Industry: Healthcare

Published Date: January-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 185

Report ID: PMRREP2832

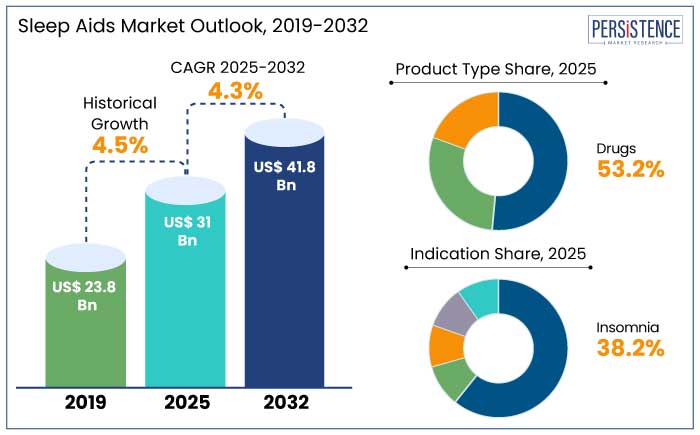

The global sleep aids market is predicted to reach a size of US$ 31 Bn by 2025. It is anticipated to witness a CAGR of 4.3% during the forecast period to attain a value of US$ 41.8 Bn by 2032.

Modern lifestyles, including high work pressure, social media use, and health concerns result in increased stress and anxiety, which significantly affect sleep quality. Growing mental health issues are resulting in the rise of pharmacological treatments and natural treatments.

The industry is witnessing rapid growth in sleep technology with innovations like smart mattresses, sleep trackers, sleep apps, and CPAP machines for sleep apnea. These technologies are integral in helping consumers monitor and enhance the quality of their sleep.

Key Highlights of the Industry

|

Market Attributes |

Key Insights |

|

Sleep Aids Market Size (2025E) |

US$ 31 Bn |

|

Projected Market Value (2032F) |

US$ 41.8 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

4.3% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

4.5% |

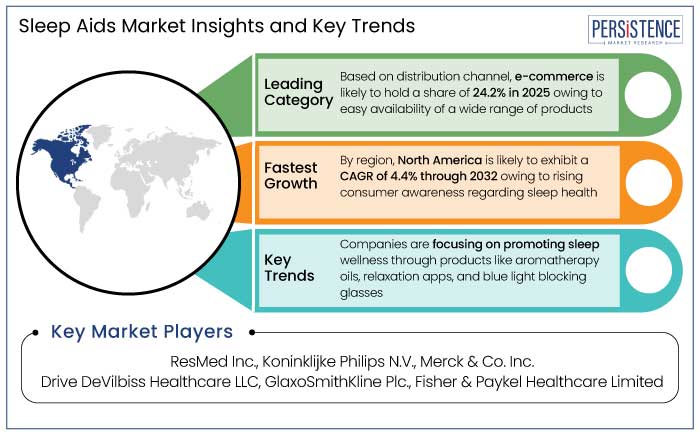

The sleep aids market in North America is estimated to hold a share of 35.7% in 2025. The region has a high prevalence of sleep disorders. Increasing prevalence of conditions like insomnia, sleep apnea, and restless leg syndrome directly increase the demand for sleep aid products. For example,

Consumers in the region are becoming aware of the importance of sleep hygiene and its impact on physical and mental health. This awareness is driving demand for pharmacological and non-pharmacological sleep aids. For example,

Drugs are projected to hold a share of 53.2% in 2025. Prescription drugs are widely used for the treatment of chronic insomnia and other sleep disorder owing to their fast-acting nature and proven efficacy.

OTC drugs have become increasingly popular owing to their effectiveness in addressing short-term sleep disturbances like jet lag or transient insomnia. Demand for effective and scientifically backed treatments is driving the market for pharmaceutical sleep aids, especially among individuals with moderate to severe sleep issues.

Consumers heavily rely on pharmaceutical sleep aids owing to their clinical validation. They also have a known mechanism of action, thereby increasing consumer trust. Prescription sleep aids, like Zolpidem (Ambien) and Eszopiclone (Lunesta), have become the go-to solution for individuals suffering from chronic sleep issues.

Insomnia is predicted to hold a share of 38.2% in 2025. It is one of the most common sleep disorders across the globe, affecting a significant portion of the adult population. For instance,

Insomnia leads to significant disruptions in daily life, affecting mental health, work productivity, mood, and overall well-being. Individuals with insomnia are at higher risk of developing anxiety, depression, and other health problems, which makes it a priority condition for treatment. For example,

E-commerce is anticipated to hold a share of 24.2% in 2025. Platforms like Amazon, Walmart, and specialty online stores offer significant convenience to consumers, enabling them to shop for sleep aids from the comfort of their homes.

Online platforms provide access to a wide range of sleep aids, enabling consumers to explore and compare multiple brands, product types, and price points easily. These platforms also offer a diverse selection of sleep aids, thereby making it easier for consumers to find solutions tailored to their specific requirements. For instance,

Positive experiences with e-commerce, combined with customer reviews and ratings, foster trust, leading consumers to choose online shopping for health-related products like sleep aids. Ability of e-commerce to reach a wide geographical market and serve previously underserved areas contributes to its dominance in the distribution of sleep aids.

Potential growth in the global sleep aids industry is predicted to be driven by rising awareness of holistic health along with a focus on non-pharmaceutical interventions. Products like sleep teas, melatonin sprays, herbal sleep aids, and relaxation devices are likely to gain popularity.

The forecast period is likely to witness a shift toward personalized sleep solutions where consumers can get products tailored to their sleep patterns, contributing to growth. Continued rise of online shopping along with increasing preference for contactless purchases is predicted to foster growth in the e-commerce sector.

The sleep aids market growth was steady at a CAGR of 4.5% during the historical period from 2019 to 2023. The period witnessed a robust demand for products like sleep medications, sleep devices, and OTC supplements. Rising conditions like insomnia and sleep apnea led to a higher demand for sleep aids. For instance,

The trend of self-care and wellness was significant in driving demand for non-prescription sleep aids, especially OTC medications and natural supplements. Consumers increasingly opted for natural sleep aids owing to concerns regarding the side effects of pharmaceutical drugs.

The forecast period is likely to witness an increased adoption of sleep-tracking apps, smart beds, and wearable sleep monitoring devices, thereby boosting growth. Introduction of AI-powered sleep solutions are likely to fuel expansion.

Government Support and Regulatory Approvals

Government regulatory agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) play a pivotal role in approving sleep medications for use. The FDA has approved a range of over-the-counter sleep aids, including products containing melatonin and diphenhydramine.

Regulatory bodies also provide guidance for natural and herbal sleep aids, like melatonin supplements and valerian root. The FDA classifies multiple herbal sleep aids as dietary supplements, which must adhere to specific Good Manufacturing Practices (GMP) to ensure quality and purity.

Rapid Shift toward Self Care and Wellness

Consumers are increasingly turning to non-prescription sleep aids as part of their self-care routine. They are also more aware of the benefits of mindfulness, meditation, and relaxation techniques, which can enhance sleep quality without the need for medication. For example,

Growing focus on holistic health is leading individuals to adopt sleep aids that integrate physical and mental well-being. Consumers are embracing solutions that enhance one’s wellness, which includes a more mindful approach to sleep. Products that support circadian rhythm regulation or promote better sleep hygiene are increasingly in demand.

Side Effects and Safety Concerns

Prescription sleep aids are commonly prescribed for insomnia and other sleep disorders. However, these medications carry several potential side effects that can discourage usage. Several people using prescription sleep aids report feeling drowsy the following morning, which can negatively affect daily functioning and productivity.

Certain sleep medications, like Ambien (zolpidem), have been linked to sleepwalking, driving, and other activities performed while asleep, increasing the risk of accidents or injury. Several OTC sleep aids can cause residual drowsiness the next day, especially when taken in higher doses. This can impact on daily activities, including driving or operating machinery. For instance,

Innovations in Sleep Technology and Digital Health

Wearable devices like smartwatches, fitness trackers, and specialized sleep-monitoring devices have become widely popular as consumers value data-driven insights into their sleep health. Data collected by these devices is used to identify sleep patterns, disturbances, and potential issues, enabling users to adjust their habits and use relevant sleep aids to improve rest.

AI and ML are being integrated into sleep apps to provide personalized and actionable insights. These apps can analyze users’ sleep data, including sleep patterns, environmental factors, and behavioral cues, to offer tailored recommendations for improving sleep. For instance,

Increasing Stress and Mental Health Issues

Stress and anxiety are two of the leading causes of insomnia and poor sleep quality. People suffering from depression often experience changes in their sleep patterns, like early morning awakening, excessive sleeping (hypersomnia), or insomnia. For example,

Workplace stress and economic concerns are among the leading contributors to increasing levels of anxiety and depression, leading to high levels of sleep disturbances.

Companies in the sleep aids market are focusing on developing new formulations and innovative delivery mechanisms to meet consumer preferences and address safety concerns. They are introducing extended-release formulations or non-addictive options to decrease side effects and dependency risks.

Businesses are also developing unique wearables and digital health solutions that monitor sleep patterns and provide personalized recommendations. Haleon recently extended its ZzzQuil product line to include melatonin gummies and plant-based sleep aids.

Manufacturers are establishing a strong presence on platforms like Amazon, Walmart, and company-owned websites to tap into the rising preference for online shopping. They are also offering subscription packages for sleep aids, ensuring consumer loyalty and a consistent revenue stream.

Recent Industry Developments

|

Attributes |

Detail |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Indication

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

The market is anticipated to reach a value of US$ 41.8 Bn by 2032.

Increasing prevalence of sleeping disorders is augmenting growth in the industry.

North America is anticipated to emerge as the leading region with a share of 35.7% in 2025.

Prominent players in the market include ResMed Inc., Koninklijke Philips N.V., and Merck & Co. Inc.

The market is predicted to witness a CAGR of 4.3% throughout the forecast period.