ID: PMRREP6976| 209 Pages | 28 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

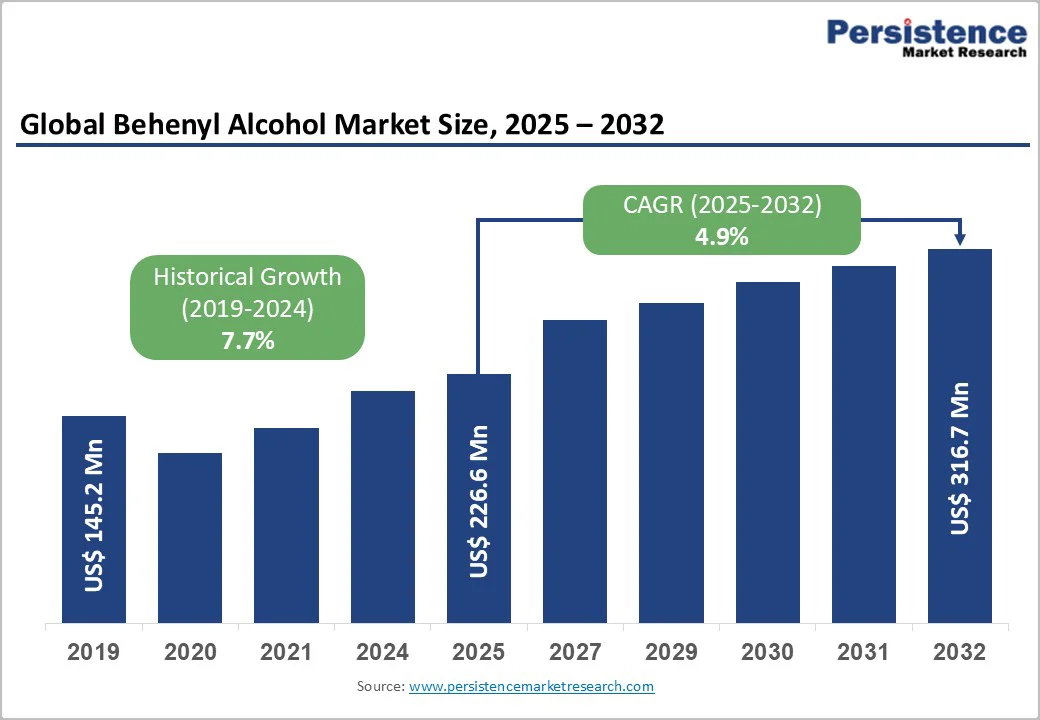

The global Behenyl Alcohol market size is valued at US$226.6 million in 2025 and is projected to reach US$316.7 million, growing at a CAGR of 4.9% between 2025 and 2032. Increasing consumer preference for natural and sustainable ingredients in personal care products boosts demand for behenyl alcohol as an emollient and thickener.

Behenyl alcohol's multifunctional properties as an emollient, emulsifier, and thickener make it indispensable in premium skincare formulations, hair care products, and anti-aging creams. Advancements in bio-based production methods from plant sources like rapeseed oil align with eco-friendly trends, further propelling market momentum as manufacturers seek compliant, multifunctional ingredients for emulsions.

| Key Insights | Details |

|---|---|

|

Behenyl Alcohol Size (2025E) |

US$ 226.6 Mn |

|

Market Value Forecast (2032F) |

US$ 316.7 Mn |

|

Projected Growth CAGR (2025-2032) |

4.9% |

|

Historical Market Growth (2019-2024) |

7.7% |

The increase in consumer awareness of natural skincare ingredients has significantly impacted the behenyl alcohol market. As a plant-derived emollient, behenyl alcohol softens the skin and improves the consistency of lotions, creams, and conditioners. This trend is reflected in the growing use of behenyl alcohol in formulations that are certified under standards like ECOCERT and COSMOS, which emphasize sustainable sourcing from rapeseed or mustard oil.

In the U.S., women spend an average of $3,000 annually on cosmetics, with 80% of them following beauty trends that prioritize multifunctional and non-irritating ingredients like behenyl alcohol. Its properties, which aid in viscosity control and emulsion stability, enhance the user experience. This trend also supports the growth of the Personal Care Chemicals Ingredients market by meeting the demand for hypoallergenic and eco-friendly products. As a result, there is sustained market growth through increased formulation versatility.

Behenyl alcohol plays a crucial role as a stabilizer and excipient in pharmaceutical formulations, especially in topical ointments and creams. Its use has fueled market growth in response to the increasing healthcare demand for skin-friendly delivery systems. Derived from natural sources, behenyl alcohol enhances drug bioavailability and improves texture without causing irritation, which aligns with the global trend towards bio-based excipients.

In the European Union, behenyl alcohol meets the animal by-product regulations under the Cosmetics Regulation when sourced from plants, allowing its incorporation in health products that require high purity and stability. This application supports the broader Specialty Chemicals Market by offering a versatile, non-toxic alternative in drug manufacturing. In key regions like China, production volumes reached 10,473.5 tons in 2022, highlighting robust demand and positive impacts on market accessibility.

The behenyl alcohol market faces significant challenges related to raw material availability and pricing fluctuations. Behenyl alcohol production is heavily dependent on rapeseed oil and mustard oil availability, and crop yields are susceptible to weather conditions, geopolitical tensions, and agricultural policy changes. Europe, which traditionally produced over 35% of global rapeseed, has experienced supply constraints affecting production costs.

Such volatility raises production costs, making it hard for manufacturers to remain competitive in price-sensitive regions. For example, in H2 2024, mixed trends in behenyl alcohol prices due to feedstock instability may deter small-scale producers and limit market entry in emerging economies. Consequently, the economic pressures could slow adoption in cost-sensitive sectors like detergents, where synthetic alternatives are gaining traction despite sustainability concerns.

The behenyl alcohol market faces competition from alternative fatty alcohols and synthetic emulsifiers that offer similar functionalities at potentially lower costs. Stearyl alcohol has emerged as a competitive substitute in cosmetic formulations, particularly in Asia Pacific markets where manufacturers have increasingly adopted stearyl alcohol in anti-aging and skincare products.

Synthetic emulsifiers and thickening agents derived from petrochemical sources also compete on pricing, especially in price-sensitive markets. Furthermore, advances in biotechnology have enabled the development of newer emulsification systems using fermented ingredients and biosynthetic alternatives, reducing the market share of traditional behenyl alcohol. This competitive pressure, combined with lower raw material costs for some alternatives, constrains pricing power and market growth potential.

The growing emphasis on sustainability presents a key opportunity for behenyl alcohol producers to capitalize on bio-based variants derived from renewable plant oils, meeting rising demands in the eco-conscious personal care sector. With consumers favoring natural ingredients, innovations in green chemistry enable higher-purity, plant-sourced behenyl alcohol that aligns with certifications like COSMOS, potentially capturing a larger share in organic cosmetics.

For instance, the European natural cosmetics market grew by +18.7% from 2017 to 2018, reaching 757 million euros, and is projected to hit 5 billion euros by 2023, driven by anti-aging products incorporating emollients like behenyl alcohol. This opportunity extends to the Cosmetic Ingredients Market, where companies can develop multifunctional, biodegradable options to address environmental regulations and consumer preferences, fostering long-term revenue growth through premium pricing and expanded portfolios.

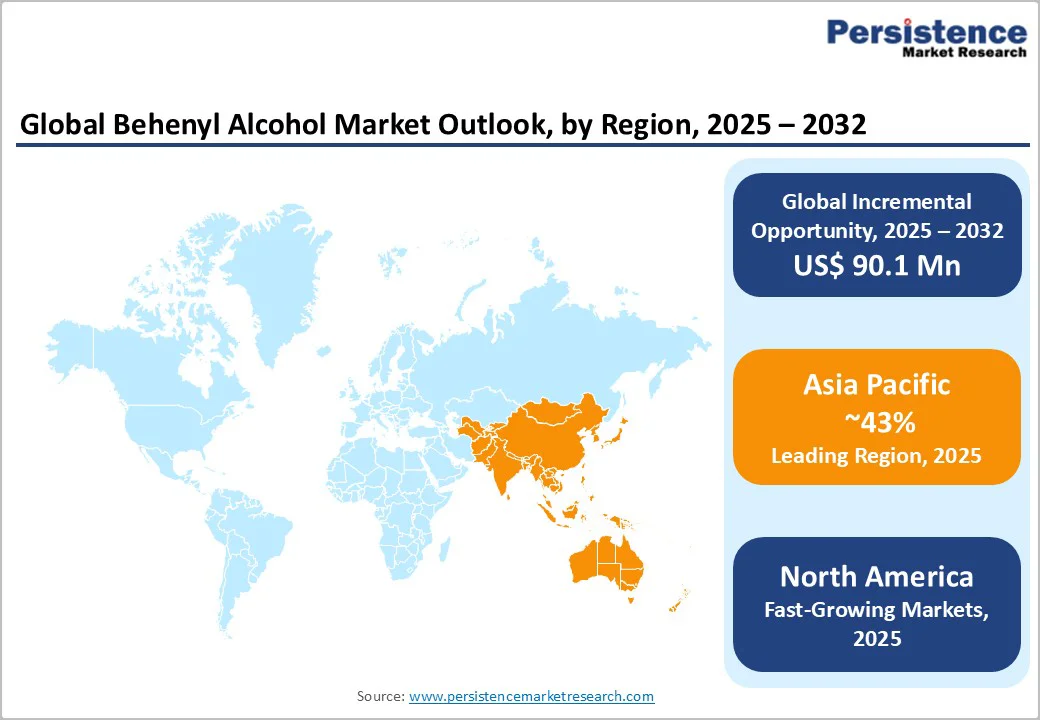

The Asia Pacific region is rapidly becoming the fastest-growing market for behenyl alcohol, fueled by factors such as an expanding middle class, rising disposable incomes, and increased demand for cosmetics. Countries like China, India, and Japan are experiencing significant growth in personal care product consumption, with cosmetic sales expected to rise by approximately 7-8% annually until 2030.

Furthermore, these countries are developing as key pharmaceutical production hubs, with more Active Pharmaceutical Ingredient (API) manufacturing facilities requiring excipients like behenyl alcohol. The region's strong manufacturing capabilities and availability of raw materials position it for future growth in behenyl alcohol production. Market participants are well-positioned to explore opportunities by establishing manufacturing facilities and forming strategic partnerships with local cosmetic and pharmaceutical companies.

The natural source segment leads the behenyl alcohol market with more than 87% share, driven by consumer preference for plant-derived ingredients that offer superior skin compatibility and environmental benefits over synthetics. Predominantly sourced from rapeseed oil and mustard oil, natural behenyl alcohol enhances emulsion stability in cosmetics while complying with organic standards like ECOCERT, making it a staple in clean beauty formulations.

In Europe, where rapeseed production is prominent, this segment's dominance is bolstered by regulatory support for bio-based materials under the EU Cosmetics Regulation, ensuring low irritation and high efficacy in personal care products. This leadership reflects broader trends in the Personal Care Chemicals Ingredients Market, where natural sourcing aligns with sustainability goals, justifying its market position through verified safety data and growing e-commerce sales of organic skincare.

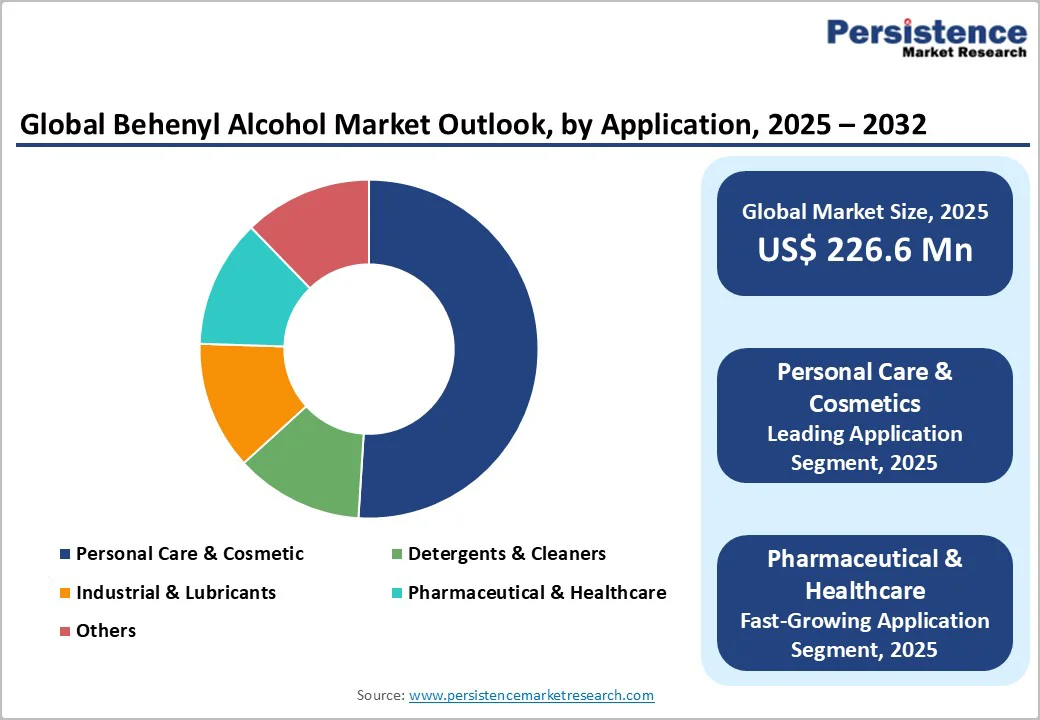

The personal care & cosmetic application dominates with around 51% market share, as behenyl alcohol acts as a key emollient and thickener in products like creams, lotions, and hair conditioners, improving texture and moisture retention for enhanced user satisfaction. Its non-greasy, waxy properties make it ideal for oil-in-water emulsions, particularly in anti-aging and moisturizing lines that prioritize natural actives.

In the U.S., the cosmetics sector's $93.5 billion valuation underscores this segment's lead, with behenyl alcohol's role in stabilizing formulations supported by FDA safety approvals for skin-contact use. This supremacy is further evidenced by its integration into certified products under COSMOS standards, driving demand in the Color Cosmetics Market where it ensures consistent performance across diverse skin types.

North America is one of the fastest-growing regions in the behenyl alcohol market, primarily through the U.S.'s robust innovation ecosystem in personal care, where advanced R&D focuses on natural emulsifiers for premium skincare. The FDA's stringent yet supportive framework for plant-based ingredients encourages adoption in hypoallergenic products, with behenyl alcohol enhancing formulation stability in sunscreens and moisturizers. Recent trends show increased use of vegan cosmetics, aligning with consumer shifts toward sustainable options.

This region's dynamics are shaped by a mature regulatory environment that prioritizes safety testing, enabling quick market entry for bio-derived behenyl alcohol from rapeseed sources. Industry developments, such as expanded production by key players, underscore the U.S.'s role in driving high-purity applications for pharmaceuticals, supported by growing e-commerce sales of natural beauty products.

Europe exhibits strong performance in the behenyl alcohol market, with Germany leading due to its chemical manufacturing prowess and emphasis on green innovations in cosmetics. The EU Cosmetics Regulation harmonizes standards across the U.K., France, and Spain, promoting plant-sourced behenyl alcohol for its emulsion-stabilizing functions in organic formulations. France's rapid growth stems from luxury beauty brands incorporating it in anti-aging creams.

Regulatory harmonization facilitates cross-border trade, with Germany's rapeseed availability supporting sustainable production. In Spain and the U.K., trends toward eco-certified products boost demand, as seen in COSMOS-compliant lines using behenyl alcohol for skin conditioning, reflecting the region's commitment to ethical sourcing and reduced environmental impact.

Asia Pacific is leading the behenyl alcohol market with 43% of the market share, fueled by China and India's manufacturing advantages and rising middle-class demand for affordable personal care. China's production of 10,473.5 tons in 2022 highlights its hub status, with behenyl alcohol integrated into cost-effective cosmetics via rapeseed-derived processes. India's herbal beauty trends amplify natural segment uptake.

Japan and ASEAN countries contribute through technological advancements in high-purity formulations for pharmaceuticals, leveraging local oilseed resources for sustainable supply. Economic expansion drives ASEAN growth, with increasing exports of behenyl alcohol-enriched products, supported by policies favoring bio-chemicals in the Cosmetic Ingredients Market.

The behenyl alcohol market is moderately consolidated, with a few multinational giants dominating through integrated supply chains and R&D investments, while niche players focus on specialty natural variants. Leaders like Sasol Ltd. and BASF SE pursue expansion via sustainable sourcing and partnerships for bio-based innovations, emphasizing ECOCERT compliance to differentiate in eco-markets. Key strategies include capacity enhancements in Asia and R&D for pharmaceutical-grade purity, alongside emerging models like co-creation with cosmetic brands for custom emulsifiers, fostering a competitive yet collaborative landscape.

Sasol Ltd. (South Africa): As a leading producer, Sasol excels with NACOL 22-98 Alcohol, offering high-purity behenyl alcohol for cosmetics and pharmaceuticals, leveraging its global supply chain for consistent quality and influencing 30% of industrial applications through innovative sustainability initiatives.

BASF SE (Germany): BASF dominates via Lanette® 22, a behenyl alcohol variant renowned for viscosity control in emulsions, with a strong portfolio in personal care driving market maturity and revenue through R&D-focused expansions in Europe.

The Dow Chemical Company (U.S.): Dow's influence stems from versatile behenyl alcohol grades for detergents and lubricants, supported by advanced chemical expertise, enabling portfolio strength in North America and emerging Asian markets for steady growth.

The global behenyl alcohol market is estimated at US$226.6 Mn in 2025 and expected to reach US$316.7 Mn by 2032.

Key drivers include rising consumer preference for natural emollients in personal care and growth in pharmaceutical excipients, supported by sustainability trends and regulatory compliance.

Personal Care & Cosmetic leads with about 51% share, due to its use as a thickener and stabilizer in skincare formulations.

Asia Pacific leads the behenyl alcohol market, driven by manufacturing booms in China and India, with rising personal care consumption boosting bio-based demand.

Opportunities in bio-based sustainable formulations for pharmaceuticals, capitalizing on demand for eco-friendly excipients in emerging health markets.

Major players include Sasol Ltd., BASF SE, and The Dow Chemical Company, leading through innovative products and global supply chains.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Source

By Application

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author