ID: PMRREP2983| 192 Pages | 15 Jul 2025 | Format: PDF, Excel, PPT* | Healthcare

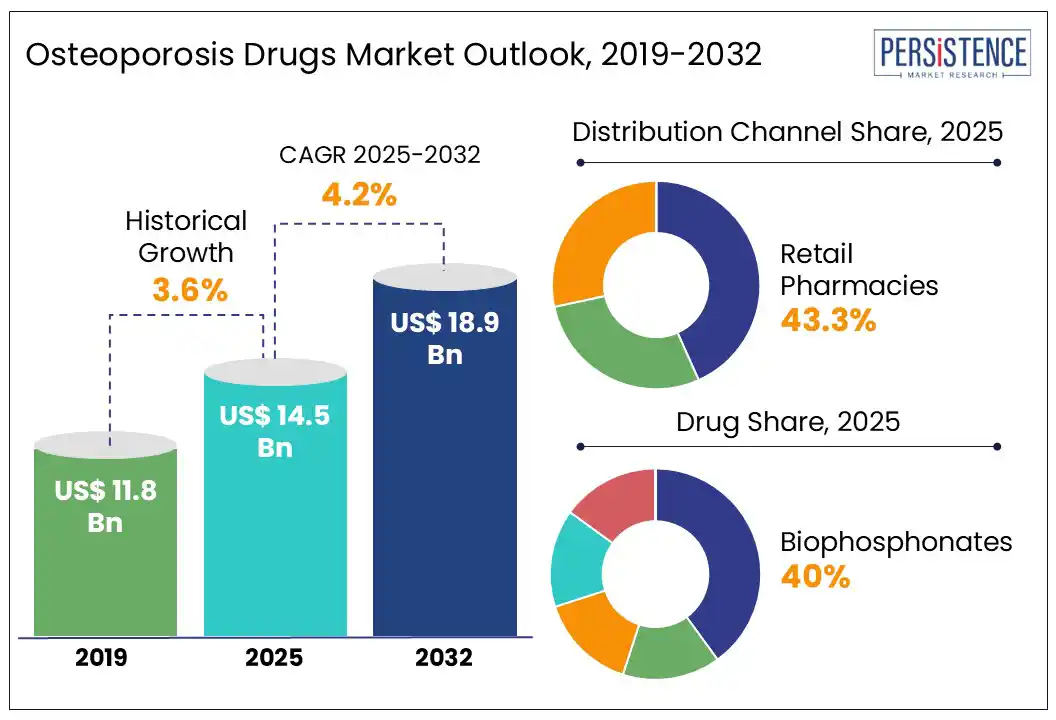

The global osteoporosis drugs market size is likely to be valued at US$ 14.5 Bn in 2025 and is estimated to reach US$ 18.9 Bn in 2032, at a CAGR of 4.2% during the forecast period 2025 - 2032.

The osteoporosis drugs market growth is mainly driven by the rising prevalence of osteoporosis, especially among the aging population and postmenopausal women.

Osteoporosis is a condition where an individual experiences a steady weakening of bones and faces an increased susceptibility to fractures. Osteoporosis drugs are medications formulated to prevent bone loss, increase bone density, and reduce the risk of fractures. These drugs include bisphosphonates, hormone therapies, and monoclonal antibodies, aimed at improving bone health and managing osteoporosis-related complications.

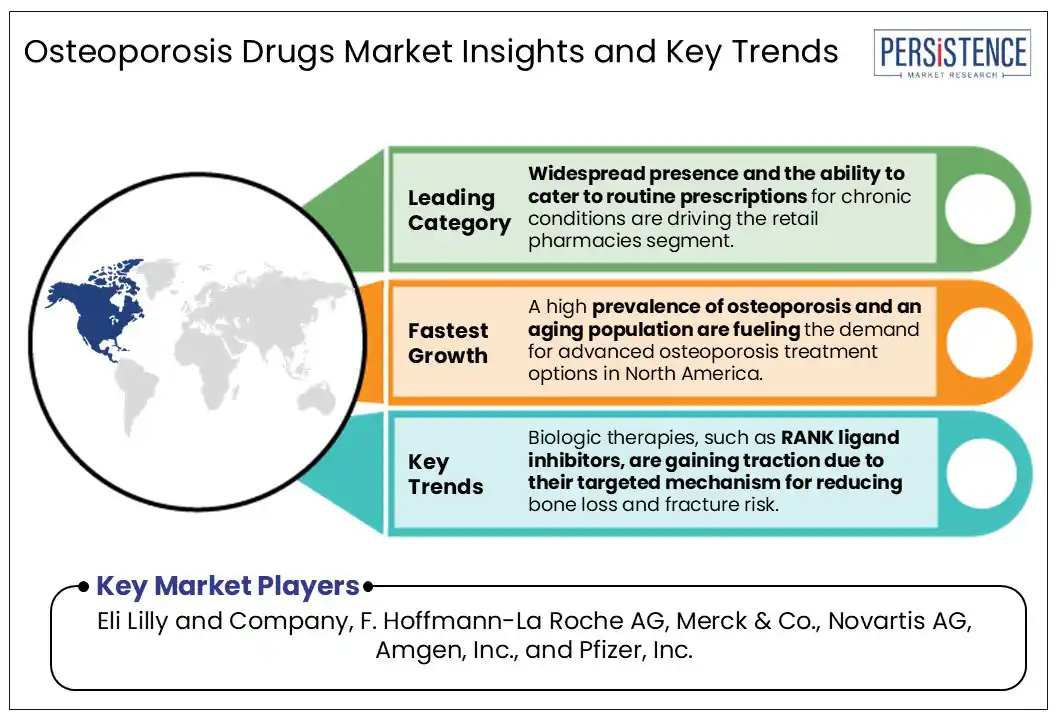

Newer drug classes such as RANK ligand inhibitors are gaining traction, owing to their targeted mechanisms that effectively inhibit bone resorption. Government initiatives promoting cost-effective treatments fuel the demand for generic osteoporosis drugs, thereby supporting market growth. Promising advancements in drug formulations, including oral, injectable, and intravenous variants, are further broadening the osteoporosis drugs market outlook.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Osteoporosis Drugs Market Size (2025E) |

US$ 14.5 Bn |

|

Market Value Forecast (2032F) |

US$ 18.9 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.6% |

A major factor powering the osteoporosis drugs market growth is the steady increase in the global geriatric population. According to the World Health Organization (WHO), the number of people aged 60 years and older is expected to double by 2050. The condition affects one in three women and one in five men over the age of 50, as per the International Osteoporosis Foundation (IOF). The growing incidence of osteoporosis has placed an urgent demand on healthcare systems and pharmaceutical companies to develop and distribute more effective osteoporosis medications. Additionally, rising awareness of bone health through public health campaigns, improved diagnostic screening tools such as DEXA scans, and the growing availability of osteoporosis treatment options across both developed and emerging economies are collectively fueling market growth.

A notable restraint hampering the growth of the osteoporosis drugs market is the adverse side effects associated with long-term drug use. Medications such as bisphosphonates, while effective, have been found to create various complications such as gastrointestinal issues, atypical femoral fractures, and osteonecrosis of the jaw. As awareness of these risks grows, it can potentially lead to decreased patient compliance and increased hesitancy among healthcare providers in prescribing these drugs, thereby limiting the uptake of prescription-based osteoporosis therapeutics.

The osteoporosis drugs market is poised to experience tremendous opportunities due to the advent of innovative drug delivery mechanisms and a growing shift toward personalized therapies. Pharmaceutical companies are investing in the development of advanced delivery systems such as monthly injectables and nasal sprays that offer better convenience for patients, leading to improved adherence to intake schedules. Moreover, the rise of biologics and monoclonal antibodies, such as denosumab, has ushered in a new era of targeted osteoporosis medications that offer improved efficacy and fewer complications. At the same time, the growing integration of precision medicine into bone health management is enabling healthcare providers to tailor and personalize osteoporosis treatments based on genetic, hormonal, and metabolic profiles.

Based on drugs, the osteoporosis treatment market has been divided into bisphosphonates, parathyroid hormone therapy drugs, calcitonin, Selective Estrogen Receptor Modulators (SERMs), and RANK Ligand (RANKL) inhibitors. Among these, the bisphosphonates segment is projected to dominate during the forecast period, accounting for approximately 40% of the market share, due to its long-standing clinical use, cost-effectiveness, and broad prescription base. At the same time, RANKL inhibitors, such as denosumab, are gaining notable traction owing to their targeted mechanism of action and superior patient compliance. The progress of this segment is also attributable to the increased investments in the development of biologics and novel compounds that offer improved efficacy and safety over conventional therapies.

Based on distribution channel, the market has been segregated into retail pharmacies, hospital pharmacies, and online sales. The retail pharmacies segment is anticipated to lead with the highest market share of 43.3% in 2025, majorly driven by the widespread presence and the ability to cater to routine prescriptions for chronic conditions. These outlets are particularly favored in urban and semi-urban areas, where patients frequently visit local pharmacies for refills of oral osteoporosis medications such as bisphosphonates and SERMs.

On the other hand, online pharmacies are projected to showcase exceptional growth on account of the adoption of digital technologies in healthcare and the increased comfort among elderly populations with e-commerce platforms. Catalyzed by the COVID-19 pandemic, the convenience of doorstep delivery, refill reminders, and access to discounted prices are prominent trends accelerating the growth of this segment.

North America is expected to maintain its leading position in the global market, accounting for a 42% market share in 2025. A high prevalence of osteoporosis, especially among postmenopausal women, and an aging population are the key factors fueling the demand for advanced osteoporosis treatment options. The region also benefits from a robust healthcare infrastructure and widespread access to diagnostic tools that support long-term medication. Growing awareness about bone health, the execution of preventive screening programs, and physician-led initiatives also drive market growth. Another emerging trend in the region is the increasing adoption of biologics and personalized medicine.

Europe is anticipated to be the fastest-growing market during the forecast period, backed by the rapid rise in the number of elderly persons and well-established public healthcare systems. High awareness levels, access to early diagnostic services, and supportive reimbursement policy frameworks contribute to a strong demand for advanced osteoporosis drugs. The region is also witnessing growing adoption of biologics and injectable therapies, particularly in countries such as Germany, France, and the U.K.

The global osteoporosis drugs market is highly competitive and led by major pharmaceutical players such as Novartis, Amgen, Sanofi, and Merck & Co. These pharma giants offer a mix of products in the form of bisphosphonates, biologics, and anabolic agents. The key market participants are focusing on strategic partnerships, R&D investments, and geographic expansion in untapped markets with a promising potential to stay competitive.

The market is projected to reach US$ 14.5 Bn in 2025.

Rising geriatric population and growing osteoporosis incidence are key market drivers.

The market is poised to witness a CAGR of 4.2% from 2025 to 2032.

Development of innovative drug delivery systems and integration of precision medicine into bone health management are key market opportunities.

The key players in the global Osteoporosis Drugs Market include Eli Lilly and Company, F. Hoffmann-La Roche AG, and Merck & Co., Inc.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Drug

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author