ID: PMRREP22993| 200 Pages | 28 Nov 2025 | Format: PDF, Excel, PPT* | Packaging

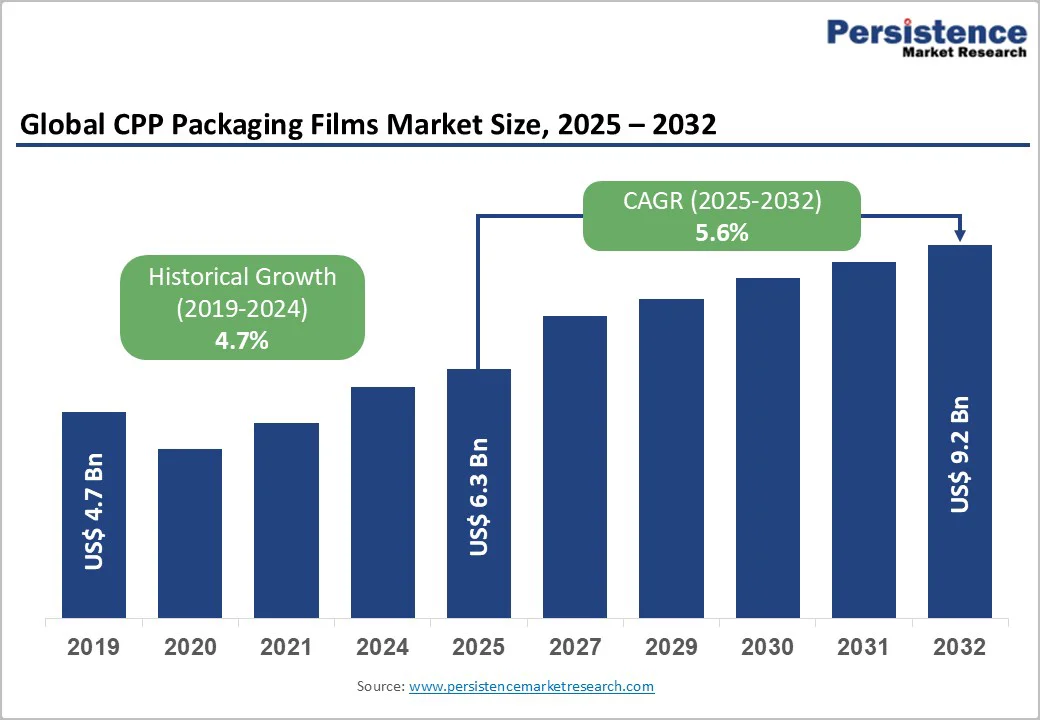

The global CPP packaging films market size is likely to be valued at US$ 6.3 billion in 2025, and is projected to reach US$ 9.2 billion by 2032, growing at a CAGR of 5.6% during the forecast period 2025-2032. Market growth is being primarily driven by the increasing demand for flexible, sustainable packaging in the food, pharmaceutical, and consumer goods sectors, along with advancements in film technology that improve barrier properties and recyclability. Rising e-commerce and ready-to-eat food consumption are boosting the need for lightweight, high-clarity films for better protection and presentation, as seen in global trade data highlighting increased exports of packaged products.

| Key Insights | Details |

|---|---|

|

CPP Packaging Films Market Size (2025E) |

US$ 6.3 billion |

|

Market Value Forecast (2032F) |

US$ 9.2 billion |

|

Projected Growth CAGR (2025-2032) |

5.6% |

|

Historical Market Growth (2019-2024) |

4.7% |

The rising demand for flexible and efficient packaging solutions in the food and beverage industry is a key factor driving the CPP packaging films market growth. Consumers are increasingly choosing ready-to-eat, frozen, and convenience foods that require packaging with strong sealing and moisture-resistant properties. According to the Food and Agriculture Organization (FAO), global food production reached 8.9 billion tons in 2023, boosting the need for packaging that ensures extended shelf life. CPP films offer superior heat-sealability and clarity, helping reduce food spoilage by up to 30% compared to conventional materials. The growth of e-commerce and online grocery platforms has accelerated demand for lightweight CPP pouches that reduce shipping weight and lower transportation costs by 15–20%. As a result, CPP films are becoming essential in maintaining food quality, visibility, and cost-efficiency, establishing them as a cornerstone of the flexible packaging industry.

Innovations in sustainable CPP film production are significantly supporting market expansion, as manufacturers respond to intensifying global sustainability mandates. The development of eco-friendly CPP films using recycled materials, down-gauging techniques, and bio-based additives aligns with circular economy goals and regulatory frameworks. The European Union (EU)’s Single-Use Plastics Directive has accelerated the use of recyclable packaging, with CPP producers incorporating post-consumer resins to maintain durability and clarity. Moreover, high-barrier CPP films that protect against oxygen and UV degradation are extending product shelf life for pharmaceutical and personal care applications. Consequently, CPP manufacturers are strengthening competitiveness while capturing emerging demand from environmentally conscious and high-value sectors.

Growing environmental awareness and strict regulations surrounding plastic waste are major restraints for the CPP films market. The United Nations Environment Programme (UNEP) reports that global plastic pollution has reached 400 million tons annually, fueling the need for stronger policies and consumer preferences for eco-friendly alternatives. In jurisdictions implementing bans on single-use plastics, CPP film demand is likely to decline drastically, particularly in retail packaging. In response, several companies are shifting toward paper-based and biodegradable materials to meet regulatory standards and brand sustainability goals. These transitions have created additional compliance costs and operational challenges for manufacturers, slowing growth in highly regulated regions such as Europe and North America.

Unstable raw material costs are another major challenge affecting the CPP packaging films market. The production of CPP films relies heavily on polypropylene resins, whose prices are directly tied to crude oil fluctuations. For instance, Russia-Ukraine tensions threatened to push crude oil prices to around US$ 80 – US$ 82 per barrel in 2025. This externalities-induced volatility significantly impacts production costs and profit margins for film manufacturers, especially in price-sensitive markets. Smaller converters are particularly vulnerable as they struggle to absorb cost increases without raising product prices.

The deepening focus on circular economy models and eco-friendly materials presents major opportunities for CPP film producers, especially in emerging markets. In Asia Pacific, where recycling rates average only 20% according to certain estimates, there is a strong demand for sustainable packaging solutions amid rapid urbanization. Manufacturers are developing bio-based and recyclable CPP films that incorporate up to 30% recycled content and use thinner gauges below 20 microns, cutting raw material use by 25% without sacrificing performance. These advancements appeal to the fast-growing e-commerce and food delivery industries in India and China. Furthermore, strategic partnerships with resin suppliers for plant-based additives are helping companies comply with sustainability laws such as India’s Plastic Waste Management Rules, unlocking potential green packaging revenue streams.

The expanding global pharmaceutical industry presents another lucrative growth avenue for CPP films, with this high-value sector demanding safe, sterile, and high-barrier packaging materials. CPP films, especially retort-grade variants, can withstand sterilization at 121°C, making them ideal for medical and healthcare products. Emerging economies in regions such as Latin America are witnessing steady improvement in healthcare access, boosting packaging requirements for drugs and medical devices. The integration of antimicrobial coatings and tamper-evident features ensures compliance with the sterility standards of U.S. Food and Drug Administration (FDA). As biopharmaceutical investments are projected to increase exponentially over the next decade, CPP manufacturers can capture a larger market share in healthcare packaging.

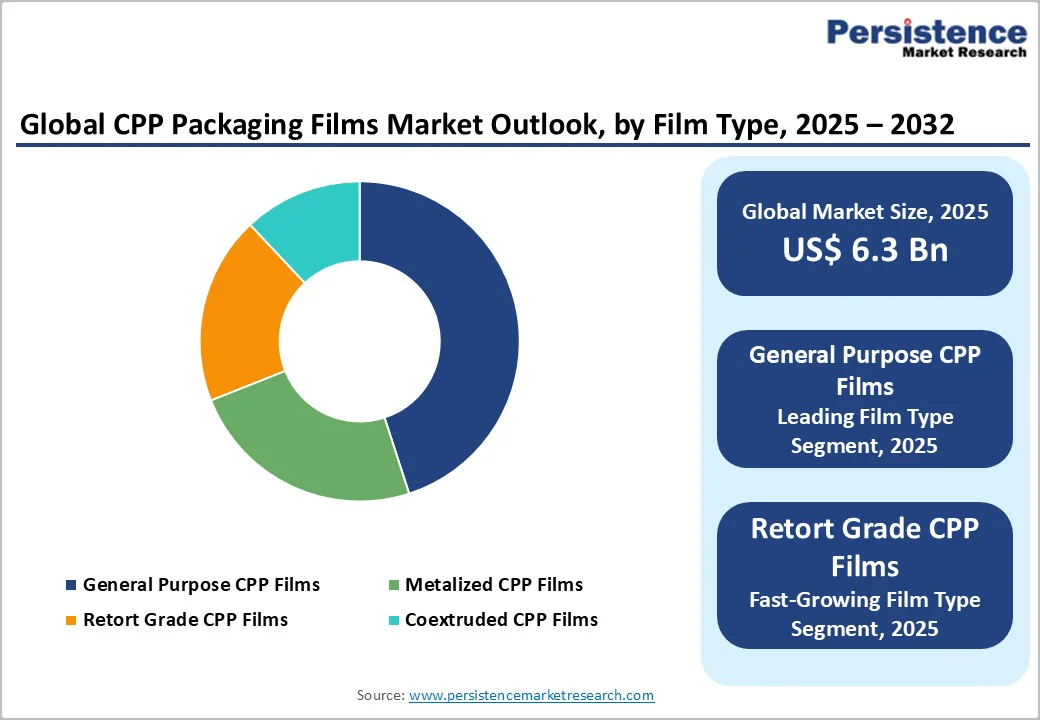

General purpose CPP films dominate the film type category with around 45% market share in 2025, primarily due to their cost efficiency and wide usability across everyday packaging applications. These films offer excellent clarity, seal strength, and printability, making them highly preferred for consumer goods packaging where product visibility influences buying decisions. Nearly 60% of the total CPP production is allocated to general-purpose applications. Their strong adaptability in lamination and printing further ensures widespread utilization, particularly in flexible snack wrappers, solidifying their market leadership.

The 20–30 microns (µm) thickness range leads the market with nearly 50% of the CPP packaging films market revenue share in 2025, as it provides the perfect balance between durability and lightweight design for large-scale packaging. These films deliver strong puncture resistance while reducing material usage by nearly 15% compared to thicker variants, making them ideal for cost-effective and sustainable solutions. This thickness range is preferred the majority of food pouch applications owing to its excellent machinability and efficiency on high-speed automated packaging lines, especially in the food and e-commerce sectors.

Bags and pouches represent the dominant packaging form, holding approximately 40% of the market revenue share in 2025, largely due to their convenience, portion control, and resealability for on-the-go lifestyles. The insulation and barrier properties of CPP films ensure freshness and secure closures, making them a top choice for food and personal care packaging. The rising popularity of stand-up pouches, growing at nearly 10% annually, highlights the consumer shift toward lightweight, flexible, and sustainable packaging formats.

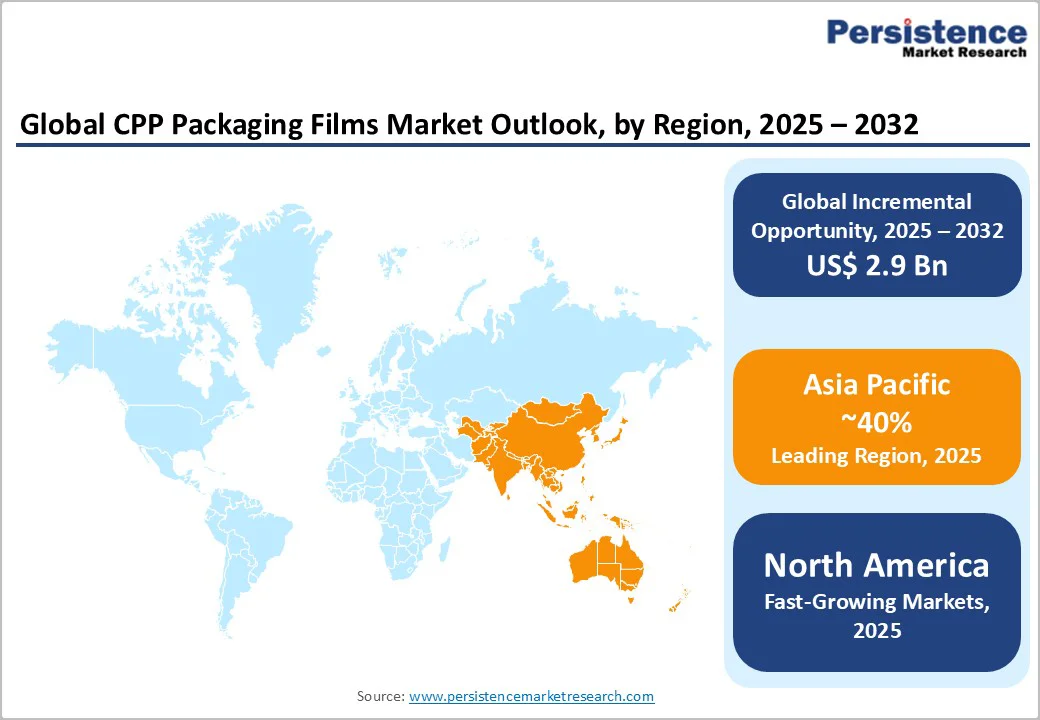

North America remains a leading hub for innovation, with the United States contributing nearly 70% of the region’s total demand for CPP films. The market benefits from advanced food processing and pharmaceutical manufacturing facilities that demand high-performance packaging. The FDA’s stringent barrier requirements have encouraged the use of metallized CPP films to enhance shelf life, leading to a notable rise in pharmaceutical packaging applications, especially after COVID pandemic. The packaging ecosystem of North America is strongly supported by heavy R&D investments, with the Flexible Packaging Association reporting over US$ 2 billion in annual innovation funding. Manufacturers are also integrating IoT-based quality control systems, cutting production defects significantly. With growing e-commerce and sustainability mandates from the U.S. Environmental Protection Agency (EPA), North America is positioned for continued leadership in next-generation CPP technologies.

In Europe, the emphasis is primarily on sustainability and regulatory compliance, with countries such as Germany and the U.K. leading regional CPP consumption. The EU Packaging and Packaging Waste Regulation (PPWR) has pushed companies to adopt recyclable and compostable CPP materials. France and Spain have witnessed a considerable growth in flexible packaging imports due to harmonized recycling standards and demand from textile and cosmetics industries.

Germany leads in metallized CPP film production, achieving 30% cost savings in lamination processes, while the U.K. reports a robust expansion in pharmaceutical film applications driven by post-Brexit innovation. The adoption of bio-additives and REACH-compliant materials continues to strengthen Europe’s competitive edge. Regulatory alignment and sustainability-focused R&D are anticipated to foster regional market expansion across Europe over the forecast period.

Asia Pacific dominates the CPP packaging films market share due to its strong manufacturing base, competitive costs, and rapid industrialization. China leads the charge in terms of CPP export volumes, supported by large-scale, cost-efficient production facilities. Government initiatives such as China’s 14th Five-Year Plan promote sustainable packaging, helping reduce industrial emissions. The ASEAN bloc is witnessing a significant growth driven by high-speed urbanization and growing middle-class populations.

India and Japan are also major contributors to market growth, fueled by rising packaged food consumption and robust e-commerce expansion. In India, e-commerce demand has led to a sizable increase in the production and consumption of CPP-based pouches. Meanwhile, Japan continues to innovate in retort-grade CPP films for export markets. Together, these factors have ensured that Asia Pacific remains the powerhouse of CPP film production and innovation, shaping global supply and cost dynamics.

The global CPP packaging films market landscape displays a consolidated structure, with major players such as Polyplex Corporation and Uflex holding a significant share of production through vertical integration and their global presence. Expansion strategies focus on increasing capacity in Asia, where investments are directed towards sustainable production lines, supported by increasing annual R&D spending. Key differentiators in the market include proprietary barrier technologies, allowing companies to charge a premium for pharmaceutical-grade products. Emerging business models emphasize circular supply chains, with partnerships for recycled resin that help reduce costs by 10%. This concentration in the market fosters innovation, while smaller firms focus on regional customizations.

The global CPP packaging films market is projected to reach US$ 6.3 billion in 2025.

Key drivers include rising flexible packaging needs in food and e-commerce, alongside sustainability innovations enhancing recyclability and barrier properties.

The market is poised to witness a CAGR of 5.6% from 2025 to 2032.

Developing bio-based CPP variants for pharmaceuticals, aligning with global sustainability policies, can generate multiple lucrative opportunities for market players.

Polyplex Corporation Ltd, Uflex Ltd, and Jindal Poly Films Limited are some of the key players in the market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Film Type

By Film Thickness

By Packaging Form

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author