ID: PMRREP2995| 196 Pages | 16 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

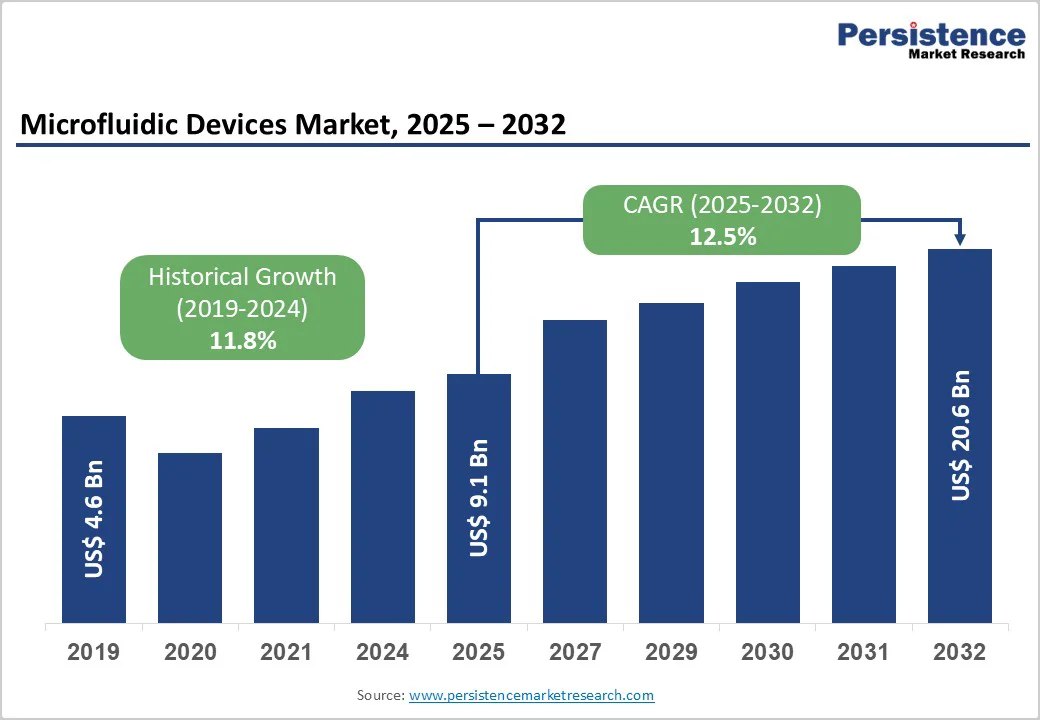

The global microfluidic devices market size is valued at US$9.1 billion in 2025 and projected to reach US$20.6 billion growing at a CAGR of 12.5% during the forecast period from 2025 to 2032.

The need for microfluidic devices is transforming laboratory workflows by enabling precise manipulation of tiny fluid volumes for diagnostics, drug discovery, and life-science research. These miniaturized systems reduce reagent consumption, accelerate reaction times, and support real-time biological analysis on compact platforms. Demand is rising due to the surge in point-of-care testing, personalized medicine, organ-on-chip development, and high-throughput screening needs.

| Key Insights | Details |

|---|---|

|

Microfluidic Devices Market Size (2025E) |

US$9.1 Bn |

|

Market Value Forecast (2032F) |

US$20.6 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

12.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

11.8% |

Microfluidic technology allows for exact volume manipulation of samples outside of cellular environments. As a result, it will eventually be conceivable to diminish disparities between in-vivo and in-vitro settings and drastically cut on both the time required for reaction rates and overall cost. To better comprehend in vivo conditions, microfluidic techniques have made significant advancements, which includes Micro-arrays and cell-based microarrays. Both, when combined with other cutting-edge technologies like optical and electrical detection techniques and a well-designed microfluidic system, have been proven beneficial for tracking changes in cellular behavior due to environmental influences.

Additionally, the cell-based micro-arrays can aid in the correct adhesion or development of numerous cell types on various substrates. The development of innovative arrays has so far involved several concepts, including suspension arrays, also known as high-throughput cell-based assays, and positional arrays, also known as multiplexed cell-based arrays.

Furthermore, state-of-the-art innovations, including lab-on-a-chip and organs-on-a-chip, are being made to advance the state-of-the-art microfluidic technologies. The projects for organs-on-a-chip and labs-on-a-chip are anticipated to continue being the focus of intensive research in a variety of fields of research and material-based sectors.

The high development costs of microfluidic devices market chips and devices come with risks and limitations that could impede the growth of the global market. With the extension of microfluidic applications, the limitations of the conventional monolithic microfluidic chips are becoming increasingly apparent.

One of the major restraining factors for the market is the high costs associated with the research & development of the products based on microfluidic technology and the lack of financial assistance. Furthermore, the lengthy development periods for R&D projects, coupled with the high costs of the clinical trials required to assess the devices and chips, add to the significant expense it incurs.

Additionally, silicon and glass are used in the fabrication of microfluidics systems, which is performed in a clean room. Due to its transparency to visible and ultraviolet light, silicon is a material that cannot be used with microscopic technologies.

The global microfluidic devices market is expected to offer various opportunities during the forecast period. Considering the rapid advancements in technology and increasing demand for point-of-care testing and personalized medicine, there is a growing need for innovative microfluidic devices across various industries. The key opportunities in the global market include the development of advanced point-of-care diagnostic devices, increased adoption of microfluidic technology in drug discovery and development, and the growing application of microfluidic devices in genomics research and analysis.

Additionally, the integration of microfluidic devices with artificial intelligence and the Internet of Things (IoT) presents opportunities for enhanced data analysis and real-time monitoring in healthcare and life sciences. With this, the global microfluidic devices market is expected to have significant growth during the study period and create new avenues for innovation and collaboration in the industry.

Based on the device type segmentation, the microfluidic devices market is further segmented into chips, and sensors, where the chip segment has a major market share. The reason for the dominance of chip segmentation is its high potential to be used in several applications, like life science, drug delivery, diagnostics, and biomedical.

Furthermore, it is estimated to dominate the global market share with the highest CAGR during the said forecast period owing to its quick reaction time, cost-effectiveness, improved sensitivity and ease of integration in several devices. The sensors segment is also said to have a steady growth rate owing to its capacity to detect a small volume in a timely manner, as well as their ability to reduce reagent and energy consumption, waste, and cost, are all factors that contribute to the growth of the sensors segment.

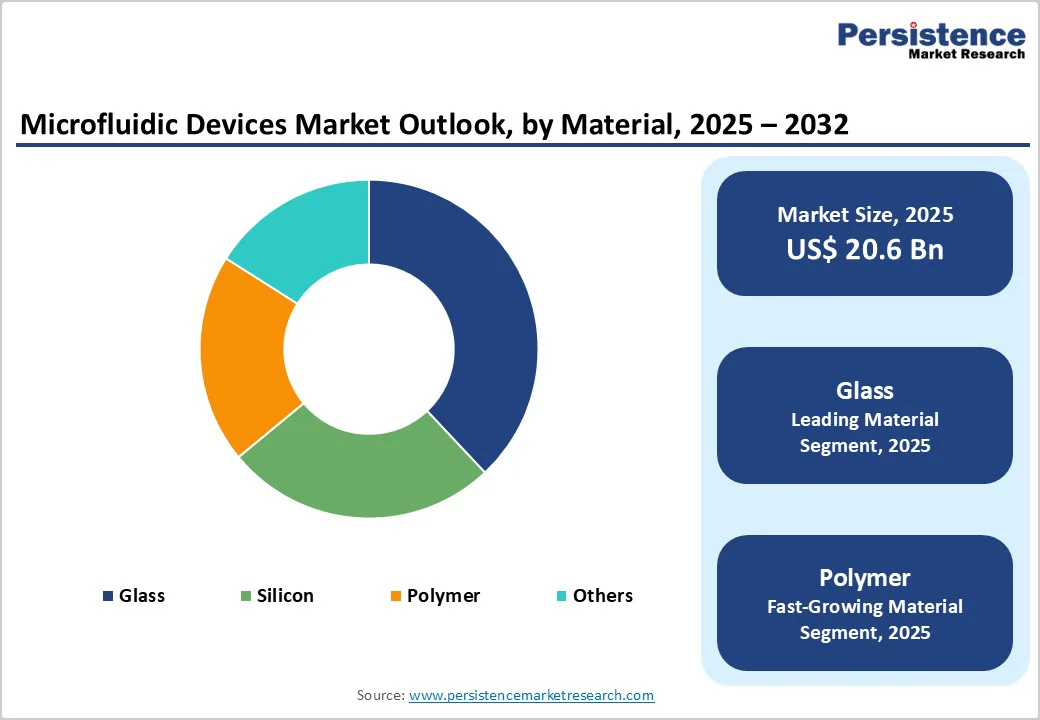

Based on the material type segmentation, the market is further segmented into glass and polymer, where the glass segment dominates the market share. The glass segment dominates other types of materials owing to its good chemical, electrical, and physical properties that are required for an accurate flow of microfluids for the detection of diseases. As glass provides higher accuracy and sensitivity than any other material, it is mostly preferred for significant applications.

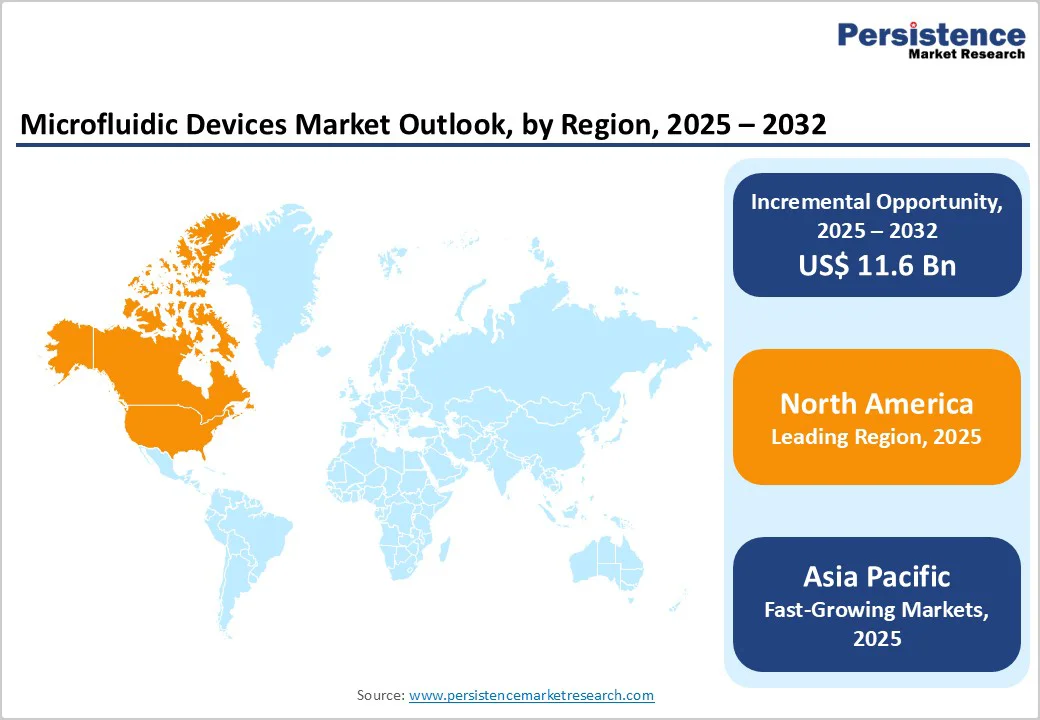

North America dominates the global market with a major market share and a growth rate of almost 20% during the forecast period. The region is expected to maintain its position as the largest stakeholder in the market owing to the presence of major healthcare and technology giants operating from the region. The market is expanding due to the firms and government organizations sponsoring research at a higher rate. Furthermore, the need for microfluidics devices in the diagnostics and research domains to expedite the commercialization of lab-built devices has propelled the industry-academia collaboration.

For example, in July 2020, Fluidigm Corporation signed a letter of cooperation for the Rapid Acceleration of Diagnostics program with the National Institutes of Health and the National Institute of Biomedical Imaging and Bioengineering. The project, which had a maximum budget of US$37 million, sought to use Fluidigm's microfluidics technology to boost the production and output capacities of COVID-19 testing.

On the other hand, the Asia Pacific also accounts for a considerable market share. During the forecast period, the region is expected to demonstrate a CAGR of 18.08%, which can be attributed to its well-established scientific infrastructure, growing economy, and cost-effective labor. Investors from around the world have taken notice of the unexplored microfluidics market in the Asia Pacific region, where the market for microfluidic diagnostic testing was mostly dominated by foreign competitors.

Nevertheless, the primary competitors in the industry are launching captivating and unique items that are both thrilling and engaging in terms of performance and, most crucially, attractive in terms of pricing.

Furthermore, the Chinese government has implemented a strategic plan to significantly enlarge the home market and position the country as a prominent participant. The "Made in China 2025" strategy places particular emphasis on the development and production of pharmaceuticals and medical products. The strategic implementation of microfluidic technology is expected to yield a favorable return on investment due to its crucial role in life sciences and diagnostics applications.

The microfluidic devices market is becoming increasingly competitive as companies race to deliver highly integrated, miniaturized platforms aimed at rapid diagnostics and scalable research applications. Competition centers on innovations in chip fabrication, biocompatible materials, multiplexed detection, and seamless integration with analytical instruments. Players are strengthening portfolios through mergers, IP protection, and partnerships with pharma, biotech, and diagnostic laboratories.

The global microfluidic devices market is projected to be valued at US$9.1 Bn in 2025.

Rising demand for point-of-care diagnostics and rapid disease detection, especially for infectious and chronic conditions.

The global microfluidic devices market is poised to witness a CAGR of 12.5% between 2025 and 2032.

Expansion of point-of-care and home-based diagnostics, especially for infectious diseases, diabetes, fertility, and cancer screening.

Agilent Technologies, PerkinElmer Inc., Thermo Fisher Scientific Inc., Qiagen NV, and others

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn, Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Device Type

By Form

By Application

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author