ID: PMRREP31490| 189 Pages | 3 Oct 2025 | Format: PDF, Excel, PPT* | Food and Beverages

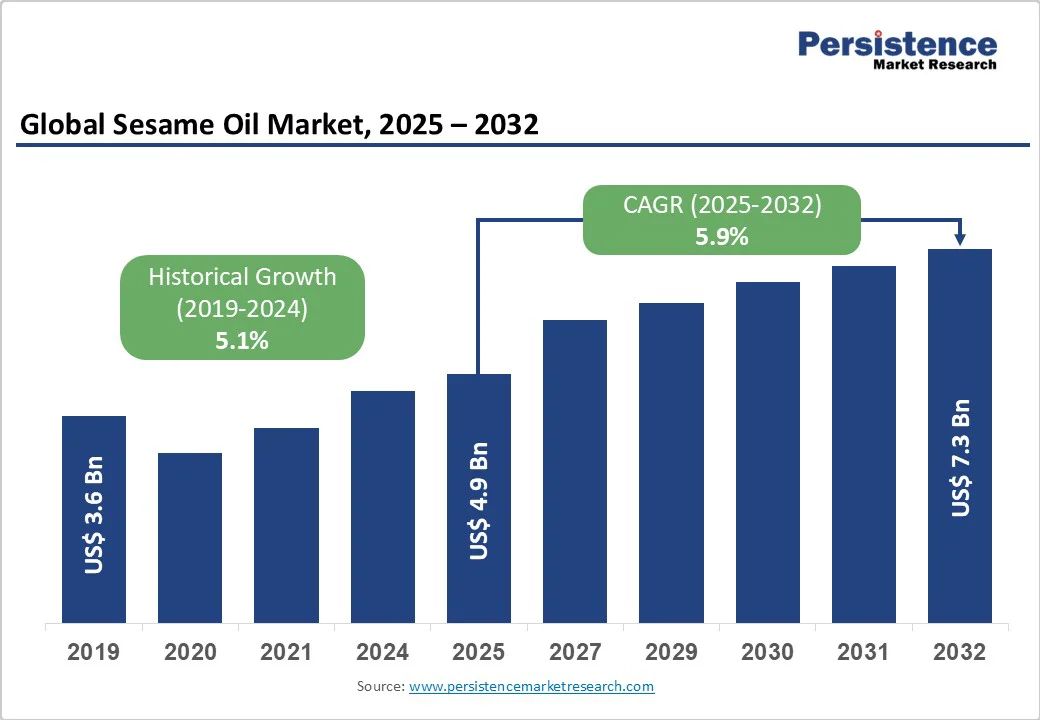

The global sesame oil market is likely to value at US$ 4.9 Billion in 2025 and reach US$ 7.3 Bn by 2032, growing at a CAGR of 5.9% during the forecast period from 2025 to 2032. The market is growing steadily driven by rising health awareness, increasing demand for natural cooking oils, and expanding use in cosmetics and nutraceuticals.

| Key Insights | Details |

|---|---|

|

Global Sesame Oil Market Size (2025E) |

US$ 4.9 Bn |

|

Market Value Forecast (2032F) |

US$ 7.3 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.1% |

Sesame oil has proven its worth in industries as well as retail markets owing to its functional properties such as enhancing the health benefits of daily meals and baby food products, along with providing the perfect texture and flavor. Producers have been striving to improve and offer nutritionally enhanced sesame oil. Companies are also offering fortified sesame oil as a unique proposal to customers as it contributes to the additional functionalities of the oil.

Sesame oil manufacturers are offering specialized sesame oil along with avocados, chia seeds, and other natural ingredients to reduce the chances of heart disease by curbing cholesterols levels in the blood. Consumers are becoming more cautious about their health and are opting for a healthy lifestyle, which has driven such trends. Fortification also helps in improving the stability, sensory quality, and nutritional properties of cuisines from around the world.

The availability of a wide range of substitutes poses a restraint to the growth of the sesame oil market. In India, sesame oil consumption has declined from 106,000 metric tons in 2014 to 46,000 metric tons in 2023, reflecting a consistent negative growth trend. This decline is attributed to the increasing popularity of alternative edible oils such as palm, soybean, and sunflower oils, which are often more affordable and widely available. For instance, India's edible oil imports dropped to a four-year low in February 2025, with a 12% reduction in total vegetable oil imports, indicating a shift towards more cost-effective options. Additionally, the government's reduction of the Basic Customs Duty on major imported crude edible oils from 20% to 10% in June 2025 further enhances the competitiveness of these substitutes. These factors collectively challenge the growth prospects of the sesame oil market.

Sesame oil offers significant growth potential in the pharmaceutical and nutraceutical sectors due to its bioactive compounds and health benefits. Rich in lignans like sesamin and sesamol, sesame oil exhibits antioxidant, anti-inflammatory, and cholesterol-lowering properties. These compounds have been linked to reduced oxidative stress and inflammation, contributing to heart health and metabolic regulation. Additionally, sesame oil's high content of unsaturated fatty acids supports cardiovascular health by improving lipid profiles. Its potential to regulate blood sugar levels further enhances its appeal in managing diabetes. The oil's applications extend to topical formulations, where it has shown promise in wound healing and skin health. These multifaceted health benefits position sesame oil as a valuable ingredient in developing functional foods, dietary supplements, and pharmaceutical products aimed at preventive healthcare. The growing consumer demand for natural and plant-based health solutions further amplifies its market potential.

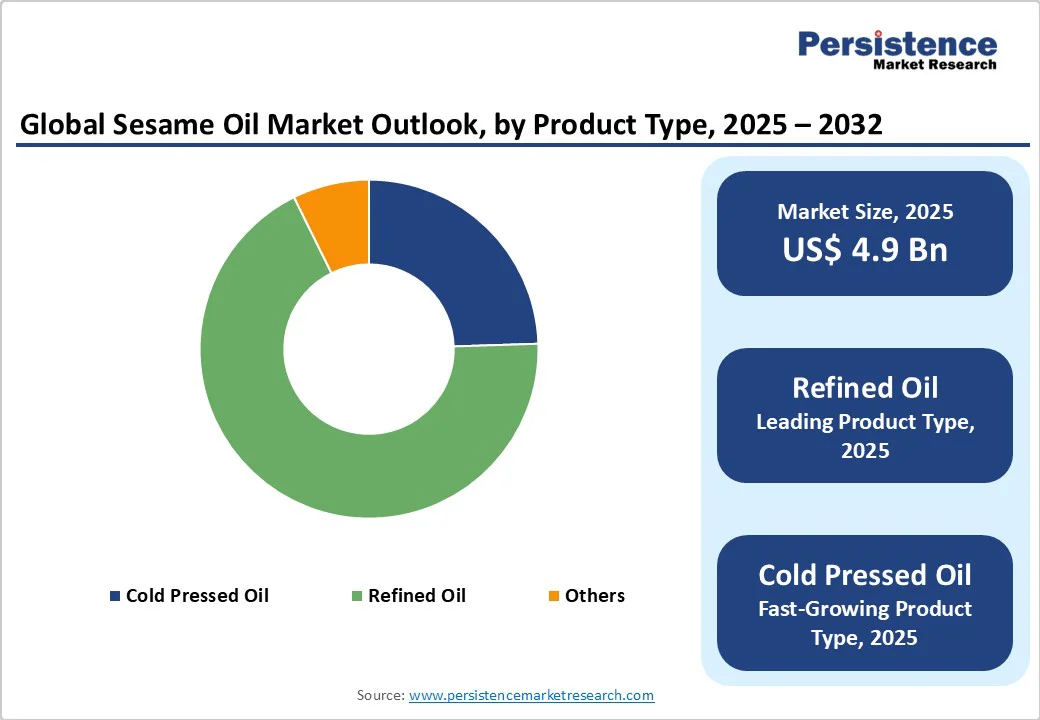

The Refined Oil segment held around 68.2% of the total market in 2025. Refined sesame oil dominates the market due to its extended shelf life, neutral flavor, and versatility across various culinary applications. In India, refined oils constitute over 80% of the total vegetable oil consumption, with refined sesame oil being a significant component. This preference is attributed to refined oil's ability to maintain quality over time and its adaptability in different cooking methods. Additionally, refined oils are more cost-effective and widely available, making them a preferred choice for both household and commercial use. The refining process also reduces impurities and enhances the oil's stability, further increasing its appeal among consumers. Government initiatives to promote oilseed cultivation and processing have also contributed to the increased production and consumption of refined sesame oil in the country.

White sesame seeds held a share of about 42.3% in 2025. White sesame seeds dominate the sesame oil market due to their superior quality, higher oil yield, and widespread culinary and export applications. India, the world's largest producer and exporter of sesame seeds, contributes approximately 25% to global sesame seed trade. The dehulled white sesame seeds are preferred for their uniform color and higher oil extraction efficiency, making them ideal for oil production. In FY 2023-24, India's sesame seed exports were valued at 390.08 million USD, reflecting their significant role in the global market. These seeds are also integral to the confectionery industry, where their quality and consistency are crucial. The government's initiatives to promote oilseed cultivation and processing have further bolstered the production and consumption of white sesame seeds, reinforcing their market dominance.

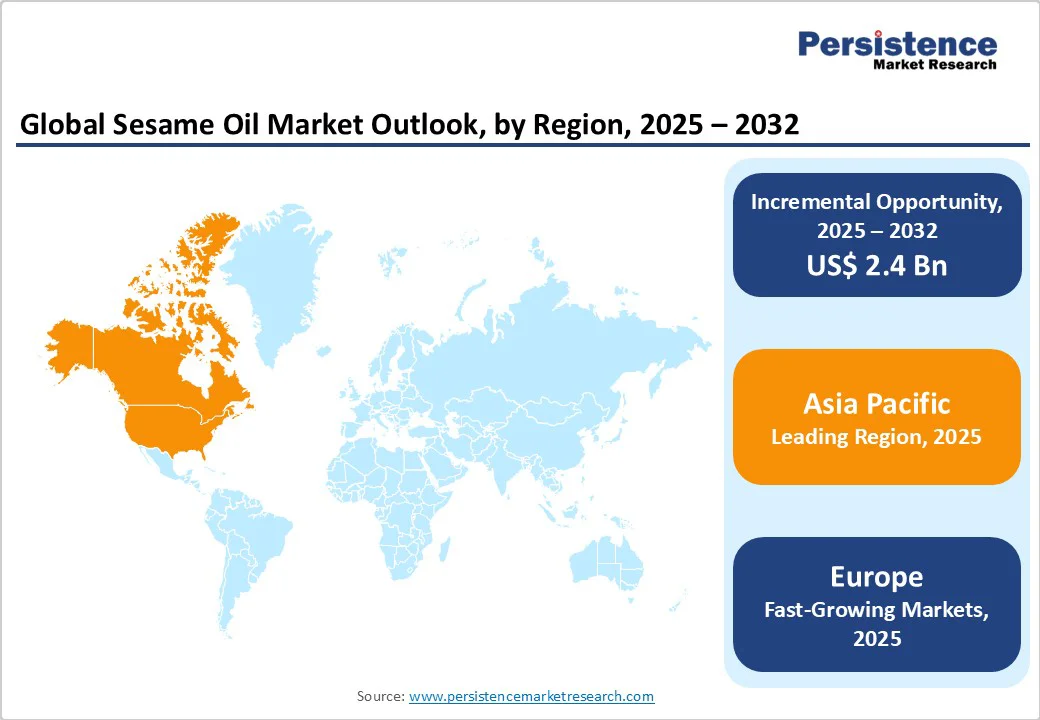

The Asia Pacific market is leading the market globally, driven by several key factors. In Japan, domestically produced sesame oil expanded its market share to 2.3% in recent years, reflecting a shift towards locally sourced oils amid rising import costs. This trend is also evident in South Korea, where sesame oil remains integral to traditional cuisine, despite increasing competition from other oils. The region's diverse culinary traditions continue to favor sesame oil for its unique flavor and health benefits, ensuring its sustained demand. However, challenges such as price volatility and competition from alternative oils persist, influencing market dynamics. Overall, the Asia Pacific sesame oil market is poised for steady growth, supported by cultural preferences and evolving consumer trends.

North America sesame oil market is experiencing gradual growth, driven by increasing consumer interest in health-conscious cooking and the expansion of ethnic cuisines. In 2019, the U.S. imported 21.4 thousand tons of sesame oil, valued at $93 million, indicating a steady demand for this specialty oil. Despite this, sesame oil's share in the overall edible oil market remains modest, with soybean oil leading at 55% of total vegetable oil production in the U.S. The growing awareness of sesame oil's health benefits, such as its antioxidant properties and potential in managing metabolic biomarkers, is contributing to its rising popularity among health-conscious consumers. Additionally, the increasing availability of sesame oil in mainstream retail and online platforms is enhancing its accessibility to a broader audience. These trends suggest a positive trajectory for sesame oil's market presence in North America.

Europe is one of the fastest-growing market for sesame oil, with imports increasing from €41 million in 2019 to nearly €69 million in 2023, capturing 11.4% of the total sesame trade value. This growth is driven by rising consumer interest in ethnic cuisines, gourmet products, and healthier oils. Countries like the UK, France, Germany, and the Netherlands are key importers, with the UK alone importing over €22 million worth of sesame oil in 2023. The demand for organic and fair-sourced sesame oil is also on the rise, presenting opportunities for exporters to meet European food safety standards and quality expectations.

The global sesame oil market is fragmented. Sesame oil manufacturers enhance sales through mergers, infrastructure expansion, product launches, and innovative offerings like cold-pressed or flavored oils. Forward integration with wholesalers, distributors, and retailers strengthens the supply chain. Improved distribution, consumer analytics, competitive pricing, and e-commerce strategies, including product bundling and discounts, increase accessibility, brand visibility, and overall market share across key regions.

The global sesame oil market is projected to be valued at US$ 4.9 Bn in 2025.

Rising health awareness, demand for natural cooking oils, expanding use in cosmetics and nutraceuticals, and growing gourmet and ethnic cuisine adoption drive the market.

The Global sesame oil market is poised to witness a CAGR of 5.9% between 2025 and 2032.

Key opportunities include expansion of organic, cold-pressed, and flavored oils, cosmetic and nutraceutical applications, e-commerce growth, and rising health-conscious consumer demand.

Major players in the global are Archer Daniels Midland Company, Chee Seng Oil Factory Pte Ltd., ConnOils LLC, Dipasa Group, Ernesto Ventós S.A., Gustav Heess and others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn Volume: Tons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Source

By Nature

By End Use

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author