ID: PMRREP34891| 190 Pages | 4 Nov 2024 | Format: PDF, Excel, PPT* | Healthcare

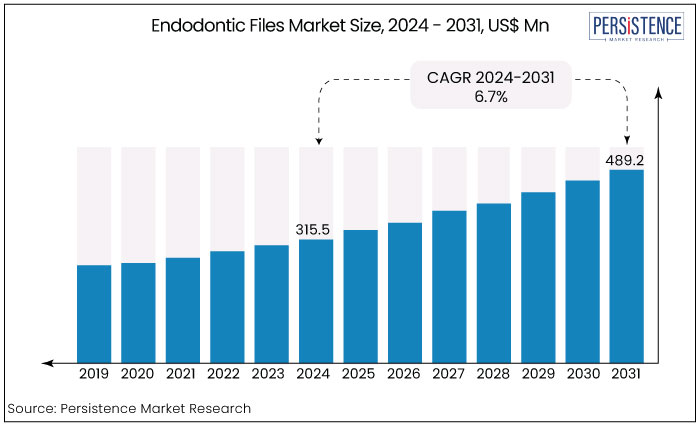

The endodontic files market is expected to rise from US$ 315.5 Mn in 2024 to US$ 489.2 Mn in 2031. The market is projected to witness a CAGR of 6.7% in the forecast period from 2024 to 2031.

Increasing prevalence of dental disorders and growing demand for sophisticated dental procedures are the main drivers of growth. As per the World Health Organization (WHO), every year, around 3.5 billion individuals are affected by oral diseases. It was also found that approximately 514 million children suffer from caries of primary teeth and 2 billion individuals live with caries of permanent teeth across the globe.

The aforementioned factors are anticipated to present manufacturers with substantial growth prospects. High-quality endodontic files are becoming immensely popular owing to rising aging population and growing emphasis on preventive dental care.

Advancements like the launch of nickel-titanium files are anticipated to boost sales as dental professionals look for effective root canal treatment alternatives. The surging focus on dental health and ongoing developments in endodontic procedures will likely fuel significant expansion in the upcoming years.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Endodontic Files Market Size (2024E) |

US$ 315.5 Mn |

|

Projected Market Value (2031F) |

US$ 489.2 Mn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

6.7% |

|

Historical Market Growth Rate (CAGR 2018 to 2023) |

5.3% |

|

Region |

CAGR through 2031 |

|

North America |

5.4% |

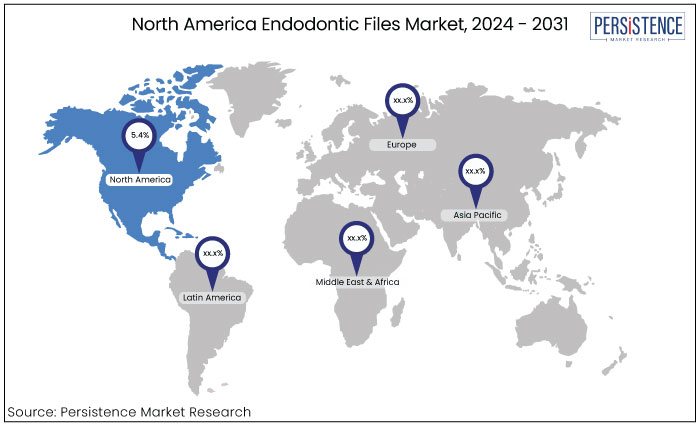

With a noteworthy CAGR of 5.4% through 2031, North America, especially the United States, is anticipated to dominate the endodontic files industry. The broad network of dental offices and retail pharmacies that provide a wide range of endodontic files from different brands and price points is primarily responsible for this rise. Easy product availability and competitive pricing are two main reasons why millennials prefer these sales platforms.

Buyers can now easily compare product features and read reviews before making a purchase due to the widespread use of e-commerce platforms. As leading dental supply firms increase their online presence, demand is further increased by advancements in logistics and distribution. They are enabling quick deliveries and access to cutting-edge endodontic technologies in North America.

|

Category |

CAGR through 2031 |

|

End User - Dental Clinics |

4.9% |

With a projected CAGR of approximately 4.9% over the forecast period, the dental clinics segment is expected to dominate the endodontic files market by end user. This growth is primarily driven by increasing number of dental clinics and rising demand for advanced dental procedures. Dental clinics are investing in the latest technologies and tools to enhance treatment outcomes and improve patient satisfaction, leading to higher adoption rates of endodontic files.

The trend toward preventive and minimally invasive dentistry is further fueling demand for endodontic files within these clinical settings. For instance,

Similar initiatives underscore the commitment of dental clinics to embrace cutting-edge technology, ultimately driving market growth.

|

Category |

CAGR through 2031 |

|

File Type - Nickel Titanium |

5.2% |

Due to their better qualities over stainless steel files, nickel-titanium endodontic file sales are predicted to rise dramatically through 2031. Dentists can easily negotiate intricate root canal anatomy owing to increased flexibility and resilience of this material to cyclic fatigue. Patient comfort and treatment results can be enhanced with this flexibility.

The need for nickel-titanium files will likely increase as dentists place greater emphasis on minimally invasive procedures and improving patient experiences in general. Although stainless steel files are still reasonably priced, nickel-titanium files are becoming highly popular due to their therapeutic benefits. These factors are making them the material of choice for contemporary endodontic procedures.

Increased awareness of oral health and growing incidence of dental illnesses are predicted to fuel a ten-year spike in demand for endodontic files. The need for top-notch files is also growing as more people look for root canal therapy to save their natural teeth.

There are a lot of development prospects due to the expansion of dental practices in emerging nations. Innovative products with better materials that increase strength, flexibility, and resistance to cyclic fatigue are being introduced by manufacturers.

The need for efficient endodontic methods is increasing owing to the trend toward minimally invasive dental procedures. All of these factors work together to position the endodontic files market for significant expansion and innovation in the years to come, catering to the changing demands of both patients and dental professionals.

The global endodontic files industry recorded a robust CAGR of 5.3% during the historical period from 2019 to 2023. Key dental product manufacturers invested significantly in research and development during this period to enhance their product offerings and counteract challenges posed by the pandemic. They continuously experimented with materials and designs to create advanced endodontic files that meet the evolving needs of dental professionals.

Manufacturers also began focusing more on the changing requirements of practitioners and patients, adapting their products to cater to diverse treatment scenarios. For instance, they developed files with improved flexibility and strength to navigate complex root canal anatomies more effectively.

Sales of endodontic files are projected to record a CAGR of 6.7% during the forecast period from 2024 to 2031. It is anticipated to be driven by increasing demand for efficient and reliable root canal treatments as more patients seek professional dental care.

Increasing Prevalence of Pulpitis and Dental Caries to Boost Demand

Rising prevalence of dental diseases worldwide is a key factor fueling demand in the endodontic files market. Conditions such as dental caries, pulpitis, and other periodontal issues are on the rise due to factors like poor oral hygiene, unhealthy dietary habits, and limited access to preventive care. According to the World Health Organization (WHO), oral diseases affect approximately 3.5 million people globally. This underscores an urgent need for effective endodontic treatments, including advanced endodontic file systems.

As awareness of oral health increases, more individuals are seeking professional dental care, leading to a surging demand for root canal treatments. This trend is especially prominent among aging populations, who are more prone to dental issues. Consequently, dental professionals are investing in cutting-edge endodontic file technologies to enhance the efficiency and quality of root canal procedures. This shift toward advanced endodontic solutions is driving market growth while significantly improving patient outcomes in dental care.

Innovations in Root Canal Therapy to Augment Growth

The market for endodontic files is being driven by ongoing advancements in endodontic technologies. Root canal therapy is now safer and more successful due to developments in materials and file design, especially the creation of rotary and reciprocating systems. More flexibility and resilience to cyclic fatigue are made possible by improved nickel-titanium technology, which makes it easier for dentists to handle intricate root canal anatomy.

The aforementioned developments make these instruments highly attractive to dentists since they not only enhance treatment results but also lower the possibility of problems. Because of this, dentists are spending more money on these cutting-edge endodontic files, which is bolstering market expansion. This pattern emphasizes how crucial innovation is to addressing the changing demands of contemporary dentistry.

Premium Price of High-end Instruments to Hamper Sales

Rising adoption is hampered by the expensive nature of sophisticated endodontic files, particularly in markets where consumers are price conscious. It is especially prevalent for those files composed of resilient nickel-titanium with improved flexibility and fatigue resistance. Purchasing these high-end instruments might be challenging for small-scale clinics and those in developing countries because of their frequently tight finances. For instance,

The quality of treatment and procedural efficiency are impacted by this cost barrier, which limits access to new endodontic technology. Despite the clinical advantages, exorbitant costs preclude some clinics from incorporating these cutting-edge files into their practices, which restricts market expansion.

Shift toward Rotary and Reciprocating File Systems to Create Opportunities

Increasing use of rotary and reciprocating file systems is anticipated to create novel growth opportunities in future. These cutting-edge devices provide considerable benefits over manual files, including increased accuracy, adaptability, and efficiency for root canal treatments. They can handle intricate canal architecture, cut down on treatment time, and enhance patient outcomes. As they can lower hazards such as file breakage, rotary and reciprocating systems are especially prized.

Innovations in nickel-titanium technology are also driving demand as these materials offer excellent flexibility and strong resistance to cyclic fatigue, enabling safe treatment in complex situations. Manufacturers are in a strong position to benefit from the growing trend of dental clinics implementing these systems due to their dependability and effectiveness. This is anticipated to present significant prospects for market expansion.

Development of Robust Dental Infrastructure to Open the Door to Success

Endodontic file suppliers are set to gain a significant opportunity as dental infrastructure broadens in emerging regions, particularly in Asia Pacific and Latin America. The need for sophisticated root canal therapy and endodontic technology is surging as dental care becomes more widely available and oral health awareness increases.

High-quality dental instruments, such as cutting-edge endodontic files, are in high demand in India. Government programs like the National Oral Health Program in India seek to improve dental services and accessibility.

In order to satisfy growing patient expectations, leading dental chains that are extending in nations like Brazil are also making significant investments in cutting-edge equipment. A strong market for endodontic files is produced by this expansion of dental infrastructure. It will likely give providers access to a new and quickly expanding clientele in these areas.

The global endodontic files industry is highly competitive, with large- and small-scale companies developing unique technologies to meet varying dental care needs. Key brands are focusing on innovations in file materials, such as nickel-titanium, to enhance durability and reduce procedural risks.

Local manufacturers are increasing their market presence by utilizing online platforms and attending specialized dental industry events. New start-ups specializing in endodontic solutions are also set to emerge. They are likely to be supported by funding and exposure from dental-focused platforms like Dental Innovation Alliance. Such platforms provide crucial networking opportunities, funding resources, and visibility across the dental community. They are set to help start-ups bring cutting-edge endodontic products to the market efficiently.

Recent Industry Developments

It is anticipated to reach US$ 489.2 Mn by 2031 from US$ 315.5 Mn in 2024.

The files are mainly used for shaping and cleaning the root canals.

Dentsply Sirona is considered a leading player in the global market.

It is likely to rise at a CAGR of 6.7% from 2019 to 2023.

Endo file sizes range from 15 (0.15mm tip diameter) to 80 (0.8mm tip diameter).

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Million for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By File Type

By Treatment

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author