ID: PMRREP2882| 198 Pages | 4 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

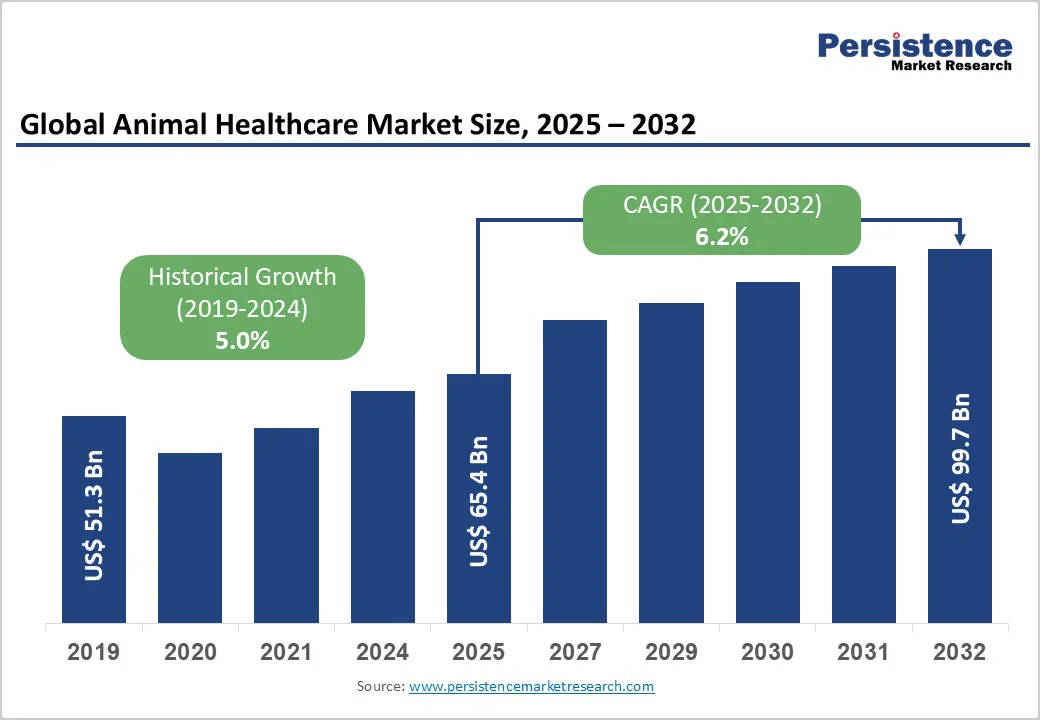

The global animal healthcare market size is valued at US$ 65.4 billion in 2025 and is projected to reach US$ 99.7 billion growing at a CAGR of 6.2% during the forecast period from 2025 to 2032.

Global demand for animal healthcare is increasing as the veterinary, pharmaceutical, and animal health industries expand the production of vaccines, biologics, and specialty therapeutics. Rising regulatory requirements for animal safety and quality, coupled with the growing adoption of advanced diagnostics and in-vitro testing methods, are fueling market growth. Additionally, the expansion of veterinary infrastructure, improved livestock management practices, and enhanced manufacturing capabilities in developing regions are increasing access to animal healthcare products and services.

| Key Insights | Details |

|---|---|

|

Animal Healthcare Market Size (2025E) |

US$ 65.4 Bn |

|

Market Value Forecast (2032F) |

US$ 99.7 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.0% |

The growing trend of treating pets as family members is significantly increasing per-animal spending on vaccines, diagnostics, specialty therapeutics, and wellness programs. This shift is expanding demand in companion-animal segments such as dermatology, pain management, and oncology, while driving steady revenue through preventive and subscription-based healthcare models.

The growing worldwide consumption of meat, dairy, and aquaculture products is prompting producers to enhance herd and flock health through vaccines, feed additives, diagnostics, and biosecurity measures to safeguard productivity and food safety. This is accelerating demand for veterinary pharmaceuticals and herd-level healthcare services, particularly in regions implementing intensive farming practices.

The steep prices of premium diagnostics, biologics, and specialized veterinary care pose significant barriers for low-income farmers and cost-conscious pet owners. In many regions, escalating veterinary consultation fees, coupled with labor shortages, force owners to opt for more affordable alternatives or postpone treatments altogether. This limits the adoption of higher-margin products and services, constraining overall market growth.

Moreover, numerous regions struggle with insufficient veterinary staff, limited clinic availability, and uneven access to diagnostics and cold-chain logistics. These challenges reduce the frequency of preventive care and diagnostic services and hinder the deployment of advanced therapies, especially in rural and low-income areas.

The increasing adoption of pet insurance, preventive care packages, and subscription-based wellness models is creating stable, recurring revenue streams for clinics and manufacturers offering bundled services such as diagnostics, vaccines, and digital monitoring. This encourages uptake of higher-value services, including specialty care and advanced medications, while enabling cross-selling opportunities in companion-animal segments.

Furthermore, emerging markets such as India, Southeast Asia, and Latin America are experiencing rapid growth due to rising disposable incomes, expanding intensive farming, and improving veterinary infrastructure. These regions present strong potential for affordable diagnostics, generic pharmaceuticals, and large-scale preventive healthcare programs tailored to local production systems.

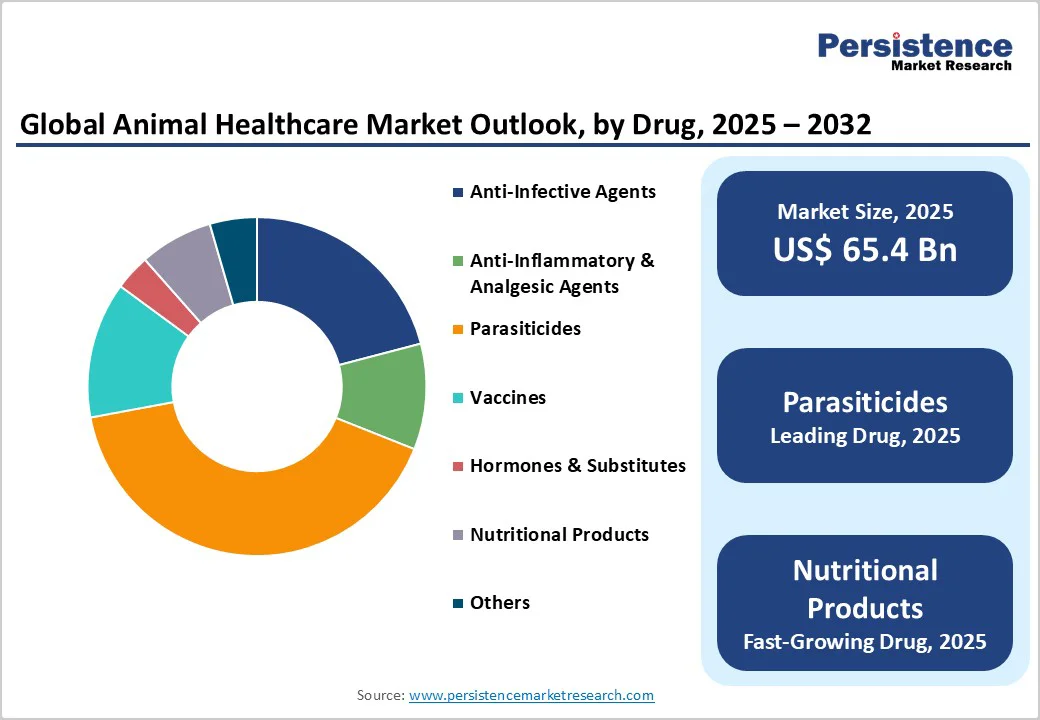

The parasiticides segment is projected to dominate the global animal healthcare market in 2025, accounting for a revenue share of 41.0%. The segment’s strong performance is primarily driven by the rising prevalence of parasitic infections in livestock and companion animals, which significantly affect productivity, health, and welfare. Increasing awareness among pet owners and farmers about the economic impact of parasitic diseases has accelerated the adoption of anthelmintics, ectoparasiticides, and endoparasiticides for effective control and prevention. Additionally, the development of long-acting formulations, broad-spectrum parasiticides, and combination therapies that offer convenience and enhanced efficacy is further supporting market expansion.

The companion animals segment is projected to dominate the global animal healthcare market in 2025, accounting for a revenue share of 59.5%. This is due to the rising trend of pet humanization, where owners increasingly treat pets as family members and invest heavily in their health and well-being. Growing awareness of preventive care, advanced diagnostics, specialty therapeutics, and wellness programs is boosting demand for veterinary services and products targeted at dogs, cats, and other companion animals. Additionally, expanding pet insurance coverage and subscription-based wellness models are further supporting the segment’s strong growth.

The oral segment is projected to dominate the global animal healthcare market in 2025, accounting for a revenue share of 43.0%. This is due to its ease of administration, cost-effectiveness, and wide acceptance of oral formulations among both companion and production animals. Oral medications, including antibiotics, antiparasitics, and nutritional supplements, offer convenient dosing without the need for specialized veterinary procedures, encouraging higher adoption. Additionally, growing awareness of preventive care and increasing demand for livestock productivity and pet health.

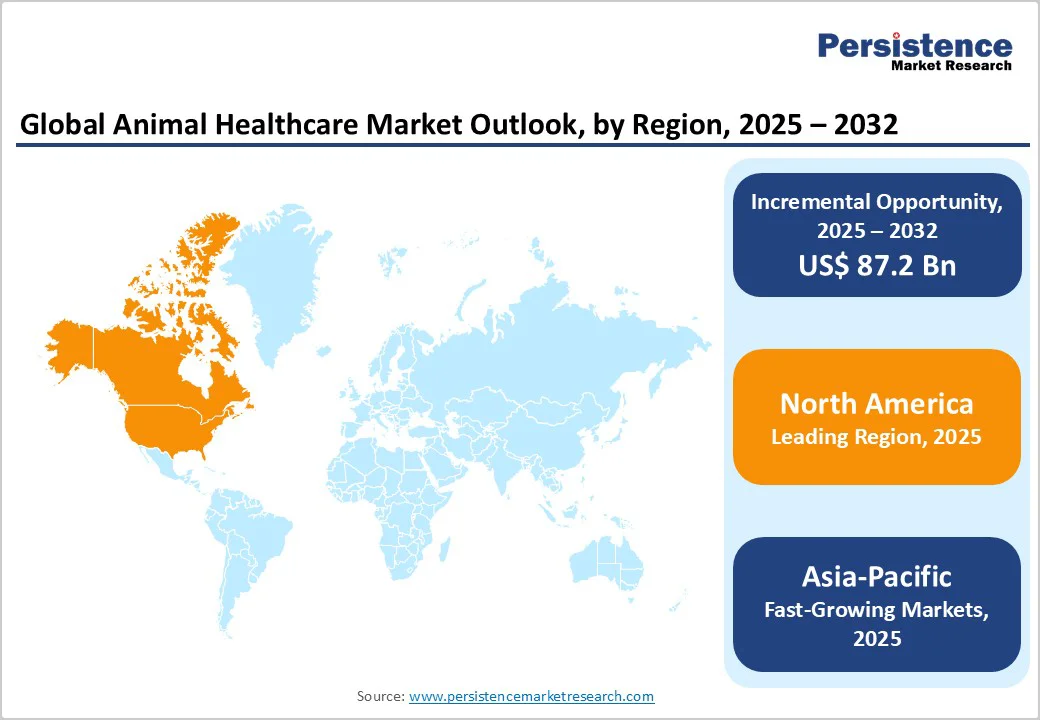

The North America market is expected to dominate globally with a value share of 43.4% in the 2025, with the U.S. leading the region due to the several key factors, including high pet ownership and the increasing humanization of pets, which fuels demand for preventive care, advanced diagnostics, and specialty treatments. The region benefits from a well-established veterinary infrastructure, a large pool of skilled professionals, and robust regulatory frameworks that ensure the availability and quality of veterinary products. High penetration of pet insurance and subscription-based wellness programs further supports the adoption of premium services and therapies. Additionally, rapid technological advancements, such as AI-enabled diagnostics, telemedicine, and biologics, are being integrated into routine veterinary care, enhancing early disease detection, treatment efficiency, and overall animal health outcomes. These combined factors position North America as the dominant region in the global animal healthcare market.

The Europe market is expected to grow steadily, driven by several converging factors. Rising awareness of animal welfare and the increasing adoption of companion animals are motivating pet owners to invest more in preventive care, diagnostics, and specialty treatments. In the livestock sector, stringent regulations promoting food safety, responsible antibiotic use, and disease prevention are boosting demand for vaccines, biologics, and alternative therapies. Well-established veterinary infrastructure, a high density of skilled professionals, and expanding pet insurance coverage support wider access to quality animal healthcare. Furthermore, the integration of advanced technologies such as telemedicine, point-of-care diagnostics, and digital monitoring solutions is enhancing treatment efficiency and animal health outcomes

The Asia Pacific market is expected to register a relatively higher CAGR of around 8.4% between 2025 and 2032, driven by multiple growth factors such as the rising demand for animal protein is prompting investments in livestock health, including vaccines, feed additives, diagnostics, and biosecurity measures to enhance productivity and ensure food safety. At the same time, pet ownership is increasing rapidly in countries such as India, China, and Southeast Asia, fueling demand for preventive care, wellness programs, and specialty treatments. Improvements in veterinary infrastructure, a growing pool of skilled professionals, and increasing awareness of animal health and welfare are further supporting market growth. Additionally, adoption of modern technologies such as telemedicine, AI-enabled diagnostics, and advanced biologics is expanding access to high-quality animal healthcare services. Together, these factors are creating significant opportunities for manufacturers, service providers, and distributors.

The global animal healthcare market is highly competitive, with major players such as Bayer AG, Boehringer Ingelheim International GmbH, Virbac, Zoetis Services LLC, HESTER BIOSCIENCES LIMITED, Intas Pharmaceuticals Ltd., and Merck & Co leading the industry through extensive product portfolios, strong global distribution networks, and continuous innovation in veterinary pharmaceuticals, vaccines, and diagnostics.

These companies prioritize the development of advanced vaccines, biologics, parasiticides, and diagnostic solutions to enhance disease prevention, treatment accuracy, and overall animal health outcomes. Strategic initiatives such as mergers and acquisitions, capacity expansions, and partnerships with veterinary service providers and biopharma manufacturers.

The global animal healthcare market is projected to be valued at US$ 65.4 Bn in 2025.

Rising pet ownership, increasing demand for animal protein, and growing awareness of preventive care. Additionally, expansion of veterinary infrastructure and adoption of advanced diagnostics and biologics are driving the global animal healthcare market.

The global animal healthcare market is poised to witness a CAGR of 6.2% between 2025 and 2032.

Growing adoption of pet insurance, preventive care, and subscription-based wellness models. Rapid growth in emerging markets and increasing demand for vaccines, biologics, and advanced diagnostics are creating significant growth opportunities in the animal healthcare market.

Bayer AG, Boehringer Ingelheim International GmbH, Virbac, Zoetis Services LLC, HESTER BIOSCIENCES LIMITED, Intas Pharmaceuticals Ltd., and Merck & Co are some of the key players in the animal healthcare market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Drugs

By Animals

By Route of Administration

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author