintech renders mass payment services at reasonable rates. This enables small and medium-sized enterprises (SMEs) to engage with fintech companies, thereby enhancing the return on investments (ROI) of the factors, including banks and third-party insurers.

Utilization of Blockchain Technology

The emergence of information technology has brought about a profound transformation in the global market.

An innovative solution in the financial sector has implemented automation in the transaction process inside the factoring services industry.

Furthermore, the implementation of automated solutions has not only bolstered the financial sector but also improved security and planning solutions.

The adoption of cryptographic solutions has enhanced the precision of transactions and safeguarded the sensitive information of both parties involved in the factoring process, namely the suppliers and purchasers, which has effectively mitigated the risk of financial fraud.

Unicsoft, a blockchain solution provider, has found several application areas where organizations are integrating blockchain technology in the factoring process.

Furthermore, the factory procedures greatly depend on the secure and efficient workflow process. Thus, the incorporation of blockchain technology improves financial transactions in the factoring business by utilizing a centralized and encrypted approach and integrating smart contracts.

Ethereum, NEO, Hyperledger, and R3CORDA are examples of open blockchain platforms. Among these options, the Ethereum platform is the most favoured.

The platform facilitates the decentralized storage and execution of a smart contract, where the hashing process is performed locally. The processed data is subsequently made public, which contributes to enhancing network security and catering to the growth of the factoring services market size.

Stringent Regulatory Policies

The legal framework governing the factoring services market can vary significantly across countries.

Complexities and uncertainties in regulations can create challenges for factoring companies. Different countries may have varying licensing requirements for factoring services market companies, making it difficult for them to operate in new markets.

Staying compliant with evolving regulations can be expensive and time-consuming for factoring companies. Some regulations might restrict the types of transactions allowed or the fees that can be charged, limiting the flexibility of factoring services.

This complex regulatory landscape discourages some factoring services companies from entering new markets, hindering overall market expansion.

Businesses seeking factoring services might also be discouraged by the lack of transparency or predictability in regulations across different regions.

Economic Conditions

The market relies heavily on the creditworthiness of both the seller (who sells the invoices) and the buyer (who owes the money).

During economic downturns, there's a higher risk of buyer defaults on invoices. This can lead to losses for factoring companies and make them more cautious about offering factoring services, especially to companies in risky sectors.

In times of economic hardship, businesses may have difficulty accessing traditional financing options. This could potentially increase the factoring services demand. However, factoring companies might be more selective due to the higher risk of defaults.

Economic fluctuations can create uncertainty and instability in the factoring market, hindering its overall growth.

Further, factoring companies might need to adjust their pricing or risk assessment strategies based on economic conditions, potentially making factoring services less attractive to some businesses.

Increased Open Account Trading

The market for open accounts in small and medium enterprises (SMEs) is growing due to the expansion of the manufacturing industry in Asian countries and the increasing demand among start-ups and SMEs for an alternative source of finance.

Furthermore, BFSI organizations are embracing and advancing machine learning methodologies to scrutinize vast amounts of data and provide relevant insights to clients.

Furthermore, the market is experiencing growth due to the increased investments in artificial intelligence and sophisticated machine learning by fintech companies and banks.

These investments aim to improve the automation process and provide customers with a more efficient and tailored experience.

Furthermore, the acquisition of financial resources for small and medium-sized enterprises (SMEs) supports their trade activities. This includes assisting with various payment methods such as cash advances, letters of credit, documented collections, and open accounts. Therefore, this drives the expansion of the factoring service industry.

Domestic Factoring Services Dominate 68% Market Share

|

Market Segment by Factoring Type |

Market Value Share 2024 |

|

Domestic |

68% |

Based on factoring type, the global factoring services market is further segmented into domestic and international, where the domestic segment dominates the market with around 65% of the total market share.

Domestic factoring dominates over international factoring due to limitations in geographic coverage and legal obstacles.

The demand for factoring services inside domestic markets is experiencing significant growth in emerging economies, mostly due to the rapid increase in small and medium-sized enterprises (SMEs) in developing nations. These firms are essential in boosting the country's GDP growth.

Nevertheless, this form of business has a shortage of financial backing, which poses a significant obstacle for them and has resulted in the closure of some SMEs.

SMEs Continue to be in the Bandwagon

|

Market Segment by Enterprise Size |

Market Value Share 2024 |

|

Small & Medium Enterprise |

58% |

Based on enterprise size, the market is further segmented into small & medium enterprises and large enterprise, where the small & medium enterprises segment dominates the market.

SMEs that operate in sectors they are not familiar with sometimes encounter difficulties in obtaining inexpensive financial resources. Consequently, small and medium-sized enterprises SMEs are increasingly using factoring services, which is contributing to the growth of the market.

Factoring is designed to facilitate small and medium-sized enterprises SMEs access to trade finance and enhance their involvement in value chains.

It distinguishes itself from both typical bank lending and asset-based lending by not creating any debt on the company's financial statement and having no outstanding loans. This facilitates small and medium-sized enterprises SMEs in generating money without any onerous obligations.

Creating a substitute for financial services is crucial for small and medium-sized enterprises SMEs that continue to have challenges in obtaining bank loans.

Certain entrepreneurs may have a deficiency in financial acumen, strategic foresight, and the ability to secure alternative financing options, which consequently limits their access to possible investors.

Therefore, the utilization of factoring enables SMEs to advance their business, resulting in an increased rate of adoption of factoring services.

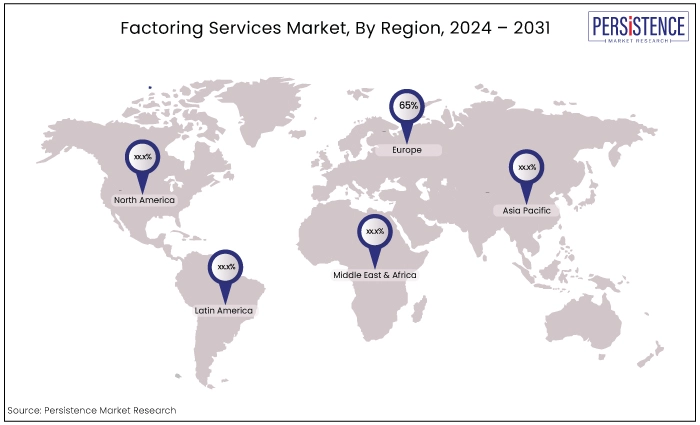

Europe Dominates, Accounts for 65% Share

|

Region |

Market Value Share 2024 |

|

Europe |

65% |

The European factoring services market held a market value share of 65% over the forecast period. It is projected to experience a healthy compound annual growth rate from 2024 to 2031.

The demand for factoring services in Europe is increasing due to the substantial industrial base in sectors such as autos, manufacturing, energy, agriculture, and food processing.

Recent events, such as the Russia-Ukraine conflict and economic downturn, have had a significant impact on small-scale dealers in the market.

Consequently, there is a substantial increase in demand for factoring services in the region to fulfil their immediate financial requirements and uphold business liquidity.

The North American factoring services market is projected to experience substantial growth, with a CAGR of 10.0% from 2024 to 2031.

Factoring services companies in North America, such as Porter Capital, REV Capital, and RTS Financial Service, Inc., are focusing on providing factoring services specifically designed for speciality sectors like transportation, staffing, and advertising.

By specializing, these organizations have a deeper understanding of their client's distinct requirements and difficulties, which enables them to offer tailored financial solutions and other services that add value.

March 2023

BNP Paribas S.A. partnered with Hokodo to launch a B2B BNPL platform to provide the best cash management and factoring services to major global factoring services companies.

June 2023

Mizuho EMEA launched the eighth and ninth funds, named Stratum VIII and IX, as part of Stratum Investments.

May 2024

ABN AMRO Bank N.V. finalized a deal with Fosun International to purchase Hauck Aufhäuser Lampe, a German-based private banking firm to become a prominent participant in offering banking services to individual clients, family-owned businesses, and institutional clients throughout the country.

The global factoring services market is becoming highly competitive, with several leading financial companies providing better commercial opportunities to their end consumers while utilizing new and high-end technologies in different categories.

Major players in the factoring services industry are utilizing high-end machinery to pacify their production with smart and automated machining tools, which eventually cater to evolving consumer needs.

The global factoring services market is estimated to exhibit a CAGR of 5.5% during the forecast period.

Europe is the leading region in the market.

The global machine tools market is segmented based on factoring type, provider type, enterprise size and end users.

Barclays Bank PLC, BNP Paribas, China Construction Bank Corporation, Deutsche Factoring Bank, and Eurobank are some of the major key companies in the market.

Domestic factoring is the dominant factoring type.

|

Attributes |

Details |

|

Forecast Period |

2024 - 2031 |

|

Historical Data Available for |

2019 - 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Companies Profiled |

|

|

Pricing |

Available upon request |

By Factoring Type

By Provider Type

By Enterprise Size

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author