Industry: Healthcare

Published Date: July-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 180

Report ID: PMRREP34697

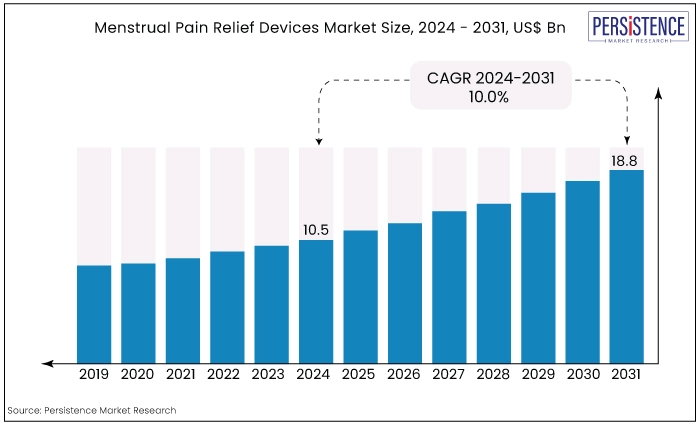

The global market for menstrual pain relief devices is estimated to be valued at US$18.8 Bn by the end of 2031 from US$10.5 Bn recorded in 2024. The market is expected to secure a CAGR of 8.6% in the forthcoming years from 2024 to 2031.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Market Size (2024E) |

US$10.5 Bn |

|

Projected Market Value (2031F) |

US$18.8 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

8.6% |

|

Historical Market Growth Rate (CAGR 2018 to 2023) |

10% |

The menstrual pain relief devices market has been growing, driven by increasing awareness of menstrual health and a rise in innovative solutions to manage dysmenorrhea. These devices, ranging from TENS units to heat therapy patches, offer non-pharmacological pain relief options, appealing to those seeking alternatives to medication.

The market encompasses a range of products designed to alleviate dysmenorrhea, the medical term for menstrual cramps, which affects a significant portion of the female population. These devices aim to provide non-pharmacological, often non-invasive, relief from the discomfort associated with menstruation.

The market includes a variety of technologies such as transcutaneous electrical nerve stimulation (TENS) devices, which deliver mild electrical pulses to reduce pain, and heat therapy products like heating pads and wearable heat wraps that help relax uterine muscles.

With advancements in technology and growing acceptance of wearable health tech, the market is witnessing significant interest from both consumers and investors.

Key players are focusing on developing user-friendly, effective, and discreet devices, addressing a substantial need for better menstrual pain management solutions.

Heat therapy has long been recognized for its efficacy in reducing menstrual pain. Wearable devices leverage this by incorporating heating elements that can be precisely controlled to provide consistent and soothing warmth directly to the affected area.

This targeted heat application helps to relax uterine muscles and improve blood flow, thereby alleviating cramps and discomfort. Smart patches, for instance, can be discreetly worn under clothing, offering a convenient and portable solution for pain relief that can be used throughout the day.

Electrotherapy, another cornerstone of wearable menstrual pain relief technology, involves the use of low-intensity electrical pulses to stimulate nerves and reduce pain perception.

Devices employing this technology, such as TENS units, are now being adapted into wearable forms like belts or patches. These devices are designed to be user-friendly, with customizable settings that allow users to adjust the intensity and frequency of the electrical pulses to suit their comfort levels and pain relief needs.

The market for menstrual pain relief devices has witnessed significant growth over the past decade, driven by increasing awareness of menstrual health, advancements in technology, and the rising prevalence of menstrual disorders.

Historically, the market was dominated by traditional methods such as over-the-counter pain medications and home remedies.

However, the introduction of innovative devices, such as TENS (Transcutaneous Electrical Nerve Stimulation) units, wearable heating pads, and other non-invasive pain relief solutions, has revolutionized the market.

From 2015 to 2020, the market experienced steady growth, propelled by increased consumer acceptance and the proliferation of digital health technologies.

The period also saw a surge in new product launches and the entry of several start-ups specializing in women's health. Major players focused on expanding their product portfolios and enhancing device efficacy, which further boosted market growth.

The forecast for the menstrual pain relief devices market from 2021 to 2028 is highly optimistic. The market is expected to continue its upward trajectory, driven by ongoing research and development, greater product availability, and a growing emphasis on personalized healthcare solutions.

Additionally, increasing awareness campaigns and the destigmatization of menstrual health are likely to fuel market expansion.

Shift Towards Non-pharmacological Solutions

The shift towards non-pharmacological solutions is significantly impacting the menstrual pain relief devices market. Increasingly, individuals are seeking alternatives to traditional medication for managing menstrual discomfort due to concerns about side effects and long-term dependency on pharmaceuticals.

Non-drug approaches, such as heat therapy, transcutaneous electrical nerve stimulation (TENS), and acupressure, are gaining popularity as they offer a more holistic and potentially safer means of pain management.

These methods often align with a broader trend toward natural and complementary therapies, reflecting a growing consumer preference for treatments that do not rely on chemical interventions.

Devices designed for menstrual pain relief, such as portable heating pads and TENS units, are meeting this demand by providing targeted, drug-free relief. These devices are increasingly favored for their convenience and effectiveness in alleviating menstrual cramps without systemic side effects.

As awareness of these non-pharmacological options spreads, driven by educational campaigns and recommendations from healthcare professionals, consumer adoption is likely to rise.

The shift not only highlights a growing trend towards personalized and non-invasive pain management but also underscores the evolving landscape of menstrual health solutions that prioritize patient well-being and quality of life.

Expanding Product Availability

The expansion of product availability for menstrual pain relief devices is a pivotal factor driving their widespread adoption. Historically, consumers had limited access to specialized pain relief products, often restricted to niche markets or specific medical supply stores.

However, the landscape has dramatically shifted with the increasing presence of these devices in both retail and online marketplaces. This expanded availability is significantly enhancing consumer access and convenience.

Retail expansion includes the inclusion of menstrual pain relief devices in major pharmacy chains, supermarkets, and specialty health stores. These devices are now positioned alongside traditional health products, making them more visible and accessible to a broader audience.

Additionally, brick-and-mortar stores are increasingly dedicating sections to menstrual health, which helps normalize the conversation around menstrual pain management and encourages consumers to explore various options.

The online retail boom has further revolutionized accessibility. E-commerce platforms offer a vast range of menstrual pain relief devices, from advanced heating pads and TENS units to innovative wearable tech.

Online shopping provides the added advantage of privacy and convenience, allowing consumers to research, compare, and purchase products from the comfort of their homes.

The ability to read user reviews and access detailed product information online empowers consumers to make informed decisions and select the most suitable device for their needs.

High R&D Costs

High research and development (R&D) costs present a significant restraint for the menstrual pain relief devices market, particularly impacting smaller companies.

The development of innovative pain relief devices involves extensive scientific research, clinical trials, regulatory compliance, and product testing. Each of these stages requires substantial financial investment and resources.

The initial phase of R&D involves identifying and understanding the underlying mechanisms of menstrual pain, which necessitates thorough biomedical research.

This stage often requires collaboration with medical professionals, acquisition of sophisticated laboratory equipment, and access to specialized research facilities. The financial burden of this phase can be overwhelming for smaller companies with limited budgets.

Once a potential solution is identified, it must undergo rigorous testing through preclinical and clinical trials to ensure safety and efficacy. These trials are expensive and time-consuming, often requiring several phases and involving large groups of participants.

The costs associated with these trials include participant recruitment, compensation, facility usage, and administrative expenses. Additionally, unforeseen issues or adverse effects during trials can lead to further financial strain as additional tests and modifications may be necessary.

Regulatory Challenges

Regulatory challenges represent a formidable restraint in the menstrual pain relief devices market.

The development and commercialization of medical devices, including those designed to alleviate menstrual pain, are subject to stringent regulatory frameworks imposed by health authorities such as the US Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other national regulatory bodies.

These regulations are designed to ensure the safety, efficacy, and quality of medical devices, but they also introduce significant hurdles for manufacturers.

One of the primary challenges is the lengthy and complex approval process. Medical devices must undergo rigorous pre-market evaluation, which includes comprehensive clinical trials and extensive documentation. These trials are necessary to demonstrate that the device is safe for use and effective in providing the claimed benefits.

The process of planning, conducting, and analysing clinical trials can be exceedingly time-consuming and resource-intensive. For smaller companies, the financial and operational burden of these trials can be particularly daunting.

Moreover, the regulatory landscape is constantly evolving. Changes in regulatory requirements or interpretations can lead to unforeseen delays and additional costs as companies must adapt their development processes to meet new standards.

Keeping up with these changes requires a deep understanding of regulatory affairs and often necessitates hiring specialized personnel or consulting experts, further increasing operational costs.

Collaborations with Healthcare Providers

Collaborating with healthcare providers to develop menstrual pain relief devices presents a significant opportunity to enhance both the credibility and effectiveness of these products.

By partnering with gynecologists, pain specialists, and primary care physicians, companies can ensure that their devices are designed based on the latest medical research and clinical insights.

This collaboration can lead to the development of products that are not only scientifically validated but also tailored to meet the specific needs of patients suffering from dysmenorrhea (painful menstruation).

Healthcare providers can offer invaluable feedback on device design, functionality, and safety, ensuring that the products are both effective and user-friendly. This can involve conducting clinical trials to test the efficacy and safety of the devices, which can then be published in medical journals.

Such validation not only enhances the credibility of the products but also fosters trust among consumers, who are more likely to adopt a device recommended by their healthcare provider.

Moreover, these partnerships can facilitate better patient education. Healthcare providers can play a crucial role in educating patients about the availability and proper use of these devices. This can be achieved through informational brochures, workshops, and one-on-one consultations.

By integrating the devices into standard treatment protocols, healthcare providers can offer a holistic approach to managing menstrual pain, combining device usage with other therapeutic strategies such as medication, lifestyle modifications, and alternative therapies.

AI-Powered Personalization

Leveraging artificial intelligence (AI) to create personalized pain relief plans for menstrual pain offers a transformative approach to managing dysmenorrhea.

AI can analyse vast amounts of user data, including menstrual cycle patterns, pain intensity, duration, lifestyle factors, and historical responses to different treatments. By integrating this data, AI can develop highly tailored pain relief strategies that cater to individual needs, enhancing both efficacy and user satisfaction.

AI-powered menstrual pain relief devices can utilize machine learning algorithms to identify patterns and predict the onset and severity of menstrual pain.

For instance, by continuously monitoring physiological parameters such as body temperature, heart rate, and hormonal fluctuations, AI can forecast when pain is likely to occur and recommend preemptive interventions.

Such interventions might include the application of heat, transcutaneous electrical nerve stimulation (TENS), or pharmacological recommendations, timed precisely to when they will be most effective.

Moreover, AI can provide real-time feedback and adjustments. As users interact with the device and report their pain levels and relief experiences, the system can refine its algorithms to better suit individual preferences and responses. This adaptive learning process ensures that the pain relief plans become more accurate and effective over time.

Personalized recommendations can also extend to lifestyle modifications. AI can analyse data from wearable fitness trackers, sleep monitors, and nutrition apps to suggest holistic strategies for pain management. For example, it might recommend specific exercises, dietary adjustments, or stress reduction techniques that have been shown to alleviate menstrual pain in similar profiles.

|

Category |

Projected CAGR through 2031 |

|

Product Type - Wearable |

8.2% |

|

Technology - TENS Technology |

9.1% |

Wearable Segment to Account for a Significant Share

The wearable product type segment is poised to account for a significant share in the menstrual pain relief devices market due to its convenience, discreetness, and efficacy.

Wearable devices, such as heat patches, TENS units, and smart wearables, offer targeted and continuous pain relief, allowing users to maintain their daily activities without disruption.

The convenience of wearables lies in their design—these devices are lightweight, portable, and easy to use, making them an attractive option for women seeking on-the-go pain relief.

Unlike traditional methods, such as oral medications which require time to take effect and can have systemic side effects, wearable devices provide localized relief directly to the pain site, offering faster and more effective results.

Discreetness is another critical factor driving the popularity of wearable menstrual pain relief devices. Many wearables are designed to be worn under clothing without being noticeable, enabling women to use them confidently in public or professional settings without drawing attention.

TENS Technology Accounts for a Significant Market Share

Transcutaneous Electrical Nerve Stimulation (TENS) technology holds a significant share in the market due to its proven efficacy, non-invasive nature, and user-friendly design.

TENS devices work by delivering low-voltage electrical currents through the skin to stimulate nerves and reduce pain perception. This mechanism can effectively alleviate menstrual cramps by interfering with the pain signals sent to the brain and promoting the release of endorphins, the body’s natural painkillers.

One of the primary reasons for the popularity of TENS technology is its non-invasive approach to pain management. Unlike medications, TENS devices do not have systemic side effects, making them a safer alternative for long-term use. This appeals to many women who seek effective pain relief without the risks associated with pharmaceuticals.

Additionally, TENS devices are generally compact, portable, and easy to use. They often come with adjustable settings, allowing users to customize the intensity and frequency of the electrical pulses to suit their individual comfort levels and pain thresholds. This adaptability enhances user satisfaction and compliance.

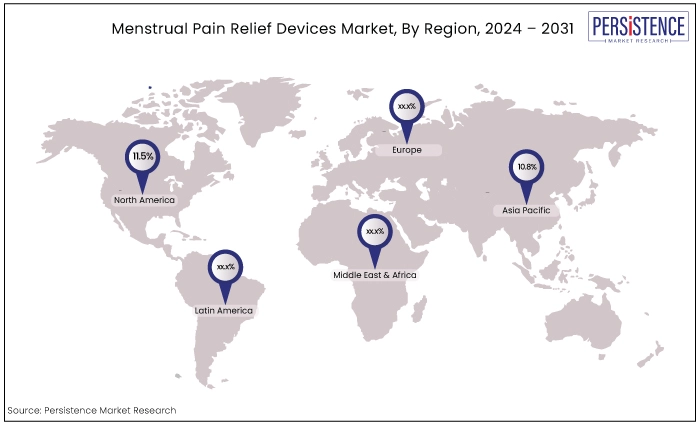

|

Region |

CAGR through 2031 |

|

North America |

11.5% |

|

Asia Pacific |

10.8% |

North America’s Leadership Position Prevails Through 2031

North America accounts for a significant share in the menstrual pain relief devices market due to a combination of factors, including high consumer awareness, advanced healthcare infrastructure, and substantial investment in research and development.

One of the primary drivers is the high level of consumer awareness and acceptance of innovative health solutions. In North America, particularly in the US and Canada, there is a strong cultural emphasis on health and wellness.

This awareness extends to women's health issues, including menstrual pain. Women in these regions are more likely to seek out and invest in advanced solutions for menstrual pain relief, such as devices incorporating TENS technology, wearable heat therapy, and AI-powered personalization.

The advanced healthcare infrastructure in North America also plays a crucial role. The presence of well-established healthcare facilities and a strong network of healthcare providers facilitates better access to information and products related to menstrual pain management.

Physicians and healthcare professionals in this region are more likely to recommend and endorse modern pain relief devices, which boosts market growth.

Moreover, North America is a hub for technological innovation and substantial investment in research and development. Many leading companies in the market are based in this region, driving the development of new and improved products.

These companies benefit from significant funding and support for innovation, enabling them to bring cutting-edge technologies to market more quickly.

Additionally, the regulatory environment in North America, particularly the Food and Drug Administration (FDA) in the United States, provides a robust framework for the approval and commercialization of medical devices, ensuring high standards of safety and efficacy.

Asia Pacific Creates Opportunities in Line with Growing Awareness About Menstrual Health

The Asia Pacific region is poised to exhibit a notable CAGR in the market due to several key factors. The region's large and growing population, coupled with increasing awareness about menstrual health, is driving demand for effective pain relief solutions.

Countries like China, and India, which have vast female populations, are witnessing a shift towards greater openness and acceptance of discussions around menstrual health, reducing the stigma that is traditionally associated with it.

Economic growth in the Asia Pacific region is also playing a crucial role. Rising disposable incomes and improving healthcare infrastructure are enabling more women to access and afford advanced menstrual pain relief devices.

As the middle class expands, there is growing demand for better healthcare products, including those that offer non-invasive and drug-free pain management options.

Additionally, the rapid urbanization and changing lifestyles in the region are contributing to the market growth. With more women entering the workforce, there is a heightened need for effective and convenient menstrual pain relief solutions that can be used discreetly during work hours, and daily activities. This market trend is particularly pronounced in urban centers where modern healthcare products are more readily available.

Collaborations and partnerships to develop innovative products and accelerate their launch across nations are the key growth strategies followed by the key players in the market. Companies are continuously investing in research and development to introduce innovative and novel interference blockers.

Recent Industrial Development

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2018 to 2023 |

|

Market Analysis |

US$ Million for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Product Type

By Technology

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

There is growing awareness about menstrual health and the impact of menstrual pain (dysmenorrhea) on daily life. Educational campaigns, and advocacy by healthcare organizations and influencers are encouraging more women to seek effective pain relief solutions.

Some of the key players operating in the market are Angelini Pharma Inc., Ovira International, Welme, Myovant Sciences (Sumitovant Biopharma Ltd.), Chiaro Technology Ltd (Elvie), FemSense, and Matri.

The wearable product type segment recorded a significant market share in 2024.

AI can analyse individual user data, including menstrual cycle patterns, pain levels, lifestyle factors, and historical treatment responses, to create highly personalized pain relief plans.

Japan is set to account for a significant share of the market.