ID: PMRREP13330| 188 Pages | 5 Nov 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

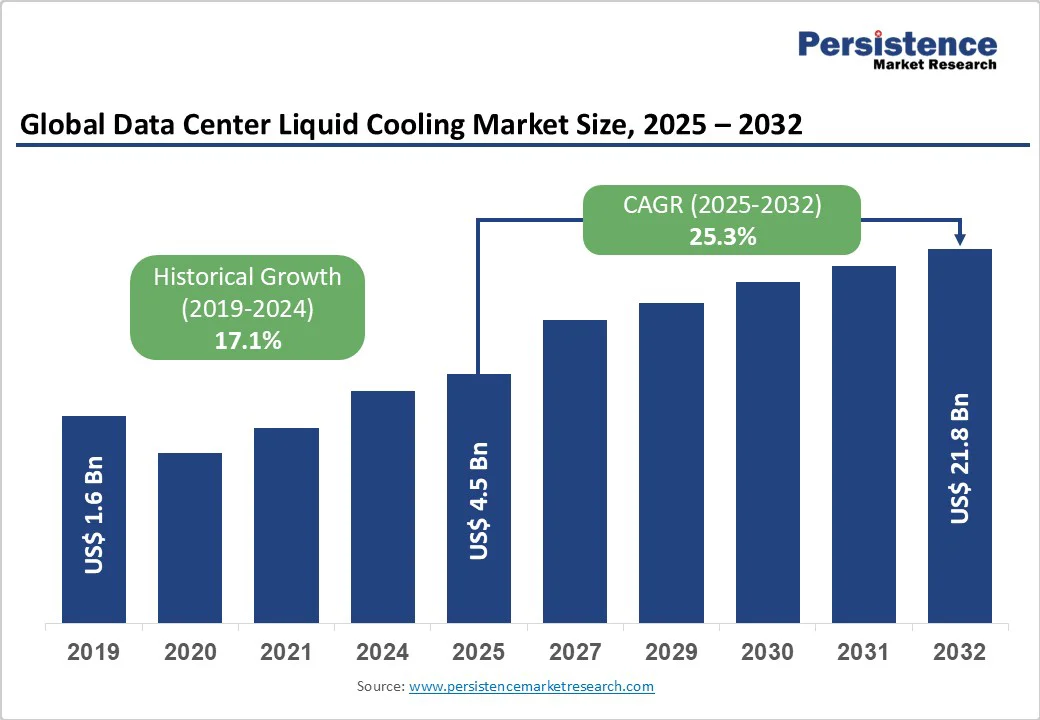

The global Data Center Liquid Cooling Market size is projected to rise from US$4.5 Bn in 2025 to US$21.8 Bn by 2032. It is anticipated to witness a CAGR of 25.3% during the forecast period from 2025 to 2032. The surge in AI, high-performance computing (HPC), hyperscale workloads, and cloud expansion is pushing data-center operators toward liquid cooling technologies to handle escalating heat loads that traditional air-cooling systems no longer manage efficiently. Energy efficiency, sustainability mandates, and rising rack densities are accelerating the shift toward cold-plate and immersion cooling systems to achieve lower PUE 1.02–1.2 and reduced carbon footprints.

| Key Insights | Details |

|---|---|

|

Data Center Liquid Cooling Market Size (2025E) |

US$4.5 Bn |

|

Market Value Forecast (2032F) |

US$21.8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

25.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

17.1% |

Increasing computational demands from AI and high-performance computing (HPC) are driving higher power densities in data centers, making advanced liquid cooling solutions essential. Liquid cooling improves energy efficiency and heat management, allowing operators to handle AI workloads projected to quadruple electricity use in AI-optimized facilities. According to the IEA, global data center electricity demand may exceed 945 TWh by 2030, with data centers in advanced economies driving over 20% of electricity demand growth. Immersion and cold plate liquid cooling are being widely adopted as high-efficiency, greener alternatives to air cooling to meet these power-intensive requirements.

Environmental and regulatory pressures are accelerating the adoption of liquid cooling in data centers. Facilities using liquid cooling achieve PUE scores below 1.2, compared to 1.4–1.6 for air-cooled centers. In August 2024, Microsoft introduced a water-free AI-optimized data center design, saving over 125 million liters of water annually per facility through chip-level cooling.

Stricter ESG compliance and energy efficiency standards are pushing operators to focus on reducing carbon footprints while lowering operational costs. Authorities like TRAI recommend green data center certifications emphasizing energy-efficient cooling, low PUE, and renewable energy use, further promoting sustainable and environmentally responsible practices in the industry. Liquid cooling solutions typically achieve 2-10 times greater heat dissipation efficiency compared to their air-cooled counterparts.

Liquid cooling systems involve significantly higher upfront capital costs compared to traditional air-cooling solutions, often requiring major infrastructure modifications. Integrating liquid cooling with existing data center facilities presents technical challenges, especially in brownfield retrofits. Direct-to-chip cooling systems are expensive due to the need for complete server overhauls.

For example, connection requests for hyperscale data centers (300–1000 MW) are experiencing lead times of 1–3 years, further highlighting significant infrastructure and cost challenges. These cost and complexity barriers limit adoption among smaller enterprises and operators in price-sensitive markets. It demands specialized piping, containment systems, and redundancy mechanisms, increasing project complexity and extending deployment timelines.

The adoption of data center liquid cooling faces significant challenges due to a shortage of skilled professionals and limited technical expertise, which slows deployment and increases reliance on specialized vendors. Integrating liquid cooling systems requires precise engineering knowledge, while compliance with regional safety, environmental, and building regulations adds complexity.

High water consumption in immersion and evaporative cooling systems raises operational costs and sustainability concerns. A 1 MW data center can be used up to 25.5 million liters annually, and according to a Morgan Stanley report, AI data centers are projected to consume 1,068 billion liters by 2028, an 11-fold increase from current levels. These technical, regulatory, and resource constraints collectively hinder rapid adoption, increase upfront costs, and create operational uncertainties for data center operators.

?The development of advanced dielectric fluids with improved thermal properties and environmental compatibility addresses regulatory concerns while enhancing performance. For instance, the EU’s planned ban on fluorinated liquids in 2028 is accelerating domestic hydrocarbon and silicone oil coolant research and development, creating opportunities for innovative fluid manufacturers.

Heat reuse applications connecting to municipal district-heating systems provide additional revenue streams, transforming cooling infrastructure from a cost center to a profit-generating asset. AI-powered thermal management systems incorporating predictive maintenance and dynamic optimization capabilities represent emerging opportunities for intelligent infrastructure solutions.

Governments are promoting green data centers through subsidies, tax breaks, and infrastructure support, lowering costs and driving adoption of liquid cooling for energy efficiency. Policies like the EU Energy Efficiency Directive, the U.S. Inflation Reduction Act 2022, and Germany’s EnEfG mandate stricter PUE targets ≤1.5 by 2027, ≤1.3 by 2030, and 1.2 for new centers from 2026, along with waste heat reuse requirements 10–20% between 2026–2028. These measures align with carbon neutrality goals and ESG commitments, making liquid cooling essential for AI, HPC, and 5G workloads by enabling higher server densities and improved thermal management.

Solutions Driving Efficient and High-Performance Data Center Cooling

Solution segment is expected to account for more than 74% share in 2025, driven by the need for complete cooling systems that tackle rising heat densities, excessive energy consumption, and limited data center space. As AI, cloud, and HPC workloads surge, operators increasingly seek advanced cooling solutions that ensure immediate performance, efficiency, and reliability improvements.

Services are expected to grow at a CAGR of 27.1%, reaching over US$ 6.3 billion by 2032, due to data centers increasingly requiring specialized installation, maintenance, and optimization support for complex liquid cooling systems. The need for continuous performance optimization, energy efficiency, and regulatory compliance drives reliance on external service providers, ensuring reliable operation and reduced downtime.

Cold Plate Solutions Powering Advanced CPU and GPU Thermal Management

Cold plate liquid cooling is expected to account for more than 43% share in 2025 due to efficiently addressing the growing need for high-density server cooling. It provides direct contact cooling for CPUs and GPUs, offering superior thermal management and energy efficiency compared to other methods. Its modular design allows easy integration into existing data center infrastructure, reducing operational downtime.

Immersion liquid cooling is expected to grow at the highest rate as it efficiently manages high-density server heat, meeting the growing demand for energy-efficient solutions. Its ability to drastically reduce power usage for cooling aligns with operators’ needs to cut operational costs and carbon footprints. Technology also addresses space constraints by allowing more servers per rack, fulfilling the need for compact, high-performance infrastructures. Single-phase immersion cooling achieves 80% higher energy efficiency compared to cold plate systems, delivering PUE scores of 1.02-1.03.

Advanced Cooling Solutions Supporting Large-Scale Data Center Performance

Large data centers (more than 10,000 sq. feet) are expected to account for over 58% share in 2025 as they face higher heat densities and energy demands compared to smaller facilities. Their need for efficient, high-capacity cooling solutions to maintain uptime and reduce operational costs drives adoption. Liquid cooling helps large data centers achieve better energy efficiency, meet sustainability targets, and support advanced computing workloads, which are increasingly common in large facilities.

Small and medium-sized data centers are expected to grow at a CAGR of 27.4%, as they face increasing demands for high-performance computing in limited spaces. These facilities require efficient, compact cooling solutions to manage rising heat densities without expanding their physical footprint. The growing adoption of edge computing and localized data processing further drives demand.

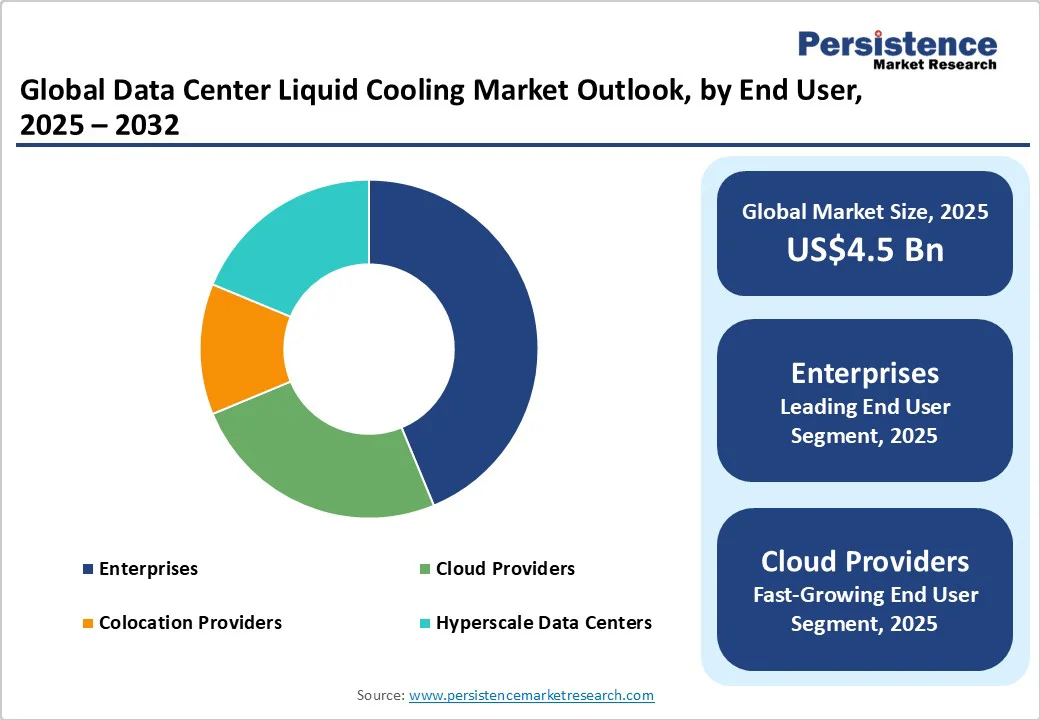

High-Performance Computing and Sustainability Fuel Enterprise Liquid Cooling

Enterprises are expected to account for over 35% share in 2025 as they face growing demands for high-performance computing, low-latency applications, and efficient energy use. It helps enterprises manage increasing server densities and heat loads while reducing operational costs. The need for reliable uptime, faster processing, and sustainability targets drives enterprises to adopt advanced liquid cooling solutions more aggressively.

Cloud providers are expected to grow at the highest rate with a CAGR of 29.3% due to AI workload expansion, machine learning infrastructure, and scalable computing platform requirements. Hyperscale operators, including AWS, Microsoft Azure, and Google Cloud, invest heavily in liquid cooling to support large-scale AI model training and inference services. Net-zero emission commitments and sustainability targets among major cloud operators drive the adoption of energy-efficient cooling technologies.

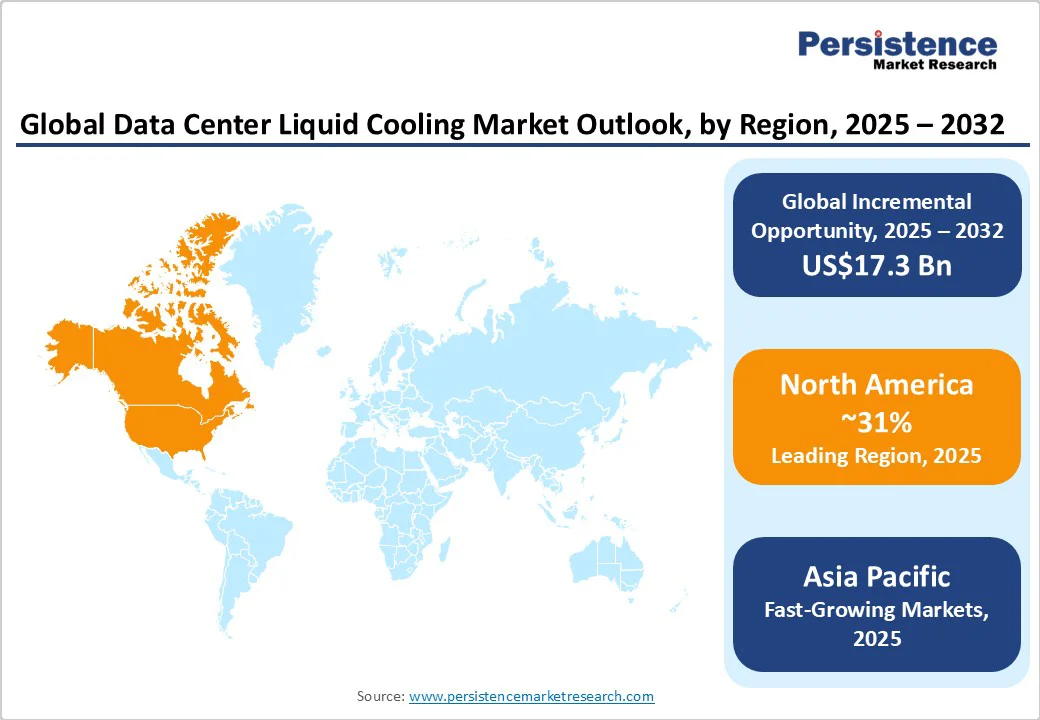

North America is expected to account for more than a 31% share in 2025, valued at over US$1.4 billion, and is projected to exceed US$5.5 billion by 2032, driven by defense modernization, autonomous vehicles, drones, biomedical imaging, and government-backed advanced optics research. The rapid rise of high-density AI/GPU workloads has pushed U.S. data-center electricity from ~76 TWh in 2018 to ~176 TWh in 2023, highlighting the need for efficient cooling according to DOE/LBNL.

Liquid cooling (direct-to-chip and immersion) supports higher rack power densities, reduces facility footprint, and lowers total-cost-of-ownership, making it attractive to hyperscale operators with renewable or carbon accounting goals. According to EIA, computing accounted for ~8% of commercial electricity in 2024, the fastest-growing end-use, reinforcing the shift toward advanced cooling solutions. The U.S. data center liquid cooling market is expected to reach US$ 4.5 billion by 2032, driven by increasing AI workloads and sustainability mandates.

Asia-Pacific is the fastest-growing market and is expected to reach a value of over US$10.2 billion by 2032, driven by rapid AI, cloud, and 5G edge growth, which pushes compute density and rack power beyond air-cooling limits, making liquid cooling essential for thermal performance, lower PUE, and reduced energy per compute unit.

China targets ~15% annual growth in data-center power and emphasizes renewables and efficiency (national plans), while India’s peak power demand hit 250?GW in FY 2024–25, with policies from BEE, CEA, and MOSPI promoting low-energy DC designs. Malaysia saw RM141.72?billion in digital investment in 2024 (MIDA), and other SEA countries provide incentives via green DC guidance and forums. These factors collectively drive hyperscalers and new sites toward cold-plate and immersion cooling solutions.

Europe is expected to reach a market value of approximately US$5.0 billion by 2032. Rapid growth in AI, hyperscale cloud, and HPC workloads, combined with stricter EU sustainability and transparency rules, is driving data-center operators toward high-density, energy-efficient liquid cooling over traditional air cooling. EU data centers consume ~3% of electricity, with mandates on PUE, energy use, and waste-heat reuse favoring liquid cooling for efficiency and heat capture, according to the European Commission.

Tight grid capacity and rising renewables, Germany’s 431.7 TWh generation with 59% renewables in 2024, further incentivize lower-energy cooling according to the Germany 2024 electricity report. National regulations in France (PUE ~1.7 vs EU ~1.6, ADEME 2024/2025) and the UK (~1.6 GW IT power concentrated in London/southeast, 2024 estimates) encourage densification and adoption of liquid cooling, especially for AI-focused hyperscaler facilities.

The Data Center Liquid Cooling market is fragmented, with numerous players offering specialized solutions for high-performance computing and AI workloads. Companies are focusing on technological innovation, such as AI-driven monitoring, high-efficiency heat transfer, and modular, scalable designs. They are also forming alliances with data center operators and cloud service providers to integrate their liquid cooling technologies into existing infrastructure.

The global market is projected to be valued at US$4.5 Bn in 2025.

Rising high-density computing workloads and the need for energy-efficient, space-saving cooling solutions are key drivers of the market.

The market is poised to witness a CAGR of 25.3% from 2025 to 2032.

The potential for waste-heat reuse and incentives for sustainable, green data center designs creates strong growth opportunities.

Schneider Electric, LiquidStack, Rittal GmbH Co. KG, Green Revolution Cooling Inc., DCX Liquid Cooling Systems, IBM, and Asetek are among the leading key players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Component

By Type of Cooling

By Data Center Size

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author