ID: PMRREP34819| 245 Pages | 5 Feb 2026 | Format: PDF, Excel, PPT* | Healthcare

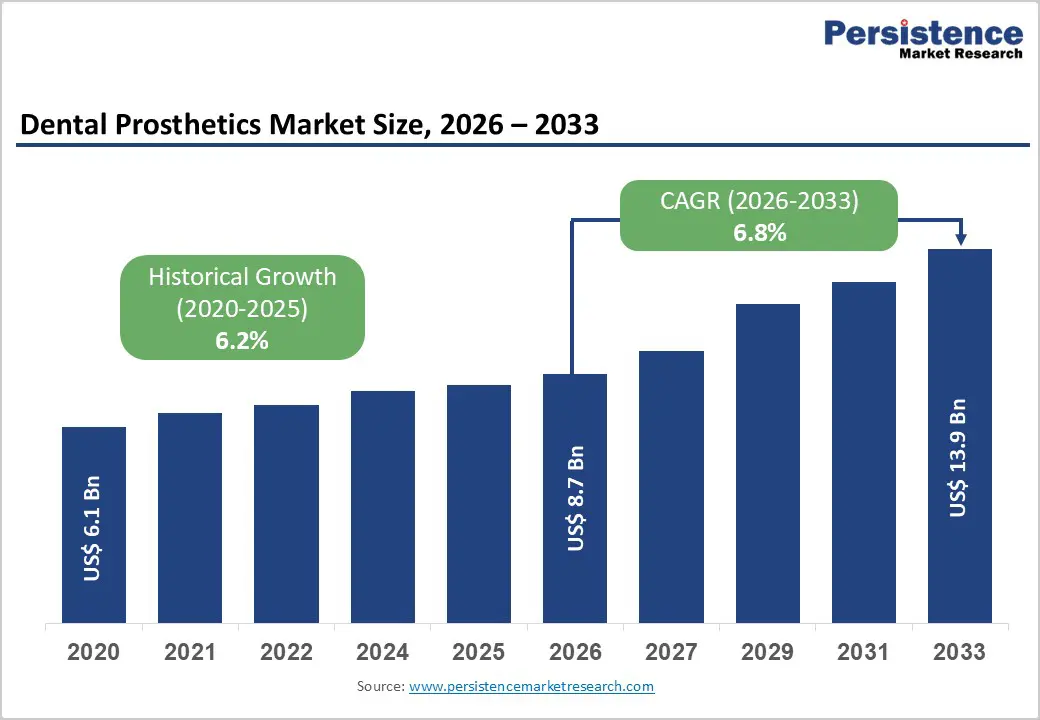

The global dental prosthetics market size is expected to be valued at US$ 8.7 billion in 2026 and projected to reach US$ 13.9 billion by 2033, growing at a CAGR of 6.8% between 2026 and 2033.

This robust expansion reflects the convergence of demographic shifts, technological innovations, and evolving consumer preferences toward aesthetic and functional dental solutions. The market's growth trajectory is primarily driven by the accelerating global aging population, which experiences higher susceptibility to dental conditions, including edentulism, periodontal diseases, and tooth decay, necessitating comprehensive prosthetic interventions. Simultaneously, the integration of digital dentistry technologies such as Computer-Aided Design/Computer-Aided Manufacturing (CAD/CAM) systems, 3D printing, and advanced biomaterials, including zirconia and high-performance ceramics has revolutionized prosthetic fabrication, enabling unprecedented precision, customization, and treatment efficiency while significantly reducing turnaround times and enhancing patient satisfaction.

| Global Market Attributes | Key Insights |

|---|---|

| Dental Prosthetics Market Size (2026E) | US$ 8.7 billion |

| Market Value Forecast (2033F) | US$ 13.9 billion |

| Projected Growth CAGR (2026-2033) | 6.8% |

| Historical Market Growth (2020-2025) | 6.2% |

Accelerating Global Geriatric Population and Rising Prevalence of Dental Disorders

The exponential growth of the worldwide elderly population represents a fundamental catalyst propelling dental prosthetics demand across all geographic markets. According to the World Health Organization (WHO), approximately 3.5 billion people globally suffer from oral diseases, with 2 billion individuals experiencing cavities in permanent teeth and 514 million children affected by primary teeth cavities. The geriatric demographic, particularly individuals aged 65 years and above, demonstrates significantly elevated incidence rates of edentulism, tooth decay, and periodontal diseases, creating sustained demand for dentures, bridges, crowns, and implant-supported prosthetics. Research indicates that among geriatric populations, between 69% to 77% require some form of prosthetic treatment, with unmet prosthetic needs particularly acute in lower socioeconomic categories and developing regions. This demographic tsunami, combined with increased life expectancy and improved healthcare access, ensures continuous market expansion as aging populations in North America, Europe, and rapidly maturing markets in Asia Pacific seek functional and aesthetic dental rehabilitation solutions.

Digital Dentistry Revolution and Advanced Manufacturing Technologies

The transformative adoption of digital workflows and additive manufacturing technologies has fundamentally restructured dental prosthetics production, delivery, and clinical outcomes. CAD/CAM technology enables precise digital scanning, virtual prosthetic design, and automated milling or printing, reducing fabrication time from weeks to hours while achieving micrometer-level accuracy unattainable through traditional methods. 3D printing technologies , including Stereolithography (SLA), Digital Light Processing (DLP), and Selective Laser Sintering (SLS) facilitate on-demand, highly customized prosthetic production with complex geometries and patient-specific anatomical precision. The integration of intraoral scanners eliminates uncomfortable physical impressions, improving patient experience while generating precise digital models for prosthetic fabrication. Industry reports indicate that digital dentistry adoption has grown by over 40% in urban clinics within the last three years in emerging markets like India, while established markets demonstrate near-universal adoption among prosthodontic specialists. These technological advancements, combined with innovations in biomaterials such as zirconia-based ceramics offering 900-1,200 MPa bending strength and superior biocompatibility, are enabling minimally invasive procedures, accelerated treatment timelines, and significantly improved aesthetic outcomes, thereby expanding market accessibility and patient acceptance.

High Treatment Costs and Limited Insurance Coverage

The substantial financial burden associated with advanced dental prosthetics represents a significant market constraint, particularly in price-sensitive emerging economies and among middle-income populations in developed nations. Premium prosthetic solutions, including zirconia crowns, porcelain veneers, and implant-supported bridges, command pricing that often ranges from US$ 1,500 to US$ 4,000 per unit in developed markets, with complete full-mouth rehabilitations exceeding US$ 30,000, placing these treatments beyond the financial reach of substantial population segments. Despite the clinical superiority and longevity of modern prosthetics, limited dental insurance coverage for cosmetic and elective procedures further exacerbates accessibility challenges, with many insurance plans providing minimal or no reimbursement for veneers, aesthetic crowns, or implant-based solutions. This cost barrier is particularly pronounced in developing regions where out-of-pocket healthcare expenditure remains the predominant payment mechanism, constraining market penetration despite high clinical need and demographic drivers favoring prosthetic adoption.

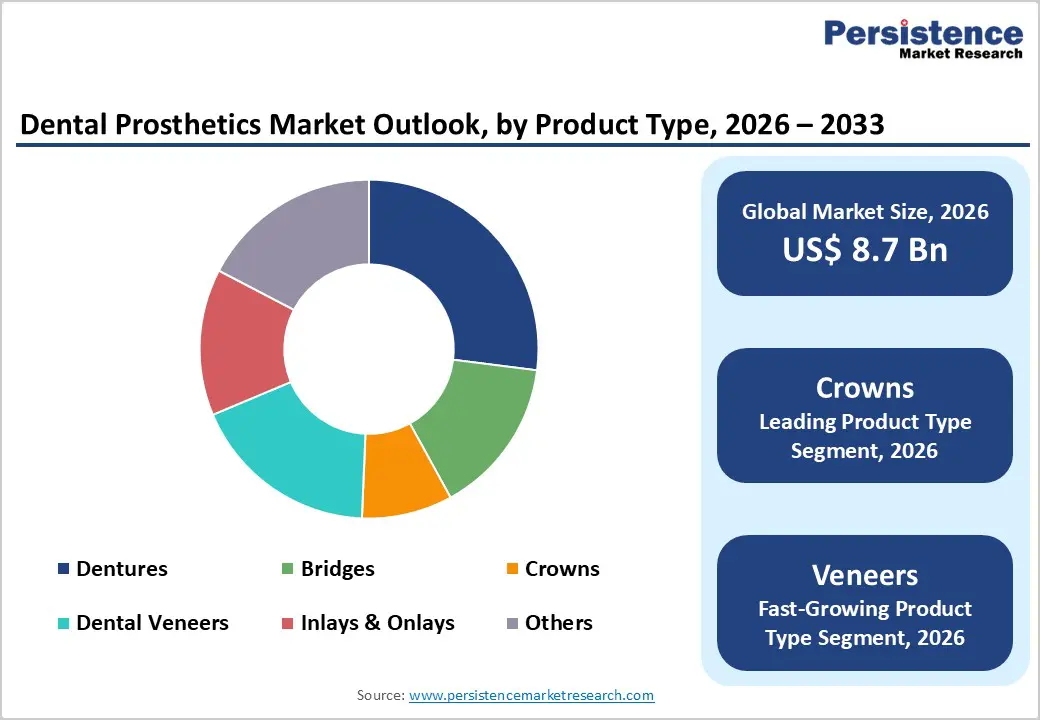

Explosive Growth in Aesthetic Dentistry and Cosmetic Procedures

The surging global emphasis on personal appearance, dental aesthetics, and smile enhancement presents extraordinary growth opportunities for dental prosthetics manufacturers and service providers, particularly in the rapidly expanding dental veneers and cosmetic crowns segments. Research indicates that approximately 65% of cosmetic dental procedures now involve veneers, with over 55% of patients under age 40 preferring veneers for smile corrections, demonstrating robust demand among economically active, image-conscious consumers. The proliferation of digital platforms, visual-centric social media, and celebrity endorsement of cosmetic dentistry has normalized aesthetic dental procedures, transforming them from luxury treatments to accessible mainstream services. Manufacturers innovating in ultra-thin, minimally invasive veneer technologies, advanced porcelain formulations, and rapid-delivery CAD/CAM systems enabling same-day veneer placement are positioned to capture substantial market share as cosmetic dentistry transitions from niche specialty to core prosthodontic practice, particularly in North America, Europe, and affluent Asia Pacific metropolitan centers.

Dental Tourism Expansion and Emerging Market Penetration

The exponential growth of dental tourism, particularly flows from North America and Europe toward Asia Pacific destinations including Thailand, India, South Korea, and Malaysia, represents a transformative market opportunity for prosthetics providers and specialized dental centers. Patients increasingly pursue overseas dental care to access cost-effective, high-quality prosthetic treatments at 40-70% cost savings compared to domestic pricing, with dental tourism procedures encompassing complex full-mouth rehabilitations, multiple implant placements, and comprehensive veneer treatments that would be prohibitively expensive in origin countries. India alone has witnessed significant dental tourism growth, supported by government initiatives such as the National School Oral Health Programme launched in July 2024 by the Indian Dental Association with Hindustan Unilever Limited and Sri Ramachandra Dental College, enhancing oral health awareness and infrastructure development. Simultaneously, emerging markets including China, Indonesia, Philippines, Vietnam, and Latin American nations demonstrate rapidly expanding middle-class populations with growing disposable incomes, improved healthcare access, and increasing awareness of oral health importance, creating vast untapped markets for affordable, quality dental prosthetics. Companies establishing strategic manufacturing facilities, distribution networks, and clinical training partnerships in these high-growth regions while simultaneously developing value-engineered prosthetic solutions tailored to emerging market price sensitivities are positioned to achieve disproportionate growth and market share gains throughout the forecast period.

Crowns dominate the dental prosthetics market, commanding approximately 27% market share in 2025, establishing themselves as the most clinically versatile and widely adopted prosthetic solution across restorative and cosmetic applications. Dental crowns function as protective caps that reconstruct tooth appearance, strength, size, and shape, addressing diverse clinical scenarios including severe tooth decay, fractures, post-root canal protection, implant coverage, and aesthetic enhancement. The segment's leadership position reflects the universal applicability of crowns across patient demographics, clinical indications, and treatment philosophies, coupled with favorable reimbursement frameworks in many insurance systems compared to purely cosmetic solutions.

Restorative Dentistry constitutes the dominant application segment, holding approximately 42% market share in 2025, reflecting the fundamental clinical imperative of restoring oral function, structural integrity, and basic aesthetics in patients suffering from dental caries, periodontal disease, trauma, or congenital defects. Restorative procedures encompass comprehensive treatment modalities including crown placements for severely decayed or fractured teeth, bridge installations to replace missing teeth while maintaining arch integrity, complete and partial denture fittings for edentulous patients, and implant-supported rehabilitations for patients with sufficient bone volume. The segment's market leadership stems from several converging factors: the universal prevalence of dental diseases affecting 3.5 billion people globally according to WHO statistics; the clinical necessity of restorative interventions for maintaining mastication function, preventing further tooth loss, and preserving facial aesthetics; and favorable insurance coverage frameworks that typically provide substantial reimbursement for medically necessary restorative procedures compared to elective cosmetic treatments. The accelerating global geriatric population particularly drives restorative demand, as elderly individuals demonstrate significantly higher incidence of tooth loss, with studies indicating 69-77% of geriatric patients requiring prosthetic interventions. Moreover, lifestyle factors including smoking, poor dietary habits, and inadequate oral hygiene prevalent in both developed and developing nations continuously replenish the patient pool requiring restorative solutions, ensuring sustained, recession-resistant demand for restorative prosthetics across all economic conditions and geographic markets.

Dental Hospitals & Clinics represent the predominant end-user segment, capturing approximately 57% market share in 2025, functioning as the primary access points where patients receive comprehensive diagnostic evaluation, treatment planning, prosthetic fabrication, and post-placement care across the full spectrum of prosthetic solutions. These facilities range from small independent dental practices to large multi-specialty hospital dental departments, collectively performing the vast majority of prosthetic procedures globally. The segment's dominance reflects several structural factors: the essential role of qualified dental professionals in prosthetic treatment delivery; the requirement for specialized equipment including intraoral scanners, CAD/CAM systems, and dental laboratories for prosthetic fabrication; and patient preferences for established clinical relationships and accessible care locations. The proliferation of Dental Service Organizations (DSOs), particularly in the United States, United Kingdom, Spain, and Southeast Asian countries, has accelerated this trend by enabling economies of scale, enhanced purchasing power for advanced technologies, and standardized treatment protocols across multiple locations. DSOs leverage private equity funding to make substantial investments in cutting-edge dental technologies including digital workflows, 3D printing capabilities, and premium prosthetic materials, thereby expanding access to advanced prosthetic solutions while maintaining competitive pricing through operational efficiencies. Additionally, the integration of dental tourism facilities, which function as specialized dental hospitals catering to international patients seeking cost-effective treatments, particularly in Thailand, India, Mexico, and Turkey, further reinforces the dental hospitals and clinics segment's market dominance and growth trajectory.

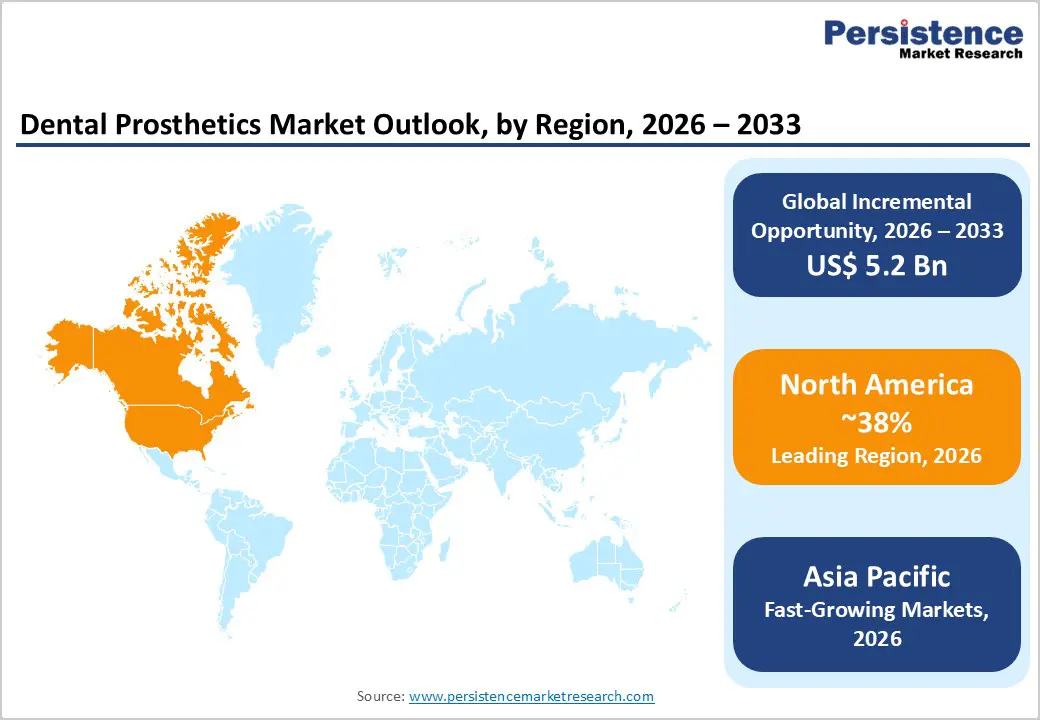

North America maintains clear market leadership, commanding approximately 38% global market share in 2025, anchored by the region's sophisticated healthcare infrastructure, substantial healthcare expenditure, advanced insurance frameworks, and early adoption of innovative dental technologies. The United States specifically drives regional performance, supported by a robust network of over 200,000 practicing dentists, widespread DSO penetration enabling technology investments, and consumer willingness to invest in premium prosthetic solutions including zirconia crowns, porcelain veneers, and implant-supported rehabilitations.

The region's demographic profile strongly supports sustained growth, with the 65-74 years age cohort demonstrating the largest absolute increase in dental implant prevalence at 12.9%, while the 55-64 years segment exhibits approximately 1,000% relative growth in implant adoption. Projection models suggest dental implant prevalence among adults with missing teeth could reach 23% by 2026, substantially expanding the addressable market for prosthetic components and related services. Regulatory frameworks including FDA oversight ensure product safety and efficacy while fostering innovation through streamlined approval pathways for novel materials and digital technologies.

Asia Pacific is rapidly emerging as a high-growth region for the dental prosthetics market, driven by expanding middle-class populations, rising healthcare expenditure, and improving access to private dental care across countries such as China, India, South Korea, Thailand, and Indonesia. Increasing awareness of oral health, supported by government screening programs and professional dental associations, is boosting early diagnosis and restorative treatment rates. The region is also witnessing strong momentum in aesthetic dentistry, with growing demand for crowns, veneers, and implant-supported prosthetics among younger and urban consumers. Dental tourism hubs such as Thailand, Malaysia, and South Korea are attracting international patients seeking cost-effective yet high-quality prosthetic procedures, further strengthening regional demand.

Market Structure Analysis

The dental prosthetics market is highly competitive, characterized by the presence of large multinational manufacturers alongside numerous regional and specialty suppliers. Companies compete primarily on technology innovation, material quality, pricing strategies, and service support to dental clinics and laboratories. Players are also investing heavily in advanced ceramics, zirconia materials, and biocompatible implant components to meet rising demand for aesthetic and long-lasting solutions. Strategic partnerships with dental chains, laboratories, and distributors are becoming increasingly important for market access and volume growth. In emerging regions, local manufacturers are strengthening competitive pressure by offering affordable prosthetic alternatives, prompting global suppliers to expand regional manufacturing, training programs, and after-sales services to protect market share.

The global dental prosthetics market is expected to be valued at US$ 8.7 billion in 2026.

The dental prosthetics market experiences growth propelled by multiple converging factors: the accelerating global geriatric population with 69-77% of elderly patients requiring prosthetic interventions due to edentulism and periodontal diseases; technological revolution through digital dentistry with CAD/CAM systems and 3D printing enabling rapid, precise, customized prosthetic fabrication; rising aesthetic consciousness driving cosmetic dentistry demand with 65% of cosmetic procedures involving veneers and over 55% of patients under age 40 seeking aesthetic solutions; expanding dental tourism offering 40-70% cost savings in Asia Pacific destinations; and growing middle-class populations in emerging markets gaining healthcare access and oral health awareness across China, India, Southeast Asia, and Latin America.

North America leads the dental prosthetics market, holding the largest share due to advanced healthcare infrastructure, high dental expenditure, and mature insurance systems.

The key market opportunity in dental prosthetics lies in the explosive growth of aesthetic dentistry combined with dental tourism. Rising demand for cosmetic procedures like veneers, along with cost-effective treatments in emerging markets, creates significant growth potential for prosthetic manufacturers and specialized dental centers.

The dental prosthetics market features established multinational leaders, including Straumann Group, Dentsply Sirona, Nobel Biocare (Envista), Ivoclar Vivadent, etc.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage | North America, Europe, East Asia, South Asia and Oceania, Latin America, Middle East and Africa |

| Segmental Coverage | Product Type, Material, Application, End User, Region |

| Competitive Analysis | Straumann Group, Dentsply Sirona, Nobel Biocare (Envista Holdings), Ivoclar Vivadent, Zimmer Biomet, Henry Schein, GC Corporation, 3M, BioHorizons, Osstem Implant, Shofu, Planmeca, Glidewell Laboratories, DenMat, Ultradent Products, Hiossen Implant, Euroteknika, Bicon Dental Implants, Astra Tech Implant System |

| Report Highlights | Market Forecast and Trends, Competitive Intelligence & Share Analysis, Growth Factors and Challenges, Strategic Growth Initiatives, Pricing Analysis, & Future Opportunities and Revenue Pockets, Market Analysis Tools |

Product Type

Material

Application

End User

Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author