ID: PMRREP35050| 190 Pages | 8 Jan 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

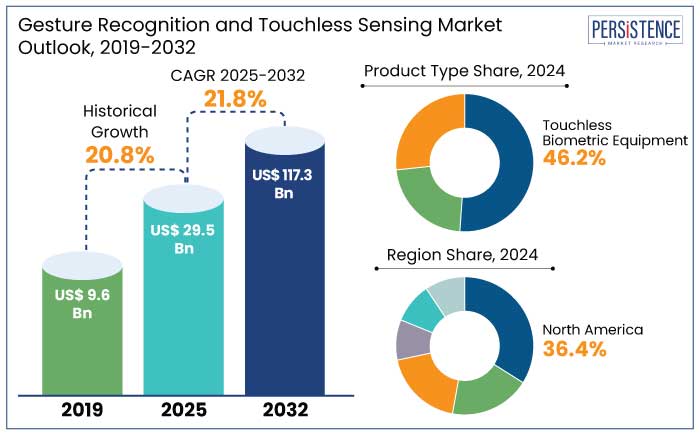

The global gesture recognition and touchless sensing market is projected to reach a size of US$ 29.5 Bn by 2025. It is anticipated to witness a CAGR of 21.8% from 2025 to 2032 to reach a value of US$ 117.3 Bn by 2032. The retail and hospitality industries are likely to leverage gesture recognition and touchless sensing technologies to create contactless payment systems, personalized consumer experiences, and interactive displays.

AI-powdered touchless kiosks and gesture-based digital signage are likely to provide personalized recommendations and seamless checkout experiences. By 2027, the retail industry is set to account for 25% to 30% of the gesture recognition market as retailers constantly adopt contactless checkout and gesture-based advertising systems.

Around 35% of all smart homes are likely to feature gesture and touchless technologies by 2027. AI-riven gesture control systems enable users to operate devices without physical contact, thereby making homes convenient and energy-efficient. Voice-controlled and gesture-based smart home devices like Amazon Echo and Google Nest are estimated to incorporate touchless gesture recognition for user interaction.

Key Highlights of the Industry

|

Market Attributes |

Key Insights |

|

Gesture Recognition and Touchless Sensing Market Size (2025E) |

US$ 29.5 Bn |

|

Projected Market Value (2032F) |

US$ 117.3 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

21.8% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

20.8% |

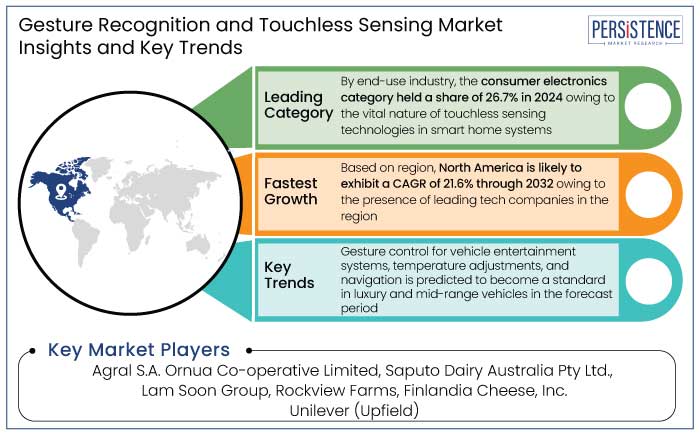

The gesture recognition and touchless sensing market in North America held a share of 36.4% in 2024. The region's robust tech ecosystem supports the rapid development and integration of gesture recognition and touchless sensing technologies. North America has a significant demand for innovative devices incorporating these technologies, such as smartphones and gaming consoles.

Companies like Microsoft and Apple are heavily investing in research and development, thereby driving technological innovations in this field. The high concentration of leading tech companies in the region further accelerates the adoption and commercialization of these technologies.

Touchless biometric equipment held a share of 46.2% in 2024. Touchless biometric systems, like facial recognition, iris scanning, and voice recognition, offer unique levels of security compared to traditional methods like passwords or physical keypads. These technologies are less prone to tampering, duplication, or hacking. Touchless biometric systems are contact-free, making these more user-friendly. They can also help in reducing the risk of disease transmission.

Significant improvements in Artificial Intelligence (AI) and Machine Learning (ML) have enhanced the accuracy and speed of touchless biometric equipment. Integration with IoT devices and cloud platforms has raised their utility and scalability. Increasing production and adoption of these systems have led to reduced costs, making these more accessible for various industries.

Consumer electronics accounted for a share of 26.7% in 2024. Consumer electronics, including smartphones, tablets, laptops, smart TVs, and gaming consoles, have become indispensable in daily life. Manufacturers are mainly integrating gesture recognition and touchless sensing technologies to improve user interfaces and experiences, thereby driving demand in this sector.

Gesture recognition enables intuitive and seamless interaction with devices, enhancing functionality and accessibility. Touchless sensing provides added convenience, particularly in devices like smart TVs, AR/VR systems, and wearable tech. The gaming sector has embraced gesture-based controls for immersive gameplay, with popular devices like Microsoft Kinect and Sony PlayStation VR driving this trend.

Sensor technologies such as LiDAR and 3D depth cameras are now more affordable and widely adopted in devices like smartphones. Touchless sensing technologies are critical in IoT-enabled smart home devices for controlling lights, thermostats, and other appliances through gestures or voice commands. Growing popularity of smart home systems contributes to the dominance of consumer electronics in this market.

Potential growth in the global gesture recognition and touchless sensing industry is predicted to be driven by rising integration of AI and ML as it will likely assist in enhancing gesture recognition systems. It is set to enable them to adapt to individual users and different environments.

The 5G revolution is estimated to enable faster and reliable real-time gesture recognition and touchless systems, especially in critical applications such as healthcare and automotive. Continuous innovations in IoT, smart devices, and consumer demand for hygienic solutions are predicted to continue driving demand.

The gesture recognition and touchless sensing market growth was robust at a CAGR of 20.8% during the historical period from 2019 to 2023. Innovations in computer vision, ML, and AI were the key growth drivers during this period. Sectors like automotive, healthcare, and retail started exploring touchless solutions for improved consumer experiences.

In 2019, the market was primarily focused on the integration of infrared sensors, camera-based gesture recognition, and the use of machine learning algorithms for more accurate gesture detection. The onset of the COVID-19 pandemic in 2020 dramatically accelerated demand for touchless and hygienic solutions.

The need to decrease human-to-human contact spurred the adoption of contactless payment systems, gesture-controlled kiosks, and no-touch devices in public spaces. The market continued to surge as businesses and consumers increasingly adopted touchless and gesture-based technologies.

The healthcare, education, and banking sectors are likely to witness increasing adoption of touchless systems for patient monitoring, digital learning, and secure transactions in the forecast period. Touchless technologies are set to play a significant role in building smart cities, where public transportation, urban infrastructure, and government services are enhanced by gesture-based controls.

Rising Applications in Retail and Banking Sectors to Spur Growth

In retail, gesture recognition enables customers to complete transactions without physical contact, thereby enhancing checkout speed and hygiene. For instance,

Retail stores are progressively adopting gesture-controlled kiosks for browsing catalogs, checking prices, and locating items. These systems decrease the need for physical interaction, improving hygiene and customer satisfaction.

AI-driven gesture recognition systems in smart mirrors and displays analyze customer preferences to recommend products. For instance,

Gesture-based controls allow store employees to interact with inventory systems in real-time without physical touch, thereby enhancing efficiency and decreasing contamination risks.

Gesture recognition enables users to operate ATMs by waving or pointing, eliminating the need for physical touch. For instance,

Banks are progressively integrating gestures and touchless sensing with biometrics like facial recognition and iris scanning for secure customer authentication. Mobile banking apps are adopting gesture recognition for navigation and authentication, offering users a more intuitive experience. For example, banks in Asia Pacific are pioneering gesture-based login systems to cater to tech-savvy customers.

Surging Demand for Hygienic Solutions to Augment Sales

Rising demand for hygienic solutions has significantly accelerated the adoption of gesture recognition and touchless sensing technologies. This trend particularly gained traction during the COVID-19 pandemic and continues to rise as businesses and consumers prioritize hygiene and contactless interactions. The COVID-19 pandemic highlighted the risks associated with high-touch surfaces, such as door handles, ATM keypads, and touchscreens.

Businesses and governments have implemented touchless technologies to reduce the spread of germs in public and private spaces. Governments and health organizations worldwide are encouraging or mandating the use of touchless technologies in high-traffic areas such as airports, healthcare facilities, and retail spaces.

Hygiene-conscious consumers prefer touchless alternatives for everyday activities like payments, entry access, and device interactions. For instance,

Increasing Privacy and Security Concerns May Hinder Demand

Gesture recognition and touchless sensing technologies often rely on sensors and cameras that capture and process sensitive data about individuals. This presents potential risks related to data security, surveillance, and misuse of personal information. In smart homes, where gesture recognition is used for controlling devices, there are concerns about how data is stored, who can access it, and how it is used.

If security protocols are not robust enough, sensitive data may be exposed, resulting in identity theft, fraud, and unauthorized access to accounts or services. If a user’s biometric data is hacked from a touchless payment system or ATM, it could be misused for financial crimes. Government authorities across the globe are increasingly regulating how companies collect and store user data, particularly biometric data.

In the European Union (EU), companies using gesture recognition and touchless technologies must comply with GDPR, which requires companies to have explicit consent from users and secure data storage practices. Failure to comply with these regulations can result in hefty fines and damage to a company’s reputation. For instance,

Trend for Smart Homes and IoT-enabled Devices to Forge Fresh Prospects

Rising adoption of IoT-enabled devices is a key attribute of growth as several of these devices incorporate gesture and touchless sensing technologies for user convenience. IoT devices equipped with gesture recognition provide intuitive and hands-free interaction. For instance, AI-powered smart assistants like Amazon Alexa and Google Home are being integrated with gesture-based controls to offer multimodal interactions.

Touchless sensors can detect hand movements to turn lights on/off, adjust brightness, or change color. For example,

By 2028, the global smart TV market is set to reach US$ 340 Bn, offering significant opportunities for gesture-enabled interfaces. Touchless sensing is being integrated into appliances like ovens, coffee makers, and refrigerators, allowing users to operate these hygienically while cooking.

Companies to Integrate AI to Develop Adaptive and Predictive Systems

Gesture recognition systems enable users to customize controls. For example,

Integration with AI enables the analysis of user behavior to create predictive and adaptive systems that customize experiences over time. For instance, AI in touchless interfaces can predict frequently used gestures and streamline their execution for a faster response. In automative industry gesture recognition systems can adapt to the drivers’ habits, thereby enhancing safety and convenience.

In the healthcare sector, these systems can be adjusted for surgeons or patients to suit specific medical procedures. Gesture recognition and touchless sensing allows touchless control for individuals having mobility challenges, thereby replacing traditional input methods like keyboards and mice.

Touchless sensing assists individuals with disabilities interact with home automation systems through intuitive gestures.

Companies in the gesture recognition and touchless sensing market are continuously investing in research and development activities to create unique algorithms and hardware solutions. They are leveraging Artificial Intelligence (AI) and Machine Learning (ML) to improve the accuracy and adaptability of gesture recognition systems.

Businesses are also developing systems that combine gesture recognition with voice control, facial recognition, and other inputs for a seamless user experience. They are progressively partnering with OEMs and collaborating with prominent technology companies to integrate gesture recognition into mainstream platforms.

Brands are further working with universities and research institutions to access cutting-edge technologies. They are offering tailored solutions for specific industries like automotive, healthcare, and gaming. Organizations are introducing a range of products targeting various market segments, from high-end systems to cost-effective solutions for emerging markets.

Recent Industry Developments

The market is anticipated to reach a value of US$ 117.3 Bn by 2032.

It is a technology that enables machines or devices to interpret and respond to human gestures.

Gesture recognition and touchless sensors are widely used in defense, healthcare, and advertisement and communication.

Prominent players in the market include Eyesight Technologies Limited, Cognivue, and Infineon technologies AG.

The market is predicted to witness a CAGR of 21.8% during the forecast period.

|

Attributes |

Detail |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Technology

By End-use Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author