ID: PMRREP28222| 200 Pages | 11 Dec 2025 | Format: PDF, Excel, PPT* | Industrial Automation

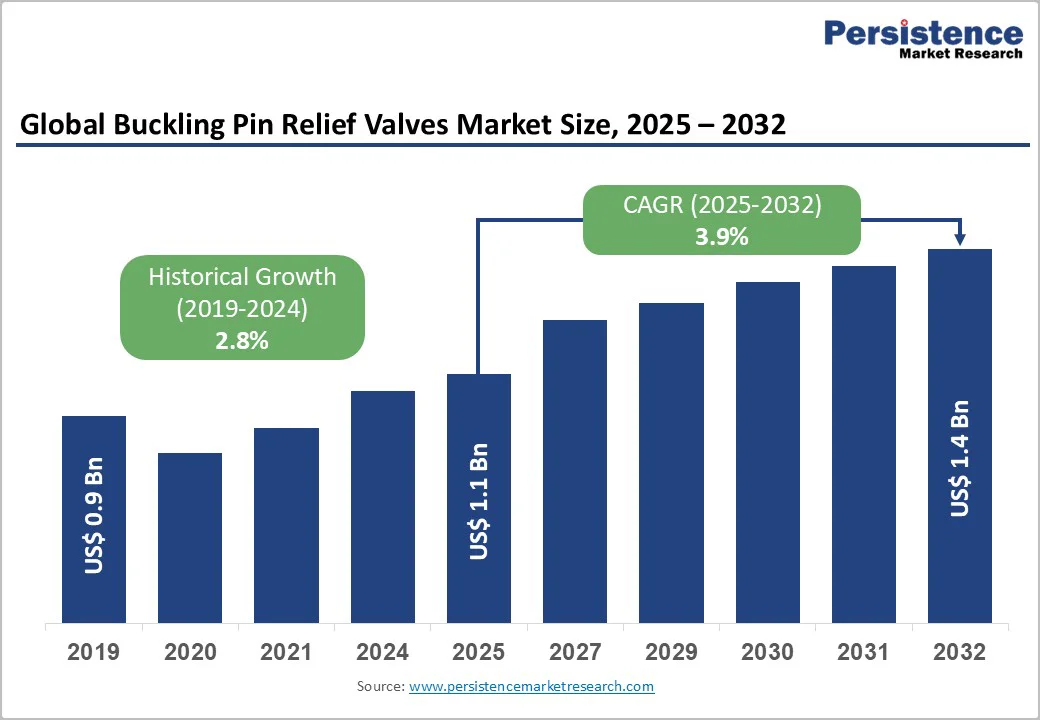

The global buckling pin relief valves (BPRV) market size is likely to be valued at US$ 1.1 billion in 2025 and projected to reach US$ 1.4 billion by 2032, growing at a CAGR of 3.9% between 2025 and 2032. The market expansion is primarily driven by rise in industrial safety regulations, increased infrastructure modernization across emerging economies, and rising demand for fail-safe pressure relief solutions in critical process environments.

Stringent compliance mandates from regulatory bodies including ASME (American Society of Mechanical Engineers), API (American Petroleum Institute), and the European Pressure Equipment Directive (PED 2014/68/EU) are compelling industries to adopt advanced pressure management systems, creating sustained demand for reliable BPRV technology that offers superior set pressure accuracy, tamper-proof operation, and minimal maintenance requirements across diverse industrial applications.

| Key Insights | Details |

|---|---|

|

Buckling Pin Relief Valves Market Size (2025E) |

US$ 1.1 Bn |

|

Market Value Forecast (2032F) |

US$ 1.4 Bn |

|

Projected Growth CAGR (2025-2032) |

3.9% |

|

Historical Market Growth (2019-2024) |

2.8% |

Industrial safety regulations represent the primary catalyst driving BPRV market expansion globally. Regulatory bodies including OSHA (Occupational Safety and Health Administration) in North America, the European Union’s PED (Pressure Equipment Directive), and international standards such as API 526 and ASME compliance mandates, are compelling industrial facilities to adopt advanced pressure management systems. According to the U.S. Department of Labor’s Bureau of Labor Statistics, there were over 1,300 workplace fatalities in the United States annually related to pressure system failures, underscoring the critical necessity for reliable safety devices. The implementation of enhanced industrial safety standards across oil refineries, chemical processing plants, pharmaceutical manufacturing facilities, and power generation installations continues to generate sustained demand for buckling pin relief valves that provide fail-safe, tamper-proof operation without requiring periodic recertification.

Rapid industrialization and infrastructure investment in emerging markets are significantly accelerating BPRV market growth. According to the Asian Development Bank (ADB), developing countries in Asia and the Pacific are projected to grow at 4.7% annually through 2025, with China contributing 4.7% GDP growth and India achieving 6.5% expansion. Major industrial nations are upgrading aging infrastructure and constructing new manufacturing facilities across oil and gas, petrochemicals, power generation, and water treatment sectors.

China occupies a dominant market share in East Asia, driven by heavy investments in power infrastructure, chemical processing, and water management systems. India’s rapidly expanding industrial base, supported by government initiatives such as the Production-Linked Incentive Scheme, is creating substantial demand for pressure relief solutions across refineries, pharmaceutical plants, and chemical facilities.

Fluctuating prices of raw materials, including stainless steel, specialty alloys, and precision engineering components, present significant restraints on BPRV market expansion. The global stainless steel market experiences cyclical price volatility driven by fluctuations in iron ore and nickel prices, increasing manufacturing costs and compressing profit margins for valve producers. High-precision manufacturing of buckling pin mechanisms requires specialized equipment and skilled labor, resulting in elevated production costs compared to conventional spring-loaded relief valves. These factors limit market penetration in price-sensitive applications and developing markets where budget constraints restrict adoption of premium-grade BPRV solutions that command price premiums relative to conventional pressure relief alternatives.

Alternative pressure relief technologies such as spring-loaded valves, pilot-operated valves, and poppet-type mechanisms continue to constrain the growth of the buckling pin relief valve (BPRV) market. Spring-loaded valves held 44% market share in 2024 among Pressure Relief Valve Market due to low acquisition cost, simple construction, and widespread use in oil and gas, chemicals, power generation, and water treatment. Pilot-operated valves are growing at around 7% CAGR, supported by rising demand for high-capacity and low-emission pressure control. Industrial operators remain reluctant to transition from familiar conventional systems since these options align with existing maintenance practices and integration requirements. Consequently, cost-sensitive sectors with large installed bases prefer traditional relief valves, limiting BPRV adoption despite their accuracy and fail-safe design.

Strong adoption of pressure management systems in the oil and gas industry offers a major opportunity for BPRV manufacturers, supported by steady expansion of Oil & Gas Valves across upstream, midstream, and downstream operations. The oil and gas application segment for BPRVs is expected to grow at a CAGR of approximately 4.8% through 2032, driven by refinery modernization and increasing emphasis on safety compliance. Chemical and petrochemical industries are also expanding at healthy annual growth rates, creating additional demand for precise and reliable pressure control systems. Buckling pin relief valves offer advantages such as accurate set pressure, fail-safe operation, and minimal maintenance, making them suitable for critical chemical handling conditions. Similar opportunities are emerging in the pressure relief valves for water and wastewater treatment market where operators seek stable and low-maintenance pressure protection solutions.

Growing emphasis on digitalization across industrial facilities creates strong opportunities for IoT-enabled buckling pin relief valve systems. Global adoption of Industrial Internet of Things platforms is expected to grow at a sustained CAGR through 2032 as industries shift toward predictive maintenance and automated process control. Integrating BPRVs with smart sensors enables continuous pressure monitoring, early leak identification, and accurate prediction of pin activation, reducing operational downtime. Demand for intelligent pressure relief systems is particularly strong in pharmaceuticals, specialty chemicals, and the Pressure Relief Valves for Water and Wastewater Treatment Market as these sectors prioritize equipment reliability and regulatory compliance. The development of HART- and Fieldbus-compatible BPRV systems further supports integration into modern automation architectures. These technological advancements position BPRV suppliers to capture premium demand within digitally advanced industrial environments.

The 5–10 inches segment remains the dominant size category in the global buckling pin relief valves (BPRV) market, accounting for nearly 42% of total demand in 2025. This size range offers an optimal balance between flow capacity, installation convenience, and compatibility with standard industrial piping layouts, making it highly suitable for mid- to high-flow relief applications. Industries such as oil and gas, chemicals, refining, and power generation rely heavily on this dimensional range due to its ability to integrate seamlessly with ASME and API-compliant flanges. Strong replacement activity in mature facilities, combined with expanding infrastructure in developing markets, reinforces the segment’s leadership. Standardized manufacturing, established supply chains, and proven operational reliability ensure that this size category continues to drive the highest revenue contribution through 2032.

The Medium Pressure (10–50 bar) category holds the largest market share, contributing nearly 44% of global BPRV installations in 2025. This range aligns with pressure ratings commonly used across petrochemical, chemical, power, and water treatment operations, creating broad applicability across industrial equipment. Its widespread adoption is supported by mature design standards, certified production methods, and decades of proven performance in managing water, steam, gases, and complex process fluids. The large installed base of medium-pressure systems creates consistent replacement demand as facilities undergo modernization and regulatory upgrades. With industrial expansion accelerating in Asia and continued activity in North America and Europe, this segment is expected to grow steadily at around 4.2% CAGR through 2032, maintaining its position as the most widely deployed pressure class globally.

The In-line BPRV configuration dominates the global market with approximately 57% share in 2025, driven by its ease of installation, compatibility with standard flanged connections, and ability to support both horizontal and vertical piping orientations. These valves enable quick access for pin replacement and routine maintenance without requiring system shutdowns or full depressurization, making them especially valuable in continuous-process industries. Their adaptability across gases, liquids, and mixed-phase fluids further strengthens market penetration. The Angle-type BPRV segment, with nearly 33% share, serves installations where directional flow change or space limitations require a 90-degree design. Through 2032, in-line valves are projected to retain leadership at roughly 4.3% CAGR, supported by strong preferences for reliable, easily serviceable pressure-relief configurations in modernization and expansion projects.

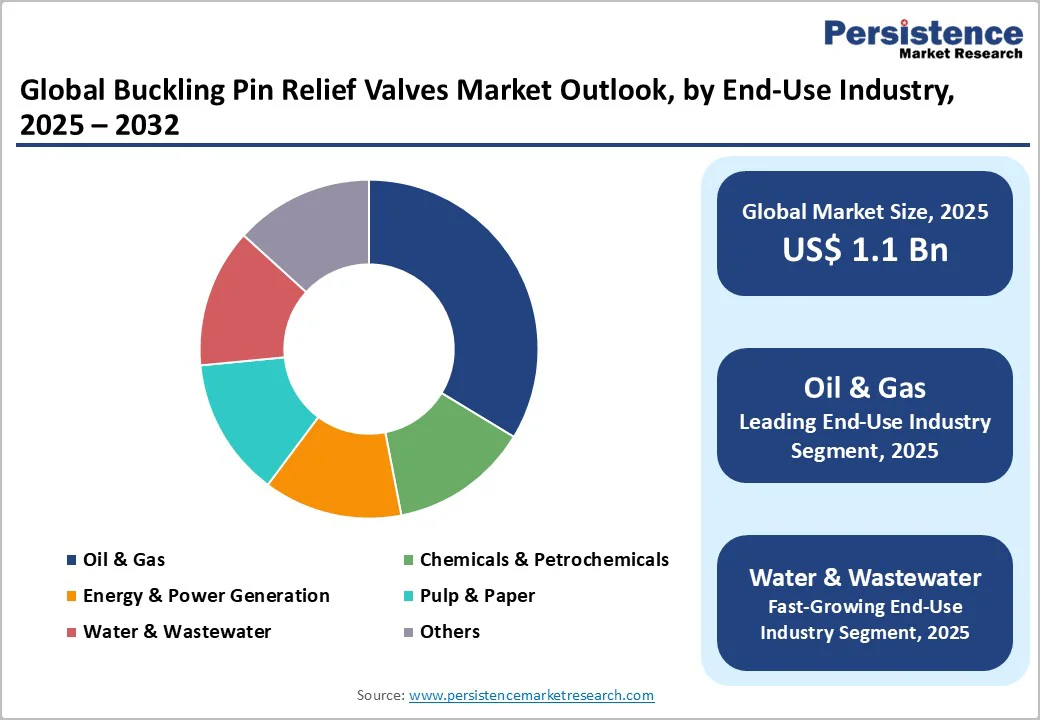

The Oil & Gas industry leads the global BPRV market with around 38% share in 2025, reflecting its dependence on reliable pressure-relief systems across upstream extraction, midstream pipeline networks, and downstream refining operations. Complex high-pressure environments in drilling rigs, wellheads, compressors, separators, and processing units demand robust BPRV solutions to ensure safety and operational continuity. Rising hydrocarbon consumption in emerging economies and increased investment in deepwater, offshore, and unconventional energy projects continue to drive demand. The Chemical & Petrochemical sector accounts for more than 20% share, supported by expanding specialty chemical and polymer production followed by Power generation and water and wastewater treatment.

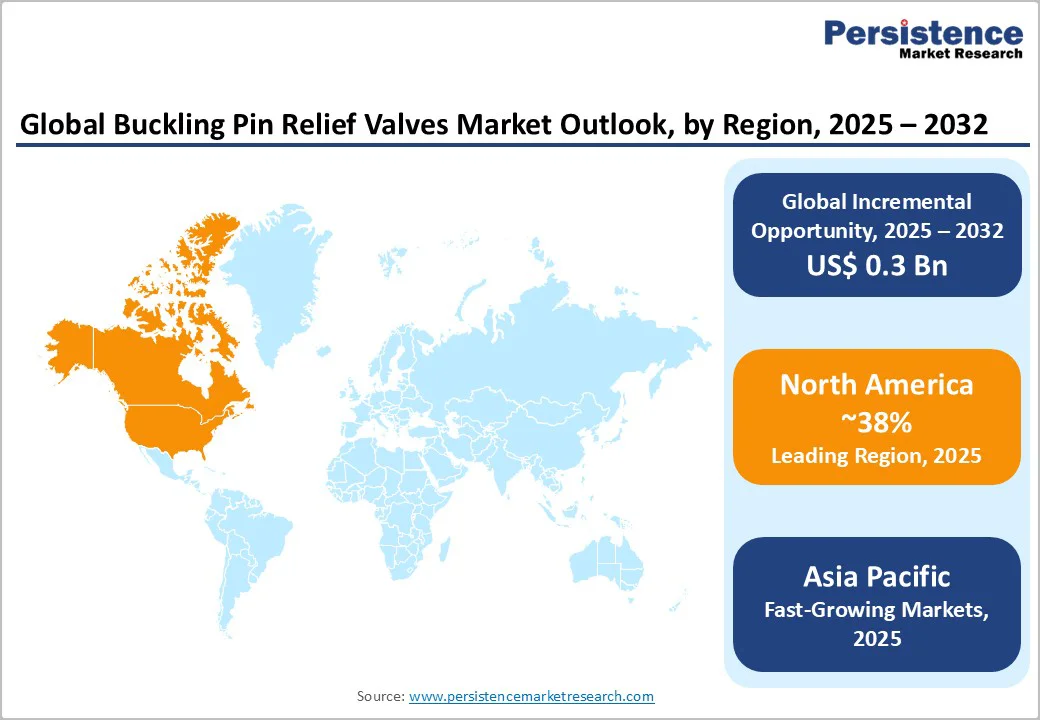

North America holds roughly 35% share of the global BPRV market in 2025, making it the leading regional hub for adoption due to strict industrial safety norms, a strong oil and gas ecosystem, and extensive chemical processing capacity. The United States accounts for the bulk of demand, supported by ongoing refinery modernization, petrochemical expansion, and upgrades in power generation facilities. OSHA-mandated safety requirements continue to reinforce the need for accurate, fail-safe pressure relief technologies.

Strong construction sector activity, valued at over US$ 2 trillion in 2024, creates additional installation opportunities in HVAC systems, water infrastructure, and industrial buildings. Shale gas development across major basins further drives investments in pressure control systems for gas processing and transportation assets. Canada contributes around 10% of regional revenue, supported by steady construction and industrial growth.

Europe accounts for nearly 22% of global BPRV demand in 2025, shaped by stringent industry regulations, advanced manufacturing capabilities, and widespread modernization of aging industrial assets. Compliance with the Pressure Equipment Directive (PED 2014/68/EU) ensures uniform quality standards for pressure systems across member states, sustaining strong uptake of certified BPRV solutions. Germany leads regional consumption due to its diversified industrial base spanning automotive, chemicals, and engineering sectors.

The UK demonstrates steady expansion, supported by infrastructure investments exceeding £600 billion and rising demand for high-integrity pressure relief equipment. France and Spain also show solid momentum driven by renewable energy capacity additions, chemical production growth, and plant upgrades. Regional adoption is reinforced by long-standing engineering standards such as the AD 2000 code, which emphasizes reliability and safety.

Asia Pacific is the fastest-growing regional market, projected to expand at 4.8% CAGR through 2032, driven by rapid industrialization, infrastructure expansion, and strong investment in energy and chemical processing sectors. China remains the core demand center, holding nearly half of East Asia’s BPRV share in 2024, supported by large-scale petrochemical capacity additions, extensive manufacturing activity, and continued development of thermal and renewable power plants. India is emerging as a high-growth market, supported by strong investor sentiment, a projected 6.5% economic growth rate, and government-led incentives that are expanding domestic manufacturing and industrial output.

Growing activity across refining, petrochemicals, pharmaceuticals, and power generation strengthens demand for reliable pressure relief systems. Japan contributes steady demand, driven by advanced engineering practices and strong emphasis on equipment reliability and safety. South Korea, Southeast Asia, and emerging ASEAN economies collectively support additional market growth through expanding industrial bases and large-scale infrastructure modernization initiatives across energy and chemical processing industries.

Competitive differentiation centers on technical innovation, regulatory certification compliance, application engineering support, and customer service capabilities rather than price-based competition. Key competitive strategies include investment in advanced manufacturing technologies, development of specialized high-pressure and low-pressure variants, expansion of technical support services, and pursuit of strategic alliances with facility engineering and maintenance contractors.

The global BPRV market is valued at US$ 0.777 billion in 2025 and is expected to reach US$ 1.09 billion by 2032, growing at a CAGR of about 4.4%.

Demand is driven by stringent safety regulations, rapid industrial expansion in Asia Pacific, rising oil and gas infrastructure investments, and increased adoption of fail-safe pressure relief systems across chemical, power, and water treatment sectors.

The medium-pressure (10–50 bar) segment leads with about 44% share due to its broad industrial applicability, established standards, and compatibility with diverse process fluids and equipment.

North America leads with around 35% share in 2025, supported by strict OSHA compliance, strong oil and gas infrastructure, extensive chemical capacity, and continuous industrial modernization.

Major opportunities lie in the expanding oil and gas sector, the rising adoption of IoT-enabled BPRV systems, and strong industrial growth across the Asia Pacific.

Key players include BS&B Safety Systems, Elfab, Taylor Valve Technology, King’s Energy Services, Jiangsu Reliable, and TAI Milano.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn/Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Size

By Set Pressure

By Valve Type

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author