ID: PMRREP34923| 184 Pages | 13 Nov 2024 | Format: PDF, Excel, PPT* | Healthcare

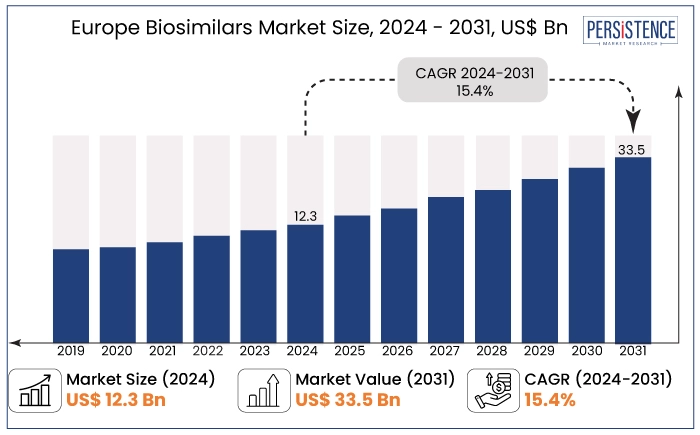

The Europe biosimilars market is projected to witness a remarkable CAGR of 15.4% during the forecast period from 2024 to 2031. It is anticipated to increase from US$ 12.3 Bn recorded in 2024 to a staggering US$ 33.5 Bn by 2031.

One of the key trends in the market is the adoption of biosimilars mainly in oncology. Rising healthcare costs are driving demand for affordable treatment options, significantly impacting the biosimilars market in Europe. The increasing acceptance of biosimilars across the region enhances competition, encouraging innovation and improving access to essential therapies.

The shift toward value-based care models is pushing healthcare providers to adopt cost-effective biosimilars as a way to optimize treatment outcomes. Together, these factors are creating a dynamic market that promotes growth, accessibility, and affordability of biosimilars, benefiting patients and healthcare systems throughout Europe.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Europe Biosimilars Market Size (2024E) |

US$ 12.3 Bn |

|

Projected Market Value (2031F) |

US$ 33.5 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

15.4% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

12.5% |

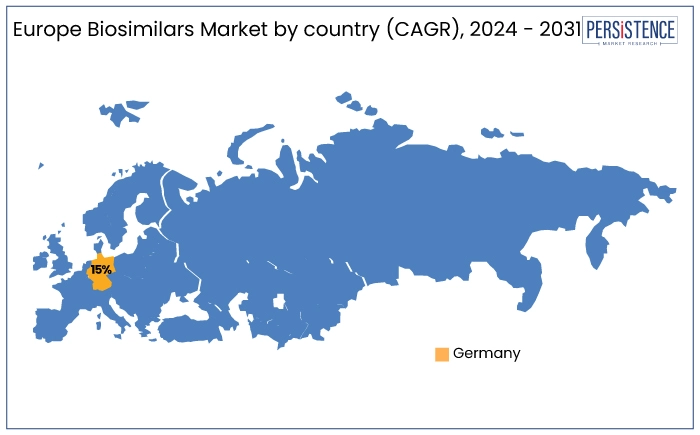

In Europe, Germany is anticipated to record a considerable CAGR of 15% through 2031. Germany has a well-established reimbursement framework for biosimilars. Combined with a robust healthcare system and early regulatory approvals, Germany’s proactive stance on biosimilars supports widespread use across therapeutic areas such as oncology, immunology, and rheumatology.

The increasing preference for cost-effective alternatives to originator biologics, alongside significant investments by global biosimilar manufacturers positions Germany as a central hub for biosimilars in Europe.

|

Category |

CAGR through 2031 |

|

Indication – Oncology Diseases |

13.7% |

In terms of indication, oncology diseases category is anticipated to lead in the foreseeable future by capturing a CAGR of around 13.7%. Oncology biosimilars offer significant cost savings compared to originator biologics, making them a more accessible option for both patients and healthcare systems.

The ability of biosimilar’s to provide effective, high-quality treatment alternatives with comparable safety and efficacy to branded biologics drives their adoption. Also, the growing demand for affordable cancer therapies, along with supportive regulatory frameworks and reimbursement policies in Europe is expected to further accelerate the uptake of biosimilars in oncology.

|

Category |

CAGR through 2031 |

|

Distribution Channel- Hospital Pharmacies |

14.2% |

Based on distribution channel, the hospital pharmacies segment is projected to exhibit a CAGR of 14.2% during the period from 2024 to 2031. This growth is driven by the increasing adoption of biosimilars in oncology and other therapeutic areas, as hospitals are central to the administration of these treatments.

Hospital pharmacies are key in providing cost-effective biosimilars, ensuring patients have timely access to affordable alternatives to expensive biologics. Additionally, the Europe healthcare system's focus on improving cost-efficiency and enhancing patient access to high-quality treatments supports the expanding role of hospital pharmacies in managing biosimilar therapies.

The growing demand for biosimilar drugs has transformed the current therapeutic landscape, offering patients affordable alternatives to high-cost biologic therapies. The Europe biosimilars market is experiencing notable growth, driven by increasing demand for cost-effective alternatives to expensive biologic therapies.

Biosimilars are expected to become a crucial component of healthcare systems with many blockbuster biologic patents expiry offering significant savings while maintaining similar safety and efficacy profiles. The Europe market is highly supported by strong regulatory frameworks from the European Medicines Agency (EMA), which has accelerated the approval process for biosimilars. Consequently, fostering wider adoption across therapeutic areas such as oncology, immunology, and rheumatology.

Shift toward value-based healthcare models, and a growing focus on improving patient access to biologics amid rising healthcare costs is a key trend being observed in the market. Additionally, the expanding role of hospital pharmacies in distributing biosimilars and the increased availability of biosimilar options for chronic diseases are further contributing to market expansion. With continued investment in research and development, the Europe biosimilars market is poised for sustained growth through 2031.

The Europe biosimilars market recorded a CAGR of 12.5% during the period from 2019 to 2023 due to factors such as growing acceptance of biosimilars, increasing patent expirations, and the need for cost-effective treatment options across multiple therapeutic areas.

Enhanced regulatory support and expanding healthcare budgets further fueled market growth during this period. Regulatory frameworks in Europe particularly from the European Medicines Agency (EMA), played a critical role in accelerating approvals, ensuring biosimilars met rigorous standards for safety and efficacy.

The market is expected to maintain strong growth as more biosimilar options become available, with increasing healthcare access and support for value-based care models across Europe. Sales of biosimilar drugs in Europe are estimated to record a CAGR of 15.4% during the forecast period between 2024 and 2031.

Wider Reimbursement and Pricing Approvals Across Europe

Many countries in Europe have recognized the importance of biosimilars in controlling healthcare costs, leading to favourable reimbursement policies that ensure these therapies are included in public health programs. This has encouraged healthcare providers to prescribe biosimilars frequently, knowing that they are financially supported.

Pricing strategies in several regions have been designed to make biosimilars affordable, allowing them to compete effectively with originator biologics. These policies not only drive market adoption but also enhance patient access to high-quality, cost-effective treatment options across Europe. Wider reimbursement and pricing approvals across Europe have significantly contributed to the Europe biosimilars market growth.

Government and Regulatory Support for Biosimilars

The European Medicines Agency (EMA) plays a central role by providing clear regulatory pathways for biosimilars, ensuring they meet rigorous safety, efficacy, and quality standards. This streamlined approval process has accelerated the market entry of biosimilars, fostering competition with originator biologics and helping reduce overall healthcare costs.

Many European governments have implemented policies to promote biosimilars, supporting their adoption in various therapeutic areas. These regulatory frameworks not only build market confidence but also improve the accessibility of biosimilars to a wider patient population.

Intellectual Property and Patent Litigation

Intellectual property (IP) and patent litigation represent significant challenges for the Europe biosimilars market. Originator biologics often have complex patent portfolios, which can delay the entry of biosimilars due to legal disputes. Patent holders may extend their exclusivity through "evergreening" practices, where they file new patents for modified versions of biologics, thereby prolonging market monopolies.

Biosimilar manufacturers face high legal costs and risks associated with patent challenges, often leading to delays in market entry. This uncertainty impacts investment decisions and slows the availability of affordable biosimilar alternatives. As patent litigation continues, it can hinder competition and the broad adoption of biosimilars in Europe.

Slow Adoption in Some European Countries

Adoption of biosimilars in some countries of Europe is quite slow, influenced by several factors including conservative prescribing practices, a lack of awareness among healthcare professionals, and varying levels of regulatory confidence.

Physicians are hesitant to switch from established biologics to biosimilars in certain regions due to concerns about their clinical effectiveness, despite rigorous regulatory approvals. In others, the price differences between biologics and biosimilars being minimal because of no pricing rules for biosimilars also impact the biosimilar uptake.

Cultural and healthcare system differences can result in uneven uptake, with some countries slower to embrace biosimilars due to financial, logistical, or educational barriers. This delayed adoption limits the potential market growth of biosimilars, preventing patients in these regions from benefiting from affordable treatment options.

Potential for Biosimilars in Biosimilar-Reference Biologic Switching

The potential for biosimilars in biosimilar-reference biologic switching presents a significant opportunity in the Europe biosimilars market.

As healthcare systems increasingly prioritize cost-effective treatments, the ability to switch patients from originator biologics to biosimilars can further reduce healthcare expenses. This practice is particularly relevant in chronic disease management, where long-term treatment is required. Furthermore, total of 10 biological medicines are expected to lose intellectual property (IP) protection in the next decade providing loss of exclusivity opportunities of nearly €30 Bn between 2030 and 2032.

Regulatory agencies, like the EMA have supported this concept by approving biosimilar interchangeability in many cases, allowing patients to transition smoothly between treatments. As physician confidence in biosimilars grows, switching programs could lead to broad adoption and further price competition, benefiting both patients and healthcare providers.

Expansion of Biosimilars in Non-Oncology Therapeutic Areas

The expansion of biosimilars into non-oncology therapeutic areas presents a significant growth opportunity in the Europe biosimilars market. While oncology has traditionally been the dominant focus, biosimilars are increasingly being developed for conditions such as autoimmune diseases, diabetes, and inflammatory disorders. These areas represent large patient populations where biologic treatments are often expensive.

As healthcare systems strive for cost containment, biosimilars offer an affordable alternative, promoting wide access to life-saving therapies. Regulatory support and increasing physician confidence in biosimilar efficacy are also driving this expansion, potentially transforming the treatment landscape for chronic and complex diseases across Europe.

The competitive landscape of the Europe biosimilars market is dynamic and rapidly evolving, with key players including both established pharmaceutical giants and specialized biosimilar manufacturers.

Companies like Sandoz, Amgen, Samsung Biologics, Biogen, and Celltrion lead the market, offering biosimilars across a range of therapeutic areas such as oncology, immunology, and endocrinology. These players benefit from strong research and development capabilities, regulatory expertise, and strategic partnerships with healthcare providers.

Competition is intensifying as new entrants continue to emerge, driven by the growing demand for cost-effective biologics. Pricing pressures, patent challenges, and market differentiation based on product quality and safety are key factors shaping this competitive environment.

Recent Industry Developments

Yes, the market is set to reach US$ 33.5 Bn by 2031.

Hospital pharmacies remain the preferred sales channel contributing more than 50% revenue share in 2023.

The market is estimated to be valued at US$ 12.3 Bn in 2024.

There are 62 biosimilars approved at present by the U.S. Food and Drug Administration (FDA).

Germany is estimated to witness a high market share in Europe by 2031.

Biosimilar therapeutics for oncology disease is considered the leading segment.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Drug

By Drug Class

By Indication

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author